Da Boyz Whacked Silver Again, Update 28 Nov 2017

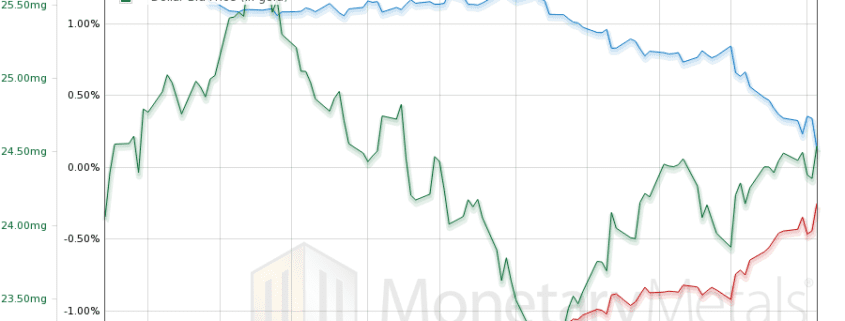

The price of silver abruptly dropped on Tuesday. There it was, sitting around $17.05 at 14:00 GMT. And boom. By 15:10, it was $16.78. Twenty seven cents of Fed-petrodollar-supporting non-profit illicit profits for da boyz in da cartel (you know who you are)! Or was it…? In the gold and silver communities, one needs no […]