Monetary Metals Supply and Demand Report: March 17, 2013

The Last Contango Basis Report

The dollar went down almost 1%, from 19.71mg to 19.53mg (gold), graphs of the currencies priced in gold here (from now on, in milligrams). The big news after markets closed on Friday was the default in Cyprus. The euro is down against the dollar and against gold in early trading Sunday afternoon as I write this in Arizona. We shall see what this does to the gold basis in the coming week!

Here’s a traditional graph of the gold and silver “prices” measured in dollars.

Gold and Silver Price

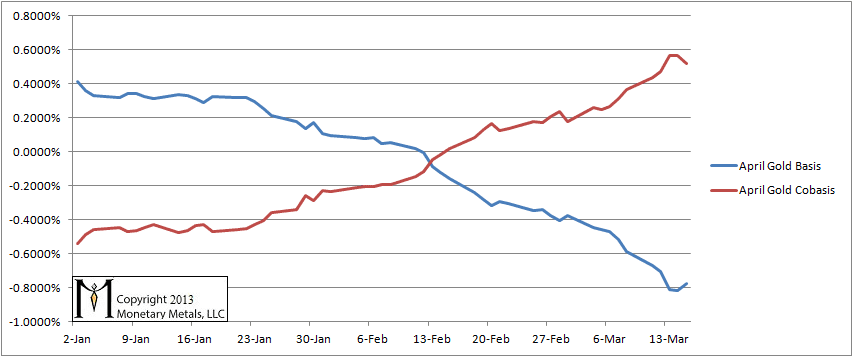

The purpose of this Report is to shed some light onto market dynamics, focusing on the basis. To summarize, a rising basis tends to go along with a falling cobasis. This is not a bullish sign for the dollar price. A falling basis along with a rising cobasis is a bullish sign.

We are entering the steeper part of the contract “roll” for April gold. This is the process by which “naked longs” must either sell the contract and close their gold position, or else buy a farther-out contract. “Naked shorts”, if there are any must buy the contract and either close their position or sell a farther-out contract. As we get close to expiration, the market makers will become less and less aggressive at maintaining the bid-ask spread. Selling by naked longs will increasingly press down the bid. Buying by naked shorts (if any) will lift the ask. A lower bid will give us a lower basis (for a refresher, click on the basis article linked in the previous paragraph). A higher ask would give us a lower cobasis. The trend in recent years has been Temporary Backwardation, wherein the cobasis rises in the contract roll and beyond.

The basis is lower, and the cobasis is higher than it was last weekend, though they corrected on Friday.

Gold Basis and Cobasis

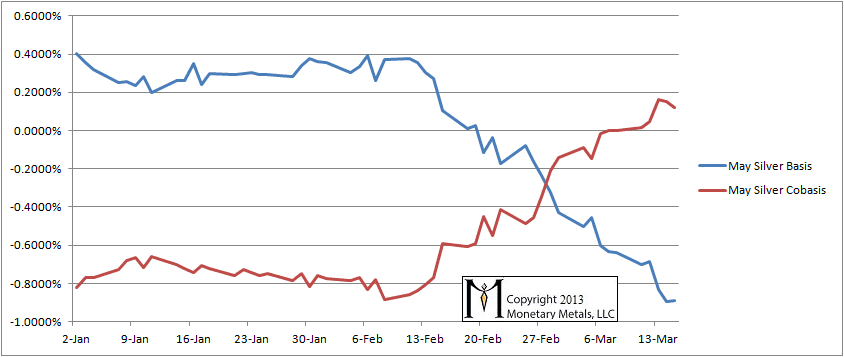

In silver, we see the same trend as in gold. May silver entered into backwardation on Monday, and does not appear to want to look back. Perhaps the speculators are buying physical metal on the dip, or perhaps the fundamentals of the silver market are turning around.

Silver Basis and Cobasis

We wrote last week that silver’s scarcity was increasing and this continued this week. In dollar terms, silver could go either way at this point. In gold terms, we are not bullish about silver at all. Silver is currently a little over 1/55. It could head to 1/60 or higher, though we must wait until this week to see how this Cyprus event may impact the markets.

Leave a Reply

Want to join the discussion?Feel free to contribute!