Gold is Not Going to $10000, Report 24 July, 2016

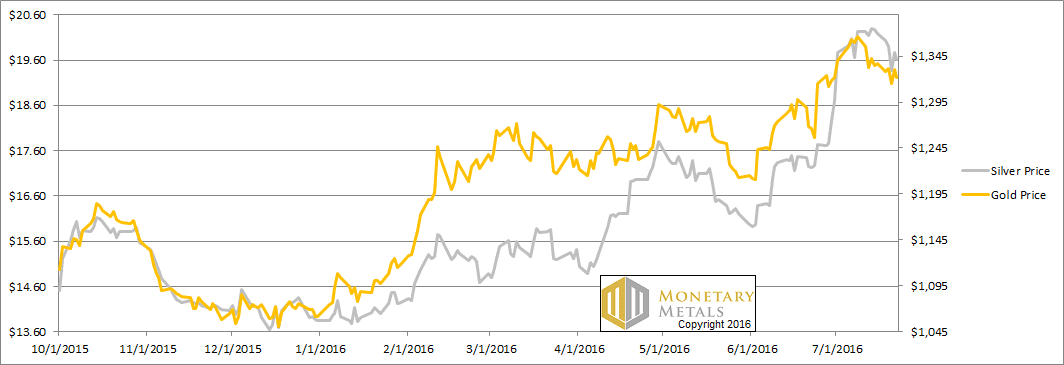

The prices of the metals were down again this week, -$15 in gold and more substantially -$0.57 in silver.

Stories continued to circulate this week, hitting even the mainstream media. Apparently gold is going to be priced at $10,000. Jump on the bandwagon now, while it’s still cheap and a bargain at a mere $1,322!

Our view is, well, not so fast.

Of course, at the end of the day the irredeemable paper currencies will fail. But we have two thoughts to add to this. By the time the US dollar is failing, it will become obvious to everyone that $10,000 is no riches. It will be clear even to the Monetarists that this does not mean gold is going up, but that the dollar has gone down over 7X from where it is now (from 23.5 milligrams of gold to 3.1mg).

Of course, our old refrain is that a lot of price action can occur between now and then. If you’re playing the gold market for dollars, you can’t trade based on the endgame.

So let’s look at the only the only true picture of the supply and demand fundamentals for gold and silver. But first, here’s the graph of the metals’ prices.

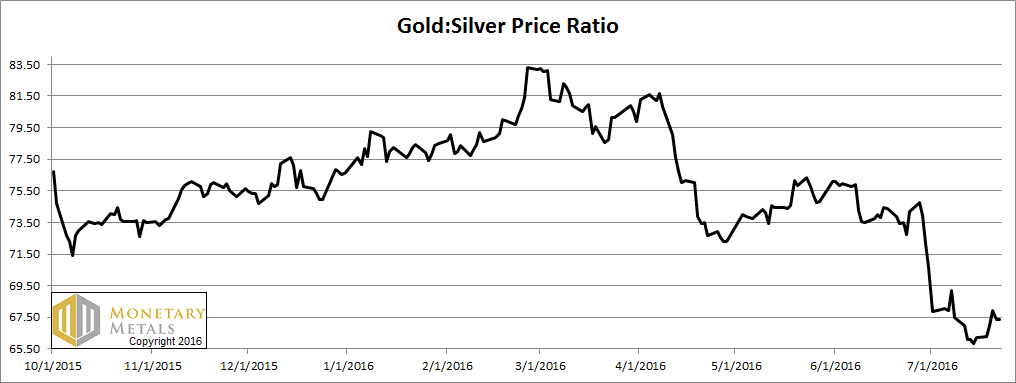

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio rose this week.

The Ratio of the Gold Price to the Silver Price

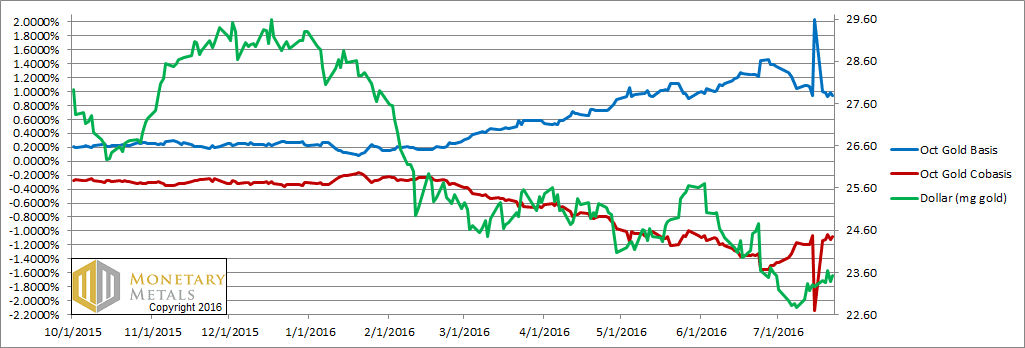

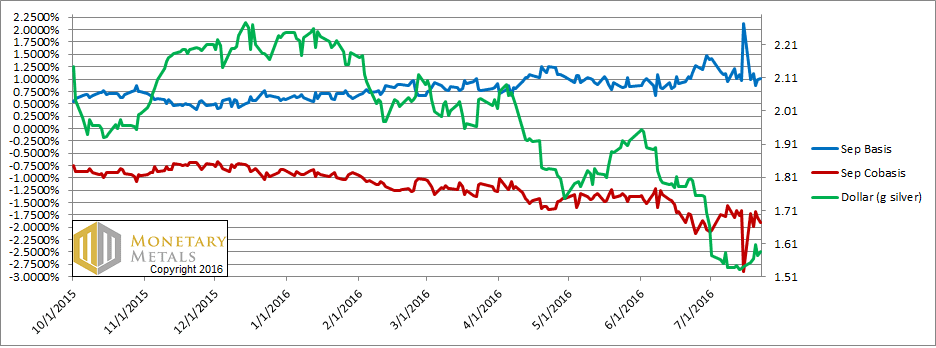

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

Last week, we said:

“We have to say that we are skeptical of the large move up in the basis (i.e. abundance) and downward in the cobasis (i.e. scarcity). We want to see the data for this coming week.”

As is clear on the graph, we were right to distrust these spikes.

The real move is clear (going forward, we will erase the one day with the bad data so the graph will be easier to read). The price of the dollar, in gold terms (i.e. inverse of the price of gold, measured in dollars) is rising. With it, gold is becoming less abundant (blue line, i.e. the basis).

The fundamental price is not buying the $10,000 gold story. Not one bit. It is down around $1,140.

Now let’s turn to silver.

The Silver Basis and Cobasis and the Dollar Price

In silver, it’s even worse as we see a falling scarcity (i.e. red line, the cobasis) as the price of silver falls (inverse to the graph, which shows the price of the dollar, measured in silver). Not counting the anomaly, the silver cobasis fell from -1.66% on Thursday, July 14 to it’s current -1.9%. While the price of the metal fell from $20.28 to $19.62.

The fundamental price is way down, to about $16.

© 2016 Monetary Metals

Thank you for the update Keith.

There was an article in the WSJ recently with the title: “Black Hole of Negative Rates Is Dragging Down Yields Everywhere”

So for the past 35 years we have been led to believe that declining interest rates are good for the economy, but now that bond yields are going negative we hear the words “black hole”.

We are fortunate to have this website to clarify the mathematics.

While slowly the arb swelled their gold

Silver’s high, you maintained. Should be sold.

Come to me, pay your fee

Get your one percent free

That poor man’s junk just leaves me cold.

Keith,

How is it that the fundamental price decreased this week while the cobasis increased??

“”The real move is clear (going forward, we will erase the one day with the bad data so the graph will be easier to read).””

wish you wouldn’t do that. it’s odd too for a graph we’ve been watching for many weeks to disappear and reset at contract roll time.

Greetings Keith

I personally don’t subscribe to the Basis, Cobasis theory for gold or silver pricing…

Prior to 1975 gold/silver did not trade on the futures exchanges…

It was only innaugurated at the behest of the elite bankers to control the prices,

which they have done an admiral job of…

The basis, cabasis can work fine for commodities but NOT MONEY [like gold/silver]

So any talk here about gold not going to $10,000 is shear DRIVEL…

At some point in time, unknown to me, the futures market for gold/silver will collapse..

and the price will undoubtedly be multiples higher…

Any and all charting for gold/silver on the COMEX futures market transactions is complete NONSENSE…

The market is rigged top to bottom…

“”IF”” you doubt me…..do your home work about the

“”Exchange Stabilization Fund”….which is authorized by the US Congress to control the price of gold….

YES !!! The price of gold will go to $10,000 or higher

Once it gets out of it’s death throws of manipulation by the US Treasury Department

Thanks for the comments.

I want to point out one thing. I said:

“Of course, at the end of the day the irredeemable paper currencies will fail.”

“Of course, our old refrain is that a lot of price action can occur between now and then. If you’re playing the gold market for dollars, you can’t trade based on the endgame.”

Fail means value will be zero, which means the price of gold in terms of worthless paper will be undefined (not infinite, actually there will be no offer to sell gold at any price).

I hope people are not buying gold hoping to multiple their dollars by 7 (or, with 10:1 leverage, multiply their dollars by 70).

“”I hope people are not buying gold hoping to multiple their dollars by 7 (or, with 10:1 leverage, multiply their dollars by 70).”””

isn’t that a big % of the $6+trillion paper dollar quoted metal market used for the basis report? people who have no use or ability to use a stack of huge gold bars?

Yes, exactly, and as they have no ability to stack bars they have to roll contracts (often at a cost) and because they are leveraged the profitability of their trade can turn quickly, hence we can consider these speculators “hot money” and unlikely to be long terms holders compared to cash (fundamental) holders. The mistake is to look at any price action in isolation and assume all of the buyers behind it have the same staying power.