Swiss Customs Data Indicates Gold Flowing East to West

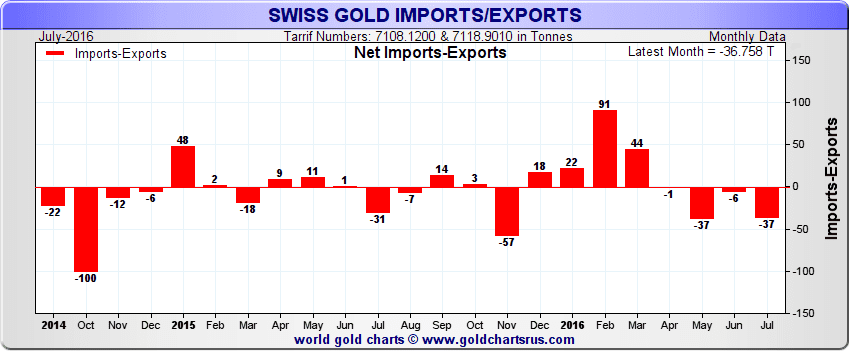

Switzerland has just released its gold import/export figures for July and the summary below from www.goldchartsrus.com shows another big month of net exports. Swiss gold flows are worth looking at because Switzerland is home to over 5000 tonnes of refinery capacity (see this BullionStar article for more detail) as well as being a major vaulting location. Their figures can therefore give some insight into regional demand and supply and investor sentiment.

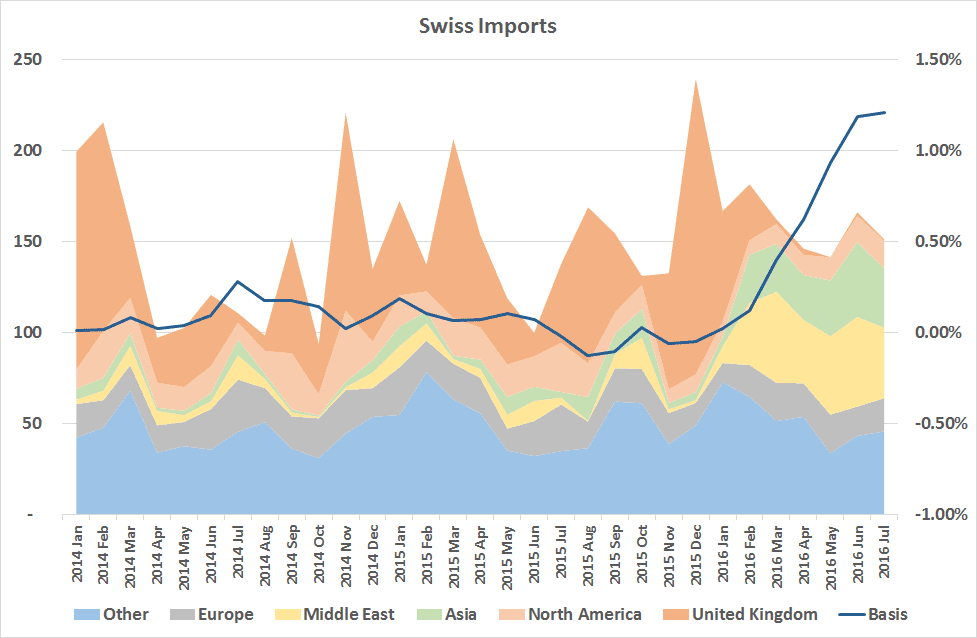

In the chart below I’ve grouped flows in and out of Switzerland by key regions. The blue “other” is dominated by gold producing countries in Africa, South America and CIS and that, along with flows from Europe, are fairly consistent. This is to be expected as mines produce at a steady rate apart from those in more extreme environments where seasonal cycles are in play. The other sources of “input” metal for Swiss refineries are scrap and re-barring of existing stocks.

The light and dark orange represent the West and green and yellow the East. The flows from the East are usually scrap driven whereas the Western flows, certainly out of the UK, would be large bars being re-barred into kilobars for the Asian markets.

It is clear there was a shift early this year where we see flows out of Asia and the Middle East increase dramatically with a corresponding reduction in flows from the USA and UK. Higher metal prices often results in more scrap flows from Asia, so the increase in gold prices in 2016 has been a factor behind this change. In the case of the UAE, as they are a source location for both legitimate and smuggling trade to India, as Indian demand has waned and the market there has become oversupplied (indicated by prices there going to a discount to London, see this article quoting an importing bank saying that “so far in 2016 our bullion business is down nearly 75 percent”) any stock build up by Middle East dealers would have to be liquidated.

The blue line is the 3 month basis (a measure of profits to carry/hoard gold), which also started increasing at the same time (hat tip to Monetary Metals commentor rowingboat for noting this correlation), an indicator that speculative money flow into gold was higher than the money flow into physical (basis rising with a rising price).

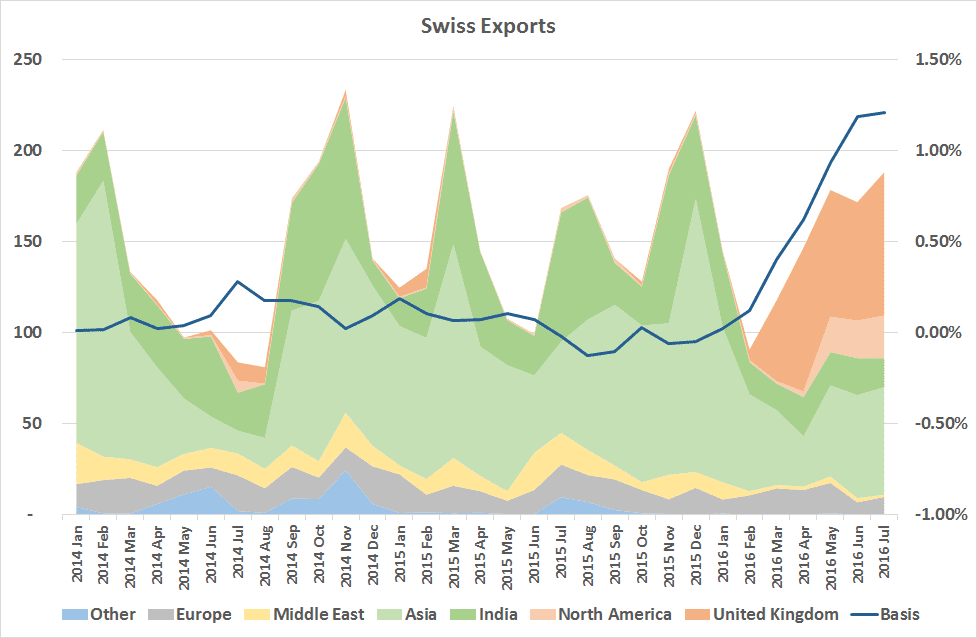

When we look at Swiss Exports we see the East-West flow change confirmed, with a drop in the flows out to India and Asia and in their place gold being shipped to the UK and USA (ETF driven).

The gold basis figures in the chart are a monthly average, hiding the weakening that occured during July and into August. Monetary Metals’ analysis of market prices and spreads indicates that this fall in the basis was driven by continued spot buying (the flows to the West in the chart above, mostly into ETFs, being but one example) while speculative interest cooled. This sets the gold market on a more solid footing, part of a necessary consolidation period I discussed in this interview, before it can attempt another leg up.

I’d be interested to see a chart of ETF changes in 2016 as I had the impression that inflows had eased in July/August?

Note that the large net imports into Switzerland for Feb/March were mainly attributable to a collapse of exports (global demand) which becomes even more pronounced when one strips out exports to the U.K. These net imports have been subsequently worked down, which could be contributing to the falling basis.

Thanks for sinking your teeth into this, Bron. Interesting comments re U.A.E that suggests when Swiss exports to India eventually improve we may also see a concomitant decline in the flow from U.A.E to Switzerland.

GLD inflows basically stopped in July, holdings have been pretty much flat since beginning of July http://www.spdrgoldshares.com/usa/historical-data/

When Indian demand turns around then flows from UAE will stop. The perfect storm is renewed demand from Asia at the same time as Western inflows into ETFs and physical.

Very good information! Thank you so much.

“This sets the gold market on a more solid footing…..before it can attempt another leg up.”

That would be the dollar attemting another leg down!

Also, which market group is the “dumb money”, “smart money” or “money of average intelligence”?

Jabs aside, it is interesting to see the correlation of these import/export changes with the change in basis. Whether these trends continues to correlate in the future will also be of interest. I will wait for tomorrow night’s report but it looks like the October gold contract is now in backwardation 60 days from expiry.

On a very loosely related note, I have been looking at the US Treasury’s website and tracking the yearly changes in total public debt. The actual numbers are well over 2x what is commonly reported as the annual deficit. For example:

Debt on August 16, 2015 = $18,151,204,858,128

Debt on August 16, 2016 = $19,445,100,633,520

1 year change in total debt = $1,293,895,775,392

The amount and % of global negative yielding debt also increases montly, with all Swiss bonds negative as Keith has warned about as an indicator of collapse. It is hard to say if gold backwardation will be a predictor of an imminently failing monetary system or merely act in response to it.