I coined the term temporary backwardation in March of last year. This is what I said:

But in the “new normal”, post 2008, the expiring gold or silver future often flirts with or even slips into backwardation for a period before expiry. This is anything but normal. It’s not a sign of imminent financial Armageddon, but it is a sign that beneath the surface there is a growing rot in the core of the system.

I used the word “temporary”, not to imply that this pathology would stop (I said it was the “new normal”), but to refer to the fact that each contract spends a short time in backwardation before either rising out of backwardation or expiring. I used the word temporary to distinguish from permanent backwardation, which will affect all contract months—the farthest first and most severely. Look at this chart of crude oil. When that happens in gold, the end of the current dollar system will be near indeed.

Since I wrote the article on temporary backwardation, the rot in the monetary system has increased. I posted a short alert on July 8, marking the first day that the October contract entered backwardation. The rot has crept from the active month (which was still very much August) to the next contract, October. I also showed the progression of how far in advance each contract was entering backwardation (Apr: 30 days; Jun 42; Aug: 55; and Oct: 61).

Let me emphasize that I think this should be regarded as rot. Backwardation provides an opportunity for a risk-free profit. At least, it is free of conventional risk. The trade does not depend on access to credit, and it involves no price exposure. Of course, as I look at it, there is one risk. Whomever takes the bait by selling metal and buying a future risks not getting his metal back. The contract may not be honored, paying dollars at the end.

One should regard rising backwardation as one would regard rising Credit Default Swaps on a bond. Even if the yield on a bond isn’t rising exponentially (yet), rising CDS should be cause for concern. Even if the gold price measured in dollars isn’t rising exponentially (yet), rising backwardation should be great cause for concern.

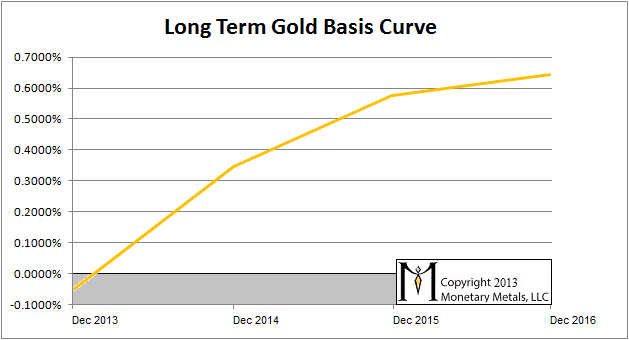

While we currently have backwardation in the near contract and the next active contract, there is no backwardation beyond October. Here is a picture of the gold basis for 2013 through 2016 (December contracts shown), taken on Friday July 19. It looks similar to the idealized yield curve.

Other than Dec 2013, which has a negative basis (it is not backwardated; its cobasis is negative), the basis is not only positive, but it is rising for each succeeding year. I acknowledge that this is open to interpretation, but I don’t see how one can look past a positive and rising long term basis curve and conclude that monetary collapse is imminent.

When distrust occurs broadly and in earnest, I expect it to creep from the farthest contracts inwards. If there is doubt about delivery, then surely Dec 2016 is much riskier than August 2013. This will be a process of the withdrawal of the gold bid on the dollar (which will look like the withdrawal of the gold offer to those who look outwards from the dollar point of view). With a rapidly withdrawing offer in spot gold, and at the same time an increasingly reluctant bid especially on far futures, there would be a large backwardation that is greatest the farthest out on the curve. In comparison, as of Friday, we have under 0.5% annualized backwardation in August and barely above 0 for October.

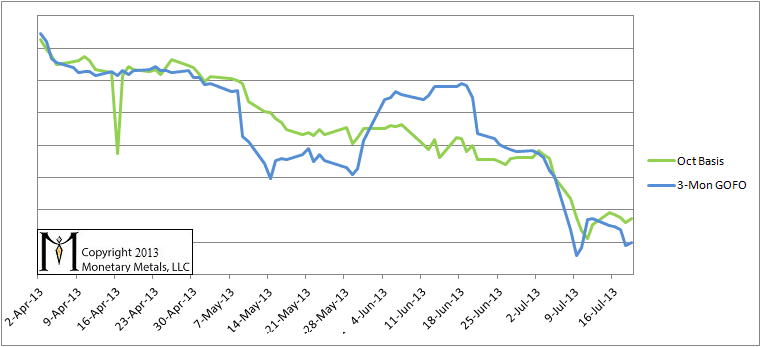

Nevertheless, the occurrence of backwardation in gold at all, much less two successive active contracts is serious. Recently, a related phenomenon has made the news and generated much analysis. The GOFO rate has gone negative. Let’s talk about what GOFO is. Short for the Gold Forward Offered rate, GOFO is similar to the basis. Here is a chart overlaying the 3-month GOFO with the October gold basis. I have omitted the axes, as I just wanted to show the shapes of the curves. There are some differences that cause a different scale for each data series.

3 Month GOFO and October Gold Basis

The London Bullion Market Association defines GOFO as the rate at which bullion banks are prepared to lend gold on a swap against US dollars. OK, but what does this mean? Let’s take a step back and look at the London market.

The London market offers a product called forwards, which are similar to COMEX futures with a few differences. They are not listed on an exchange, so they’re less transparent. The settlement date can be set to fit the buyer’s needs. Unlike COMEX futures, forwards always have a convenient expiry date, so there is no need for “naked longs” to sell the expiring contract. In contrast, the “contract roll” pushes the basis off the bottom of the graph. This is why I showed the October contract, rather than showing a pasted-together series of nearer contracts as they dropped.

GOFO depends on the spread between the gold forward and the gold spot market. This is why the GOFO graph looks so similar to the gold basis graph. Keep in mind that GOFO is an offer by bullion banks, not a pure spread between prices in a market. Along with a few other factors, this makes the GOFO rate less “noisy” than the basis.

After reading my articles (Why Does the “Paper Gold” Price Track the Physical Gold price?, The Gold Futures Open Interest Caper, What is the Meaning of GLD Outflows?, and Why is Gold Draining out of COMEX Warehouses?), readers should be able to guess the punch-line: it is arbitrage that keeps GOFO in sync with the gold basis.

To understand why the spread between the forward and spot gold is important to GOFO, let’s drill down into the transaction that the bank is offering to the client. It is a swap, which means each party is exchanging an asset and the opportunity to get a yield on for another asset. A swap is not a simple trade. It comes with a clause that both parties agree to return the assets to the other party after a specified duration.

In this case, the client has dollars and wants gold. In calculating its offer, the bullion bank must consider its costs and benefits in doing this transaction. Here is a breakdown of the discrete steps (all are committed simultaneously):

- Client gives dollars to bank

- Bank invests dollars (receiving LIBOR)

- Bank borrows gold (paying GLR)

- Bank gives gold to client

At the end, the client returns the gold to the bank, which delivers it to the gold lender, and the bank returns the dollars to the client.

The equation that represents the above swap is:

GOFO = LIBOR – GLR

LIBOR is a typical interest rate that could be earned on dollars. GLR, or Gold Lease Rate, is the “interest rate” that could be earned on gold. Ever since the 1930’s, of course, there has not been any real borrowing and lending of gold as money. However, there is a specialist market for borrowing and lending gold, who refer to it as “leasing” (who might want to lease gold is the topic for a separate article).

It is logical that the rate on a swap is the difference in the interest rates between the two things being swapped. Because of the mechanics of how the bank provides the swap using the forwards market, arbitrage will keep this rate close to the spread between forwards and spot. Arbitrage will also keep this forwards spread close to the spread between COMEX futures and spot—the basis.

The next question is whether LIBOR is falling or GLR is rising. LIBOR has indeed fallen slightly, from 28bps at the start of April to 26.5bps on July 19.

Let’s develop a single integrated theory that takes into account all the facts. First, we have temporary backwardation. This indicates a liquidity issue in near-dated futures, if not a broader problem in the monetary system. Second, the basis has been falling (even far-dated futures), and cobasis has been rising. Evidence of this is the increase in advance dates that each contract goes into temporary backwardation, plus we have two active months backwardated for the first time in a long time (years, to my recollection). Third, there have been many news reports since April, of higher than normal positive spread in the gold prices between London/NY and China.

I think there is a simple arbitrage that explains all observed phenomenon. For every gold bar that a bullion bank buys, it has several options for how to make money without incurring price risk. One is to “lend it on the swap” as described in the GOFO example above. Another is to carry the gold by selling a futures contract against it, earning the basis.

A third is to sell it for a premium in China. If this premium is larger than the profit of the first two options, then selling to China will be attractive. This option has another advantage. It does not expand the bank’s balance sheet, with the attendant capital requirements. It is a simple buy and sell, with the only headache being actually shipping the bar to China.

Water flows down-hill, from higher elevation to lower. Analogously, gold flows up-price, from lower price to higher. Right now the spare bars are going from New York and London to China. The result is temporary backwardation and a negative GOFO.

:

:

Thank you for the article explaining the liquidity issues. I really appreciate your articles which explain things without getting into conspiracy theories.

There has been speculation for years that China would augment their currency reserves with gold and it would lead to huge price increases in Gold. I cannot speculate as to what caused the price drop, but it certainly seems they are taking advantage of it.

The big question is, of course, how much will they buy? Are they done, or will their buying continue? A very interesting situation.

For that, we have to watch the basis…

Thanks again. I just saw Mike Kentz’s article quoting you and Mr. Barba (at http://www.reuters.com/article/2013/07/22/derivatives-gold-idUSL1N0FP1CB20130722). As to the price slippage, do you think the onset of the seemingly risk-free play might have put a larger segment of warehouseman’s gold on the sale block? After all, if there is no more profit in short-term gold carrying, those customers have to be driven off some how.

As to China, the bigger question is whether they will open a gold futures market themselves, or will they do the far wiser thing and mint a gold standard yuan?

I would rather they repeal the legal tender laws, allow gold clauses in long-term contracts, and repeal all sales and capital gains taxes on gold. Let gold emerge in the market, rather than fix the price of a unit of their central bank’s credit.

China launched a gold future market since 2008 http://www.shfe.com.cn/Ehome/doclist_904_904005001_0_1.htm

Great article Keith. Many thanks!

Thank you Keith for another great article. I would love to know whether you think they will / can taper QE because I have a feeling gold may be starting to call their bluff

Thanks for that enlightening article. I enjoyed your analogy of the meaning of short term backwardation and long term backwardation.

Whether they taper or not, the dollar is in its terminal decline. This is not due to its quantity, but the reality that the debt is unpayable. Look at Detroit (I blogged about it on my personal blog at keithweinereconomics.com). Almost a total wipeout of pensions and bonds especially unsecured bonds. Who are the creditors? Any bets that other pension funds own some Detroit bonds? The whole paper system will be seen to be capital-less. Why should gold make a bid on toxic paper?

WHY? To pay for increased taxes for one reason!

Hi,do you think china buy gold to use for currency word. More specific china and bric country want create new currency base on gold standard?! Or just matter of speculation. Thanks