Monetary Metals Supply and Demand Report: 22 Feb, 2015

The price of gold dropped another 27 bucks, and that of silver fell a buck eleven. Without picking on anyone we saw a headline this weekend, “Can the Bear Get Any Worse?”

Regular readers know that we do not regard it as a gold bear market. We regard it as a dollar bull market. Why? It’s easy to say, but harder to get your head around. Gold is the objective measure of value (see my Forbes column this week for more on this topic). It’s simply wrong to price gold in terms of the elastic dollar. One must price the dollar in gold.

If you do this, a number of confusing issues snap sharply into focus. One of them is that a rising gold price is just the flip side of a falling dollar. Far from being something to cheer—even if you’re short the dollar—it’s a slow motion calamity that no one should wish to see accelerate (yet accelerate, it shall, soon enough).

Right now, the calamity is more visible around the rest of the world. In Switzerland, the interest rate cancer has metastasized through most of the yield curve. In Greece, a default (perhaps by any other name) is impending. Currency calamities are occurring all over, from Russia and Ukraine, to Venezuela, to Indonesia. People are losing their precious savings, and businesses are losing their precious capital.

Credit is contracting (though, in the US, junk bonds are having a month-long reprieve so far). People increasingly prefer what they think of as “base money”—i.e. the much-maligned US dollar—over more exotic and yieldy credit. They clearly have not figured out yet that gold serves as a superior safe haven.

How can we be so sure? It’s not simply by looking at the price, though that tells you there is no mass panic in the world of paper just yet. It’s our unique approach to the fundamentals of supply and demand. The data talks. For our picture, read on…

First, here is the graph of the metals’ prices.

We are interested in the changing equilibrium created when some market participants are accumulating hoards and others are dishoarding. Of course, what makes it exciting is that speculators can (temporarily) exaggerate or fight against the trend. The speculators are often acting on rumors, technical analysis, or partial data about flows into or out of one corner of the market. That kind of information can’t tell them whether the globe, on net, is hoarding or dishoarding.

One could point out that gold does not, on net, go into or out of anything. Yes, that is true. But it can come out of hoards and into carry trades. That is what we study. The gold basis tells us about this dynamic.

Conventional techniques for analyzing supply and demand are inapplicable to gold and silver, because the monetary metals have such high inventories. In normal commodities, inventories divided by annual production (stocks to flows) can be measured in months. The world just does not keep much inventory in wheat or oil.

With gold and silver, stocks to flows is measured in decades. Every ounce of those massive stockpiles is potential supply. Everyone on the planet is potential demand. At the right price, and under the right conditions. Looking at incremental changes in mine output or electronic manufacturing is not helpful to predict the future prices of the metals. For an introduction and guide to our concepts and theory, click here.

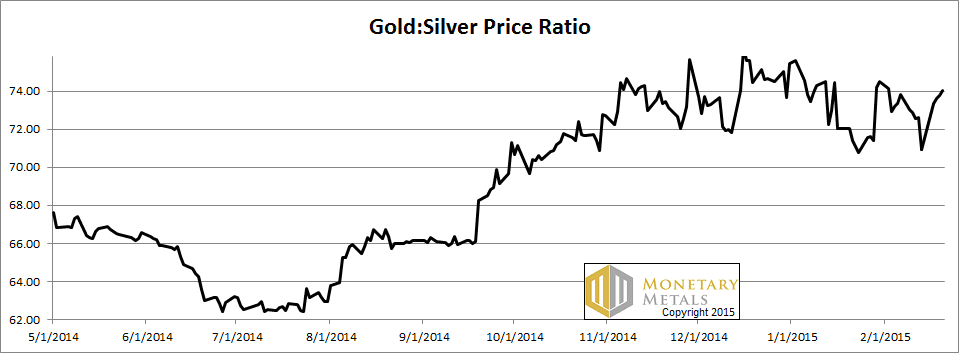

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It moved up over 4% this week.

The Ratio of the Gold Price to the Silver Price

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide terse commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

The price of the dollar is up about six tenths of a milligram of gold in this shortened four-day week (it was President’s Day in the US). Gold bulls will be disappointed to see the cobasis (scarcity) fall as this happened. A big component of the price drop was the selling of physical metal.

Our calculated fundamental price is still tens of dollars above the market price, but it’s come in somewhat.

Now let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

Last week, we said we said, “17.34 reasons … to say caveat emptor argenteos“. We now have 1.11 less reasons, but nevertheless still urge caution.

Despite the drop in the silver price (i.e. rise in the dollar from 1.8g to 1.9g silver), the cobasis (scarcity) dropped. Either buying of the white metal dried up, or someone is dumping more on the market. Perhaps it’s dollar thinkers, who have reached the end of their tolerance for dollar losses?

Everyone knows that QE is going to devalue the euro. Therefore everyone knows how the price of gold and silver should react—silver 2X to 3X more. Therefore they’re all positioned for it. It’s dangerous when too many traders run to one side of the boat.

Our calculated fundamental price of silver is still a few bucks below the market, even this week after the market price dropped over a buck.

© 2015 Monetary Metals

6 responses to “Monetary Metals Supply and Demand Report: 22 Feb, 2015”

Leave a Reply

You must be logged in to post a comment.

Keith,

Why do you feel the value of the dollar will accelerate down soon enough as it still seems the cleanest of the dirty shirts with the yen and euro going nowhere but down?

Thanks,

Mark

Also, last week the fundamental price of gold was $80 greater than market and this week, with the cobasis changing little, why is the fundamental price only $10 higher?

Thanks,

Mark

Do you take COT positioning into account. Specs and money manager are long and commercials heavily short against them–is it any wonder why metals should be declining. Expect lower until the specs get short yet again.

Great great lines about the bull market in the elastic dollar. I love when gold is cheaper to buy with dollars if dollars is what I have, and the same when I buy in RMB. I love the reinforcement of these objective value concepts.

Thanks for the comments.

miamonaco: When I say dollar will fall, I mean as measured in gold. I don’t expect it to fall against the paper currencies (though of course there can be corrections). I did not say the fundamental price of gold was ten dollars over market, but tens of dollars.

johnchew: Yes, but not by trying to incorporate those numbers. The effects of those actors show up in the basis and cobasis spreads.

Max: thanks!

Why not short gold when you have a lopsided COT position–like shooting fish in a barrel?