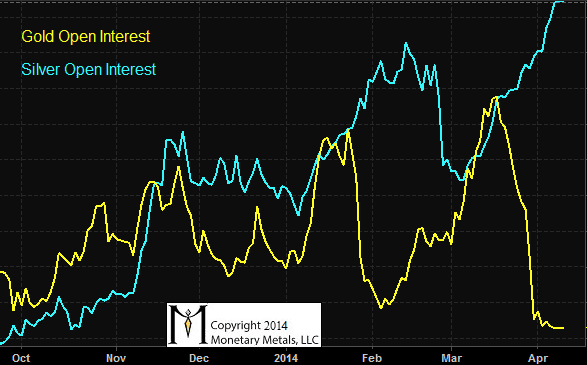

There is a stark difference between the states of the markets for the monetary metals. The number of open futures contracts in gold is low, while in silver it’s high. First, let’s look at the data and then we’ll discuss what it means.

Here is the graph showing the open interest.

The picture is clear enough. Since the beginning of fall, the number of gold contracts has blipped up and down and now there are somewhat fewer (-3.7%). Meanwhile, the number of silver contracts has gone up substantially (+39%).

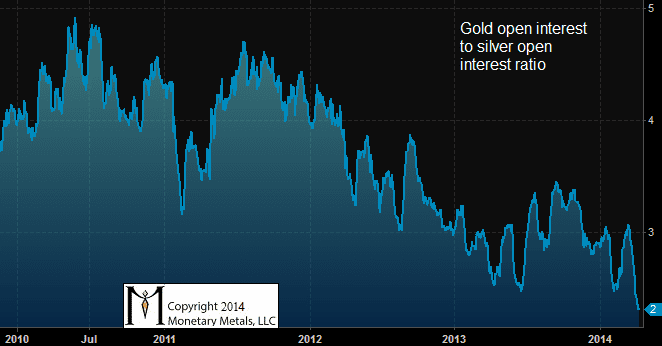

Now let’s look at the ratio of gold contracts to silver contracts, going back to 2010.

There is an unmistakable downward trend since the middle of 2010, almost 4 years ago. Then, there were about five gold contracts for every silver contract. Today, the ratio is down to two.

OK, but what does this mean?

Open interest is a proxy for speculative interest. This is not simply because contracts are created by buying, and destroyed by selling. You can’t assume that contracts are created and destroyed as the price moves. To see why it doesn’t work that way, look at the stock market. The price of a stock can move all over the place, but there need not be any change to the number of shares outstanding.

In the futures market (unlike in the stock market), the number of contracts changes continually. Contracts are added or removed by the computer software that operates the market. When you buy or sell, an existing contract may be transferred from one party to another, or a new one may be created.

It’s complex, but in essence if you want to buy a contract just when else wants to sell, the contract will change hands. It works similarly if you want to sell short, right when someone who is already short wants to buy.

By contrast, if there is no current owner of a contract to sell it to you, when you want to buy, then a new contract must be created. Who sells, who takes the short side of this contract? It can certainly be someone else wants to speculate on a falling price. There are always (well, usually) traders who go short silver. However, I don’t think that this is the full explanation of the data shown in these two graphs.

I favor a theory of arbitrage. If it’s profitable to buy metal in the spot market and sell a future against it, then someone will take this trade. This short seller is a source of unlimited contract creation, if it’s profitable.

It’s called carrying the metal. If you carry, then you make a small spread—without price risk. This spread is called the basis—the price of the future minus the price of spot metal. Or, more precisely, basis = Future(bid) – Spot(ask), because you must pay the ask when you buy the metal, and accept the bid when you sell the future.

Let’s take a look at the gold basis and silver basis for the Dec 2014 contract, from early fall through today.

The profit to carry gold has been steadily falling. It began at 0.35% (annualized), when the duration was 15 months. It was hardly the stuff of legends—or getting rich quick—even last October. That meager margin has been steadily eroding, and is now 0.1% for 8 months. Suffice to say that gold carry has offered little or no opportunity to make money. Therefore the gold carry trade has not been a big source of contract creation.

The profit to carry silver, by contrast, has not much changed. It’s still around 0.5% (annualized) or more. This is far more attractive than gold, and probably more attractive than other opportunities in our zero-interest world. Therefore, the silver carry trade has created many silver contracts.

What drives the basis spread? Speculators, when they buy a future, drive up its price just a little bit. This is the inducement to the arbitrager to buy a bar of metal and sell the future to the speculator. The arbitrager carries metal, to provide a service to the speculator. He is the one who “converts” (I use this term carefully, in the full context defined here) metal to paper, a bar to a contract. He’s ready, willing, and able to deliver that bar should the speculator have the cash to demand delivery.

The long and short of it (to make a tired cliché into a dreadful pun) is that in gold, there just is not much speculation, and therefore no profit to be made carrying the metal, and therefore when a buyer occasionally comes to the market his demand can be satisfied by a previous buyer who is selling a contract.

However, in silver buyers are running at a much more torrid pace. They’re too numerous to be satisfied by the occasional seller. They bid up the price of the futures, which makes it attractive for arbitragers to carry silver and sell them the contracts they desire.

Incredible as it may seem, at the low price of $20, speculation in silver is rampant. Market participants are trying to front-run a big price move. Due to rumors or gut feel or for whatever reason, they are expecting not only that silver will outperform gold, but that the silver price will rocket to a much higher price. Their frenetic buying of futures has pulled a lot of silver into carry trades.

Maybe hoarders will all of a sudden increase their appetite for silver metal that they will take off the market and bury. If so, the silver futures speculators will be proven right, and they will make a lot of dollars (money is a different story entirely).

I would not recommend that anyone bet his hard-earned money on a maybe. The data—both open interest and basis—show that the buying in the silver market is primarily speculators. They cannot sustain a higher price forever. They are merely trying to front run a higher price driven by hoarders. If hoarders don’t come in, the speculators will be forced to capitulate. When that happens, watch out below.

The neutral price of silver is in the $16’s today. If the price overshoots as far to the downside as it is now stretched to the upside, we could see silver with a 12 handle.

:

:

Hi Keith,

Is there a possibility that gold is less and less purchased on Comex by physical buyers because they are more and more concerned about the ability of this exchange to deliver gold in an easy way resulting in lower gold OI than this of silver ?

Nonetheless, recently everything confirms that physical gold is much harder to find than silver.

Don’t you still think that silver fate is directly linked to the gold one : if gold breaks down 1180 (or 26.3 mg if you prefer) that is indeed VERY highly probable that gold/silver ratio will go back to 80/100, but if not do you think the speculators may throw the towel and GSR will go to 80 or more without gold new carnage ?

Regards.

Something I forgot is that this rise in silver open interest happened when silver fell in dollar term : some may try to front run potential silver physical buyers but as you wrote they have to buy the physical and sell the future in order to profit from the carry. If so the silver basis should have been falling ?

Regards.

Hi Keith.

Another good piece of analysis, as usual.

I must admit that I do a bit of speculating in both gold and silver and also some hoarding of gold

I sold half my silver at the very top a several of years ago but for some reason I hang onto my gold and add on occasions.

A while back I read an article (POPESCU) about the strong price correlation( direction) between G and S. Wherever Silver went, Gold followed.

My thought at the time was this..that if there is an economic downturn and likely less use for silver industrially, then should its price go down ,then gold would likely follow, given the strong correlation.

Gold technically broke its uptrend at the beginning of 2013 and silver before that, with no real end in sight for silver.

Looks like both will continue down as far as I am concerned at this stage at least.

Thanks Keith !!!!

Keith, Hi,

I just love your analyses. Either the clarity of your writing has increased or I am becoming more able to understand them – not sure which.

Just a thought on your belief that the gold price is not manipulated. With the dumping of large quantities of paper gold being done at unsociable hours, thus dropping the price and then with the London gold fix taking place only a few hours later when it must be influenced by the overnight price action and is dropped accordingly – could the timing gap not be too narrow to show up in your basis, cobasis calculations.

Keep up the good work.

Keith,

What do you mean by “the neutral price of silver is in the $16’s today”

Regards

Thanks for all the great comments.

pherisse: If a significant part of the market believed that COMEX won’t deliver, we would see backwardation in many, if not all, gold futures months. Also, I think we will see it in silver too. The prices of the two monetary metals are definitely linked. There are arbitragers who drag the one if the other price changes. I believe that right now, there are long silver / short gold arb positions held.

Let me clarify one thing. Those who try to front-run a price move are not arbitraging. They are not carrying. They buy futures and wait for the “blast off”. The arbitragers are a different group–I mentioned them because they are the ones who are the source of the new silver futures.

blowforhome: maybe it’s both? ;)

Regarding the price manipulation claims, I have written a sizable body of work debunking it. It’s all on this site, just scroll back through the pages to last winter. I am sure I wrote more than half a dozen articles about different aspects of it.

What’s the neutral price of gold?

Thanks for the article Keith.

Thanks for replying NOT!

Here’s why your argument is complete nonsense: The total open silver interest on the Comex is 162,988 contracts, representing 814 million ozs. Against that, total silver inventory reported in Comex vaults is 178 million ounces. There is 450% more total silver open interest than there is total silver available for “arbitrage” against those contracts.

Furthermore: There are 79,035 front-month silver open contracts, or 395 million ozs. Against that is 53 million ounces “registered” and available for delivery. That’s 750% more front month o/i than there is available to silver to deliver.

To justify the relative underperformance of silver vs. gold by saying that there’s an easy “basis” arb trade to be made is absurd. The underperformance of silver is completely attributable to to the naked short-selling being done by the primary Comex silver banks, which are JP Morgan, Scotia and HSBC. This are not coincidentally 3 of the 5 banks involved in the London gold and silver price “fix.”

Investment: Do you want to learn? Or do you just want to be right?

That’s a well thought out, articulate response. Thanks.

Your “neutral” price concept is complete and utter nonsense. Sure, it might work with depletable commodities for which the futures open interest and the supply of underlying is closely aligned. But to apply this analysis to gold and silver is beyond absurd. Furthermore, neither you not I have any clue whatsover the degree to which OTC silver derivatives factor into the equation.

Furthermore, you fail to explain why the CME has put the clamp-down over the last 3 years on silver vs all other commodities contracts, including gold. Not only that, the CME overlooks the fact that JPM has gone many multiples beyond violating position limits in silver.

The interventions and lack of rules enforcement has distorted the fundamentals of the silver market well beyond the distortions in the stock market caused by Fed intervention.

should read “clampdown on silver leverage vs. the leverage allowed on all other commodities futures…”

Over the past 15 months, I have posted a large body of material debunking the manipulation conspiracy theories and another large body of material (and some videos) explaining my theory and methodology of analyzing supply and demand in gold and silver. I absolutely agree that gold and silver are different from all other commodities. Whatever you think of my approach to these metals, I think you will agree that I am not taking the conventional approach used for wheat and crude oil.

Perhaps the simplest case in point I make against the manipulation theories, I showed to Lauren Lyster on Capital Account (video is under videos on this site).

I’ve considered your work carefully and think you’ve debunked nothing, yet you continue to hammer away with these obtuse arguments that don’t apply, so desperate to prove that somewhere there’s always a free market like some kind of caricature out of an Ayn Rand novel.

Your arguments don’t apply because you can’t prove a link between the paper being bought and sold and the physical those contracts allege to represent. It’s that simple. You need to prove that and you can’t. And that should be a much lower bar than manipulation arguments which need to prove intent, which can never under any circumstances be proved.

Ted Butler has been banging on about manipulation for years in the Silver Markets…and to what avail?

Waste of time.

CFTC said there was nothing to find.

Anyway, I am not sure either way. When you see multiples of short contracts being dumped when the market is extremely thin, I have to wonder.

However, I do not mind. The $ price is still more than I originally paid.

When i deem it appropriate I will swap some increasingly worthless dollars for more Gold and Silver.

Is it not good that both are cheaper in dollar terms?

For me it is all about the ever increasing erosion of confidence in the DOLLAR .

Gold is the monetary metal. It is the only metal hoarded by central banks. That alone tells you what you need to know. Silver is an industrial metal.

If you want to speculate in or hold silver go ahead, but you’ll be disappointed. It is the metal for all sorts of indebted riff raff.

Gold, by its nature, accumulates and accumulates into strong hands, the hands of savers. When the dust settles, you will either be holding real gold, or you won’t. And you will curse the fact that you ever bothered with silver.

Read Another/FOA/FOFOA.

Then explain why ASE sales are breaking records every month, forcing the mint to ration with weekly allotments.

And re: manipulation, rationing should never occur in a free market.

Keith

Although “InvestmentResearchDynamics” could have phrased his response in a less agressive manner I think he makes a valid argument regarding total open interest vs total silver inventory. How do you respond to his point ?

Also, you have not responded to my question regarding your statement that the neutral price of silver is in the $16’s

Regards

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/4/14_Comex_Casino_Lies_%26_Silver_Skyrocketing_To_New_All-Time_High.html

And yet another view

Dear Dr. Weiner:

I second rutz007. How do you read a fundamental price for silver of $16 while in a prior post you mentioned $1,400 for gold.

So the fundamental ratio is 87 oz of silver per one oz of gold?

Now that’s interesting……

There seems to be a big discrepancy between what is happening and what we hope will happen. Keith reports on what he sees while KWN (Kingworldnews) report on what they believe.

why do i say that?

because KNW has the same message no matter what happens

if gold goes up or down, KWN says it will go up.

the only reliable thing about KWN is that everyone that talks there says the same thing

one could consider that reliable, but in that case so is a parrot

At least keith is basing his data on research of current market conditions

KWN seems to basing things on belief.

years ago keith was pointing that silver was going to go down in price

KWN kept on saying it was going to explode

KWN keep on saying that till this day, while in the mean time it has dropped below 20

why listen to KWN or the idea that the gold and silver ration is going to go back to 16

I think the last 4 years have clearly shown that in this day and age, it’s not happening

we in a bear market, it hurts, and that’s just the reality of things, no ?