Monetary Metals Brief 2015

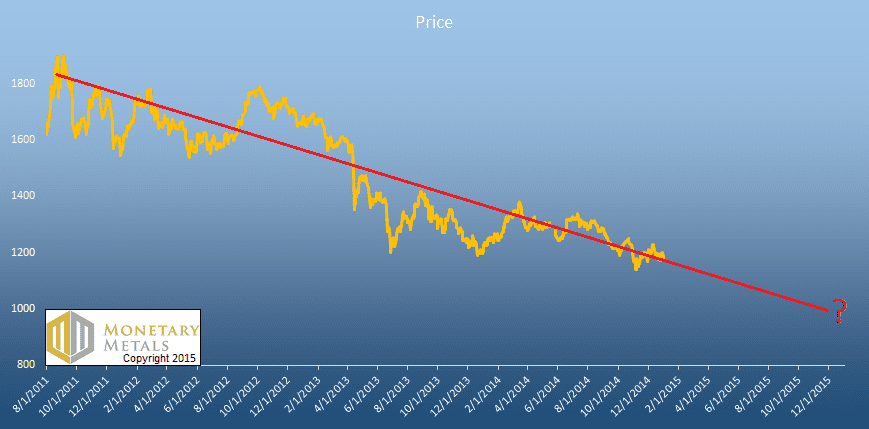

It’s the start of a new year. The question on everyone’s mind is whither the prices of gold and silver? This Brief presents our answer (and the full Monetary Metals Outlook 2015 report gives our reasoning). One approach to the question of price is to draw a line, extrapolating the past trend into the future. […]