This was a shortened week, due to the American holiday of July 4, celebrating the start of the war that lead to “Amexit”, 240 years ago.

The prices of the metals were up this week, +$25 in gold and +$0.48 in silver. The gold to silver ratio dropped a fraction of a point, showing that the silver price gain was the greater. This is fairly typical in a market where the prices of the metals are rising (but not guaranteed!)

There is a sense of foreboding among contrarians and central bank skeptics that the other shoe has yet to fall following the “Brexit” referendum. Meanwhile, mainstream commentators are almost gloating that British stocks (to say nothing of US stocks) have recovered their losses since the vote was tallied. In their unseemly rush to declare the all’s clear, they omit to mention that the British pound is down from about $1.45 to about $1.29, or -11%. The British people have so far lost 11% of their savings, and unlike the FTSE, the pound has so far not shown any sign of recovering. Maybe it will in the future, but it’s certainly premature to call that.

On the other side, the gold bugs are doing a bit of gloating of their own. You see, gold has gone up from £834.05 just before the vote tally to £1054.55 at Friday’s close, or +26%. In US dollars, the price of gold has gone up in the same period $1251.58 to $1365.85, or 9%.

Who is right? Are British bullion dealers correct to say that owners of the metal have gotten 26% richer? Or are American counterparts smarter, as they cheer almost as loudly for 9%? Is the dollar realer than the pound? Is either one of them suitable to measuring gold?

In reality, the pound has gone down from 37.3 milligrams gold to 29.5mg, a drop of 21%. The dollar has fallen, but less.

We think it’s OK to measure the dollar’s derivative currencies (such as the pound) in terms of the dollar. It’s fair to say the pound fell from $1.45 to $1.29. However, we argue it’s not OK to measure gold in terms of dollar. Gold does not go up or down.

The dollar has value so long as gold bids on it. Certainly, it will become worthless the day this bid is withdrawn. At current prices, and under current market conditions, there is no sign of this withdrawal.

There was no sign of the bottom of the North Atlantic from the bridge of the Titanic when it was first underway, either.

The pound fell. Gold owners in the UK are not richer than they were on June 23. They merely avoided the losses incurred by their non-gold-owning countrymen. To get richer, you need to increase the amount of gold you own. If you’re just watching the price go up, then you’re merely witnessing the national currency go down. And with it the national savings. Even gold owners depend on savers and savings, investment, and capital accumulation. That’s not possible when the currency is sinking.

We wish the best for our British friends, and hope that the damage stops here. To this we would add one thing. The regime of irredeemable paper creates many perversities. A move towards more independence and liberty can cause the pound to lose value. Why is this?

Growth in this regime consists of borrowing more. Well, Brexit calls into question if some of this debt may not be repaid. It is hard to think of any scenario in which this debt becomes more certain to be repaid, and easy to think of many scenarios in which it is called into question.

For example, there may be reduced tourism to the UK. Hotels and restaurant revenue may decline, and hence these businesses face increased difficulty in paying their debts.

Another example is the loss of EU subsidies, such as to Transport for London. While it’s good that UK taxpayers may be off the hook for sending part of their productivity to Brussels, that does not necessarily help TFL service its debts unless the newly independent UK government decides to make up the loss of the EU subsidy with a UK replacement subsidy. And the same for every institution and corporation across the country which is losing its subsidy.

It’s very difficult to tell real demand from artificially stimulated demand due to monetary policy and its bloody wealth effect. Well, when one central bank and the perverse policies it enables—including subsidies not paid for by taxation—goes away, watch out. The debt incurred to support this phony demand may default.

If enough debt seems likely to go bad, that can cause the currency itself to go down.

The price of gold has been bid up in anticipation of something, perhaps a credit crisis. Let’s look at the only the only true picture of the supply and demand fundamentals for gold and silver. But first, here’s the graph of the metals’ prices.

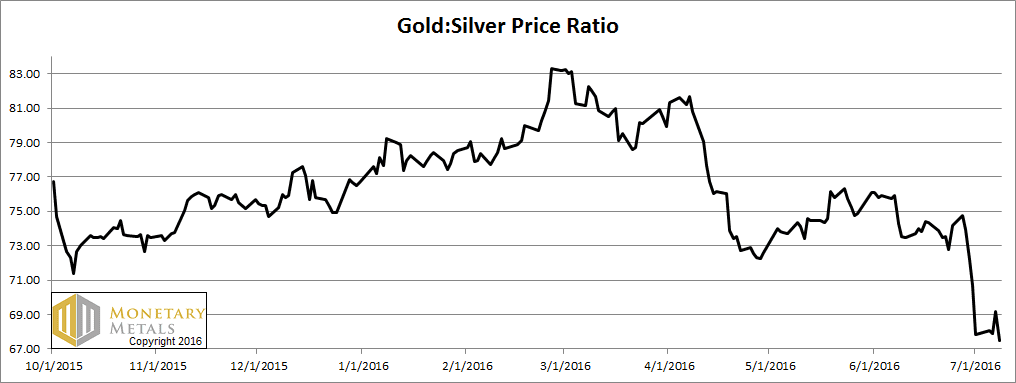

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio declined a bit more this week.

The Ratio of the Gold Price to the Silver Price

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

We switched from the August to the October contract.

The price of the dollar continued to drop (i.e. the price of gold, measured in dollars, rose). And the scarcity of gold (i.e. the cobasis, the red line) rose. So far, it’s looking like a bounce off the bottom of the abyss. But it is notable that it happened with a rise in the price of the metal.

Our calculated fundamental price of gold is up a further $50 ($100 higher than on June 24). Now the fundamental is only $170 below the market price.

Now let’s turn to silver.

The Silver Basis and Cobasis and the Dollar Price

In silver, the same move occurred. The price of the metal is up, and the scarcity is up a bit too.

The fundamental price is up, but still about $2.50 below the market price.

The fundamental gold to silver ratio barely budged, still just under 69.

Keith Weiner will be speaking at FreedomFest in Las Vegas this week.

© 2016 Monetary Metals

:

:

In March this year, before the pre-Referendum ramp-up, £/$ stood at 1.38; today it trades at 1.2980

That’s a loss of 6%, not 11%

Looked at the other way, if we were to look at long-run history rather than a brief window of post-Brexit noise, Gold is still showing massive losses down from $1,900, and Turd Ferguson still hasn’t regurgitated the hat he ate when Silver failed to reach $23 two years ago

It all depends which end of the telescope you choose to look through; over here in the UK things are looking just fine (if you can ignore Commercial Real Estate funds, which are in any case typically dominated by overseas investors)

Andrew a point is missed here..you can’t measure gold in terms of Dollars or pounds.

Its all about how many ounces you own because “when the bid on the dollar by gold is withdrawn” it is game over.

Regards

“There was no sign of the bottom of the North Atlantic from the bridge of the Titanic when it was first underway, either.”

Great quote!

… and yet a few had forebodings.

Thanks for the link!

I found it as interesting as these two:

https://www.youtube.com/watch?v=VvgaJYKRM8Y

https://www.youtube.com/watch?v=m140AXJxfyY

Come, come Keith! Reduced foreign tourism to the UK is hardly a likely effect of a pound that has lost 13% against the dollar since its pre-Brexit high (or 6% since its February low, or 24% since its 2014 high) and 17% against the Euro. Analysts are predicting and hoteliers are rightly expecting a foreign tourism boom!

You are far too pessimistic about the post Brexit prospects. The drop in the Pound will also stimulate exports around the world as well as having a positive effect on the domestic market for raw materials – so much so, that together with the Chinese decision to cut steel production, it has caused Indian steel giant, Tata, to reverse its decision to sell off completely the Swansea steel works. Depending upon government policy, this could also help to re-invigorate our engineering and tool-making industry, reversing the Blair slide into a service economy. Almost nothing could be better for the UK economy than the sharp drop in the pound against nearly all other currencies.

It is my guess that our economy is in for a booming time and the pound will soon rebound – provided, of course our politicians resolve to keep their fingers out!

I can’t imagine how Osborne may plan to let the house price bubble down gently – it isn’t, of course, what he has been planning and achieving for the past six years, but unless he does it is likely to burst and crash down rather violently, IMHO – but not until he and Carney run out of fairy dust to sprinkle.

Monday morning, 8:00am, 7/11/16:

Despite the possibility of one more new high ($1425/$22.00?) in the days ahead, the stage is otherwise set for an immediate decline. In other words only a move and close above $1376 would suggest that the move over $1400 is in progress. Otherwise, i’m calling bull****.

And with bullish consensus now at 93% in silver, this is a terrible terrible time to be stacking.

I’m relieved to hear that the fundamental valuation has been rising. The Brexit vote and Cameron’s and Farange’s resignations are substantive news relevant to many players’ subjective valuations of gold (at least for those with dealings in London). Yours seems to be a slightly lagging indicator, but your weekly release schedule may have a lot to do with that impression.

On the broader subject of the gold market, gold standardization, news analysis, and macro economics, I want to mention Scott Sumner’s “Midas Curse” book, not because I’d agree with his conclusions or even many features of his analysis, but because it is really decent scholarship about the day-to-day financial news during the Depression written with huge respect for the international gold market and the (flawed) gold standard of 1929-39. I hope to write a complete review including some criticism later this summer. But until then I have no qualms about recommending it to gold enthusiasts who like me are distressed by having the Depression blamed on “the Gold Standard”. I note that when Bloomberg interviewed Alan Greenspan about Brexit, he pined after the Gold Standard and took pains to point to its pre-1913 incarnation.

Gold out of backwardation around January 21 as per this report.

CME Gold in warehouses on January 21:

Total Registered: 275,425 oz.

Total Eligible: 6,125,955 oz.

Grand Total: 6,401,380 oz.

Numbers as most recent report (July 8 activity)

Total Registered: 1,479,207 oz. (+ 1,203,782 oz.)

Total Eligible: 8,060,765 oz. (+ 1,934,810 oz.)

Grand Total: 9,539,972 oz. (+ 3,138,592 oz.

Silvery out of backwardation around 9 days earlier than gold (approx January 12)

CME Silver in warehouses on January 12:

Total Registered: 36,148,230 oz.

Total Eligible: 119,208,400 oz.

Grand Total: 155,356,630 oz.

Numbers as most recent report (July 8 activity)

Total Registered: 25,061,061 oz. ( – 11,087,169 oz.)

Total Eligible: 125,731,420 oz. ( + 6,523,020 oz.)

Grand Total: 150,792,482 oz. ( – 4,564,148 oz.)

Comex stocks alone do have to be read carefully as games can be played with them, see http://goldchat.blogspot.com.au/2012/02/martin-armstrong-on-metals-manipulation.html as well as the more recent http://marketslant.com/articles/guest-analysis-jpm-silver-decision-flawed-vince-lanci

There’s an old expression: “Gold starts the rally and silver finishes it”

“Gold owners in the UK are not richer than they were on June 23. They merely avoided the losses incurred by their non-gold-owning countrymen”

Wrong I’m afraid Keith.

I am richer.

My Gold has meant that if I want to buy a Jaguar car it is now less of a percentage of my wealth. The Jaguar is still the same price in GBP.