Don’t Trade Last Week’s Silver Story!

Since February of this year, there has been at least one silver contract in backwardation. Since May 31, the September contract has been backwardated. But that has now come to an end.

Before we get to the graphs, let’s define our terms. Some people look at a graph of (cleared trade) prices. If they find a futures price that is below a spot price they declare it to be backwardation. One problem with this approach is that the quotes may not be simultaneous. A contract that is close to expiration often has low trading volume, and so one could be comparing the current spot price to a contract price that cleared minutes ago. The spread we’re looking at is small, relative to the normal price jitter that occurs minute to minute. This signal would be lost in the noise inherent to such an approach.

There is another problem with using cleared prices. They don’t tell us if someone took a bid or an offer. Profit-seeking arbitragers look at spreads, because spreads determine where they can make money. We want to understand this, not necessarily to compete with the arbitragers, but to understand what the market is offering them and why. If we know what to look for, spreads and changes to spreads tell us more than prices and changes in price. We are doing fundamental analysis, as opposed to technical analysis.

The basis is the (annualized) profit offered in the market if one buys gold and at the same time sells a gold future. This is a gold carry. The cobasis is the profit offered if one sells gold and at the same time buys a future, also called decarrying. These arbitrages involve no price risk.

This is why we define the basis = Future(bid) – Spot(ask). If one is buying gold in the spot market, one must pay the ask, and likewise to sell a gold future one must take the bid. When the basis is positive, the market is in a state callde contango.

Similarly, the cobasis = Spot(bid) – Future(ask). One sells gold metal in the spot market on the bid, and buys a future to recover the same gold position at the ask. Backwardation is when the cobasis is positive.

Contango (to vastly oversimplify) means the good is relatively abundant. Why? There is enough of it, that the marginal buyer is carrying it. When a good is in shortage, one does not see it going into warehouses. Backwardation means the good is in shortage. It is so short that it comes out of warehouses. Carrying is really storing a good in a warehouse (think about it), and decarrying is really taking it out of a warehouse.

With this background, the significance of silver’s recent price move comes into sharp focus. For half a year, silver has been in backwardation. The peak cobasis reading was 1% (annualized), which works out to around 3 or 4 cents an ounce. The silver price was around $19.60 at that time.

Since then, the price has rocketed to more than $23, a gain of about 18%. In the process, the cobasis has collapsed to zero. What is especially remarkable is that this has occurred in the middle of the contract roll.

With futures, if you intend to take delivery and pay cash for the metal, you hold the contract until it is replaced with title to the metal held in a COMEX vault. If you do not wish to take delivery or if you don’t have the cash (most futures traders use leverage), then you must sell the contract before First Notice Day. If you want to keep a long position in the metal, you can buy the next liquid contract month (currently December). First Notice Day of the September contract is August 30. As of Friday, around 38% of those who had September contracts have sold them, and the rate of selling is accelerating (it will peak this week).

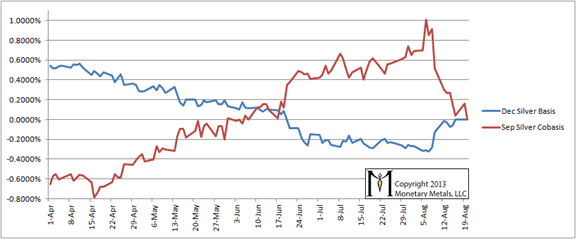

Here is a graph showing the cobasis for September and the basis for December.

Silver Cobasis (September) and Basis (December)

I say this is “remarkable” because all of this selling pressure should tend to make the cobasis for the September contract increase. This is just how the mechanics of the contract roll work.

Instead we see that against the mechanics of the roll, the cobasis has collapsed. Also, another interesting observation is that the December basis, which has been negative since June 20, has now risen to zero. December silver is on the verge of being in contango.

Traders are looking at the charts, wondering if they should bet on silver based on the recent breakout. I can’t tell you that the price couldn’t go higher (or a lot higher). But the data is telling you that the fundamentals of supply and demand are no longer supporting the case for the price to rise. The data is saying that the price has not been driven higher by buying of physical metal (either hoarders or banks desperate to cover short positions). The price has been driven by speculators in futures.

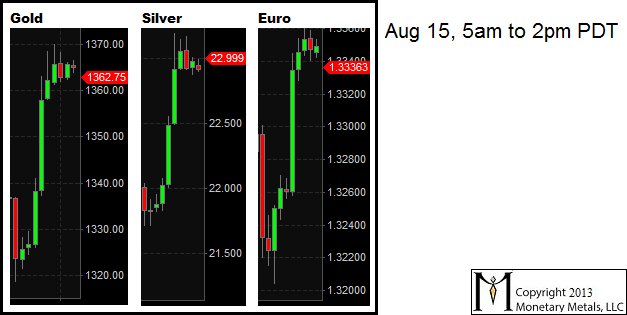

Here is a picture showing the price action of gold, silver, and the euro. Credit conditions drove these moves, and this is a consideration outside the fundamentals of silver. A tight correlation with the euro is hardly a ringing endorsement to buy silver.

Gold, silver, and euro prices in US Dollars

Caveat emptor argenteum.

Monetary Metals publishes the Last Contango Gold Basis Report weekly, which shows updates of the gold and silver bases. It is free (registration required): https://monetary-metals.com/basisletter/.

Good read. I was led here by PricedInGold.com – glad he shared your link (http://pricedingold.com/2013/08/26/market-update-23-aug-2013-silver-at-resistance/).

I occasionally write about silver (and my other investments), less eloquently though, here…

http://noonaninvestments.wordpress.com/

I think my last couple of posts have been in/around silver – not from a technical perspective, but just an understanding for the little guy on how their money us being spent when dealing with a local coin shop.

What were the basees? In the bear market of 1980 to 2000. You write as if this backwardation is so bullish. Well, you say it did not happen in the bull market (2000 to 2011) except in the 2008 severe correction. Now that the price of the dollar has rallied dramatically, we have gold backwardation. And it’s logical that it would happen in a bear market. The producers and long speculators want $1900 so they are holding back as much as possible. Since most speculators are not in a position to initiate new longs, actual users are the primary buyers who do need it now. Backwardation, from what you have presented could be a bottom indicator. However, it also could be the sign of early phases of a bear market. I don’t have the 1970 to 2010 data to tell. But it is interesting that there was no backwardatin in the bull of 2000 to 2011, butnow it’s bullish.