Liquidating Civilization, Report 22 Apr 2018

Further to our ongoing theme of capital destruction, let’s look at a topic which is currently out of favor in the present market correction. Keynes called for pushing the interest rate down near to zero, as a way of killing the savers, whom be believed are functionless parasites. The interest rate has been falling since 1981.

It did not merely fall near to zero. Nor even to zero. It has gone beyond zero, into negativeland. This alone ought to wipe out the mainstream notions of how interest rates are set in our very model of a modern monetary system. You know, the rubbish about bond vigilantes, inflation expectations, real interest rates, risk, etc. Might as well add unicorns, dragons, and leprechauns!

Instead of this rubbish, the world needs a non-linear theory of interest and prices in irredeemable currency.

In recent years, rates have plunged below zero in Switzerland, Germany, Japan, and other countries. Despite the current global uptick in rates, all Swiss government bonds out to 8-year maturity have a negative yield. Hey, at least that’s a recovery from when the 20-year had a negative yield. In Germany, bunds out to 5 years are negative, as they are in Japan.

This is pathological (in fact, due to negative long bond yields in Switzerland, Keith wrote a paper arguing that the Swiss franc will collapse).

As an aside, we note that when people hear our arguments, they go through a process akin to the well-known stages of grief. These include denial, anger, bargaining, and then finally acceptance and hope. It is much easier to think about rising quantity of dollars, and the presumed linear effect of rising consumer prices. And more pleasant, too.

Yields Must Fall

What does a negative yield have to do with capital destruction? As Keith argued in the heat death of the economic universe, yields must keep falling in order to make more and more debt serviceable. If the rate of interest does not keep falling, then the extant debt must be wiped out. Since everyone’s money in our system is someone else’s debt, that means a wipeout of money itself.

Something extraordinary occurs when you cross what economists blithely euphemize as “the zero bound”. Investors are doomed to lose some of their capital. It should not be controversial to say that if you buy a CHF1000 bond and get back CHF999, then you have lost 1 franc. Now imagine that this is occurring to everyone, across the entire economy. And the trend is downward.

Regime apologists should not dare to tell the investor that, “well you see, you got a positive real interest rate, so your purchasing power increased. You lost money (or what everyone believes to be money). But hey the booby prize is that what you have left will buy more groceries.”

We expect that it will be controversial to say that negative interest allows borrowers to destroy capital, unseen. In a normal world—that is one where Keynes and Friedman never convinced us to adopt government debt as the risk-free asset, and central bank credit paper backed by that debt as if it were money—no enterprise could borrow and repay less than it borrowed. No one hands over an ounce of gold to get back 0.99 ounces (if you disagree, please call us, we will borrow as much as you want to lend!)

However, we’re not in a normal world. We’re in a Keynes-Friedman world, and that irredeemable currency is believed by most people to be money. And rates are sinking (yes, we know, not in the present correction, the latest of many in the 37-year trend), and now in a number of countries are below zero. Don’t worry, ‘Murrica, we’ll get there too—last.

In a normal world, borrowers cannot run a loss-making enterprise indefinitely. Though even in positive-rates America, they can get away with it for a long time if the Fed creates a permissive credit environment.

However, Fed or no Fed, losses are written on the financial statements. A business that destroys investor capital at -1% per year will run out of cash, sooner or later. This is in a normal world. What if the world is not normal?

Let’s consider that. Losing Corp. loses money at -1% but borrows at -2%. Earnings before interest is negative. But after interest, “earnings” is positive. Unlike the former case where the company reports loses while other companies are presumably reporting profits, and thus the money-losing company will eventually repel investors, in this case it is sustainable. At least so long as the interest rate is negative. Which it will be (and falling) for all the reasons we have been writing for years.

Liquidating Civilization

Of course, it’s not sustainable. It will end, but the central banking regime has made it much more difficult to liquidate losing businesses (while ensuring more and more businesses will lose). Large scale business liquidation can only occur when it is no longer possible to slowly liquidate civilization.

Let’s defend that statement. The interest rate is the single most important price in the economy, because every other price and every investment and every enterprise depends on it. And the central banks have created a system which has driven it down to zero and beyond.

The interest rate is the expression, in the market, of a universal in the human condition. Time itself (we will revisit this idea in a future essay).

When interest sinks below zero, it means that the return to be earned on capital is negative. It means all savers are doomed to slowly lose their capital. It means any other better opportunities have, for one reason or another, gone away. No one would lend at -2% if he could get +3% obviously. So the market being moribund at -2% means the marginal enterprise sees no better opportunity. They are willing to borrow only if the rate is that or lower.

As an aside, this is a good way to think of the dynamics of a falling interest rate. There is little demand for credit, other than on a downtick in interest rates.

By the time it gets to the terminal phase, where businesses are borrowing at -2%, the marginal business is not able to bid higher than that. It does not want credit, except when the price is -2%. A business will always seek to borrow at lower than its return on capital (or else there’s no point). A bid of -2% means the business wants credit to finance wealth-destroying activities.

There is no mechanism to deprive one particular wealth-destroying enterprise of capital, when large numbers of them are losing. There is not one bad company showing losses on its financial statements, slowly running out of cash. There is a whole economy full of them—showing profits! If something is profitable, businesses will scale it up until it no longer is.

In a free market, only wealth-creation is profitable. But in this terminal stage of the unfree market based on the forced feeding of credit, borrowing at -2% and destroying capital at -1% is profitable. This trade will be scaled up.

Perverse Incentive → Perverse Outcome

Inevitably, people will blame free markets, business, and the profit motive itself. They will not question the perverse outcome that comes from the perverse incentive of a falling interest rate and the heat death of the economic universe. So the for-profit business will take the blame that should go to the Fed and the legal tender laws and the rest of the whole edifice of our monetary regime.

No matter, one thing is for sure. If it is profitable to destroy, if the profit scales with no corrective negative feedback loop, if the Fed has long since substituted pennies for every fuse which could prevent this conflagration, then destruction will proceed. We will cannibalize the capital on which our civilization was build. All the while, reassuring ourselves with every macroeconomic aggregate in the statist’s playbook. GDP will show growth (though marginal productivity of debt will decline). Inflation, so called, will be tamer and falling. There is one possible exception.

Keith has been saying for years that there is no extinguisher of debt in the system. Therefore, debt necessarily grows exponentially, as the accrued interest is added to the debt. And even faster, if you want what passes for growth.

Negative interest rates provide a compensatory force. If debts in general pay back less than what was borrowed, then debt can decrease. However, this is not what we would call “extinguishing” debt! A better way to think of it is a partial default. If you lend $1,000 and get back nothing, then that is a total loss of capital. You write off $1,000. If you get back half, it’s a partial default and you write off $500. Negative interest should be thought of like this.

Default is never good, but it’s particularly bad in a system that has long depended on perpetual growth of debt. Not to mention a system with falling profit margins of financial intermediaries (a consequence of falling interest rates), and hence provided both the motive and the means of increasing leverage. The key to keeping the game going will be to make sure that assets remain greater than liabilities. Since there is a steady erosion of assets in nominal terms, the trick is to ensure nominal capital gains outpaces this loss.

In other words, you can borrow to carry an asset, even if there is a negative cash flow, so long as asset prices are rising. People do this in real estate all the time (and call it “investing).

It gets trickier, because rising bond prices mean falling interest rates. The rate must go deeper into negative territory. Which accelerates the nominal losses. No doubt, the central bankers will boast about how clever they are, how much skill the technocrats possess. Until the end.

In the end game, runaway paper losses are in a race against runaway destruction of real capital assets. As horrible as it will be, if the Fed loses control and the paper losses bring the dollar down, this is the less bad outcome. That’s because the alternative is to keep eating the seed corn, keep consuming capital until we actually run out. Total capital destruction would be worse than paper currency destruction.

One question arises from this discussion, which we shall leave to next week: do negative rates make it possible for the quantity of dollars to decline?

Keith will give a talk in Las Vegas in early May. Please contact us if you would like to attend.

Supply and Demand Fundamentals

This week, we saw a tweet from a prominent goldbug. He said, “Russia added another 9 tons of gold to its reserves in March. The hits just keep coming.”

How many errors in this short quip? We count six, exactly one error for every two words.

One, we call this the fallacy of the famous market actor. Russia is famous. Its purchase of 9 times is therefore imbued with meaning, that the sale of those same 9 tons is not given. Because the sellers are not famous.

Two, the concept of stocks to flows measures the abundance of a commodity. It is not a measure in terms absolute tonnage, which would be useless. It looks at how much of the good is accumulated. Virtually all of the gold ever mined in human history is still in human hands. Russia’s purchase is merely the shifting of a very small percentage of total stocks from one corner of the market to another. Hell, 9 tons is a small fraction of 2017 mine output let alone 5,000 years of accumulated mining output.

Three, this goldbug speaks often of a change in the monetary order, hopefully and presumably one based on gold. But this bit about Russia shows the ambiguity of most gold bugs. Buy gold because of new monetary order and because its price will go up. Huh? If the dollar is collapsing, what meaning does the price of gold measured in dollars mean? Conversely, if one is promoting a new monetary order, why promote Russian gold buying to promote a quick trade to make a buck?

Four, this purchase by Russia is bullish (remember, it’s not a sale by smarter people to the dumb money of central banks). Is all news bullish? 2011-2016 would suggest it isn’t.

Five, a gold standard is not about central banks buying gold. Or loading up on gold. Or having “enough”. There is no amount of gold that could ever conceivably be enough for the Russian central bank to have, to defend a gold price peg. All rubles (and dollars, pounds, etc) did not begin life as gold deposits. They cannot retroactively be declared to be gold-redeemable.

Finally, the ruble is not exactly in a rising trend. So whatever “hits’ he means, it is not a “hit” to the US dollar. Which the goldbugs want to hear, in the dualist world of gold going up vs. seeking out good news about the dollar going down because it’s good for gold.

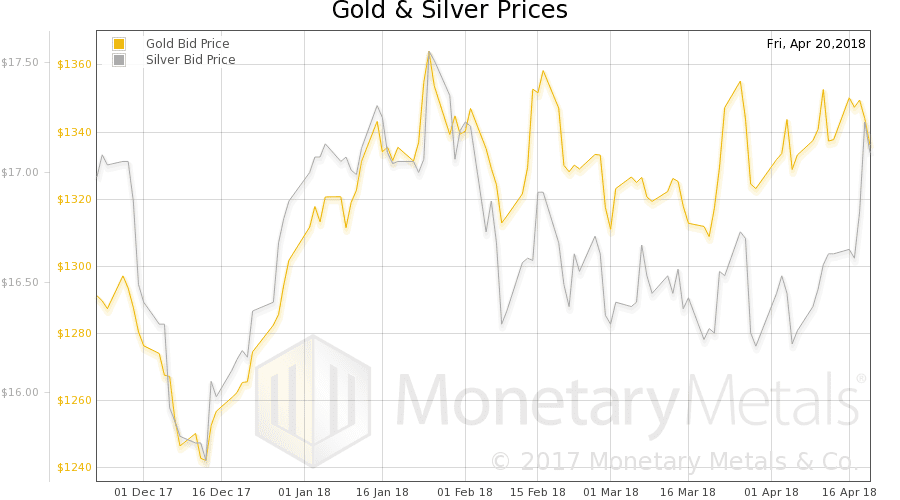

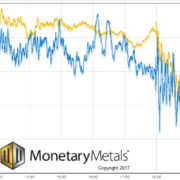

That said, gold fell ten bucks, but silver rose about half a buck. Silver bugs have begun to (more aggressively) say that the rally’s back on. We will look at the fundamentals, but first, here is the chart of the prices of gold and silver.

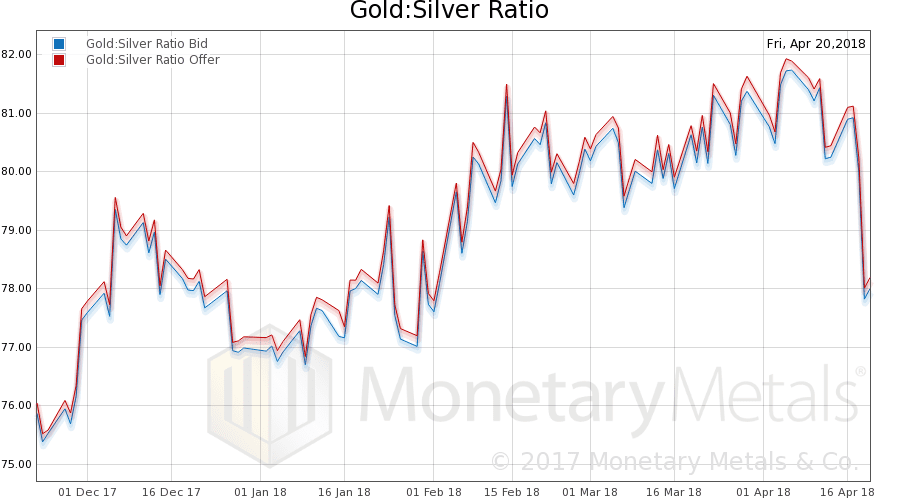

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). Big drop in the ratio.

Here is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price.

There was a small increase in the scarcity of gold (i.e. cobasis, red line), as its price fell. The Monetary Metals Gold Fundamental Price fell $2 this week to $1,507. Now let’s look at silver.

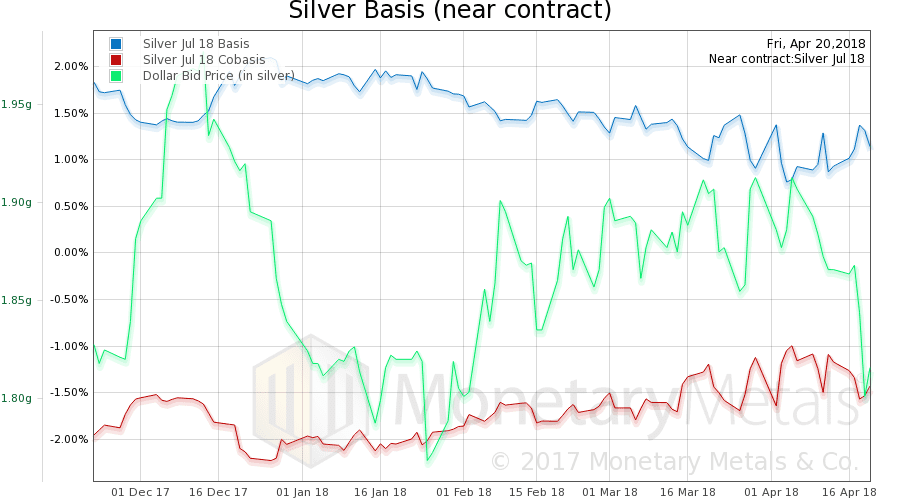

Silver’s scarcity fell, however unlike in gold the price of silver was up considerably. Much of this buying was buying of metal, rather than the typical in recent years of futures contracts. The Monetary Metals Silver Fundamental Price rose 31 cents to $17.77.

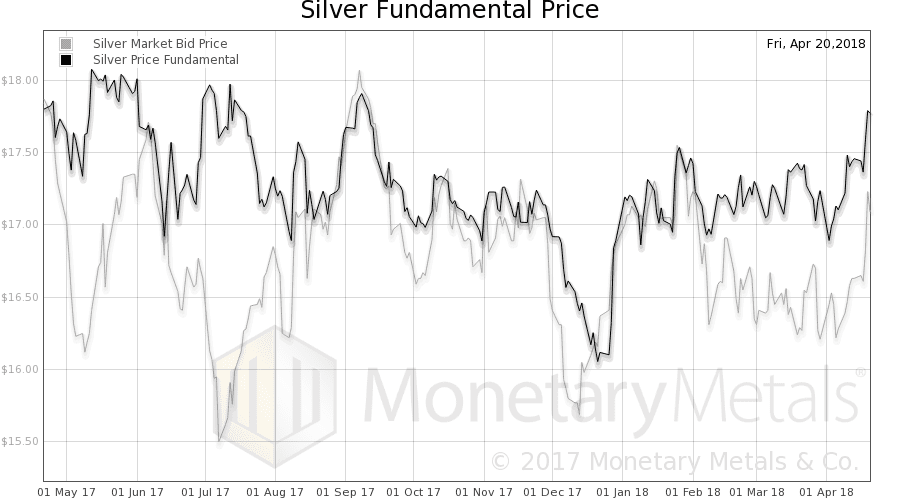

Here is a chart of the silver fundamentals for the last year. Has the silver fundamental had a breakout? We would want to see more evidence before pronouncing this. Heck, even the market price has not surpassed its level from January yet.

© 2018 Monetary Metals

Keith,

If the fundamental price of gold is circa $1507/ounce what are your thoughts on why gold continues to languish in the low $1,300’s and falling presently?

Thanks,

Mark

Hi Keith.

Logically speaking, and likely over-simplifying, when debt is at a level at which it is not sustainable, it won’t be. So, default is inevitable, one way or another.

I usually think of this as either explicit default, or as the more clandestine default through inflation. You seem to be describing “a third way” – partial default through negative interest rates.

We see the negative rates in advanced economies predominately in Japan, Germany, and Switzerland. It “seems like” those economies who have the worst debt sustainability issues should be the most inclined to permanently offer negative interest rates.

The above makes sense to me for Japan, but not so much Germany and Switzerland. It seems on the surface that these Northern Europe economies are in a more sustainable debt position than the U.S. Why should they be stuck in negative interest rates while the U.S. continues to avoid it? Are they being dragged into it just because of their profligate neighbors to the South?

Best.

Inflation is the process of borrowing more, so it’s not a way out of debt.

It may not be a way out of debt, but it’s certainly a way to kick the can down the road… until, that is, the marginal productivity of debt says it’s not.

The FED has announced an increase in the number of interest rate increases it’s planning, increases that will theoretically end at 3.25% now instead of the previous 3%. I’ll have to see that one to believe it. Because every attempt to raise rates will be both forced (with dramatically reduced demand for credit) and will incur mindboggling costs to the overall debt itself.

For example, just that extra .25 they’re planning would add 6 Trillion to the national debt over 30 years. Isn’t that funny? No, not that .25% could alone add 6 trillion (which is a LOT of money; 1/3 of our current debt) No… what’s so sadly humorous is the notion that this entire fiasco could continue another 30 years. Ain’t gunna happen. We’re down to a few years before the signs of rupture become apparent… and a decade before the radioactive material reaches critical mass.

I meant inflation in the more conventional sense of rising wages and prices. Isn’t a Venezuela style hyperinflation a default on the un-repayable debt, despite the fact that many debts get settled in the process?

As I have written about many times, an elevated F price suggests investor psychology towards gold is too optimistic. Other current measures of sentiment offer solid verification. The Daily Sentiment Index (DSI for short, an index professionally managed), for example, reports that bulls outnumber bears by a wide margin now, approximately 80% to 20%.

In my opinion, and I stress that, there is a psychological component to one of the “Fundamental” Price’s internal structure. Which is not good. It will lead to exactly the opposite effect.

Fortunately, psychology can change quickly, and there are other factors decidedly more favorable towards gold. The bottom line with an elevated Fundamental is simply this — ‘there are worse times to buy gold’, or ‘whenever gold is below F — especially by a wide margin, gold is a relative bargain’. I’m not sure I buy all that, but that’s the gist of it.

Another tremendous article. It’s almost as if nobody in the world truly understands economics like the big brained guys at Monetary Metals. Bravo guys. (and gals?) Bravo.

Thanks for your kind words and for your comments.

Why is the market price < the fundamental price? "Everyone" knows that gold is going nowhere. They only want to buy things that are going up! The Fundamental price is not a measure of sentiment, though it can show that sentiment is low (relatively) as now.

I don’t rightly know the ingredients of the Fundamental secret sauce. It’s simply been my experience that elevated Fundamental prices tend to correlate with periods of excessive optimism, and vice versa. (Not that much can be determined from it)

That said, silver is currently at 45%…. hardly excessive bullishness. Gold last week hit 80%, however, which is certainly noteworthy. But overall sentiment has been fairly moderate, except for those dastardly cheerleaders we call gold bugs. They’re 100% bullish 100% of the time. At least they’re consistent!

I mentioned other signs that were more bullish. For example, gold remains much closer to its break-out levels ($1365 – 1375?) than to any support levels. Yet, as we measure the level of participation from the big Managed Funds (trend-following hedge funds really) that throw around a lot of money, we notice that their long positions are a fraction of their former selves. Gold has managed to get up here and stay up here despite a lack of typical financial drivers at the margin. As you might put it, Keith, that’s the physical market at work.

So that group of big hitters will essentially need to rebuild their long positions now at higher levels, as they are market followers by definition. Some large traders have even started to short gold, given the problems at $1,365.

It’s developing into an intriguing situation. The signs might be subtle but the pressure continues to build for an eventual breakout over $1,370.

You are getting to the heart of things. Let me remind you, our ability to affect this outcome is zero.

Economic growth now requires debt growth. For growth to continue, debt must grow, but can only do so with falling and even negative rates. Guaranteeing this outcome. We are foreclosing on all human generations to come, and perhaps even the biosphere and life on this planet, to eek out more growth in the present. And this is worldwide, with no resistance.

To speak now on whether there is capitalism without debt is meaningless. There is no challenge to this system from the business community, and why should there be? As you say their profit is debt. To ask whether there are real profits misses the point. Nobody knows, and nobody will ever know.

Game over, modern industrial civilization is going bust in front of our eyes. Nobody will even write the history, as the entire system is now irredeemable. And along with this everything follows: the destruction of truth, the loss of trust, inequality, greed, drugs, entertainment, crime, war, etc. Look closely. We are all acting in various ways like it’s over, because it is.