BitTulip

In the 17th century, the price of Dutch tulips ran up to incredible levels before collapsing, ruining many who participated in the first well-documented bubble. We are not knowledgable about horticulture, but we are sure that those Dutch tulips were fine specimens and produced wonderful flowers. And this is where bubbles generally begin. There is a good story.

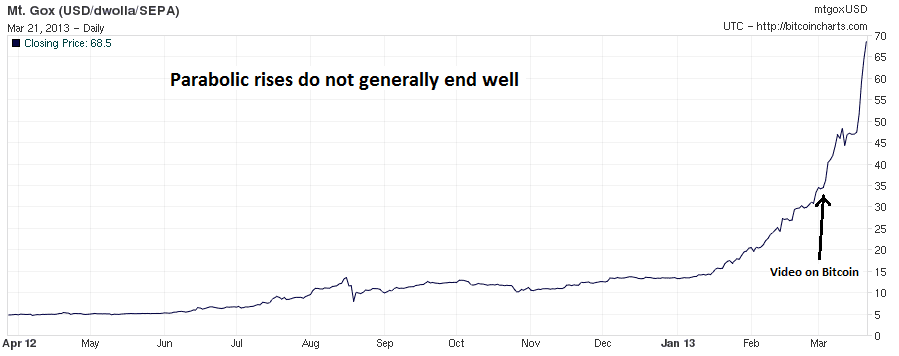

On March 3, we published a video (Is Bitcoin Money?) in which we said that Bitcoin is built on interesting technology and has unique features that enable some commerce that would otherwise not be possible. We did not express an anti-Bitcoin position, but we did argue that Bitcoin is not money, it’s an irredeemable currency. We also noted that Bitcoin might be a good speculation, the Bitcoin price had had a great run-up in price and therefore the risk was increasing that it could crash. Since then, the Bitcoin price has almost doubled.

We are not Monetary Electrons, and we do not attempt to forecast Bitcoin prices. We do note with wry amusement that one commentator said that “gold has been collapsing in Bitcoin terms for years.” This kind of cart-before-the-horse thinking, much less hyperbole, is a warning signal. We don’t recall it becoming quite so extreme as that, in silver in April 2011 (though it was pretty extreme).

There may be further speculative gains in Bitcoin. Or not. But this is a scary-looking chart.

Caveat emptor.

I had to laugh at your reference to tulips. I was speaking with a friend last week and he asked for my opinion on BitCoin. I told hime I thought I detected the scent of tulips. It seems I am not the only one. That said, I did kick in $10 for a lark. According to the chatter, I should be a wealthy man this time next year :-)

I’ll wager the ‘Dutch Tulip Bubble’ had less to do with tulips & more to do with the state of Dutch national finances at the time in question. In particular the issue of the Dutch Central Bank, or whatever it was called at the time.

I think there is a good chance that redeemability of the ‘monetary unit’ was ‘temporarily suspended’ at the time, likely due to unpayable war debts. The South Sea & Mississippi ‘bubbles’ were of a similar genesis.

JimT: who knows, the price of Bitcoin could go a lot higher.

JR: Not necessarily suspension of specie, but I agree that bubbles are not phenomena of the free market but of monetary manipulation of one sort or another.

Isn’t the more interesting question not if Bitcoin is money but why are Bitcoins valued? It seems to me an interesting divide between different mediums of exchange is not only redeemability but whether they are backed by something more valuable or in itself a commodity. Bank account money is debt and backed by the assets of the banks. The dollar is debt backed by the assets of the US government, regardless of if it’s redeemable or not. As long as there is trust in the US governments finances then there is trust in the dollar. They are valued according to their backing. What is referred to as fiat money is in fact backed money. But gold is not backed, no ones liability, it is a commodity. What is then Bitcoin? A virtual commodity? But it got no use other than as money.

The stock of the South Sea Company was highly valued, over 1000 pounds sterling, in 1720!

The US government has no assets. The $, actually the obligation of the Federal Reserve Bank, does not trade on trust, but rather in South Sea fashion.

Kind of like Bitcoin.

I guess that depends on if you believe in the real bills doctrine or not. The dollar is issued in exchange for securities. It is backed by the assets of the federal reserve. If the backing looses value, the dollar looses value. If the US can’t handle its debt obligations the securities looses value and the dollar looses value. So the dollar depends on the assets of the fed which in turn depends on the income stream of the US government to handle its debt oligations. Bitcoin on the other hand does not seem to depend on the assets of it’s issuer. Thanks for the answer, I appreciate a discussion about this.

I was initially enthusiastic about Bitcoin and its ability to show those addicted to fiat currency that there are alternatives to their printing presses. It seemed as a rather good jab at ‘the establishment.’ Unfortunately, the hysteria will reach a climax which is unlikely to benefit ‘holders’ of Bitcoins: government thugs will impose restrictive regulations purely to keep their fiat market cornered. You heard it here first. When will it be shuttered officially? Probably when it collapses and the Federales must step in to ‘restore order for the benefit of all.’ The problem with Bitcoin is the mass mentality of get-rich quick and overnight financial success that comes with no effort or work or diligence involved. (See: Charles Mackay’s ‘Extraordinary Popular Delusions and the Madness of Crowds, Volume 1’ published nearly 200 years ago.) Far too much hyperinflation for me to participate. I’ll make my money the EF Hutton way, “I’ll earn it.” Tread safely, all!