Backwardation, the Bank of England, and Falling Prices

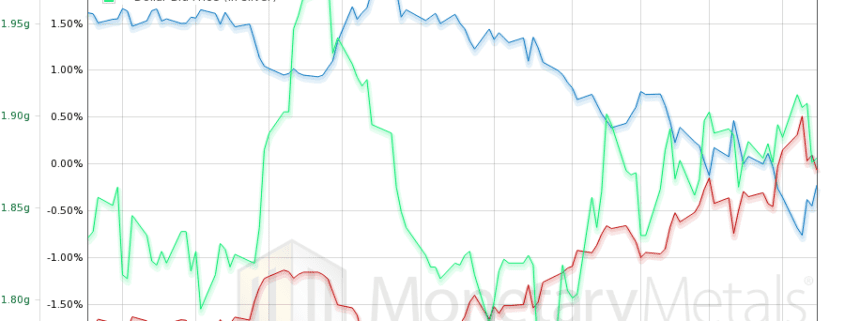

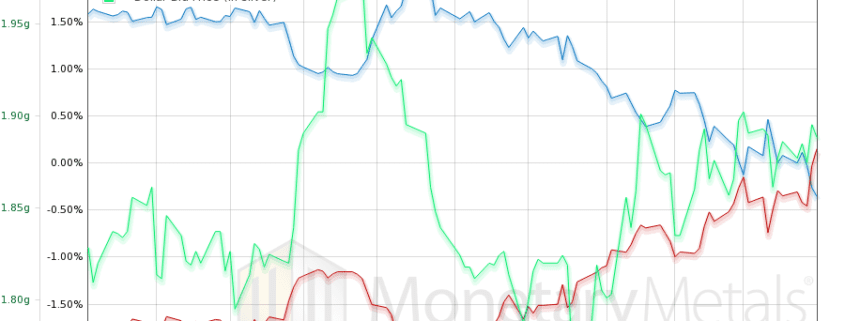

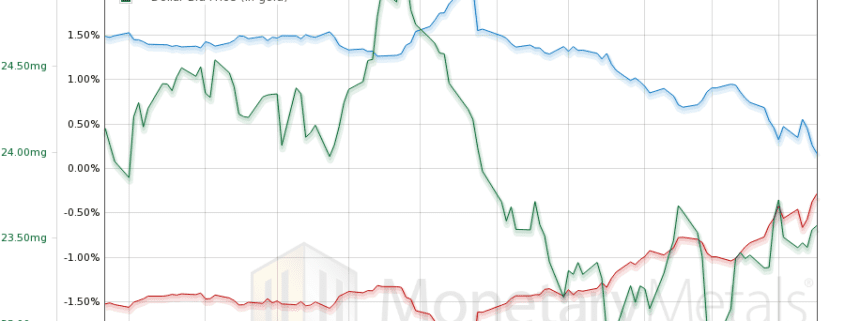

In commodity markets backwardation is an indicator of physical shortages. Shortages result in buyers bidding up the cash price of the commodity above the future prices. This creates a profitable trade (called decarry) for those holding the physical commodity – they can sell it now and buy a futures contract at a lower price, locking […]