The Last Contango Basis Report

The downdraft in the dollar prices of the metals began in late January, with gold just under $1700 and silver over $32. This is not likely news to readers of the Last Contango Basis Report.

Gold and Silver Price

The purpose of this Report is to shed some light onto market dynamics, focusing on the basis. To summarize, a rising basis tends to go along with a falling cobasis. This is not a bullish sign for the dollar price. A falling basis along with a rising cobasis is a bullish sign.

Our analysis of the basis led us to call for the price of silver to fall in gold terms on January 24. When we produced the video, the gold:silver ratio (i.e. the gold price divided by the silver price) was 52.3. As of close of market yesterday, Friday, the ratio sat at 55.1, which is an increase of 5.4%. When you consider that the silver price in gold terms strips out the volatility of the collapsing dollar, a 5.4% change in a month is huge.

In this weekly Report, we will show graphs of the basis for gold and silver along with our commentary.

Gold Basis and Cobasis

There has been a steady falling trend in the basis all year (and longer). On February 20, it may have put in a bottom. We shall have to see. It is significant that the cobasis is positive, which is another way to say that the April gold contract is in backwardation. While it is not a large amount of money (less than a dollar an ounce), it has a yield higher than a Treasury bill of the same duration. For whatever reason(s), not enough people are taking the arbitrage (sell gold metal / buy an April gold future) to compress this to zero.

This is a very bullish looking chart, though readers should note that there is no guarantee that the gold price could not fall further. And the basis is not a timing indicator. It is simply saying that, at the current price, the supply of physical metal is tight.

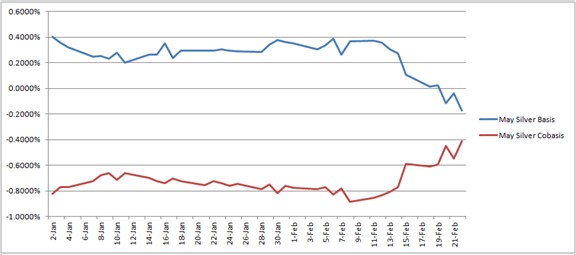

Silver Basis and Cobasis

The silver basis, unlike that of gold, was not looking especially bullish. It began to change around February 15 and accelerated last week. This corresponds roughly to the sell-off in silver. Now, it is not possible to carry silver at a profit (to carry is to buy metal and simultaneously sell a future against it, to earn the basis as one’s profit). This is one degree of tightness in the market. But nor is May silver in backwardation (March is, but that is less significant).

:

:

If I understand correctly, the basis/cobasis is simply a measure of the spread between spot au/ag and the futures contract prices. If so, then why use two terms for what is essentially the same metric? Why not just say the spread is +/-X%? Also, is there a way for the layman to track this spread online — preferably charted as illustrated above?

You got some negative comments on Jim Sinclair’s website from Dan Norcini. Way to go! It shows you are touching a nerve. No one knows everything. This is just one indicator. There was not much doubt that prices were going to fall. If you’re going to tell me different, my question to you is why don’t you and the Doc own all the gold and silver in the world?

Tyonker, allow me to explain something to you. I but gold and silver regularly. Recently, i made a sizeable gold purchase. From reading Keith’s analysis regularly, I leaned the charts were strongly suggesting silver correction. Normally, I wouldn’t sell my silver for 31.90 because, amongst other reasons, it wasn’t profitable enough. But, i learned from him that I could buy and sell silver in terms of gold. That gave me the understanding that I could sell that silver, in essence, to cover that gold purchase I’d just made.

So I sold my silver to pay for gold. Then silver dropped the next day and eventually sunk to mid $28. I repurchased $10k silver for a friend and picked up another $7k for me.

Ok, so I’ve worked special arrangements. Got the good at 1% under, sold silver to cover it at 4% over spot (31.90). Then bought back in at $29.70. Had I not read Keith’s articles, etc, it would have never occurred to nee to buy/sell silver in terms of gold rather than dollars.

ps. The order of the transactions is flexible. Silver could be used in advance for the intent of twitching gold OR hold can be purchases then silver sold to cover.

Its very interesting for a guy like me who is not a money/numbers guy but appreciates intelligent ways of doing things. ;)

Best wishes

E

until you take delivery, you’re no different than everybody else who gambles in the pm market. you buy for us$, sell for us$ and end up with more us$, or whatever fiat you operate with.

I get that one may purchase gold for silver or vice versa, unfortunately I don’t have any special purchase arrangements to be able to ignore premia. Yes this is a strategy that has potential, nontheless silver and gold both being down you might at times increase your holdings of one or the other metal but still decrease you overall purchasing power, would you agree?

So what We have to do With Silver ?

Buy , Hold or Sell

Personally, I think silver is going to really this week

Actually I didn’t get this sentence.

“Personally, I think silver is going to really this week”

My question is to get Your opinion on the Silver.

silver is going “Down” or “UP” for the 3 month perspective and also for 1 year perspective.

Actually I didn’t get this sentence.

“Personally, I think silver is going to really this week”

My question is to get Your opinion on the Silver.

silver is going “Down” or “UP” for the 3 month perspective and also for 1 year perspective.

the fed is printing trillions to goose the market, the banks are manipulating libor rates, cb’s are rigging fx markets, pegging currencies to each other, there are dark pools and shadow banking schemes, naked derivative bets; but somehow this tiny pm market is pure of all the fraud out there. like the banks wouldnt print gold fiat iou’s they can default on, would they? and, of course, all the gld/slv etf’s have the metal. . unencumbered. right? i dont get it.

Hi ex. This probably won’t help but some of your concerns are a bit misplaced. Your comment on libor rigging, even for 1/8th percent, is well taken but some of the other problems aren’t so dire.

Central banks aren’t pegging their currencies and that is what is allowing this “race to the bottom”. Nobody (except maybe China) is pegging. Everyone is trying to devalue against everyone else.

I’m not to sure what you mean by banks printing unbacked gold fiat I.O.Us. If you have an example that would be helpful.

As for the metals ETFs, especially the large one’s, they are third-party audited regularly and no discrepancy has ever been found. The same is true of the large (multi-billion dollar) vaulting organizations like GoldMoney and Bullion Vault. You can chose not to believe it but no evidence to the contrary has ever surfaced, just vague mutterings from folks who have no data.

I was involved with the futures market as both a trader, CTA and the owner of a brokerage firm. I can tell you from experience that about 95%+ of the horror stories you hear (like the Comex warehouses are empty and they are going to default) have no basis in fact. The other 5% are badly distorted and usually based on a misunderstanding of how the exchanges work. Do as much research as you can but get objective *facts*, not unfounded rumors, and then decide how to handle your funds. You’ll sleep better.

Fine commentary, Jim. One thing that struck me in this recent ‘race to the bottom’ particularly with the Yen is how this time their mere threat of intervening has had a much more dramatic impact than on previous occasions in the past 3 years where they actually did manually sell Yen vs. X (Euro/USD, etc.) What amazed me about ferocity of this particular move leads me to believe there are some very powerful forces behind the move, like Soros and others of hid kind.

Trade wisely, all. Fiat cannot exist forever.

Jim, that is a good, and informed reply

Thank You

If I understand correctly, the basis/cobasis is simply a measure of the spread between spot au/ag and the futures contract prices. If so, then why use two terms for what is essentially the same metric? Why not just say the spread is +/-X%?

To compare to other sources of interest income in the market?? Kieth?

Dennis: whether it is possible to decarry gold profitably (positive cobasis) is not the same thing as saying it is not possible to carry profitable (negative basis)–both can be negative.

tyonker: “all the gold in the world” has a nice ring to it… *yeah* that’s the ticket! :)

ex nihilo: this is not about claiming there is no fraud, or what banks would or would not do. One common allegation is that the banks sell futures naked. The data does not support that claim.

JimT: Thanks your comments. One day I’d like to write a piece about the empty warehouse. In short, if someone buys a gold bar, sells a future against it, and leases it out in the meantime. The warehouse would be empty, but is this fraud?

Research: yes, it is important to be able to compare basis to the Treasury bill of the same duration. Also see my reply above.

So if the cobasis theory is correct, the charts are saying there is room for silver to fall relative to gold even though they probably will rally. I don’t have any experience with the basis/backwardation contango other than to have noted them in the past. Is it likely that gold’s rally will be more in percentage terms? If we are in the early stages of the rally isn’t that more likely? Does anyone have a recommendation of a safe place to allow for this kind of swapping?

Quick note on warehousing. The warehouse simply acts as a transit stop between sellers and buyers. Sellers who are delivering move gold into a warehouse and it is then turned over to the buyer who can move it out or leave it there and pay for storage. A better question is what if I sell a future and have NO physical gold? Is that fraud? No, that is the way 99% of all futures transactions are structured. Deliveries are very rare and usually only occur between banks settling accounts with each other. The futures market is a place for speculators. It is all about betting on the price. Arbs keep it aligned with the physical market but it is not in itself a market for physicals. Folks fixate on the futures market far too much. It can be a very useful indicator of current market sentiment and the supply situation, however.

One more quickie. The other side of the futures market is, of course, commercials which do have (or will have) physical possession. For them the futures market provides a hedging function. Most folks on this site that trade in futures probably belong to the speculator group and that’s who the previous comment was addressed to.

One more quickie. The other side of the futures market is, of course, commercials which do have (or will have) physical possession. For them the futures market provides a hedging function. Most folks on this site that trade in gold futures probably belong to the speculator group and that’s who the previous comment was addressed to.

tyonker: please contact us using the form linked at the top of the page.