Merry Christmas to our American friends. Happy Christmas to the rest of the Anglosphere. Felicem natalem Christi to our Latin-speaking audience, and góðr jól to those who are reviving Old Norse as a great language!

Let’s address two themes about the gold price trend that are increasingly in popularity the past few months—as the price of gold has been falling. Blame bitcoin. And blame rising interest rates.

There is no direct mechanism—no arbitrage—that pushes up bitcoin and down gold. As there is, for example, with changes in relative palladium or platinum demand if diesel engines gain or lose market share from gasoline engines.

Nor do we give truck to the idea that the dollar has been pushed from Ƀ1.00 to Ƀ0.000053 (we don’t think even the bitcoin bugs who say it, really believe it). What are you going to believe: a B.S. theory, or your own lying eyes?

There is arguably an indirect bitcoin-gold price connection mechanism. Those who own gold for the price appreciation may be attracted to bitcoin. While gold does not seem to be going up, bitcoin obviously is. If someone wants to make dollars quick, bitcoin sure seems to be a better vehicle to ride than gold.

However, we think bitcoin’s effect on the gold price is likely, if anything, to be in the other direction. For everyone selling gold to buy bitcoin, there are surely two who made big bucks in bitcoin and want to diversify into gold. With the price up so much, many people are sitting on 20X gains (or more). In order for new people to buy, SOMEone has to be selling. We think it is likely the diversification trade. It certainly is not anyone saying to himself, “well now that bitcoin has hit my price target, it is fully valued and I am out.”

Gold would be the logical diversification asset, for those seeking anti-Fed money. Once someone becomes aware of the problem with the dollar, which most bitcoin owners are, he will not become unaware. He will be looking for other alternatives. Gold is not only not a dollar, but it is not the wild ride of bitcoin either. For that portion someone wants to take off the table, gold’s stability is a feature, not a bug. The more that bitcoin rises, the more people have more capital to take off the table.

One could call this a kind of reflexivity, where bitcoin’s rising price tends to drive a rising price of gold. And this is likely a ratchet; a bitcoin crash does not seem likely to cause selling of gold to buy bitcoin.

It is a fact that the gold price has been in a downtrend since September (though the price picked up the last week and a half). If not bitcoin, what is the driver?

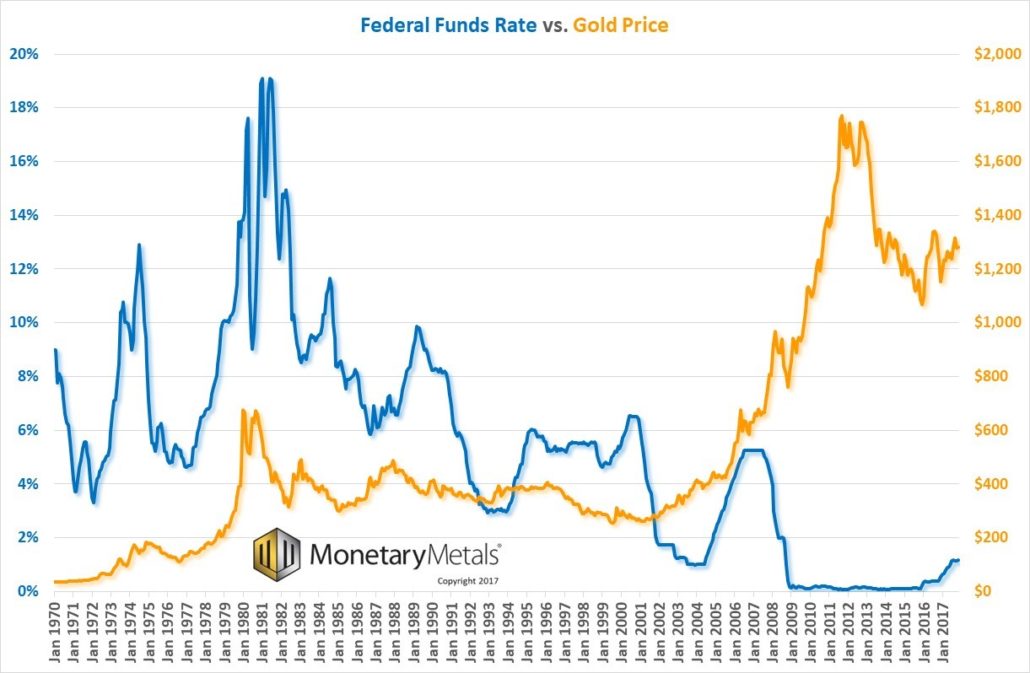

We have written a number of pieces on the topic of interest rates and the gold price (bottom line: there is no clear correlation). Let’s not forget that the gold price was rising in the 1970’s while the rate was rising, and again in the 2000’s while it was falling. Here is a graph of the Fed Funds Rate and the gold price from 1970.

There looks like a correlation while the Fed Funds Rate was rising in the 1970’s. But it is hard to argue that they’re correlated during the big run up in price from 2000 through 2011. This could mean that rising rates causes a rising price, while falling rates do not cause a falling price. Or it could mean something else.

At this point, many would say it’s not the nominal but the real rate. If you add apples, oranges, rent, fuel, etc. you get a hypothetical measure of consumer prices. No one agrees on what should go in to the basket, or the weights given to each item (some people eat more apples than others). But change in consumer prices gives us inflation. So we use hypothetical inflation to adjust the actual rate at which lending occurs. The adjusted number, is called the real rate, apparently without intending any irony.

Perhaps people buy gold when the real rate is rising or falling or too high or too low?

We think that real rate is the wrong concept. The inflation number is rather arbitrary, and it’s invalid to subtract consumer prices from interest. It’s wrong to ignore the rate at which actual lending occurs in favor of a rate at which lending does not occur. And finally, it’s wrong to try to measure money (or even irredeemable currency) in consumer prices. Do feel free to try this at home. How many rubber bands long is your child’s plastic yard stick?

However, there’s a grain of truth in that, which should be identified explicitly. Time preference is that grain of truth. Central banks can manipulate the market interest rate. For proof, just look at a long-term historical chart of the interest rate on the 10-year Treasury bond. There is an obvious difference between pre- and post-Fed.

However, central banks cannot manipulate the time preference of the people.

In a normal world, interest must be greater than or equal to time preference. Central banks turn normalcy upside down, literally. They can invert the time preference – interest spread.

Time preference, by the way, can change too. Not by central planners’ diktats, but in response to changes in the market. For example, people who have little debt in a market of skyrocketing consumer prices will increase their time preference. Whereas people who are loaded up with debt in a lethargic or falling market decrease their time preference.

The upshot of this is that interest at 10% might, at one time, be totally insufficient. And another time, interest of 2% might be more than enough. One would be hard-pressed to plot a graph showing time preference against interest. It’s certainly much easier to plot interest – inflation.

We would suggest that people are impelled to buy gold much more when their time preference is violated by too-low interest rates. And less inclined (or even induced to sell) when interest is above time preference.

Well, today, we have rising rates (at least short-term rates, the long bond is a different story). And yet debt saturation is not changing any time soon. It could be that the Fed is now giving people an inducement to give up their gold: restoring some interest to paper, even if only a small amount.

If so, then we are obliged to mention that we offer A yield on gold, paid in gold.

The prices of the metals moved up $29 and $0.34 respectively. As typically occurs, the price of silver moved more in proportion.

Let’s look at the only true picture of the supply and demand fundamentals of both gold and silver. But first, here are the charts of the prices of gold and silver, and the gold-silver ratio.

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio dropped.

In this graph, we show both bid and offer prices for the gold-silver ratio. If you were to sell gold on the bid and buy silver at the ask, that is the lower bid price. Conversely, if you sold silver on the bid and bought gold at the offer, that is the higher offer price.

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph showing gold basis and gold price on Friday, as there was some interesting price action.

What a nice correlation between price and basis (until late in the day). We hold our breaths, waiting for conspiracy theorists to argue that this is manipulation. Whether it is, or isn’t, it is buying of futures and it pushed up the price of gold.

Despite the rise in market price, our Monetary Metals Gold Fundamental Price fell $35 this week, to $1239.

Now let’s look at silver.

We see the same thing. A beautiful correlation between price and basis. Yessiree, it’s the naked longs buying silver futures on leverage, planning to make dollars when the price rises.

The Monetary Metals Silver Fundamental Price dropped 25 cents from last week, to $16.12.

© 2017 Monetary Metals

:

:

When it comes to BTC or anything related to economics the analysis provided on these pages is not only brilliant, it is lucid. We owe a debt of gratitude to Monetary Metals for bringing sanity and sound thinking to a confused world.

But moving on to the so-called “fundamental” price of gold (let’s abbreviate that price ‘F’) things tend to get murky, as I’ve noted over the past months and even years. I see F not as some stable “anchor” but possibly a lagging sentiment indicator, at least in its effects. Have my observations been merely a coincidence? We’ll see.

Recently we’ve had the fundamental calculation drop ~$100. What inputs to F caused a drop of that magnitude I wonder. If you’ll recall, earlier in December gold was first lower than F by at least $75 (when gold below $1240) but now that same gold is higher than F by $51, $1287 versus $1236.

What are the implications of this elevated volatility in the F price?

Have the fundamental drivers of gold really changed by 8% over the last few weeks? That’s hard to believe. But that’s what the model is claiming, isn’t it? Gold’s fundamental value has dropped from well over $1325+ to $1236 in a matter of weeks. That’s quite a drop any way you slice it, and the model now suggests that gold is actually overvalued whereas a month ago the same approach suggested gold was undervalued. I’m confused.

As it happened, gold rallied from it’s undervalued condition. Will it now drop from its overvalued condition?

We do know that one reason gold rallied is from short covering. In mid-December popular sentiment indicators showed about 9 of 10 traders excessively bearish on gold. If one further assumes that some of those bearish traders took short positions, what we are seeing now is short covering. The next COT report will serve to confirm that suspicion.

What will happen after the short covering is largely complete? Will gold head back down as the current F price suggests? I have my doubts about that too, but it is possible. The more probable scenario is a continuation of gold’s rally into 2018. Once the rally has convinced enough traders that the bottom is in, the F price will rally too, and will quickly overtake the actual price of gold. Then, once the F price is well above gold, suggesting excess optimism, it will be time for a drop in the gold price.

I’ll be monitoring the common sentiment indicators and post the aggregated results here. Let’s see if there’s a pattern.

Hi Keith:

Perhaps the rate of interest does not have a demonstrable effect on the USD price of gold. However, I have two questions from a different perspective. Years ago Antal Fekete commented that the gold contango was much “wider” when gold futures began trading in the 1970s.

My first question is this: Is that observation true; back then having access to a commercial spot gold price quote during spot futures trading hours would have been much more difficult than nowadays; does MM have the data that would corroborate Fekete’s statement? My second question is: If indeed the contango has narrowed significantly over the course of 40-some years, to what extent if any do you think that is due to the concurrent secular decline in interest rates?

12/27/17 — Based on the most recent COT report, there is scant belief in the current rally. Speculators continue to sell, not buy. And speculators, especially the big ones who manage money, are notoriously wrong at major turning points.

The “more probable” scenario I outlined above continues to unfold. Given this backdrop, the Fundamental price of gold is unlikely to overtake the dollar price any time soon. If my theory that the inputs to F reflect sentiment — at least to some degree — then the F price is likely to rebound slowly, at least in the first week or two. I suppose it’s even possible that with so much negative sentiment the fundamental will continue its decline.