Monetary Metals Supply and Demand Report: March 24, 2013

The Last Contango Basis Report

All the major currencies fell this week, with the dollar down about 0.2mg, (graphs of the currencies priced in gold are here). Cyprus continued to dominate the financial news this week, with one plan after another proposed and rejected. Meanwhile depositors can’t withdraw euros from their bank accounts in the island country. As people ponder this unhappy development, they may begin to realize that gold has no counterparty risk. Their hoarding, should they act on this conclusion, would drive down the gold basis and drive the cobasis deeper into backwardation, at least until the gold price rises.

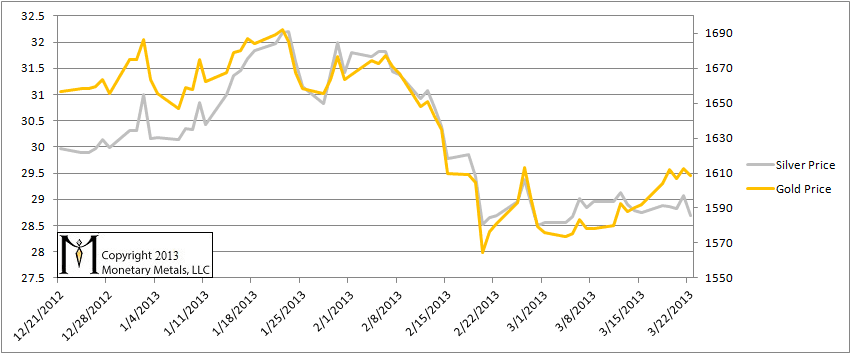

Last week, we said we wanted particularly to look at gold in light of Cyprus. The gold price is up $17. Here’s gold and silver “prices” measured in dollars.

Gold and Silver Price

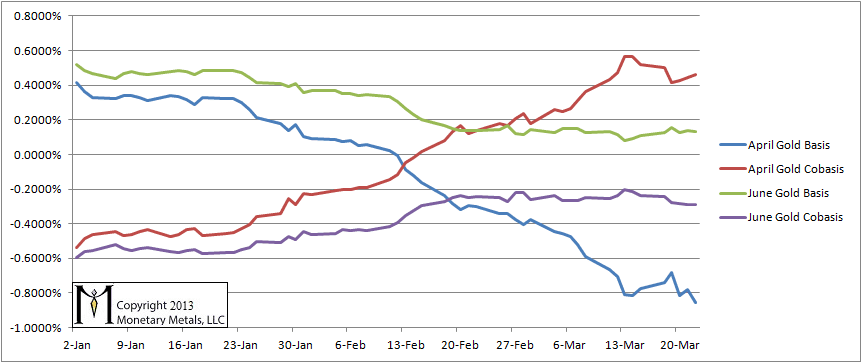

This report is named for the idea that the positive gold basis is disappearing. The word for a positive basis is “contango”. Gold is in contango now (aside from temporary backwardation, also discussed in this video). Once it is gone, once backwardation in gold becomes permanent, then gold no longer bids on the dollar and the dollar game is over. Cyprus is just the sort of event that allows us to test a hypothesis and see if the gold withdrawal from the market is beginning. In this letter, we also aim to shed some light onto market dynamics. A rising basis tends to go with a falling cobasis and this is not a bullish sign for the dollar price. A falling basis along with a rising cobasis is a bullish sign.

We are still in the middle of the contract “roll” for April gold. “Naked longs” must sell the April contract. They can buy June if they want to remain long gold. “Naked shorts”, if there are any, must buy the April contract. Selling by naked longs will increasingly press down the bid. Buying by naked shorts (if any) will lift the ask. A lower bid will give us a lower basis (for a refresher, click on the basis article linked in the previous paragraph). A higher ask would give us a lower cobasis. The trend in recent years has been a falling basis all the way to when the contract goes off the board, and a rising cobasis that goes well into backwardation (though not necessarily rising through the end of the contract).

Due to the contract “roll”, we think it’s important to look at both April and June. In April we see the basis rising and the cobasis falling for the early part of the week, before resuming their trends. In June, we see not a lot. This is interesting because the “roll” puts buying pressure on June. Ceteris paribus, we would expect a rising basis at this point in the process. Instead we have nada.

Still, this is the dog that did not bark in the night. We see a de minimus price increase in gold, and not even a blip in the basis corresponding to Cyprus. One would think that the bank “holiday” together with the possibility of taking dreadful losses would be a powerful motivator to buy counparty-free gold. But this is clearly not yet occurring to any significant degree.

Gold Basis and Cobasis

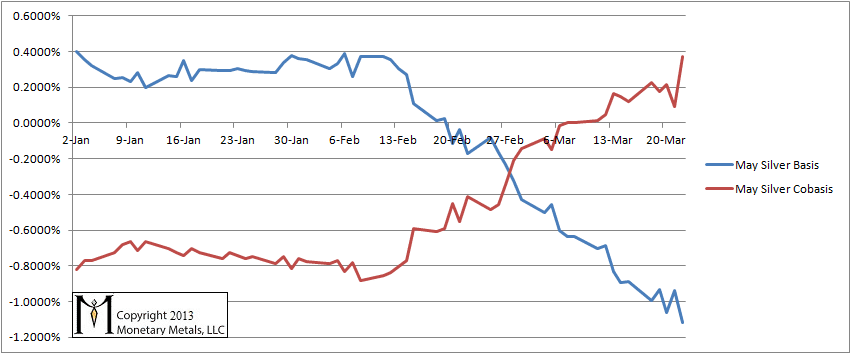

In silver, the price is bouncing along the bottom. Somebody is buying physical silver (or refusing to sell it). The cobasis is now at a very meaningful 0.4%. Where else can anyone get that return for just over 60 days? Nowhere in Bernanke’s World…

Silver Basis and Cobasis

We wrote last week that silver’s scarcity was increasing and this continued this week. In dollar terms, silver is more likely to rise from here than fall. In gold terms, the picture is changing. We were not bullish about silver last week, when the price was 1/55 oz of gold. Now, it is almost 2% lower at just under 1/56 oz. We could see a bounce here. Whether it is sustainable and silver begins moving in earnest to 40 dollars or 1/40 oz of gold remains to be seen. We would not say it’s impossible, nor would we make that call here.

the 0.4% is p.a. right? if p.a., it is not fair to mention “get that return for just over 60 days” as I doubt if investors can get a similar arbitrage opportunity after 60 days. In theory, investors can only get that 0.4% absolute return if he can immediately enter into another similar arbitrage opportunity. This is a rare case so I think you should either mention an absolute return in this case or drop the word “just” which misleads readers the shorter the number of days, the better. In fact, the longer the number of days, the better as investors do not need to ‘roll’ their arbitrage so often.

allen: I say “just” 60 days because the arbitrageur does not need to lock up his capital for very long. Yes, the 0.4% is per annum. What other 2-month investment can yield 0.4%?