Grave Silver Mistake

We came across an article today, talking about silver supply troubles. We get it. The price of silver has rallied quite a lot, so the press needs to cover the story. They need to explain why. Must be a shortage developing, right?

At first, we thought to just put out a short Soggy Dollars post highlighting the error.

Then we thought we would go deeper. Here’s a graph showing the price action in silver since the beginning of the year, overlaid with our abundance indicator.

It’s uncanny, isn’t it? As the price has risen, silver has become more abundant to the market. Anyone buying silver on grounds of an anticipated “supply troubles”—much less buying it with leverage—is making a mistake.

This doesn’t mean the rally couldn’t extend further. We would kind of expect that at this point, just from watching the momentum. It does mean that the story is false, and when the price action reverses, there are going to be dreadful losses. Especially to those who buy with leverage.

Let’s debunk a few other errors in the article.

“Output from mines will fall for the first time since 2011…”

Mankind has been accumulating silver for many thousands of years. Unlike gold, some of it is consumed. Unlike any ordinary commodity, most of it is not. Economists call this the ratio of stocks to flows—inventories divided by annual production. In gold and silver, stocks to flows is measured in decades. In ordinary commodities, it’s months. In wheat, crude oil, or lithium if inventories build up too much, that is called a glut. The price crashes until the glut is worked off.

There is no such thing as a glut in gold or silver, nor a shortage. This is part of what makes them money.

“Production is declining just as signs of stabilization in China’s economy fuel optimism…”

We would not bet on this.

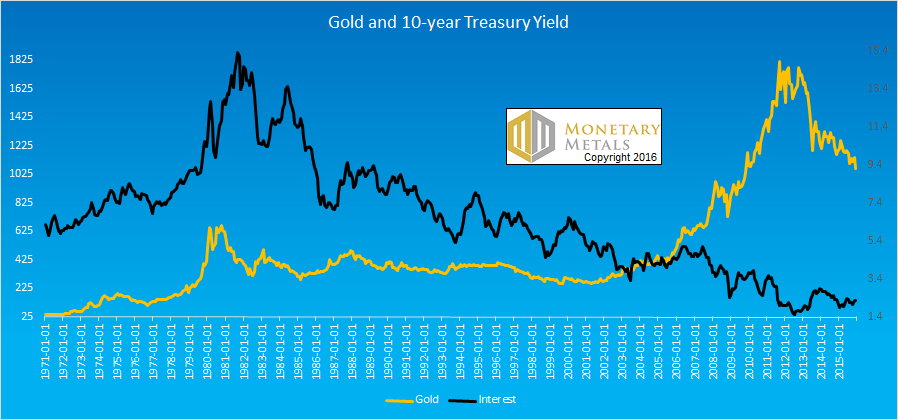

“Both metals are benefiting from increased expectations that the Federal Reserve will be slow to raise interest rates this year…”

Every time we see this old saw, we wonder if anyone has access to historical gold prices and interest rates. Here’s a graph we published in our Outlook 2016.

Whether the Fed is to raise interest this year or not, there is no correlation to the price of gold or silver. Whatever may drive the price of silver to $20 much less $50, it won’t be a 50 bps hike or cut in the funds rate.

“Output will drop 2.4 percent to 784.8 million ounces in 2016…”

Supply of a monetary metal consists of the stocks plus the flows. All of that hoarded metal is potential supply, at the right price and under the right conditions. Stocks are a large multiple greater than flows. And this article is citing analysis that predicts a 2.4 percent change to flows. In the total supply, this may be about 2.4 percent of 2.4 percent.

“Holdings in exchange-traded funds backed by silver surged more than 1,132 metric tons this year”

This is a measure of silver stocks moving from one place to another. This statistic might be important to businesses in the trade, such as refiners and depositories. It is not useful in predicting the price. Ironically, the big gain in ETF inventories may be metal coming from Asia. Metal flows from where it is cheaper to where it is priced more richly. If speculators relentlessly push up the ask price on the ETFs, then they will draw in metal from where it is cheaper.

To underscore our point about abundance, isn’t this a sign of it? The marginal use of metal is to go into paper vehicles designed to let asset managers speculate on the price of silver using an equity.

Caveat emptor argenti.

© 2016 Monetary Metals

“Supply of a monetary metal consists of the stocks plus the flows.”

Correct but the characteristics of the two are different. Flows mainly come from price taking sell at market producers. They are forced to sell to meet cash flow needs for mining operations and debt service payments. Not exactly sophisticated sellers. Producer supply (Flows) is also sold through a well established large, liquid, quickly delivarable market conduit in relatively standardized forms.

Stocks are held in various forms, across many more different and much less connected counterparties and in most cases are not forced price takers.

Calling the projected supply drop as “2.4 percent of 2.4 percent” maybe technically correct, but have far outsized practical implications in market trading.

“The margin” in a market is by definition that which establishes the quoted price.

One way to decide whether the “marginal use of metal is to go into paper vehicles” would be

to show that industrial use volume has shrunken relative to the ETF volumes.

Another would be to consider that producers cutting back their flows are in effect hoarding their proven reserves, perhaps speculatively in the form of selling paper futures.

Announced reserves are effectively additions to the “stock” that just hasn’t yet “flowed”.

Slowing production may in fact represent an increase of the silver stock, even if it isn’t quite as available to market as silver in a bullion bank, it is available enough to hedge.

I think that the analysis that Monetary Metals does is fine and accurate and I also understand the stocks to flows etc etc.

Good stuff Keith.

Be that as it may, how is it that some entity can drop multi millions of dollars worth of sell orders in very thin silver markets.

Why would anyone do that ?

Are those orders Naked?

Do they actually deliver the goods?

But above all Deutsche Bank has admitted to market rigging of the silver market…why would they do that…both the rigging and the admission.

Given that fact…is any fundamental analysis correct.?

In some ways none of it matters to me. I buy gold when I can because it is money and its nice to hold. Insurance cover… and hopefully I don’t need to claim.

As an aside, I speculate long and or short on gold and silver using purely technical analysis…at the end of day!!! ALL THE INFO is in at that time.

I do OK and I buy gold with my “profits”…its mostly fun to me.

I also follow John Kim of smartknowledge and wonder about technical analysis when markets are not free to function as an unfettered price discovery mechanism.

If prices are set by paper that are not backed by the physicals then surely any analysis is suspect – “garbage in – garbage out”.

Until precious metals are once again acknowledged as a form of money and price manipulation ceases I wonder how anyone can really be able to analyse with too much confidence. Better to buy as insurance.

test

When demand exceeds supply, metal is dragged out of hoards – by higher price, for there is no other mechanism – to remedy the deficit. That is the rationale behind fundamental analysis of silver supply and demand. The presence of stocks should not be exaggerated in the case of silver, for they are thin. Silver is not merely a monetary metal and it should not be viewed as such. It has dual characteristics which need to be understood, not obfuscated.

Surely you acknowledge a correlation between the $US gold price and the real interest rate?

“Ironically, the big gain in ETF inventories may be metal coming from Asia.”

This is certainly the case with gold. Following the sharp price rise in 2016 that saw large net flows into the UK and Switzerland for the first time since 2012, exports from Switzerland to the East collapsed by 72% in March (year-on-year).

In fact, there was an overall net flow from the East to Switzerland in March, compared with a net flow of 184mt to the East in March last year. The West has diverted bullion otherwise destined for Asia/Middle East by bidding up the price, to the point that there has been a reversal, particularly from U.A.E.

My calculations for the “East” are collectively: China, Hong Kong, India, Malaysia, Saudi Arabia, Singapore, Thailand and U.A.E sourced from this database:

https://www.swiss-impex.admin.ch/

I fixed the link to the Bloomberg article. It is http://www.bloomberg.com/news/articles/2016-04-26/silver-supply-trouble-shows-why-momentum-for-rally-is-building.

Thanks for the good comments.

email protected: we shall have to see to what, precisely, DB has admitted. I will bet an ounce of fine gold against a soggy dollar bill that they did not say “well, the price of silver should be $50 but for our long-term manipulation efforts that keep it well under $20.”

rowingboat: I am not a believer in the idea that we can adjust the interest rate by the average of apples, oranges, bread, milk, gasoline, and owners equivalent rent. Consumer prices have a large number of forces pushing on them in both directions, such as regulations, labor law, taxes, litigation, and even monetary. To take it as a single “inflation” value is extremely problematic from a methodological standpoint (as the folks who do just this will admit). To subtract from interest is not even wrong, to again borrow that excellent quote from Wolfgang Pauli.

I’m a believer that interest rates net of inflationary expectations are an important driver of gold prices, leading to better correlations than nominal rates themselves. E.g. Pater Tenebrarum’s observations of the Federal Funds rate minus CPI since 1970 (link below) that has recently turned negative after a rising trend for several years. These so-called “negative rates” were pivotal for gold in the last two bull markets and the dishoarding we have seen by the West from 2013-15 was mainly driven, in my opinion, by expectations of a Fed rate hike cycle and return to normality (“positive rates”). This is now being questioned by investors and supported by the resumption of gold flows into Switzerland, UK and America this year to date (net basis, import-export analysis).

http://www.acting-man.com/?p=42111

Keith,

Thanks for the link. Having read it, I also agree with your comment that it is nonsensical to draw conclusions from ETF balances, since these represent just part of the stocks equation with many unknown variables. As I mentioned elsewhere, however, actual production figures and individual components of demand (e.g. investor demand as much-researched by Rocco and others, especially when it concerns mint coins that rarely return to physical supply) represent useful hard data that sometimes reveal trends that will ultimately play into s/d – who knows even into the basis as you measure it.

No one knows the correct price for gold, silver, or platinum; it is unknowable. These metals are a relatively poor medium of exchange in an increasingly digital world. But they are a store of value and quite liquid, competing with cash, publicly traded stocks, and bonds. If the metals are perceived as a better investment than cash in a ZIRP and NIRP financial environment, then the prices are likely to increase, and visa versa. It’s all about the net perception of hoarders, investors, and speculators … period.

Keith is correct that huge above ground stocks of gold and silver make blips in mining statistics and industrial uses almost irrelevant. Platinum trading is very closely correlated with gold and silver; but above ground stocks are quite small. And platinum trades at an almost historic discount to gold. Platinum is much rarer than gold, and more expensive to mine.

For the gold price to increase substantially, billions of dollars of new demand is required. Not so for platinum, a small favorable change in perceptions backed up by a few hundred million dollars could substantially move the needle. Therefore, I view the risks of investing in gold and platinum as approximately equal, while the upside potential for platinum is superior.

If you are speculating about dollar pricing of things, your main concern should be volatility, and presumably you’d want lots of it so that you can win big on each correct bet. If your motivation is “I want more dollars”, the upside potential for gold is never going to look so good. As you put it you need billions of dollars of new demand, which can only come from renewed interest in gold’s money function. I’d say that will eventually come from a huge decline in interest (literally) for the dollar’s money function, which is a Catch-22 for anyone whose “wants” are truly dollar-denominated.

Digital dollars and Federal Reserve Notes are a much better medium of exchange than gold, silver, or platinum. The same is true for Euros, Yen, Pounds, Yuan, and most other currencies, perhaps excluding Venezuelan Bolivars, and definitely excluding Zimbabwean Dollars.

This reality is highly likely remain as is, highly likely but not an absolute certainty. It is possible that a government can destroy the value of its currency at a rapid enough rate (Zimbabwe for example) that some other medium of exchange is desirable. Still, that doesn’t necessarily mean gold and silver; Zimbabwe and Ecuador use U.S. dollars. Only if there is a collapse of the dollar are gold and silver likely to regain their former status as money.

Yet all three metals perform a valuable near monetary function, a liquid store of value not affected by management mistakes like stocks and sometimes bonds. The three metals do have implicit interest rate risks similar to bonds.

Betting on the collapse of the dollar is a very long shot. Betting on negative real interest rates net of income taxes is much more realistic scenario; in fact that has been the exact case in recent years. The three metals are a viable alternative store of wealth versus cash or bonds.

It’s just that simple. Perceptions (net) of hoarders, investors, and speculators will tell all. I choose to wager on the moderate irresponsibility of governments and central banks, and therefore view platinum as a superior risk and tax adjusted investment compared to cash and bonds, given its current market price.

“”As the price has risen, silver has become more abundant to the market.”””

really? i’ve complained alot about the bar market. what does a kruger have to do with a good delivery bar? nothing except confusion. i’m coming to believe that it is the number of bars presenting that is moving the paper exchange rate. the fewer there are the stronger the dollar gets. and vice versa. maybe we’ve got the cart before the horse. the big stack is out there but you just never know who what when or where it’s going to show up. that’s the value of counting contracts and considering the basis. a bluff call if you will. fwiw.

“as the price has risen, silver has become more abundant to the market”

It’s obvious , because there are more people who sell it , after few years of manipulation they finally can get more money for that.

This days there are no free markets , statistics are garbage. How can you trust anything?!??

Big question remains – why gold and silver went up till 2011 ???

That was nothing to do with demand and supply.

There was different reason up to 2011, but are we better and safer today than in 2011 ??

Of course not, unless you believe in bullshit.

.

Big question remains – why gold and silver went up till 2011 ???

Perform an import-export analysis for Switzerland (link above) then again for UK and America (USGS data). The Swiss trade data dates back to 1982 and reveals interesting trends through bull and bear markets, over a period in which the stock of non-monetary gold in the world (i.e. non central bank gold) more than doubled.

It is quite clear that western investors drove the price higher until 2011 as evidenced by the thousands of tonnes of bullion that were pulled into Switzerland, UK and America (in part from traditional markets like Italy and Japan in the 1980s/90s that became net suppliers during the bull market, post 2001).

This tremendous buying force by the west then vanished and went into reverse, pushing gold east (to understand why, research gold’s relationship with various macroeconomic factors). And now that gold has started to flow west again, the east has been happy to provide it to them (notably UAE) given that gold just had its best quarterly performance in 30 years.

In my opinion partly I would blame Bullion Banks and Central Banks for pushing prices of gold and silver till 2011 and of course there was panic too about Europe and economy.

But after 2011 prices of gold and silver went only down , their plan is to push prices of gold to maybe to $600 and then start accumulating again , but whether they going to succeed, I am not really sure , they got China ,India , Russia and others to beat. This time is different and the economy is on “the edge” too. So,who cares about supply? buy it, when you can!!

I know many of you believe, as I do, that the metals ended their multi-year bear market last December and — in all probability — began a new bull market. Or at least we’d like to believe that, right? (Personally, I think a move below $1150 would seriously bring that into question, with $1220 a big warning)

While I believe it’s a new bull market, I also agree it’s shameful for promoters to instantly speak of “$75.00” silver or “$3,000” gold: http://www.24hgold.com/english/article-gold-silver-gold-price-target-is-3-000-and-silver-is-75-per-ounce.aspx?article=8370134790H11690&redirect=false&contributor=Jason+Hamlin

But is anybody really listening? I mean, have your neighbors started bragging about how much money they’ve made in silver lately? Didn’t think so. Gold and silver are still very much a fringe market, to say the least.

This ain’t 1980 you know.

So don’t hold it against a few leveraged rookies who might be getting lucky or who might be ‘cruising for a bruising’. COT exposures (and other sentiment indicators in the news lately) are meaningful only if the market begins to turn south, something it has refused to do.

And don’t forget this — it’s only natural for a new bull market to appear over-extended at first…. especially when you study daily charts or other short term technicals. So do yourself a favor and look at a weekly and monthly perspectives, if not quarterly data. The charts I posted weeks ago would be a good place to start too. Then decide how “grave” the danger is for yourself. Because ultimately it’s your money, and I doubt whether anybody hanging around these quarters is terribly leveraged. (Clearly, those leveraged should be using trailing stops active 24/7. Otherwise let the market run, imo)

Most importantly, if this is a new bull market, does anybody seriously think a new bull market only lasts 4 months?

Well said bbartlow.

It’s starting to feel like a new bull market; yet we have witnessed numerous false starts. It also feels like the commercials have been caught wrong-footed. Selling rallies has been a foolproof strategy for commercials for years, except for the last several months. Old habits die hard, as confirmed by COT.

When the trend following CTA’s, hedge funds, and algos are changing direction by going long (moving average breakouts and such), who is left to sell when commercials scramble for cover? Answer: Mostly only other commercials still trying to play the sell the rallies game. The dearth of sellers coupled with CTA, hedge fund, and algo buyers feeds on itself.

This scenario could continue for some time, at least until some major new market participants enter the precious metal markets. Who will be these new players, how big will they play, and when will they appear? All very good questions. Eventually this will happen.

Maybe now is the right time to be a pig; yet it takes lots of guts to be a pig. And capital. Maybe should we ride this potential wave until the last bear is decapitated.

gold leading silver tempers the gsr maybe alot. oil is a poker chip. what it must be like to actually work in a casino ; ) mind your leverage boys house rules be prepared to settle