Gold and Silver Aren’t Getting Stronger, Report 29 May, 2016

The dollar moved up, though most people would say gold fell about $40, and silver 32 cents. In the mainstream view, the value of the dollar is 1/N (N is the quantity). So how could the dollar go up? Certainly, the quantity keeps on increasing.

Our view is different. If you borrow dollars to buy an asset, and the asset doesn’t produce generate enough yield to pay the interest, you have to sell or default. It should go without saying that it’s an unsustainable Ponzi scheme if everyone keeps borrowing more and more to simply bid up the price of any asset (including gold).

So here we are, and the dollar is getting more valuable again.

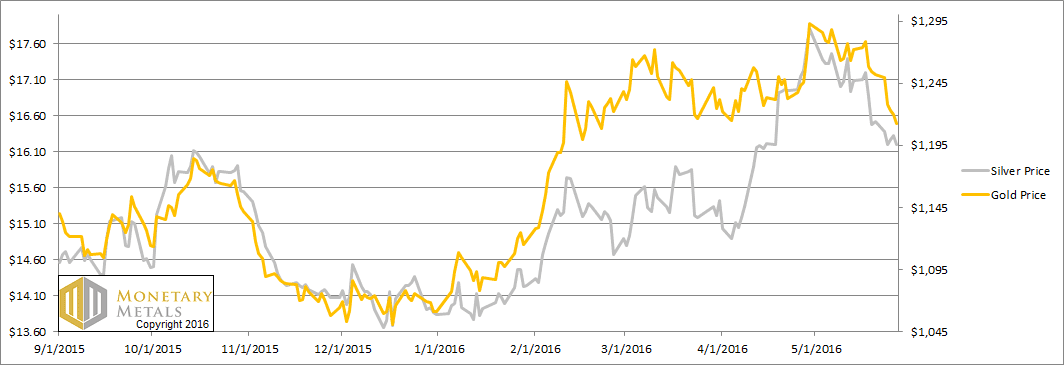

Let’s take a look at the supply and demand fundamentals. But first, here’s the graph of the metals’ prices.

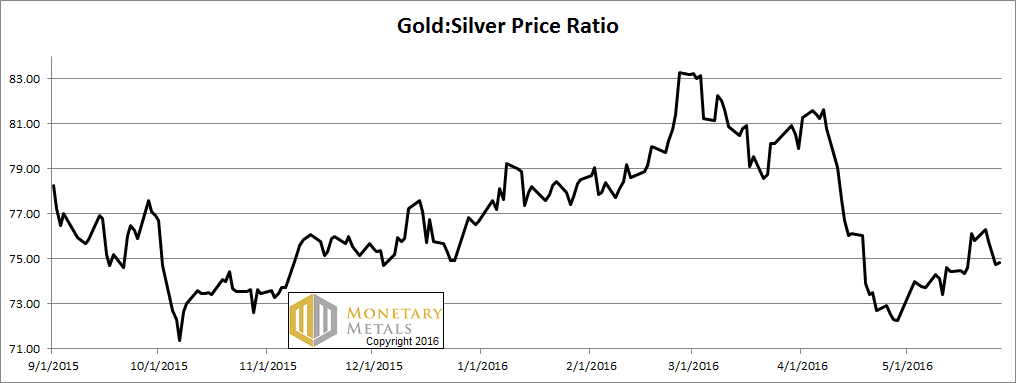

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio was down a bit this week.

The Ratio of the Gold Price to the Silver Price

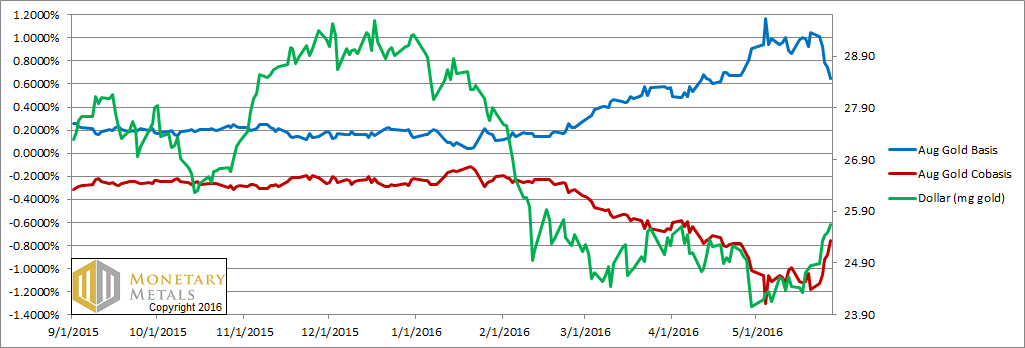

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

The red line is back to a tight correlation with the green. That is, the price of the dollar is rising (i.e. the price of gold, measured in dollars is falling). Along with it, we finally see a noticeable rise in the scarcity of gold. Gold finally got a bit scarcer as its price fell another $40. Speculators finally flushed a bit, with stop orders getting hit in this brutal (to them) price action. Regular readers of Monetary Metals didn’t get caught, as we have been saying that the fundamental price of gold is below the market.

Our calculated fundamental price of gold is just under $1,170. Sure, gold got scarcer with the price drop. But only in proportion.

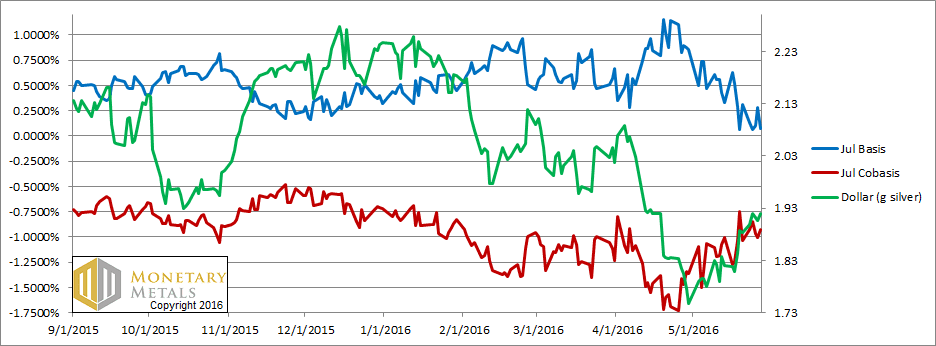

Now let’s turn to silver.

The Silver Basis and Cobasis and the Dollar Price

The same pattern applies in silver.

As in gold, silver is scarcer at this lower price. Proportionally.

The fundamental is $13.90. This gives us a fundamental gold-silver ratio of about 84.

© 2016 Monetary Metals

I’m on record here as selling at $1303. Big deal – i’m not running the website. But we heard no such declaration, no specific entry point, from Monetary Metals. So how can Monetary Metals take credit?

It’s not enough to say the fundamental price is below ((or above) the current dollar price. That’s always the case. To take credit for a trade — or for saving people money — you must make that trade or specific recommendation, not just talk theory after the fact.

@bbartlow

You’re correct: you are not running the “website”; Mr. Weiner is.

Where in the above comments does the author make any statement about a trading call or take credit for such? Frankly, I visit this blog for insight and not for trading recommendations from either its author or people from the peanut gallery such as yourself. Just a suggestion: if you have good input re gold or silver and are a hotshot trader as well, how about you starting your own blog then informing us so we can visit and check it out?

There are some key people I pay attention to regarding economic cycles and price movements. Martin Armstrong’s cycle work is suggesting a washout looming in the gold market. Tom McClellan is also forecasting a gold price dump sometime between August of this year and sometime early next year. Keith Weiner is asserting that the fundamental price of gold is under its current market price (and the pendulum always swings too far one way before swinging back).

The ideas I’ve posted before in these comments about gold dumping in response to bank liquidity tightening and overnight repo rate spikes may be occurring again, this time in Saudi Arabia as they try to maintain their dollar peg. It will be a losing battle as they sell gold to get dollars, but they just don’t have enough gold at this price. Pegs always fail eventually.

See http://wolfstreet.com/2016/05/27/dollar-exerts-stress-saudi-banks-riyal-currency-peg/

When everything ties together, look out!

On the other hand, when the gold dump happens, don’t be afraid. Have the courage to jump in and buy with both hands up to your maximum comfort level (and then some!).

I do want to clarify one thing for the record.

Monetary Metals does not give investment advice. For that reason and others, we do not say “sell X” or “buy Y”. We are publishing information on the state of the market that we calculate from publicly-available price quotes. And we publish the output of our proprietary model, in the form of our fundamental prices.

bbartlow is correct. We never said “THIS IS THE TOP!!! SELL YOUR GOLD NOW!”

We said that gold is overpriced compared to its demand.

We recognize that each reader has a different time horizon, goals, position, etc.

I think you meant Jim_n is correct. But we get the point.