Keith gave a keynote address—the only speaker with an hour to cover his topic—at the Gold and Alternative Investments Conference in Sydney on Saturday. Said topic was the nature of money.

“Money is a matter of functions four: a medium, a measure, a standard, a store.”

Most of the talk was structured around discussing these functions. Medium is pretty obvious: the dollar is the universal medium of exchange. It is basically frictionless, trading at zero spread (with perhaps a fee to wire dollars internationally). Bitcoin claims to be a medium, but it’s slow, can be expensive due to limitations of the blockchain. And as later confirmed by bitcoin proponents, bitcoin’s bid-ask spread is wide and can widen unpredictably for large orders. Like $5,000.

Even in cases where bitcoin is a medium, there is a third-party currency exchange broker who finds a fourth party who wants to buy bitcoin. The merchant gets the dollars he really wants, the customer pays in bitcoin, and the fourth party buys the bitcoin and provides dollars to the merchant. All for a fee charged by the broker.

Store is also pretty straightforward. The dollar’s managers issue an Orwellian statement, states that objective #2 is:

“stable prices for the goods and services we all purchase”

That would be all well and good (though impossible to achieve, and not sound money), but below that on the same page, the Fed asserts:

“…inflation at the rate of 2 percent … is most consistent over the longer run with the Federal Reserve’s statutory mandate.”

Got that? Chronic monetary debasement (the Fed believes that the value of the dollar is 1/prices) is stable prices! Orwell would be glowering if he could see this, 1984 was not supposed to be a how-to manual.

So the dollar is not a store of value. And bitcoin is not a store, even in the first phase of its cycle, the skyrocket. And, wow, did it have that phase on Friday! Bitcoin was up more than $2,500.

Measure is trickier for many people to grasp. Keith suggested to the audience to imagine if they formed a business in 2009, when bitcoin was $1. The business was capitalized with BTC 1,000,000, and keeps its balance sheet in bitcoin. The value of the business plunged from BTC1,000,000 to BTC50 from 2009 to 2017.

What explains this epic collapse? Is it just an epic business failure? Well, assuming the business is going along at an even keel, the explanation is simple but counterintuitive. Bitcoin went up. It went up 20,000 fold.

A visual might help. Picture a millimeter. It is about the thickness of a credit card (not quite, but to keep the picture simple, let’s go with that). What if a millimeter could grow 20,000 times longer? A house could then be said to be one millimeter long. And that credit card? It is now 1/20,000mm thick.

Of course, the credit card does not get thinner. And it is preposterous that a unit of length would grow. We only accept such change for a unit of economic value, not for a unit of length. Most people tolerate that the dollar is supposed to shrink by 2% per year, and some even tout the benefits of this.

Neither the dollar nor bitcoin are good measures of economic value. The dollar works for short periods of time, but over decades it gives distorted measurements. If you get a 5% raise this year, you can be sure you are doing OK. It’s just when you make an investment in a long-term project, such as a power plant, that you cannot tell if you are creating or destroying capital. Which is the existential question for any enterprise—and for civilization itself. No society can survive if it renders it impossible to tell creation from destruction.

Later in the program, a 20-something bitcoin enthusiast went on stage and made some extraordinary claims. Keith had a chance on a panel Q&A to partially respond to them (and the audience responded with spontaneous applause). But let’s look at two of them in more detail here.

One is that bitcoin could replace all assets extant: base money, bank money, bonds, stocks, etc. Here is his slide, which Keith took a picture of.

The multicolored inverted tetrahedron is known as Exter’s Pyramid. It is a ranking of asset classes, with gold at the bottom representing the smallest and safest and going up from there.

This speaker tried to convince the audience that bitcoin could displace these other assets, and hence the market cap of bitcoin could grow to tens or hundreds of trillions. Therefore, he wanted the audience to imagine the value of one bitcoin to be $1,500,000 or more.

Can people really stop buying businesses (forget real estate) and just go all-in to a crypto coin? We write about the pathology of replacing investing with speculating. The source of your profit in investing is the new production enabled by your investment. The source of your profit in speculating is the next speculator’s wealth (Keith covered this briefly in his talk).

In a few slides and a few minutes this speaker was touting the absurdity of going all the way. He imagined it was a stairway up to Heaven, but it’s really the road down to Hell. Just think of buying bitcoin at $10,000 and selling it at $1,500,000! Heady stuff, provided that everyone else is still investing and working to produce all the cars, and jets, and champagne that a new bitcoin billionaire wants to consume. But if they’re all doing that, then they can’t be bidding up bitcoin as he wants you to imagine.

He said that gold’s monetary premium will collapse to zero, as the quantity is increased by more mining such as on asteroids. This is an appeal to the debunked Quantity Theory of Money. That the value of a currency unit is 1/N. On the panel, Keith had a chance to ask a pointed question. Which currency has by far the most units in circulation? It ought to be—by this theory—the least valuable currency, by far. It’s actually the most marketable, most universally recognized, most widely used, and most widely held.

It is interesting that bitcoin always seeks to compare itself to gold. Bitcoin is mined, has scarcity, and trust, etc.

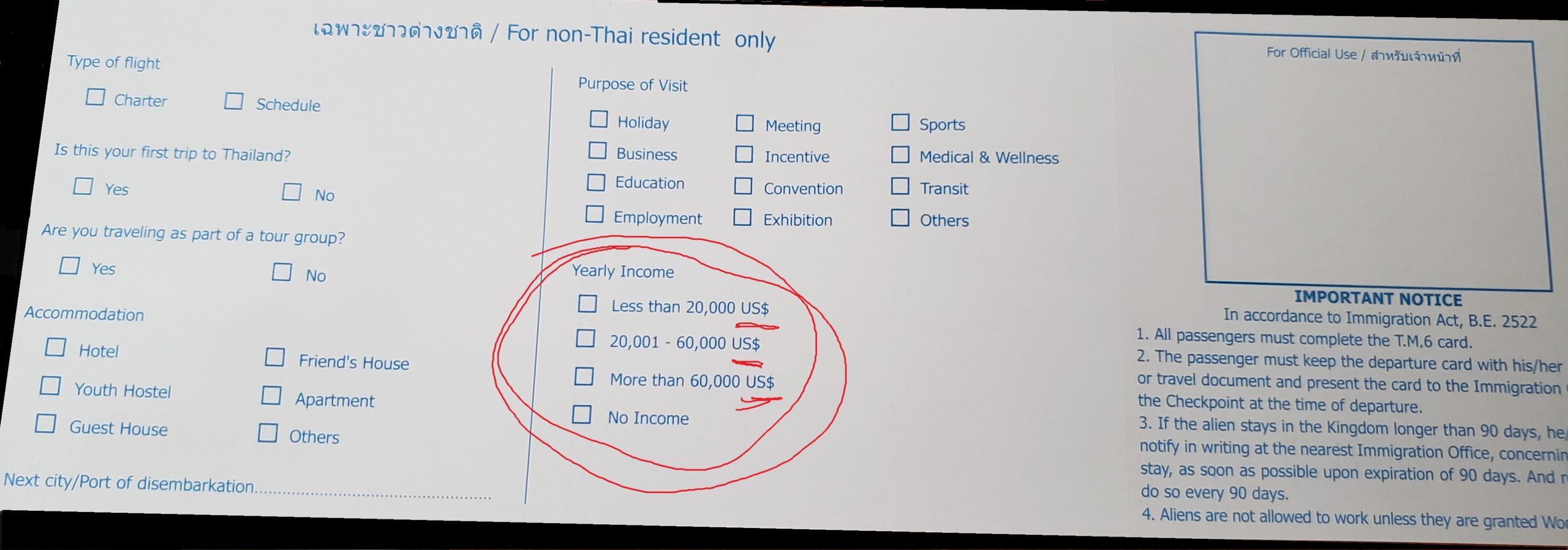

Meanwhile, the dollar is still entrenched. Here is a picture of the back of the landing card that all passengers who fly to Thailand must fill in.

Not yuan, even in Asia. Not euro. Not pound or franc. Not even Thai baht. Definitely not bitcoin (who would even know or recalculate his income in something so volatile—after Friday, everyone’s income dropped over 25% as measured in btc).

To the list of the four functions, we add one more. Extinguisher of debt. The dollar, being a debt instrument itself, cannot extinguish a debt. Only shift it. Bitcoin being that it is going up—according to all of its proponents—means that it is not suitable for borrowing. If that fictional business had borrowed BTC1,000,000 in 2009 it would long since have declared bankruptcy. No one can survive a 20,000 fold increase in his debt and monthly payment.

Gold is the extinguisher of debt (and silver). Which is why it is so important that borrowing begins to shift back to gold. Once, not too long ago by a historical perspective, bonds were gold bonds. They will be again, if Monetary Metals succeeds in our project.

Supply and Demand

The prices of gold and silver were up $19 and $0.48 respectively. But that’s not where the massive inpouring of groceries went.

When Friday began (Arizona time), bitcoin’s purchasing power was under 75 groceries (assuming a grocery unit is $100). By evening, speculators added 25 more groceries to the same unit of bitcoin. Think of it this way, if you forked over 75 groceries worth of farmland to buy a bitcoin Thursday night, the next speculator would fork over 100 groceries worth of tractors to buy it off you on Friday night. You could buy back your farm land, and consume a quarter of his tractor.

Viewed this way, bitcoin is not the anti-dollar. It’s just another chip in the dollar casino, which people can speculate on to increase their purchasing power. And by that, we mean give up their capital in the hopes that someone else will give up even more of theirs. Because, that’s what acute yield deprivation makes people do.

Congratulations to anyone who caught this wave. We do not blame the speculators, we blame the Fed for forcing us to play this game.

Read on for a look at that the only true picture of the supply and demand fundamentals of gold and silver. But, first, here is the chart of the prices of gold and silver.

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). The ratio dropped this week.

Here is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price.

The cobasis increased again, slightly, while the price was up.

The Monetary Metals Gold Fundamental Price, was up another $28 this week, to $1,511.

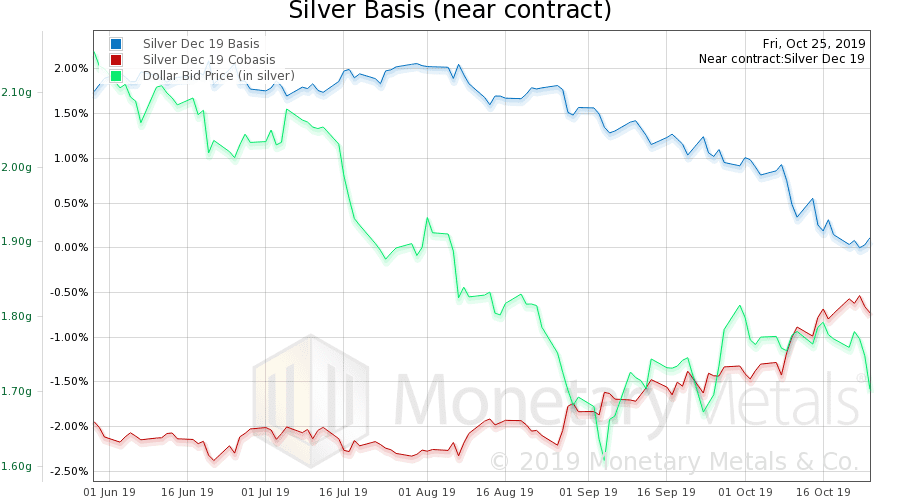

Now let’s look at silver.

In silver, the December cobasis rose slightly, though not the silver basis continuous.

Despite the rise in market price, the Monetary Metals Silver Fundamental Price fell 8 more cents to $16.87.

© 2019 Monetary Metals

:

:

There is no limit to how many cryptocurrencies can be created.

Keith,

Nice poetry. Next line: “extinguisher of debt, which then one may forget”

or something like this!

Actually. It’s not a tetrahedron.

Regarding bitcoin, whether it can become the money or not, there are several uses for it right now and several huge advantages to holding it over the US dollar, though of course, it is easily susceptible to being speculated on. First of all, there is no counter-party risk. If a bank where you are holding your dollars goes under, you may never see those dollars again. And banks may fall in domino fashion. Second, bitcoin’s growth is not subject to human manipulation (The trading of it IS subject to manipulation in that more than 90% of bitcoin transactions never go on the blockchain, affecting bitcoin’s price, but how many new bitcoins are issued and the rate at which they are issued cannot be tampered with). These two things alone make it vastly more valuable than fiat currency. Further, it cannot be counterfeited. It is true that the transaction throughput is not great right now for bitcoin, but there are a lot of developers working on that and a solution will most likely be found. Yes, it is extremely volatile, however, (to a lesser extent) so is gold and silver in terms of the dollar. But it is all relative. Is it the dollar that is volatile in relation to bitcoin? Yes, I understand what you are saying. It is the dollar that is accepted and not bitcoin. But that can change in an instant.

Other factors. Incentives can be figured to make bitcoin desirable to merchants. Millions of dollars can be transferred in bitcoin without government-inspired questions from banks sending out a wire transfer and the bitcoin will arrive much faster and at lower cost. Bitcoin transaction costs are generally less than a dollar now.

Whether theoretically bitcoin is or can be money or not, when confidence in the dollar plummets, as is bound to happen with negative interest rates creeping in more and more (Trump is urging the Fed to lower the Fed rate to zero or below.), people will be hysterical to get into gold and silver, of course; but also into bitcoin, because of its qualities (and into other cryptos). Bitcoin is like gold except it is far easier to transact in and all the (verifiable) transactions are recorded on the blockchain. There can be no backroom deals as with gold. What gives gold its value? Gold has little utility except as being used as money (well, status in the form of gold jewelry, too) and as a store of value, but why is it a store of value? Because of its superior qualities as money. Same as bitcoin.

This is one of the babies discarded with the bathwater. Tampering, by connotation, is not a sound practice; but flexible quantities are both necessary and potentially as sound as physical assay or proof of work. When a currency supply is inflexible it acts like a sclerotic artery that cannot swell or shrink to handle the changing blood flow of the economic engine at work; systolic pressure spikes and the engine is overworked to overcome the friction of an inflexible circulatory system.

Sounds like you are a monetarist, a theory made famous by Milton Friedman, where a monetary system is treated as not being able to be trusted to regulate itself. How has human intervention worked out? Less than 50 years after going off the gold tether, we have huge debts around the world and bond interest rates are falling deeper and deeper into negative territory.

The only thing wrong with the gold system is that governments are always trying to beat it, dishonestly trying to stretch the money supply more and more while affirming that its currency is still fully backed by gold (Eventually that affirmation becomes no longer trusted). This happened until 1971, when Nixon announced that US obligations to other governments would no longer be exchangeable into gold.

But the staying power of gold over the millenia is proof that it is a great money as long as governments are disciplined. Bitcoin is even better because it takes all money creation out of the hands of governments.

Au contraire! I said nothing that advocated “tampering” with the money supply or requiring “intervention.” Of course I am against “dishonest” attempts (by governments, bankers or anyone) to “stretch” the actual supply of base money. I just want to point out that all the hope for bitcoin becoming the currency cannot rationally be based on its inflexible supply. Gold is money, its supply is exceptionally stable, but notice how it is not rigidly bounded.What was once gold standard currency was, in fact, bank notes and bills that were backed in various ways by gold (either on deposit, or on-the-fly in well-examined transactions). This currency had a decidedly flexible supply but not one which was centrally planned. Circulation credit was not granted by government powers, it was a specific market-based activity undertaken by depositors and investors who assumed modest risks in the money markets of the day. One might argue that bitcoin could act as a gold-like base money for such markets and hence could become the “backing” for a sound currency. It wasn’t designed to do this, and I think it would be sub-optimal in that role, but it’d be a rational argument. The hope that bitcoin blockchain is going to fulfill all transaction needs for currency is vain and you should not tout it as a possibility.

Also–money supply elasticicty is not a Monetarist (Milton Friedman or otherwise) concept. Simply read the opening statement of the 1913 Federal Reserve Act it is the second- or third-priority purpose for having a Fed (although no central bank is needed to make a currency supply elastic, and its provision hardly justifies enacting the Federal Reserve system).

Gregory,

Approximately 2% additional gold is mined each year when compared with the existing gold stocks. 25 bitcoins are mined every 10 minutes and that is going down to 12.5 bitcoins per every minutes at the next bitcoin halving. Both are small flows to stock ratios, the only difference being that the increase in the number of bitcoin can be known to greater exactitude than gold. So how is the supply of gold flexible or elastic? It only becomes flexible when institutions and governments are playing fast and loose by issuing more paper backing the gold than the gold they possess. This is not possible with bitcoin – that is a huge advantage in bitcoin’s favor over gold. I am not going to argue that bitcoin must be the world currency, or arguing against it, either. I am just saying, look at the advantages bitcoin has over fiat and over gold, one of the biggest ones being that bitcoin’s rate of issuance and appearance in the blockchain cannot be manipulated by anyone. That one quality alone makes government unable to fool with bitcoin, which is something gold cannot accomplish. Do you realize what that means? It would make it practically impossible for governments to fight wars for lack of funds, as all bitcoins are accounted for on the blockchain.

During and after WWI, the pressure to go off the gold standard was insurmountable, with huge war expenses having been racked up. There is no way those debts could have been paid off without governments stretching their currency in relation to the amount of gold in existence (Is this the kind of flexibility you are talking about that is necessary?) or outright going off the gold standard.