Gold Caught With Its Backwardation Showing

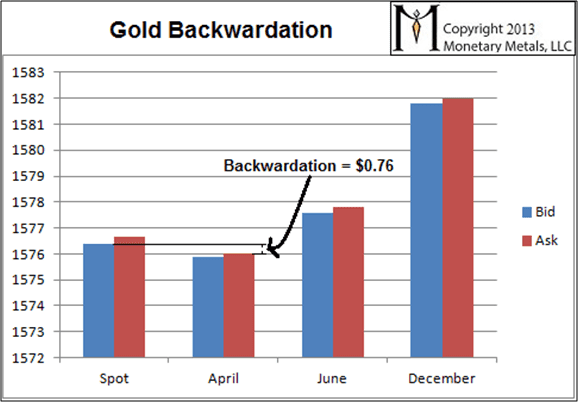

With all the discussion on the Internet, some of it confusing, we thought a picture would be worth a thousand words.

Backwardation is when there is a profit to decarry the metal. This is the simultaneous sale of metal in the spot market and purchase of metal in the futures market. Selling is on the bid and buying is at the ask. So the spread one could earn is the decarry: Spot(bid) – Future(ask).

We normally quote this as an annualized percentage (the basis), but we thought we would show the raw numbers. This graph was made about 10:15am ET on March 4.

Sure enough, there is a 76-cent per ounce profit to be made decarrying gold. This is a small number compared to the price around $1600, and it could be easily missed. It is the actual profit one would make in the real market by this arbitrage (not including commissions and fees, which a bullon bank would not be paying).

It is fascinating that it persists. It’s been there for weeks! Does no one have gold to put towards this trade? Is there no attraction to a 0.3% annualized return on a risk-free trade maturing in less than 60 days?

Monetary Metals publishes the basis and cobasis with commentary every week (free registration required).

Decarrying seems to be (not) happening for quite some time now. Is it safe to say that whomever is in the position to do this does not trust the dollar enough to give up their gold for it… even temporarily?

Where do you get your numbers, Keith? Do you have access to them programatically?

It would be quite interesting, in my opinion, to create a live tracking of backwardation. Ie., like the graph you show above, but on a website, updated live as the markets change.

It could have additional bars, or simply be made to only show the contracts that are currently below spot price. It could even update live, on-screen as one views the web page. I fear that the data costs money though, which makes it unprofitable to make such a page just for fun.

I use Yahoo Finance, but they don’t show an order book, only “last trade” prices, for one, and secondly, the futures price often lacks behind the spot price, making it possible to seem like there’s backwardation, when it’s really just a thinly traded futures contract not catching up with a rising spot market.

I find this very interesting but I guess 0.3% annualized return is just too little compared to other almost risk free investments. It’s also not possible to leverage up on the trade. Financing would be more expensive than the profit. I think backwardation has to be a little bigger than this to get really interesting.

Uronly: I think there are trust issues, but I wrote about temporary backwardation some time ago: https://monetary-metals.com/temporary-backwardation-the-path-forward-from-2008-3/

runeks: you need a (paid) realtime quoting service to see bids and asks; last cleared trade price is not sufficient. We are thinking about additional ways we could offer the information, but for right now we are doing the weekly basis letter (https://monetary-metals.com/basisletter).

danho: remember that someone owns every gold bar in the system. One of them ought to be tempted by this trade…

The decarry trade isn’t risk free: there’s a counter-party risk involved in giving up your physical metal now and trusting that the futures contract to be “good as gold” in 60 days, or whenever.

bingo!

i disagree wi/ your preposition that decarry isnt risk free because “somebody” gives up physical metal….etc.. it sounds good on paper but the reality appears to be different.

what if the premise that someone owns every gold bar in the system and if found on the wrong side of the trade must “decarry it” is wrong? what if the one that owns the gold bar can pledge it many times w/o any fear that the bar will be lost to the party on the other side? please keep in mind that if libor rates can be rigged, so can be gofo rates rigged; thus, basis/cobasis can be rigged; and if markets can be this rigged, it cannot be discounted that settlements can be forced in cash as opposed to metal. my question then is: what happens in “those” circumstances?

Watched your latest video on gold backwardation Keith. Interesting. While I remain sceptical that the credit bubble that is the modern monetary system can be measured, at least in in $ terms, I applaud your willingness to make your ideas freely available.

Am I right in thinking that you believe gold is in backwardation in the nearest month & not the outside months due to the sheer volume of transactions in the nearest month contract?

I’m assuming that the nearest month is the most ‘liquid’.

I should add – the sheer volume of transactions in the nearest month contract, so requiring the most gold?