Dang It Gold’s Supposed to Go Up! Report 4 December, 2016

We’ve gone through a succession of events and processes that were supposed to make gold go up. The following list is by no means exhaustive:

- Quantitative Easing

- Bernanke’s Helicopter Drops

- Janet Yellen’s Keynesianism

- Obama’s Deficits (US government debt is now a hair away from $20,000,000,000—and that’s just the little part of it they put on their balance sheet)

- The election of Trump

- The Italian Referendum (current as we write this)

Each has been good for a little blip that has been forgotten in the noise. We are seeing articles now that have moved on to the next old-new story. It seems that Trump is going to spend a lot on infrastructure. This will require massive deficits. But the market will distrust that the government can pay. So we will see a twin sell off of the US dollar in terms of other currencies, and Treasury bonds in terms of dollars. This will cause the mases to Discover Gold and the gold price is going to skyrocket. Click here to buy our fine gold, we have the very best gold.

We get it. Everyone thinks that interest rates are going up because inflation because more spending. Actually not quite everyone—our view is that the drivers which have caused the interest rate to fall for 35 years are still in full, deadly effect. Nor the folks who are bidding on junk bonds, or stocks for that matter.

But most everyone. Rates have to go up, because they’re lower than ever before history. Right?

And if rates are going up, then so is gold, right?

The Treasury bond is payable only in US dollars. The US dollar, which is the liability of the Federal Reserve, is backed on by Treasurys. It’s a nice little check-kiting scheme. But besides that, the two instruments have the same risks. If you don’t like the bond, then you won’t like the dollar either. The day will come when en masse, the market decides it doesn’t like both of them, and gold will be the only acceptable money.

With due respect to our old friend Aragorn, today is not that day!

We believe interest rates are headed lower, not higher. But that said, we do not see any particular causal relationship between the interest rate and the price of gold. The former is the spread between the Fed’s undefined asset and its undefined liability. It is unhinged and while it could shoot the moon from Truman through Carter, it’s sailing in the other direction now. Down to Hell.

The price of gold is the exchange rate between the Fed’s liability and metal. So long as people strive to get more dollars—most especially including those who bet on the price of gold, and those who write letters encouraging the bettors—there is no reason for this exchange rate to explode.

To again plagiarize the Ranger from the North, the day will come when gold goes into permanent backwardation. But today is not that day!

Today (Friday’s close), the price of gold is down seven Federal Reserve Notes from where it was a week ago.

So where to from here? Are those dratted fundamentals moving?

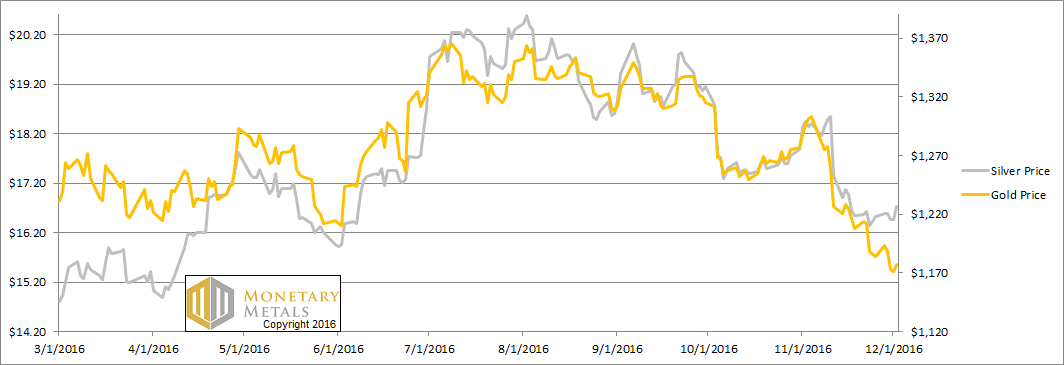

We will update those fundamentals below. But first, here’s the graph of the metals’ prices.

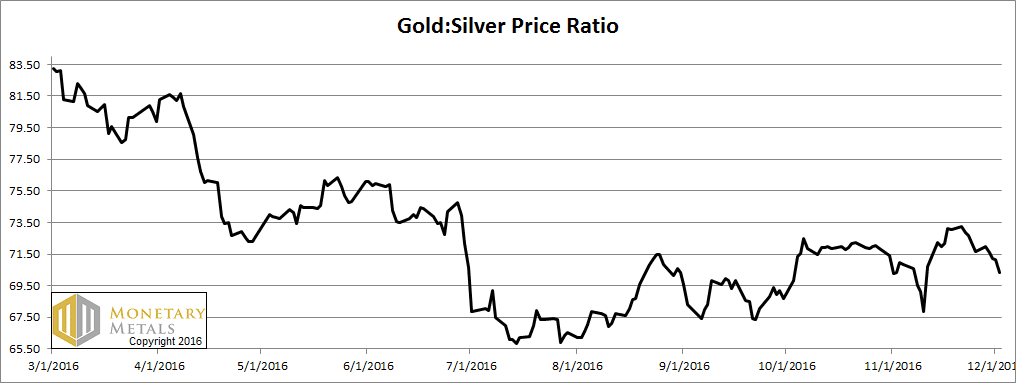

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It fell a bit more this week.

The Ratio of the Gold Price to the Silver Price

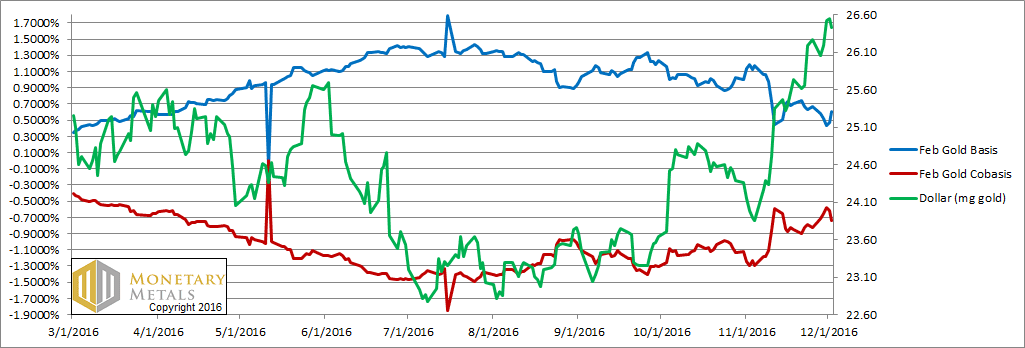

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

The price of gold fell (i.e. the price of the dollar rose, green line), and the basis (abundance) fell and cobasis (scarcity) rose just a bit.

Our calculated fundamental price of gold fell about ten bucks, now about $1,200 even.

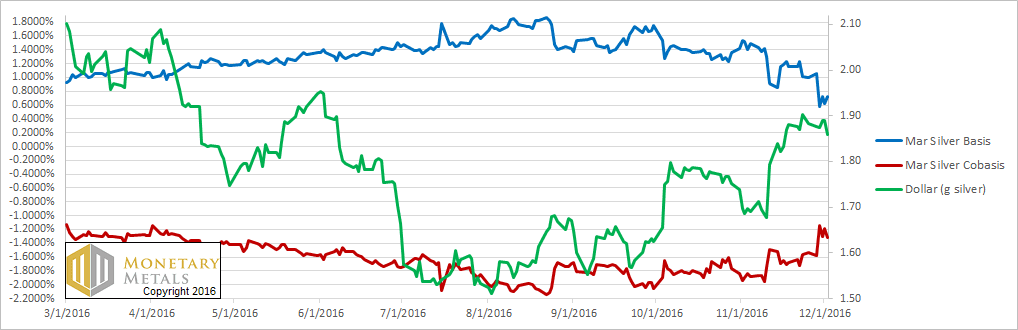

Now let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

In silver, we see a 14-cent rise in price but the cobasis is up.

The fundamentals got ever-so-slightly tighter. And our calculated fundamental price moved up to just under $15.

We note that speculators bid silver up this evening (Arizona time) in the wake of the Italian vote, some 30 cents to just under $17. But as of this publication, they couldn’t hold the line and the price fell back and is now a nickel below Friday’s close.

© 2016 Monetary Metals

Gold has done exactly what it was supposed to do with rising USD/JPY and US long term rates and rising capital controls in Chinidia.

Personnaly, I can see lots “bettors” newswriters who are short gold in USD. By the way that’s funny when a capitalist is horrified by what (others of course , not him) capitalists are doing !

RD,

Can you explain why “rising USD/JPY and US long term rates and rising capital controls in Chinidia” cause the price of gold to fall? Thanks!

It appears that for the last months/quarters, there was a very high correlation between USD/JPY and Gold expressed in USD. One could imagine that a rising USD/JPY means risk on but who knows ! The reality is that algo computers detected this and now are playing until this correlation disappears.

For now, bonds are falling but money went primarly into stocks (US and probably less in europe too though) but historically it is a rare occurence. Indeed at one stage bonds will become more attractive in term of stocks. yields will decrease which “should” benefit to gold (who wants gold with a real rates on T bonds of 2/3/4% ?).

Chininda has begun to tighten capital control to limit outflows (some chinese banks reported difficulties to get a gold import licence) which caused local prices to spike (rising premiums compared to western prices). If premiums are rising that means that they have issues to import gold from elsewehere (LBMA namely). However, I think that chinese and russian central bank are probably buying more but as usual they are doing everything to buy offmarkets in order to not bid the prices.

Nice to see some contrarian thinking in the gold community.

The logic behind the basis/cobasis stuff makes sense but then again, there are lots of things affecting the gold dollar ratio. It would be good to see how the fundamental price of gold has changed over time and how this correlates with the gold price. Just seeing the two curves would tell us if the calculated fundamental price has any predictive power. If you have this data it would be interesting if you wrote about it and commented on the correlation or whatever relationships you see.

If I am not mistaken, some have asked this but that is one of the zone 51 of the gold basis merchants…

excellent response. Love the Area 51 analogy.

A few points:

1) First, a welcome to all newcomers to the site! Forget this idea of analyzing the predictive power of this so-called “fundamental” gold price based on the basis, cobasis, etc. Some of us have been asking for years.

2) Keith is a great guy, very smart. Speaks better than he writes. . But is very creative in his thinking and will get very excited when gold’s term structure starts into backwardation.

3) If you search previous articles dating back around 2011 you’ll find Keith was unusually friendly to gold… near the highs (of course… who wasn’t!) and afterwards. He had doubts about that episode (gold at 1900) being the Big Bang terminal event, however. He wrote that The End should require several more years.

4) Obviously with gold down it’s easy now to say things like “today is not that day” because we’re at the opposite end of the trading cycle…. just like it was easy to be bullish when gold kept going up for years.

5) My take: I do not expect another 20 year period when gold remains in the doldrums. I believe that IF we’re closer to the “end game”, a reasonable assumption, each down cycle or bear market in gold will be more abbreviated than that last. I also believe the dollar is being bid higher because of it’s liquidity and our crushing level of indebtedness, as cash is needed to handle debt obligations. I’m sure you’ve heard that “Cash is King” and that’s especially true in a Depression. This Cash is King episode will be followed by a “Cash is Trash” episode as those debts are inflated away… eventually. But Keith is right, today is not that day. As long as the system can continue to expand credit the game goes on. My point is, however, we are indeed closer to that day… never forget that. The math is simply unsustainable, especially as we get past 2025 – 2035. Of course, the markets will sense this much earlier than most, and slowly begin to price in the Ultimate Solution, i.e., gold.

6) The more interesting aspect of our dilemma is the Fed’s Balance Sheet. Without the Fed’s ability to buy more bonds, who else can step in to give us more time? (For the moment let’s assume that the Fed doesn’t want to print, monetize and go hyper) The only other entity in the world is the IMF, with its special drawing rights or SDR’s. Look for the next big bailout — perhaps a world-wide bailout — to somehow be connected to the IMF.

If i’m not mistaken Keith has discussed this as well.

1) There is a TM on this magic theory. so move along he just wants to make some money bec

1) There is a TM on this magic theory. so move along he just wants to make some money because he has discovered the formula to transform lead into gold like all others… I note that other fekete’s school was not very kind with the Keith’s theories (I have one short email who “explained” me issue issue when I asked what were the difference because the two methods).

2) So much intelligence indeed wasted into filth, that’s the purpose and fate of capitalism… Lots of us at some degrees are not using own skills for real human needs, so sad…

3) It is very difficult to analyze in depth capitalism when you bow and aknowledge to every of one its principle.Just for the sake of fun, the ultimate fate of this huge cycle is the end of capitalism, no more no less (it could take many many many decades).

4) Yeah, the terminal crisis is not here yet.

5) Indeed, a huge crisis is coming, but never understimate capitalism to morth in a new structure. After all participation rate is still a huge 62.7%, it could be maybe reach 50,40,30 or even 20 to face its terminal phase.

6) It does not appear as a major issue, they have many toods remaining : QE for people, universal income, and increasing debts into africa, ex ussr countries and central and south american areas, and probably more tools in order to postpone the day when capitalism cannot reproduce the conditions of its materiality.

Don’t forget that the Fundamental price changes just like the dollar price of gold. So now, not only do you have to forecast the price of gold, you have to forecast the future price of the Fundamental, making it twice as hard, i.e., forecasting two prices instead of one. Why make it so complicated? If you’re going to use the Fundamental price as a general guide (its intended purpose) you might consider this:

1) A possible buy signal (assuming you’re in the market to buy) is when gold is considerably under the Fundamental and the Fundamental begins to strengthen, or go past certain trigger points.

2) A possible sell (or “wait until later”) signal: A good time to avoid gold is when gold is considerably over the Fundamental and the Fundamental continues to be flat or even weakens, as if a dam is ready to break.

With such proximity to the event horizon, we couldn’t really expect them not to try and turn the ship around.

basis and cobasis graphs are reciprocals. they sum to zero. what is your point?

They are not reciprocals, one is bid, the other ask. And what I ask for is some statistical analysis regarding the fundamental price of gold as it is calculated on this site and whatever predictive power that fundamental price has.

Hi andy106.

They don’t exactly sum to zero, and measure different things. These articles give a bit of background:

https://monetary-metals.com/basiscobasis/

https://monetary-metals.com/introduction-to-the-monetary-metals-supply-and-demand-report/

Deutsche Bank settled a “gold manipulation” lawsuit for $60 million. Any comment on why they might have done this?

because $60 million is such a small amount, which is easily recouped from their silver manipulations…..

Correction:

The “Gold Manipulation” lawsuit was settled for $38 million

The “Silver Manipulation lawsuit was settled for a separate $60 million

My guess is DB are probably not in the business of giving away nearly $100 million to wild accusations with no merit.

They have completely exited the precious metals markets so there is some element of not wanting a protracted case draining money and management time, but the amount seems quite high. What will be interesting is to see what happens next re the remaining defendants with DB having turned over records.

My personal position has always been that tactical manipulations would not surprise me but that is completely different to ongoing price suppression, which unlike what can be achieved with paper based markets (eg LIBOR, BTW curious no one seems to wonder about GOFO and focus on price only) in precious metals ultimately requires physical metal to be handed over. Central banks are the only ones who could backstop such action, but after taking away those CBs who are not deemed to be leasing (eg Russia) and other calculations based on physical flows, some came to the conclusion a few years ago that the CBs had run out – yet the price refuses to shoot to da moon. I’ve yet to see such analysts revisit their articles to ask why they were wrong. I’d suggest it is because they have the wrong model of how bullion banking works – something I hope to address in some youtubes upon launch of our new website early next year.

Blah, blah, blah Mr Suchecki. Over the past several years Keith Weiner made the point over and over again that the price of silver could not have been manipulated because his basis analysis said so, period. Today he looks like a complete charlatan. The recent DB revelations have given us what we thought we would never get: iron-clad evidence of the INTENTION to suppress the price of silver. If Mr Weiner had an ounce of integrity he would admit how wrong he was and adjust his thinking on how the world really works. Yeah, right.

I do not think Keith has said that the price could not be manipulated, tactically/short term as I mentioned, but that the theory that the price was continually suppressed over the long term was not supported by the facts, as to implement such a supression the bullion banks would need to have massive naked short position in the futures market (which is what many claim) and would be forced to buy back the expiring contract and sell the next. Such massive buying of an expiring contract would cause the basis to rise, yet the opposite occurs, see https://monetary-metals.com/gold-always-wins-report-6-november-2016/ for more details.

The DB chat logs show us collusions to tactically manipulate the market. If you read the complaint, you do not see any chats referring to intent to suppress the price on an ongoing, multi-period basis, nothing about managing their naked short position, nor how they are acting for the Fed. The complaint resorts to statistical analysis to argue that those tactical manipulations resulted in ongoing price weakness, and I think if they are going to prove damages they are going to have to do a better job because there are a number of holes in their analysis.

Tie yourself into as many smart-talk pretzels as you like, your basis is useless for manipulation because it’s paper silver.

Short-term, lol:

http://www.goldchartsrus.com/chartstemp/MarketManipulation.php

That is a great chart isn’t it, I suggested it to Nick over the weekend to help with an article I am writing on this topic. You may also find this of interest, which I put together for the article https://graphcommons.com/graphs/b84e9734-3519-408c-9337-7930320f8023?auto=true

I think you have missed the whole point of Keith’s approach, which is to recognise that the futures market ARE mostly paper silver and that is what enables him, via some complex analysis, to identify paper/speculator driven price factors vs fundamental real physical buying/selling.

In fairness to Keith I don’t think he is obliged to divulge full details of his methodology, which is the summary of a large body of work. He’s been good enough to publicly post it here for those who wish to evaluate it for themselves.

That being said, from what I can see, the fundamental price does tend to indicate the direction of the market, but the signal is ‘weak’ relative to other market forces, and there can be large swings in price until the market discovers the fundamental price.

It’s also a relative measure of risk/probabilities, not certainties. Earlier this year, the fundamental was calling for gold/silver ratio in excess of 100, while the ratio turned from >80 to <70 in short order, matched with a drop in fundamental to 70 ish. But there have been plenty of instances where the fundamental price has been discovered by the market relatively quickly – as expounded by Keith.

As for the 2011/2012 peak, I agree it would be handy to know what the fundamental saying at the time, although the basis was strongly positive at the time, suggesting lower prices. It would have been a killer psychological setup.

The basis seems best suited to patient investors who are looking to hold metal and increase their holdings in ounces through gold/silver arbitrage, which is something Keith has been reinforcing throughout.

New website coming soon and more graphs including fundamental prices of gold and silver…

Another reason to add to the list: the new Shariah Standard on Gold (https://goldau79.blogspot.ae/2016/12/the-case-for-gold-in-islamic-finance.html).

I remember ten years ago it was “if only every Chinese bought 1g of gold…”, now they are playing up the Muslim angle. Owning physical gold was never in doubt by Muslims as being Shariah compliant, this isn’t going to suddenly result in a huge surge in physical cash and carry demand. Everyone has missed the key bit from the bloomberg article “We fully expect to announce imminently that GLD does qualify,” – that was the WGC’s angle all along in supporting getting this standard up.

As Keith notes, there are huge above ground inventories of gold and silver. And gold and silver earn no return, except by spreading in the futures market. Therefore sentiment, inflation expectations, interest rates, “risk off” trades, blah, blah, blah determine the price … except, actual supply and demand considerations can be meaningful, such as jewelry demand and Indian gold bonds.

The price of gold and silver are primarily based on sentiment, due to the huge above ground stocks. Keith’s “fundamental price”, very much like COT data, indicates speculative buying, selling, and holding influences. Fair enough, speculative interest can go to extremes. This is certainly meaningful short term at least.

I prefer platinum. Above ground stocks, maybe 6 months supply (suppose it is a year or two worst case), and at the marginal cost of production in somewhat unstable South Africa, in my opinion, I have the best of both worlds. A store of wealth, like gold and silver, without a huge inventory overhang. An industrial metal, a jewelry metal like gold and silver, only dependent on a tiny investment demand to balance supply and demand. Much much much much dependent on investment demand than gold, much more costly to extract. Historically valued at a premium to gold, now a substantial discount.

I’m not a purist. I still evaluate wealth in dollars. I don’t think the dollar will collapse soon, maybe never or decades away. I simply want to preserve wealth in a low interest environment. I think, rightly or wrongly, that platinum is a lower downside higher upside investment compared to gold, nothing more, nothing less.

Cheers, and Happy Holidays!

Excellent point! Add to this that SA seems hellbent on introducing some new truly destructive mining laws and the case for platinum only grows stronger.

http://piercepoints.com/mining-investment-exploration-south-africa-charter-chamber-bee-taxes/

Looks like Wellgreen is the only reasonable play outside SA. If you don’t mind some very high risk Northern Shield Resources is a play too. Some platinum coins might be a better alternative…