Monetary Metals Supply and Demand Report: March 8, 2013

The Last Contango Basis Report

The dollar went down 0.16%. After close last Friday (March 1), it took 19.74mg of gold to buy a dollar. Today, it takes 19.71. By the way, we publish weekly graphs of the prices of the major currencies.

It’s a paradigm shift to begin thinking of the price of the dollar (or euro, pound, etc.) in terms of gold. A paradigm shift is always simple (after you get it) and yet it can be very difficult to wrap your head around it. For example, most people can easily grasp what it means to buy $10,000 worth of gold (even if they have no idea if this quantity can fill your pocket). It’s much harder to speak of buying 6 ounces worth of dollars, though we expect that this phrase is coming into general use soon!

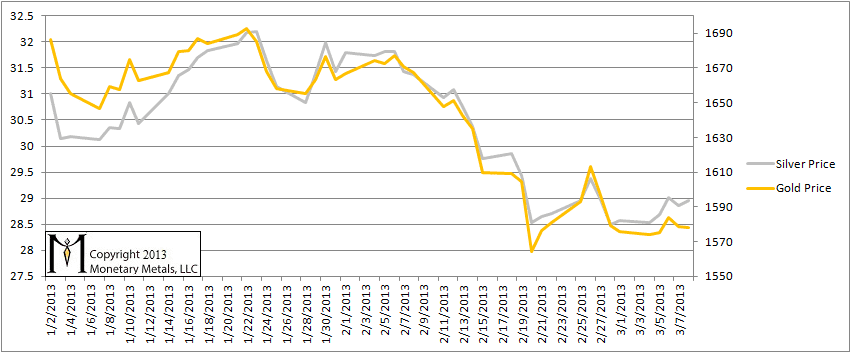

That said, here’s a graph of the gold and silver “prices” measured in dollars.

Gold and Silver Price

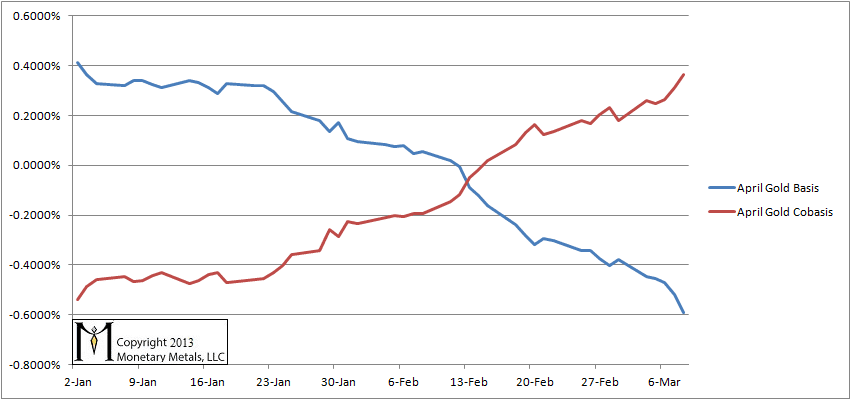

The purpose of this Report is to shed some light onto market dynamics, focusing on the basis. To summarize, a rising basis tends to go along with a falling cobasis. This is not a bullish sign for the dollar price. A falling basis along with a rising cobasis is a bullish sign.

We are at the beginning of the contract “roll” for April gold. This is the process by which “naked longs” must either sell the contract and close their gold position, or else buy a farther-out contract. “Naked shorts”, if there are any must buy the contract and either close their position or sell a farther-out contract. As we get close to expiration, the market makers will become less and less aggressive at maintaining the bid-ask spread. Selling by naked longs will increasingly press down the bid. Buying by naked shorts will lift the ask. A lower bid will give us a lower basis (for a refresher, click on the basis article linked in the previous paragraph). A higher ask will give us a lower cobasis.

So much for the theory that there are many naked shorts in the market. As with February, we see in April a falling basis along with a rising cobasis. Naked longs are much in evidence by the result of their selling (falling basis). Naked shorts? Not so much. The cobasis has risen to nearly 0.4%.

Gold Basis and Cobasis

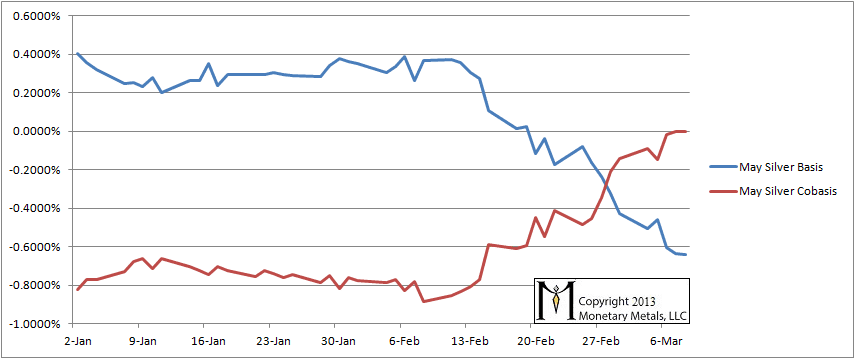

In silver, the May contract is not yet in the “roll”. And we see the same pattern of falling basis and rising cobasis (as we did with March). Towards the end of the week, open interest began rising again, and we see that the cobasis (temporarily?) hit a plateau of 0. There still appears to be an expectation of a shortage and hence rapidly rising silver price, among silver speculators. They may be “buying the dip” using futures.

Silver Basis and Cobasis

Certainly, silver is scarcer in the market today, than it was when we produced that video on January 23. And the price today is about 10% lower too. We can see the silver start to come out of the market beginning in the second week of February in the chart above. We will have another update next week!

The number of long (be they naked or not) must be equal to the number of short (be they naked or not) in a particular contract. By fairly assuming the proportion of long which needs to roll is equal to that of short, a statement implying there is more naked long (..are much) than naken short (…Not so much) by observing basis near roll-over prime moment is, to me, difficult to be justified.

“Certainly, silver is scarcer in the market today, than it was when we produced that video on January 23. And the price today is about 10% lower too.”

That throws a spanner into the quantity theory.

“Selling by naked longs will increasingly press down the bid”

Naked longs are not going to undercut the bid, so doesn’t it really depend on the bid? That is, the price will only fall if the bid doesn’t at least remain constant. If there were ‘naked shorts’, wouldn’t the bid for futures rise with the need to ‘close out’?

allen: if the shorts are arbitrageurs, they have no urgency to buy the expiring month. They can just deliver the metal. If the longs are naked, they *must* sell the expiring month. And this is what the data shows.

JR: naked longs won’t undercut the bid, they will accept it. The next bid in the stack is typically lower. If there were naked shorts, the *ask* would rise. With the expiring contract, the market makers are departing and so the bid-ask spread can widen significantly.

“The next bid in the stack is typically lower”

That’s assuming the bid does not stay constant, that the ‘stack’ does not shrink. What I’m trying to say here is that it is the BID that has to fall for the price to fall.

Whatever is the BID determines the price, not the ask, as indeed the “naked longs won’t undercut the bid”. The naked shorts might cause the ask to rise but that’s because they ‘add to the stack’, the bid rises & no long is going to undercut it.

It is not just a minor detail either. It goes to the root of the matter. Supply does not directly influence the price. In the case of money, supply is irrelevant since money has constant marginal utility.

that should be the ‘stack’ does shrink.