Let’s do a quick thought experiment together.

Imagine you want to order ten widgets. You place your order with the highly rated Widget Providers Extraordinaire, Inc. They receive and confirm your order for ten widgets, but they only deliver five. How do you feel about that?

Miffed? Stiffed? Troubled? Triggered?

Now let’s imagine you want to invest $10,000 in Widget Providers Extraordinaire’s recent debt offering. They accept and receive your offer to invest, but they only allocate you $5,000 because of oversubscription in the deal. How do you feel about it? The same as above? Different?

While the above two examples may seem similar, they are indeed different. The former is simple, and you would be right to feel a bit miffed if you were shorted on an order for widgets.

But receiving an allocation because of oversubscription on an investment offering is a different animal altogether. Unlike with the simple widget order, it can be a strong signal that you’re in the right place as an investor.

Though counterintuitive, oversubscription offers numerous and significant benefits to investors. In this article, we will look at five benefits of oversubscription to investors. But first, let’s define what we mean by oversubscription.

Oversubscription is when there is more capital offered on an investment than what is needed.

How much additional capital offered determines the rate of oversubscription. For example, if there is a 1,000 oz gold investment opportunity, and 2,000 oz are offered, then the oversubscription rate is 200%. In this case, the deal is said to be “two times” oversubscribed.

In such an example, investors would receive an allocation at 50% of their offered amount. If I had offered 100 oz, I would get 50 oz placed in the deal and have the other 50 oz come back to my account.

Now, let’s look at the 5 ways in which oversubscription benefits investors.

1. You’re in the Right Place

Oversubscription is a signal that you’re investing in the right place. It shows that you’re neither the “first money”, nor the “only money.” You’re not the first money because for an investment to be oversubscribed there typically has to be a number of investors already involved in that market. You’re not the “only money” because the very definition of oversubscription is that there are other investors who are invested in the same opportunity with their capital. In other words, oversubscription adds validity to the investment.

2. Ability to Withdraw

Perhaps the most important benefit of oversubscription is the fact that it offers investors hard evidence of their ability to withdraw capital from an investment should they need to.

How so?

Consider an investment which is three times oversubscribed (300%). This means there are three ounces ready and able to replace any one ounce in the deal. For someone who may need to unexpectedly withdraw their capital – that’s great news! Imagine if you were trying to withdraw capital from an investment where the providers had to go out and seek new capital in order to replace your investment. This would cost you both in time and money. Oversubscription implies a ready source of capital to replace yours, should you need to withdraw.

3. The Wisdom (and fairness) of Crowds

The market is the “market” for a reason. Because what comprises markets (the free ones at least) are the trillions of voluntary decisions made by the billions of people with real skin in the game all of which have a determinative effect on the world as we know and experience it.

So, when you participate in an oversubscribed offering, that’s the market signaling to you and the watching world that “there’s something happening here!” In other words, oversubscription represents both a statistical and material significance (or reliability) to the information (price, oversubscription rates, etc.) coming from that market.

But it goes beyond mere reliability. There’s a moral component as well – it’s fair, just, & equitable.

Compare a residential real estate transaction with the price of Apple shares. There’s really only one buyer and one seller in a residential real estate transaction. That means there’s a lot of room to argue over the fairness of the price and negotiate back and forth. Not so with the shares of Apple. With Apple, you are looking at live bid and ask prices, which represents real capital at risk, in large volume, being offered or deployed several thousands of times per day. There’s literally no room in that process to say “not fair.”

Appealing to the morality of markets may be out of fashion in today’s world, but that doesn’t make it any less true. And while we may have built a track record of bashing the medieval doctors for planting the seeds of the erroneous quantity theory of money they deserve some credit where it’s due. Consider the following quote from the late Spanish Scholastic – Luis Saravia de la Calle,

Excluding all deceit and malice, the just price of a thing is the price which it commonly fetches at the time and place of the deal, in cash, bearing in mind the particular circumstances and manner of the sale, the abundance of goods and money, the number of buyers and sellers, the difficulty in procuring the goods, and the benefit to be enjoyed by their use, according to the judgement of an honest man.

Luis Saravia de la Calle – Instrucción de mercaderes, 1544 “Of the Just Price”

Señor Luis is describing the “market” and he makes it clear that excluding deceit and malice, the market price is the just price. Oversubscription illustrates the reliability and the fairness of the market you’re investing in.

4. No Whales Allowed

Oversubscription also reduces the risk that any one large investor could take down the entire deal if they were to pull their capital out early. Most large investors remain large investors because they think carefully about risk and aren’t likely to put too much capital into any one opportunity.

However, if they were to do so, oversubscription limits the amount they get assigned in the deal and therefore reduces the risk that the deal would be disrupted should they choose to withdraw their capital down the road.

5. Liquidity and Marketability

Everything we’ve mentioned so far could be understood as different windows into the concept of liquidity or marketability. Liquidity is the ability to transact (buy or sell) with little friction and cost. Oversubscription is a signal you’re investing in a liquid and marketable opportunity. Why? Because oversubscription indicates significant depth “at the market” (or at the marginal price) for an investment.

Market depth generally refers to the number of buyers and sellers, and their respective volumes, participating in an investment beginning at the market price and then going down (or up) the stack of bids and offers. Depth, at the market, shows convergence among investors at the cleared rate, or price. Thus, the greater the oversubscription in an offering, the more liquid the investment, ceteris paribus.

The Marketability of Monetary Metals

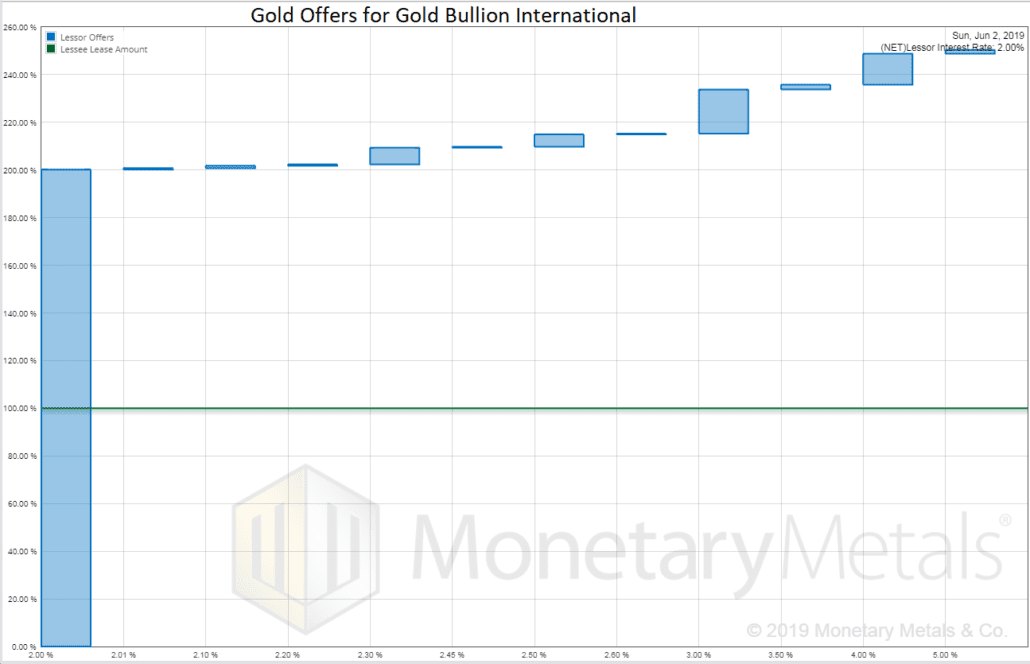

Gold is the most marketable commodity and Monetary Metals has built marketability into everything we do. This shows up in the oversubscription rates for our gold and silver leases – where we pay interest on gold and silver. Let’s look at one historical example (you can find others here) – our gold lease to GBI (Gold Bullion International) from May 2019.

This chart illustrates the oversubscription of this particular lease. The green line represents the amount of gold raised for the lease. The blue bars represent the amount of gold offered on this lease at each interest rate. As you can see, this lease was 200% oversubscribed at the cleared rate, with even more gold available if you go up the stack of interest rate offers.

Investors in this lease, as with all the others in our marketplace, possess the benefits of oversubscription for their gold and silver earning a yield.

:

: