Yellen Said Something, Gold & Silver Update 20 Sep 2017

Fed Char Janet Yellen said maintain rate, support job market, blah blah. Well, that set off an avalanche of selling. Copper, crude, the Australian dollar, even the euro fell almost 2 cents. Oh yeah, and da boyz in da cartel manipulated gold and silver down. For those hoping to trade their metal for more of the Federal Reserve Notes that they assure us will be worthless by—when is it, according to the latest insider peeps, January—today was not a good day.

Anyways, Fedlov’s Dogs have been well trained. Once the sell-off ended, it was buy the dip! And they did. Silver was bid up from its low of $16.94 to $17.15 within hours. S&P stock market futures surged from 2494 to 2507. And so on.

But what really happened? Was this just noise, as so many Fed-triggered price events have been? To answer this question, we cannot look to the price action. We must look to the fundamentals of the market. The spread between spot and futures, which is called the basis. The basis tells us a lot, but here it’s very simple. If a move is driven in the futures market, then the move will be greater in the futures price than in the spot market price. The basis is the spread between spot and futures, so the basis will move down if the selloff is futures. Or up if the selloff is spot.

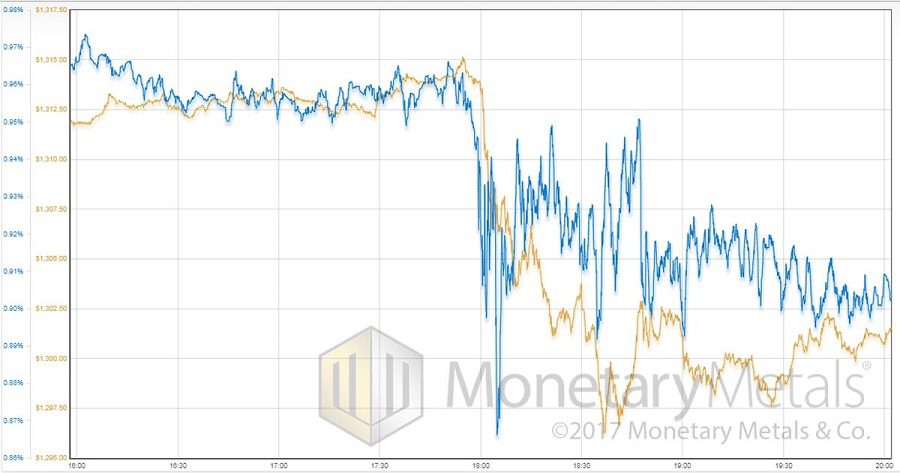

Here is a picture of the intraday December gold basis and price.

This is an interesting chart. We read the action as mixed. At 18:00 GMT (14:00 in New York), when the Fed news hit, the price of gold begins dropping sharply. Initially, the basis drops from around 0.96% to 0.9% (not counting a short spike below). However, the basis recovers nearly to its original level at 0.93% to 0.95%. This is buyers of futures, without a doubt.

Then around 18:45—after the price shoots up $5 to $1302—the basis drops 5bps. The basis has a stable to falling pattern after that, as price sags and recovers. Buyers of metal had come into the market.

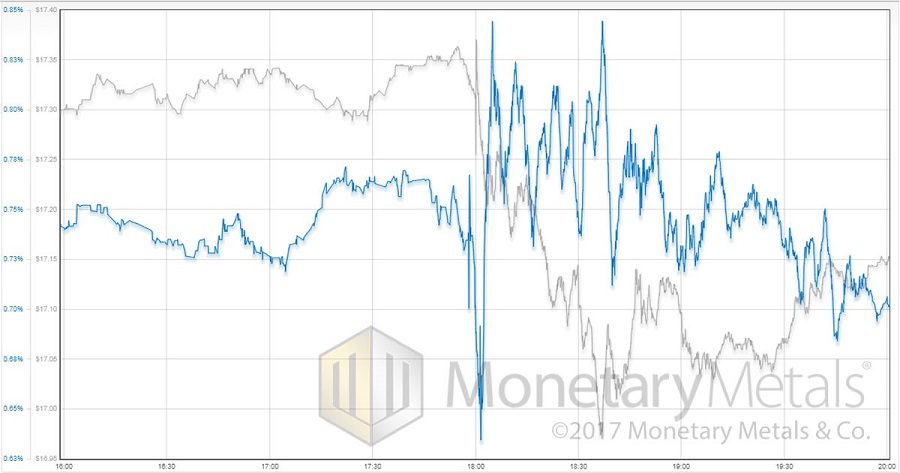

Here is the silver graph.

It is a similar dynamic in silver, though the decline in basis is a bit larger after around 19:30.

In both metals, we end on a lower price and the basis is lower. As we have come to expect, it is the leveraged speculators in the futures markets who are most jittery to sell when a news event occurs (or we should say “news”, in this case, as we don’t think the Fed said anything surprising).

© 2017 Monetary Metals

Leave a Reply

Want to join the discussion?Feel free to contribute!