The Curious Widening of the Bid-Ask Spread in Silver

Last week, I wrote about a curious development in silver. The bid-ask spread widened in November and December. My article concluded:

One should regard this as another type of rot in the core of the system. The point of my dissertation is that narrowing spreads is a sign of increasing economic coordination, and widening spreads is a sign of discoordination. And now we have widening spreads in one market for one of the monetary metals.

This is not good.

I received a lot of email in response to this. Everyone wanted to know what I meant, and if this predicts a rising or a falling silver price. I think the price is likely to fall, though that prediction is not based on the widening spread. It’s based on my supply and demand analysis. My standard caveat is: never naked short a monetary metal. Look at the sharp rise in silver for no reason on Friday, when a disappointing payroll report was released. A 60-cent rise would hit naked shorts in the shorts (if I may be permitted a rude analogy).

If a widening-spread has any impact on price, it won’t be in direction but in volatility. Let’s look at the mechanics. When Joe comes to the market to buy, he pays the ask price. When Sue comes to sell, she is paid the bid price. If the bid-ask spread is a penny, then the trace on your screen moves up one cent and then down one cent, first moved by Joe and then by Sue. Supposing the spread widens to 20 cents (it has gotten nowhere near that yet, but just for example), then your screen will show a 20-cent move for one tick. That is a 1% move.

Not only does one more tick increase the move to 2%, but there are many momentum traders watching for a price breakout. With them piling on, and with a 1% move per tick, silver could easily have 10% or 15% moves in a day. How will the market makers respond to this? Most likely by widening the bid-ask spread, to give themselves a safety margin for big price swings. And how will most traders respond to this? They’ll pile onto big moves they see developing, but set tight stop-losses.

Volatility will beget volatility.

Before I explain what I meant by my last comment “this is not good,” I want to say something important. I don’t regard the rising price of gold and silver as good, though I argue that it’s inexorable. I remind everyone that it’s not gold going anywhere, but the dollar going down. The price of the dollar must be measured in gold, though by force of habit we presume to measure gold in dollars. As an analogy, think of having a rubber band in your left hand and a meter stick in your right. Which can be used to measure the length of which?

It currently costs about 25mg of gold or 1.6g of silver to buy one dollar (keep in mind a paperclip is one gram). The price has been lower in recent years, and it will go much lower than that in the not too distant future. Why? Not because of the dollar’s quantity. The problem is its falling quality. The dollar is backed by debt, and as that debt moves closer to default the dollar moves closer to its high-velocity rendezvous with zero.

In the end, it will come to a race between a rapidly rising dollar-denominated price of gold and the onset of permanent gold backwardation. There is no way to predict what the last gold price will be, before gold goes off the board, though I think it will be a highly non-linear process at the end.

It should be obvious why a collapse of the dollar is bad.

Now, on to my parting remark last week. A widening bid-ask spread is evidence of rot in the heart of the system. It’s definitely not good. Why not? I alluded to my dissertation, the theme of which is that narrowing spreads mean increasing coordination and widening spreads mean decreasing coordination.

What does coordination mean in the economy? It means cooperation, the division of labor, specialization, efficient production and distribution, economies of scale, and the extension of credit. It means that you can have confidence that prices and terms won’t change tomorrow, that things are stable, and that everyone realizes it’s better to work productively and trade with others than to become a parasite who lives by attacking others.

What could cause economic coordination to go in reverse? The government can.

The single most important thing in the economy is money. If the government distorts the meaning and value of money, then rot inevitably sets in. Activities that add value, that people demand, that produce wealth, may appear unprofitable as measured in dollars. Other activities, which destroy or consume wealth, may appear to be quite profitable as measured in dollars.

An unstable and distorted dollar, with an unstable and falling interest rate imposes massive perverse incentives. Whether this causes prices, as measured in terms of the defective dollar, to rise is a whole separate question. I answered this question “sometimes, but not necessarily” in my theory of interest and prices.

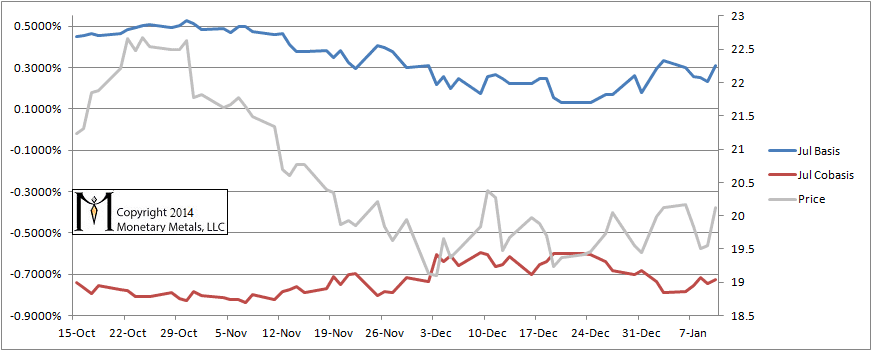

Whether prices rise, stay flat, or fall, damage is still being done. One way to look at the damage more closely is to look at spreads. This is the approach I take in my supply and demand analysis of gold and silver. I study two spreads between metal in the spot market and the futures market. By seeing whether there is an increasing or a decreasing spread to carry or warehouse metal—to buy physical metal in the spot market and sell it forward in the futures market—we can glean a lot of information about the current state of the markets. If metal is flowing into the warehouse, we know that the marginal demand for metal is to be carried. Sooner or later this will reverse, and this source of demand will disappear to become the marginal source of supply (I plan to publish more about the gold markets, arbitrage and warehousing in the near future).

Another way is to look at the bid-ask spread of something. In my article last week, I noted that the bid-ask spread in silver futures had widened. I discussed why this might be occurring. It is heavy buying at the ask, and at the same time selling on the bid—in a market with fewer and fewer market makers.

Now let’s address why this is bad.

The bid-ask spread is the loss one will take to get into and out of an asset. In the case of a silver future, let’s say the bid is $20.15 and the ask is $20.16. Then you could buy and sell and lose only 1 cent per ounce. On the other hand, if the bid drops to $20.10 and the ask rises to $20.20 then your loss would be 10 cents.

Another way of looking at the bid-ask spread is liquidity. Commodities with narrower spreads are more liquid than those with wider spreads. For example, gold is more liquid than platinum and platinum is more liquid than molybdenum.

The monetary metals became money, as I argue in this article, because they had the narrowest bid-ask spreads. Now we see evidence that silver’s spread is widening. This is tantamount to saying that silver may be losing some of its moneyness. Though it should be emphasized that this is not happening in the spot market for silver, but the futures. I think it may not be silver losing its moneyness, so much as the futures markets becoming less efficient.

Along with too much focus on price, I think too many people look at the futures market in terms of how many ounces are in the warehouses vs. how many ounces are under contract. They expect the market to blow up by a failure to deliver metal when demanded at contract maturity.

A different kind of worry, which is completely off the radar at the moment, is if the futures market seizes up due to lack of liquidity. If the spread were to continue to widen significantly more (this is a big “if”), then we should expect to see falling trading volumes. At some point, the bid-ask spread could widen to the point where either silver stops trading or silver trading is forced into another venue. It’s far too early to make predictions about this.

So who is impacted by wider bid-ask spreads? Producers and consumers are hurt. Wider spreads reduce the profitability of silver miners and recyclers, and any other producers or hedger who must sell future production or inventory on the lower bid. It also reduces the profitability of jewelers, electronics manufacturers and other silver users who must buy future production at the higher ask. It will also hit those who must buy and sell futures to hedge inventory like bullion dealers. They typically sell futures short when they buy inventory, and buy those futures back as the inventory sells through to the consumer.

The only beneficiary is the surviving market maker. Unlike everyone else, who experiences the bid-ask spread as a cost, to him it’s a profit because he buys at the bid and sells at the ask.

Since I wrote A Curious Development in Silver, the silver basis for most contracts has risen about to its level of the third week of November (the March contract is beginning to spiral into the gravity well of temporary backwardation). It seems that the widening bid-ask spread cancer has gone into remission for now, though it bears watching.

Just before I hit send, comes this piece from Bloomberg. It makes an interesting postscript. “The Federal Reserve is planning to release a notice seeking information on ways to curb banks’ ownership and trading of some commodities,” it says. Here’s the money quote, “Senator Sherrod Brown, an Ohio Democrat, has raised concerns that banks may have a conflict of interest when they own and trade both physical commodities and instruments tied to them.” That would seem to target carrying metal—buying spot and selling it forward. Forcing banks out of this business will cause the basis spread to become wider and more volatile.

As i understand it above that its not Gold thats moving but its the dollar and at some point dollar will or should fall apart so the natural out come of this should be that Gold price should go much higher. What about maybe that by the time dollar falls apart there are other currencies( CHINA) or a combo of basket commodities that will be tied to the new currency ? Could this be another alternative to just Armaggedon?

Hi gs,

Thanks for your question.

The other currencies are dollar derivatives, and China’s debt problem is more advanced than the debt problem of the US. I don’t expect any other currency to survive as long as the dollar.

As to other commodities, they don’t work as money because their bid-ask spreads are far too wide. See what I wrote on Forbes: http://www.forbes.com/sites/realspin/2013/11/12/why-gold-is-the-best-money-of-them-all-and-nothing-comes-close/

thanks

Who is Keith Weiner?

Keith,

As always , SUPERB analysis and explanations for the average person. Greatly appreciate your wisdom. :)

Thanks! :)

So if the futures spread is widening for silver, the reward to be a marketmaker is increasing as opposed to the reward for being a warehouseman. If that is true then may this be seen as a predictive precursor to futures market failure?

Yes, excellent article and very helpful. Thank you Keith.

Wow all very visionary for those who don’t know how the system works.

Do you think it is best for Canadian and those holding other currencies to

buy dollars now and try to buy metals lower or buy metals now while they are widely available

and not worry about the decling price as the canadian dollar will also be decling

ManyThanks

Tyonker: yes, the market maker benefits from the wider spread (though faces other challenges, which is why market makers are leaving). Yes, I don’t recall if I touched on the point that if the bid-ask spread widened sufficiently, that would be the end of the futures markets. With each tick wider in the spread, the marginal user of the market will walk away, as the market does not serve his needs.

chrisjf: While I can’t give individual investment or trading advice, in general I expect the other currencies to enter a terminal decline relative to the dollar. This is not timing advice, as any particular currency could have a large rally in the meantime. It may be years away in some currencies (CAD is one candidate to last longer than many others such as JPY). As to buying metal, if you don’t have any at all, then my recommendation is always: buy some. No need to go all-in, but some. If you have some, then depending on how much you have and your target of how much you want, then you can think about timing, trading, etc. My thoughts on timing and trading and pricing are in the weekly Supply and Demand Reports.

Trying to understand this very interesting analysis of widening spread.

Thanks

hosali