The Curious Case of Falling Gold and Silver Prices

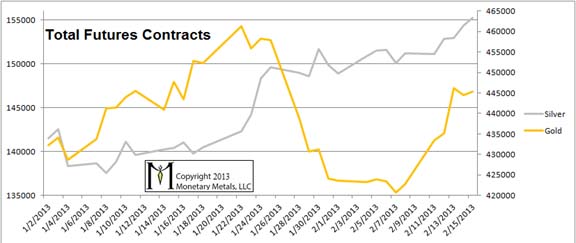

A curious thing happened last week. The prices of both monetary metals have been falling for a week and a half through February 15. No, that’s not the curious part. There is no law of nature that says the prices have to go up, but if they go down it must be artificial somehow. The curious thing is that the price fell while open interest in futures rose, which is not typical of how the market has actually been behaving in recent years.

Now let’s look at the data.

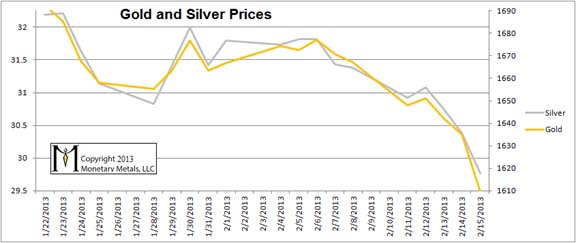

Silver loses about 6.6%, and gold about 4%; thus the gold:silver ratio gains about 2.6%.

Next, let’s look at the open interest data, which is the number of futures contracts in each metal.

One possible explanation is the notorious “naked short sellers”. If so, they made money. Prices did fall. However, there is more data that doesn’t quite fit this theory.

As we showed, silver open interest was already quite high. It increased a few thousand contracts (under 2%) during the period through February 15. Gold open interest was not high by recent historical standards, and its open interest rose by 25,000 contracts (around 6%).

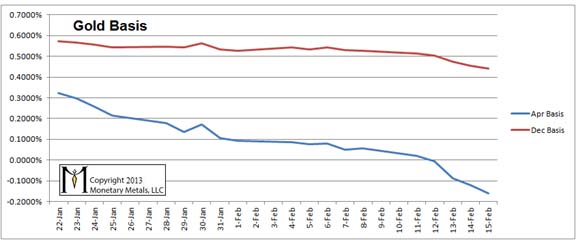

Now let’s look at the basis data. This adds additional color to the data provided above.

The gold basis has been falling for a long time . The basis generally (but not always) moves in the opposite direction of the cobasis, and this linked article showed the cobasis rising. The falling gold basis is not news in itself.

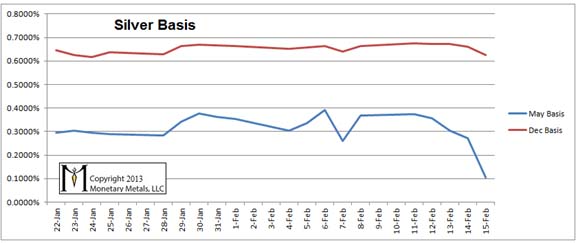

Let’s look at the silver basis.

The silver basis for December has been in a rising trend since at least last July (which uptrend is not yet broken, in our opinion). Here in this graph, we see it is not much changed from start to end. The May basis is falling, which is interesting as it occurs against the contract “roll” from March-May, now occurring. The “roll” is when “naked longs” must sell because they cannot take delivery, and typically they buy the next month if they want to keep exposure to the metal.

The above data shows: (1) falling prices, (2) rising open interest, and (3) falling basis in gold and slightly more ambiguously in silver. We have provided all of the data comprising this curious circumstance. You can form your own conclusion.

Or you can read Part II of this article (free enrollment required for full access) for our analysis and surprising (though tentative) conclusion.

Wow all very visionary for those who don’t know how the system works.

Do you think it is best for Canadian and those holding other currencies to

buy dollars now and try to buy metals lower or buy metals now while they are widely available

and not worry about the decling price as the canadian dollar will also be decling

ManyThanks