A Curious Development in Silver

I write frequently about supply and demand in the monetary metals, gold and silver. I’ve argued that one cannot just look at numbers pertaining to “famous” buyers or sellers like India or the People’s Bank of China, while ignoring thousands or millions of anonymous people who are on the other side of the trade. Who has been “right” (from a dollar profit-and-loss perspective) over the past few years, those who sold their gold to China—or China who bought it? The gold price is a lot lower today, and that is a fact.

To do supply and demand analysis, one must look at the basis. The basis is simply the spread between the price of a futures contract and the price of the metal in the spot market. By watching changes in this spread, we can glean information about supply and demand.

If we drill down further into this idea, then we see there are actually two spreads. The basis is the profit one would make to carry metal (i.e. to buy a bar and sell a contract to deliver it in the future). The cobasis is the profit to decarry it (i.e. to sell a bar and buy a contract to get it back in the future). In general, if the basis is high and rising then we know that the marginal demand for metal comes from the warehouseman. If the cobasis is positive and rising then we know that the marginal supply of metal comes from the warehouseman.

The warehouseman does not speculate on whether the price will go up or down. He is an arbitrageur, playing the different between spot and future to make a small but low-risk spread. The basis analysis is based on (no pun intended) an arbitrage theory.

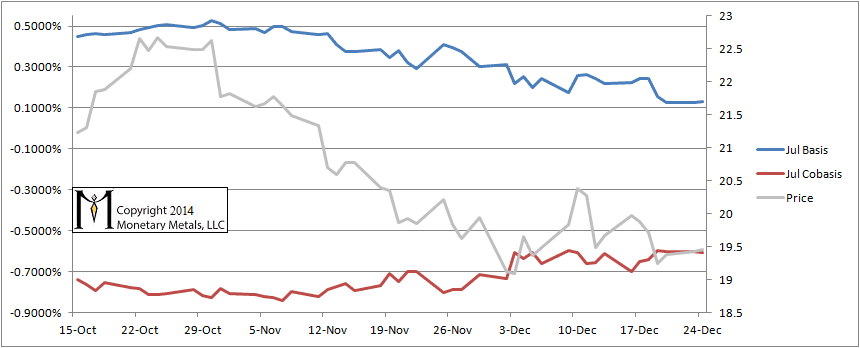

This theory leads us to some insights based on silver market data. Starting in November, the silver basis begins falling and continues falling through Christmas Eve. Let’s look at the July 2014 contract, as it’s far enough out to be beyond the gravity well that sucks the nearer months into temporary backwardation.

As we can see in the chart, the basis falls from 0.53% on October 30 to 0.13%, a drop of about 75%. The cobasis should be a near mirror-image of the basis. But, curiously, the increase in the cobasis is small by comparison. In the same period, it rises from -0.83% to -0.61% or about 25%. What could cause the basis to drop so much but the cobasis not to rise proportionally?

The silver price was dropping for most of this period, falling over $3.53 an ounce or 16%. This means we’re looking for a bid being pressed down, rather than an ask being lifted.

Basis = Future(bid) – Spot(ask)

Cobasis = Spot(bid) – Future(ask)

It has to the bid on the future.

If it were the bid on spot, the cobasis would be falling which is not occurring. In fact, the cobasis is rising, though slowly compared to the drop in the basis. How do we parse this in light of a rapidly falling basis, slowly rising cobasis, falling price—and dropping bid on the future?

We can rule out a rising bid on spot for two reasons. First, the price is falling. Second, there’s no way for the bid on spot to rise without the ask on spot rising, which would keep the basis down.

We reluctantly conclude that the ask on the future is rising. What could cause this?

Some speculators are still buying futures. While we’ve been urging caution for quite a while in our free weekly Supply and Demand Report, many commentators are still saying, “silver’s goin’ to da moon.”

This gives us a futures market with widening bid-ask spread. The bid is being pressed by one group of speculators dumping their silver positions due to stop losses and margin calls. The ask is being lifted by another group buying the dips.

Even in a normal market, simultaneous buying and selling of the future could cause the bid-ask spread to widen a bit. Market makers may not be able to hold the spread in as tightly, at least while this pressure is intense. Today, the market is not normal. A number of banks have exited or scaled back their commodities market making activities, or their lending to market makers.

One should regard this as another type of rot in the core of the system. The point of my dissertation is that narrowing spreads is a sign of increasing economic coordination, and widening spreads is a sign of discoordination. And now we have widening spreads in one market for one of the monetary metals.

This is not good.

Hi OK you lost me. Why is a rising ask on the Future no good for silver? Also why is discoordination bad? Sorry for my obtuseness.

So the bid ask spread in the future contracts is larger than for spot. Is this a new development, since when has this persisted?

I certainly appreciate these analyses you provide, Keith. There are far too many emotionally charged commentators out there plugging one thing, while the markets are certainly telling us another story. Outside of some small physical holdings, I am only buying these dips that I feel are good for short term trades in my non-pro opinion. The trend is clearly down and there will be a bottom at some point. I don’t know where, nor when.

Or I can take my $48.00 silver Max Kaiser said was going to $500 and now top tick Bitcoin? Or just trade what I see, not what I ‘feel’.

My observations have led me to notice how some of the industrial metals, like palladium & copper have fared far better over the past year in comparison to gold & silver.

Thanks for the commentary. Cheers!

Keith,

Is the basis a supply – demand indicator, or a confidence indicator about the future availability of a metal for settling forward contracts? These two are not the same.

My understanding has been that the basis is, at best, an indicator of belief, correct or incorrect as that may be, about the risks and rewards of letting go of metal now and being able to get it back later.

If so, how much confidence should we place on market participants being correct in their belief about said risks and benefits? Can they get it wrong, so to speak? Even more importantly, can they be tricked and mislead through propaganda and disinformation?

Thanks.

You have obviously been watching this sort of thing for some time. When was the last time you have seen something like this occur.

Keith,

I am a bit confused about the way you described the fall in the basis in percentage terms using the zero value as your datum. This seems to be somewhat arbitrary. Would it mean that a drop from 0.1% to 0.0% would be a 100% drop? Or even that a drop from 0.01% to 0.00% would also register as a 100% drop? How would you characterise a drop from positive 0.1% to negative 0.1%? Surely miniscule changes in price like this (a few cents per ounce) should not raise alarm bells?

Can you comment please. Thanks.

Phil