Gold is a Giant Ouija Board, Report 25 Feb 2018

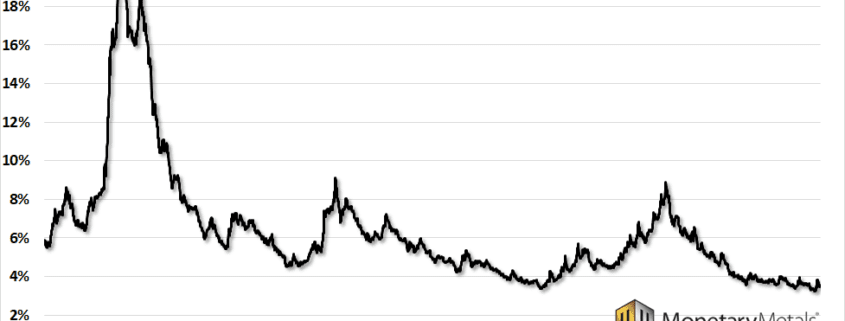

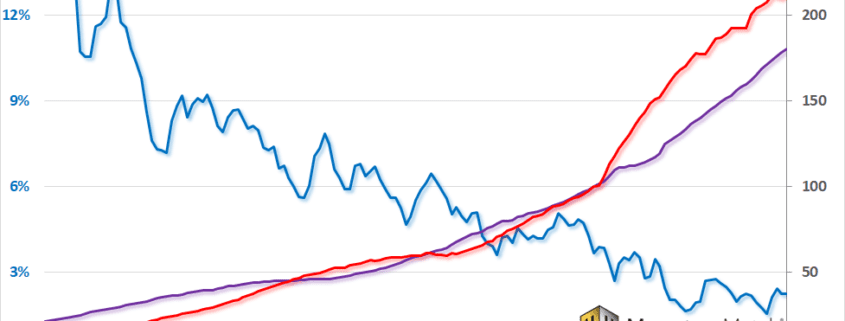

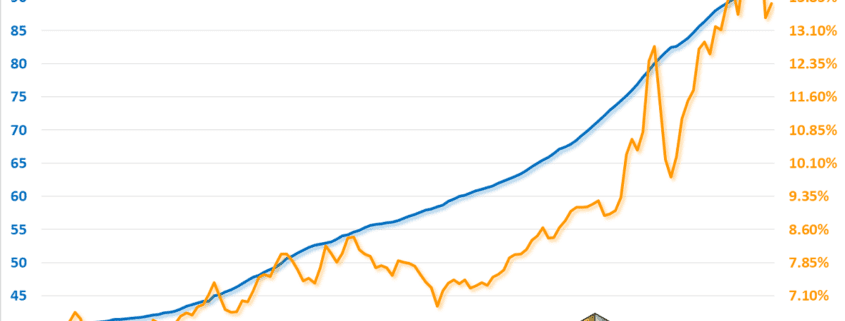

We have been promising to get back to the topic of capital destruction, which we put on hiatus for the last several weeks to make our case that the interest rate remains in a falling trend. Today, we have a different way of looking at capital destruction. Socialism is the system of seeking out and […]