Grow Your Gold

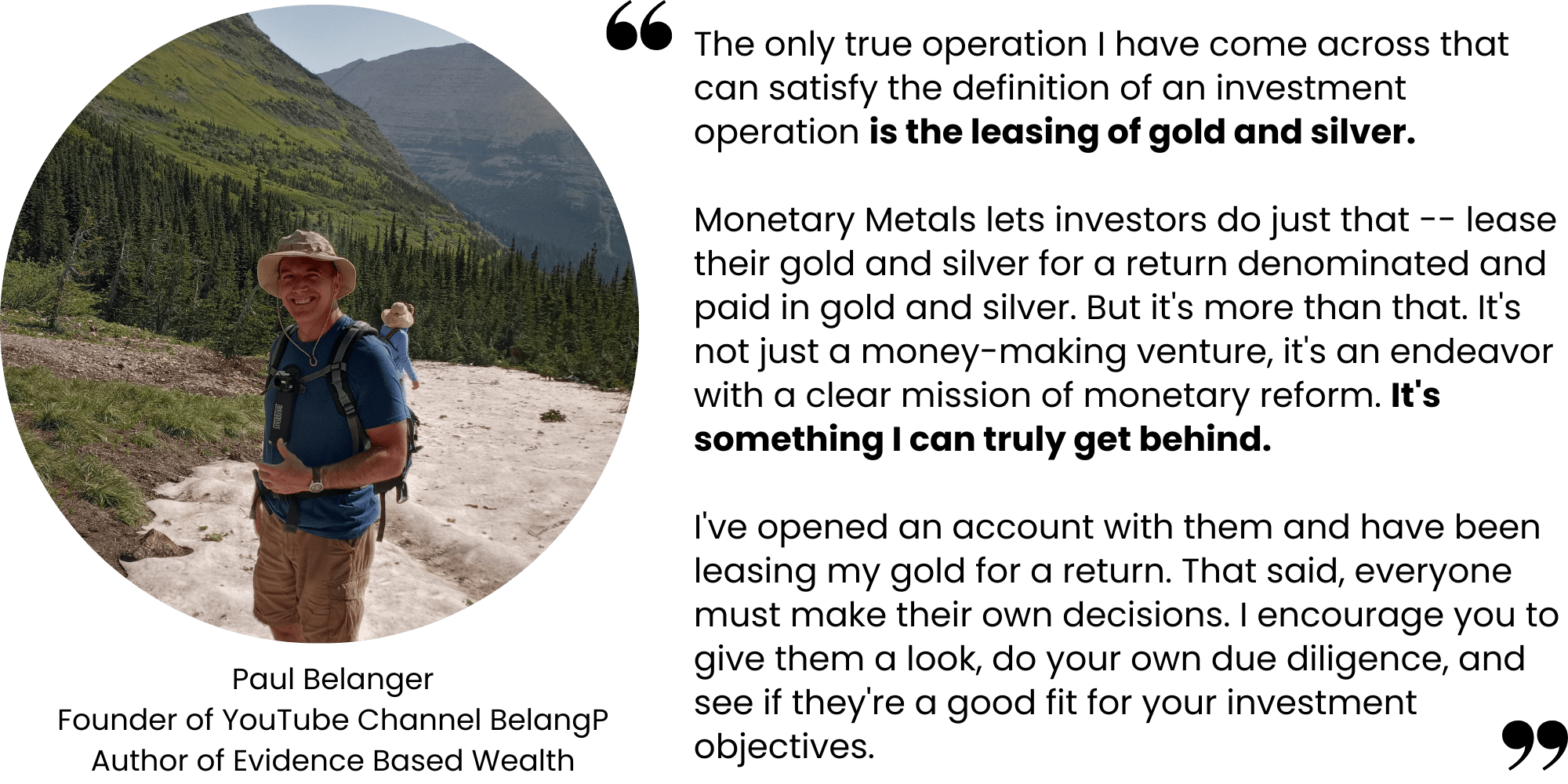

Paul Belanger’s Evidence Based Wealth site and YouTube channel, Belangp, gives you unique insights and methods to help you build enduring wealth and achieve financial freedom.

If you’ve listened to Paul, you already know about the benefits of owning gold in your portfolio. What you may not know is that your gold can do a lot more…

With Monetary Metals, you can earn A Yield on Gold, Paid in Gold®

You can earn 2% to 5% in our lease program, paid in physical gold and silver. Higher yields are offered in Gold Bonds, which are available to accredited investors only.

STOP trying to save and earn in dollars. Start saving and earning in gold and silver, and watch your total ounces compound and grow.

How it Works

1. Create your account

Complete your account set up in less than 15 minutes. We work with clients in the United States, and all over the world.

2. Fund your account

Purchase gold from us or send in metal you already own (bullion products only). Our purchase fees are below 1% for gold and silver. And we offer FREE shipping and insurance for any metal you send to fund your account.

3. Select your yield opportunities

Choose which leases or bonds you want to participate in. You can opt-out of any opportunity, and you can withdraw your metal at any time. Actively manage your account, or set it and forget. It’s your metal. You’re in control.

4. Watch your ounces grow!

You work hard for your metal, now it’s time your metal works hard for you. Day or night, 24/7, 365, your metal is earning you interest without you having to lift a finger. The only thing that’s better than compound interest, is compound interest in gold and silver!

Open Your Account

Complete the following steps to Open your Account:

Opening a Monetary Metals account can be completed online in as little as 10 minutes.

Step 1: Select the type of account you want to open

Step 2: Complete your financial profile and upload a valid, government issued photo ID

Step 3: Choose how you want to fund your account

Step 4: Review the information you provided and sign your account documents

Step 5: Fund your account to receive your account number and online login instructions

Not quite ready to open an account?

Schedule a call with a Relationship Manager to answer your questions at a time that’s convenient for you.

Or call us directly at +1-646-653-9729

Fill out the form below and we’ll send you more information on our offerings.

Trusted by Industry Leaders

Mickey Fulp

The Mercenary Geologist

“Monetary Metals’ business model allows a portion of my gold holdings to generate a rate of return over a short period of time. It’s hard to beat that as an investment in a negative real interest rate world.”

Daniel Oliver Jr.

President, CMRE

Founder, Myrmikan Capital

“Monetary Metals allows companies to return to the relative stability of a gold standard and thereby mitigate exposure to the instability of political and speculative money. Their success so far is encouraging.”

Stefan Gleason

CEO, Money Metals Exchange

“Monetary Metals has become an excellent financing solution for our company. We’re proud to participate in a program which is working globally to remonetize precious metals, and we’re also gratified to be paying lease fees to precious metals investors rather than paying interest to bankers!”

Jim Brown, CFA

Financial Advisor, Board Member

“Monetary Metals has delivered from the start. I’ve been a client since 2017. In addition to paying me interest on my physical gold and silver holdings, this company is solving one of the largest problems we face today – a deteriorating financial system.”

Adam Trexler

Founder and CEO, Valaurum Inc.

“Monetary Metals is a strategic partnership for us. Their innovative financing helps us grow, with a unique user-friendly and low-cost finance solution.”

Greyson Geiler

Investment Advisor, Board Member

“Monetary Metals performs extensive due diligence and closely monitors performance. My clients and I were able to obtain exposure to gold, and an attractive yield. That’s a win-win in today’s investment environment. I’m very pleased with the results.”

Frequently Asked Questions

How is Monetary Metals able to pay interest on gold and silver?

Our ability to pay interest on gold and silver deposits comes from connecting investors with businesses that use gold productively. We provide them Gold Financing, Simplified™.

What kind of businesses? Jewelers, mints, precious metals dealers, refiners, recyclers, mining companies. Basically any company that has physical gold or silver as inventory or work-in-progress.

Our lease financing eliminates the price risk present in traditional bank financing, and protects their margins (since they no longer have to hedge). They happily pay a fee to lease the gold & silver inventory required in their business. The fee they pay enables Monetary Metals to make interest payments on clients’ gold and silver.

Consider a simple example. Acme Inc. borrows $1,000,000 to buy $1,000,000 worth of gold. It makes 3% gross profit, meaning the finished goods sell for $1,030,000. However, during the manufacturing process, suppose the gold price drops 5%. The raw gold is now worth $950,000. The finished product with 3% markup is $978,500, and Acme loses $21,500.

To avoid the price risk, most gold businesses would sell (short) futures contracts. This solves the price risk problem, but it brings its own costs and risks, such as having to borrow additional cash for the margin on the futures contract and constant need to roll their short futures contracts.

Acme would benefit greatly from a gold lease. It simplifies their financing, eliminates price risk along with the need for hedging, and saves them money. They just need some gold, and they don’t want so many moving parts. In other words, possession of the gold without the problems of owning it. Gold Financing, Simplified™.

Monetary Metals® facilitates the matching of investors and businesses, with a fixed fee. Our vision is to create a transparent and open market, the Gold Yield Marketplace™.

Monetary Metals® performs its due diligence before offering a gold lease to investors. We work exclusively with companies that use gold productively–and have physical gold. We will NOT offer a gold lease that could be used for short selling or other derivative transactions. We work out the best type of lease to finance the business, and put together the terms of the deal.

We present the terms of the lease and the result of our due diligence for clients to review. Then it’s up to you. You have the right, but not the obligation, to participate. You can opt-out of any lease you don’t like for any reason. If you don’t opt-out, your gold will automatically be accepted into the lease. Once your gold is allocated into leases, you will start earning interest on your gold, paid monthly into your account.

What can I expect to earn on my gold? What’s the interest rate?

Historically, Monetary Metals’ leases have paid between 2.0 – 4.5% net annual to investors. The weighted average rate of return in our lease program currently hovers around 2.25%. In other words, 100oz earning 2.25% every year, will generate 2.25oz in gold income, annually. Gold bonds, which are securities, offer higher yields (such as 19% on our recent offering). Gold bonds are available to accredited investors only.

Can I earn interest on silver too?

Yes. We offer silver leases in addition to gold leases. Clients can open an account, hold a silver balance, and earn interest in silver in that account, in addition to holding and earning on gold.

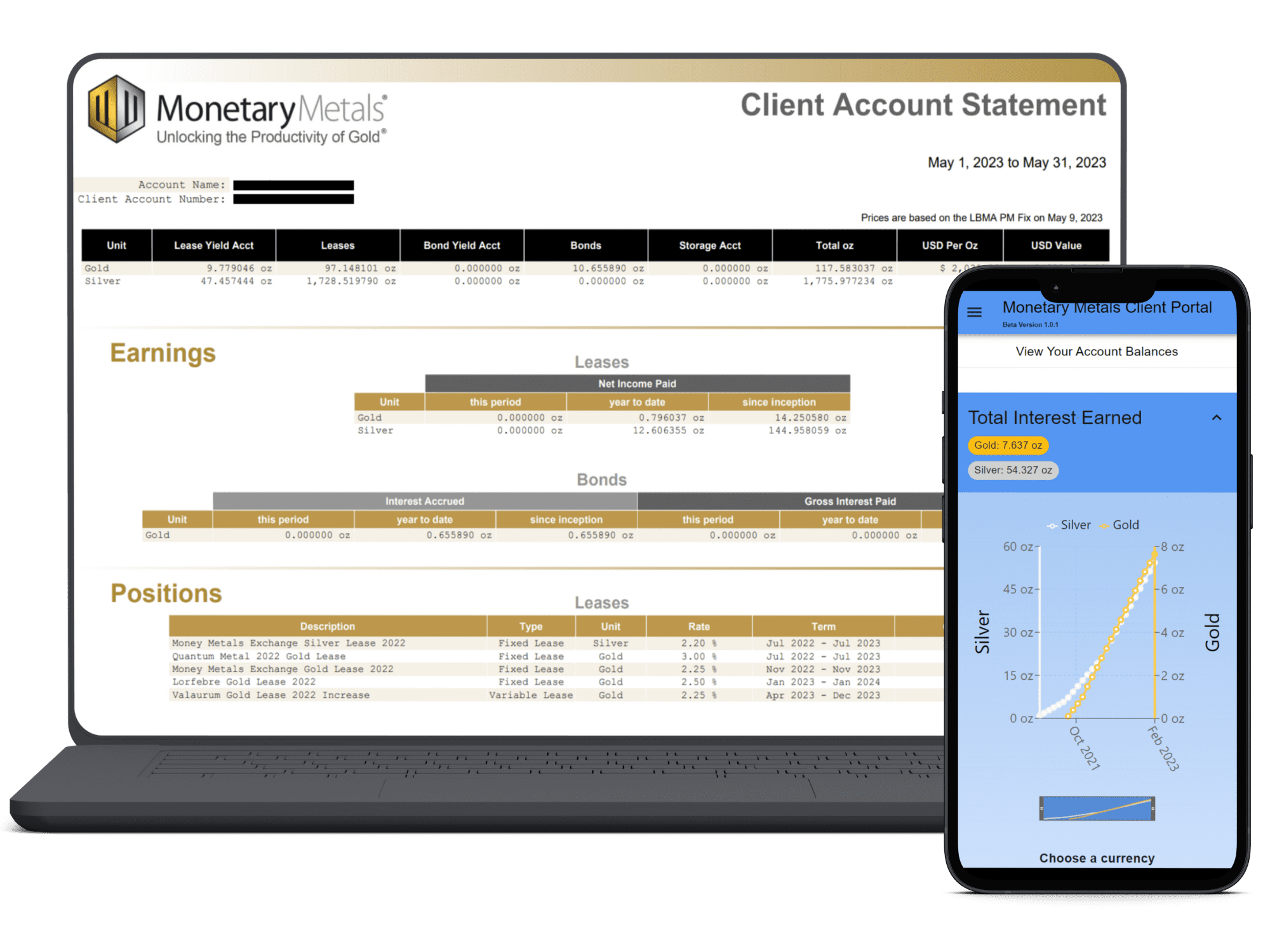

Some clients have gold as an investment and silver as an investment. Take a look at a client statement showing both (with growing ounces!) here.

When and how is interest paid?

Most of our leases pay interest monthly, but some pay quarterly. This is disclosed to investors prior to committing to a deal.

Generally, interest is paid in kind (silver interest for silver leases, gold interest for gold leases) and is deposited directly into the client’s account. The interest payments are made in allocated gold and silver, which is vaulted and insured through our vault partners.

Clients receive monthly statements showing how much gold or silver they have earned over the previous period, year to date, and since inception.

You can view an actual client statement, here.

How do I open an account?

You can begin the preliminary steps online, here.

If you prefer to talk to a Monetary Metals team member, just schedule a call that suits your schedule.

What is required to open an account?

To open an account, you’ll need to:

- provide a photo ID if you are a US citizen; for non-US citizens, two copies of ID may be required

- complete a W-9 (or a W8BEN or W8BEN-E for foreign account holders)

- complete the account agreement and precious metals lease agreement

- fund the account with bullion or cash

How do I withdraw my metal from my account?

Clients can initiate a partial or full withdrawal request at any time by completing a one-page form. Metal can be sold for cash, redeemed for physical delivery, or shipped to a different storage account. Any metal in your account that is not actively deployed in a lease can be withdrawn immediately. While metal that is in a lease must wait until the lease matures before it can be withdrawn.

If the price of gold or silver goes up during the lease, do I still get the price gain?

Yes. You own the metal, whether it’s on lease or not.

If the dollar price of gold doubles, then the dollar value of your gold doubles as well. If the dollar price of gold falls, then the dollar value of your gold in the lease falls.

Monetary Metals is focused on one thing – enabling investors to grow their total ounces of gold. This provides a unique way for investors to express a long gold investment thesis, while earning income on that position for the duration of the investment.

Does Monetary Metals have insurance on my metal?

We require the depositories where we store the metals to have insurance, and also of each lessee who leases the metals.

As part of our due diligence process, we require the lessee to have Monetary Metals listed as loss payee on the insurance certificate.

We also have an additional policy through a leading global insurer based out of the UK that provides additional insurance coverage for our gold and silver leases.

Can a company sell or hypothecate my metal in a lease?

No.

The lease is to finance a company’s physical inventory. And although inventory is purchased and sold, the lessee must buy the replacement gold or silver first, to ensure that the full amount of gold on a Monetary Metals lease is present & secure at all times.

For example, there is a 1,000 oz gold lease and the dealer has 1,000 oz of coins in his inventory. His customer orders 50 oz of coins. The dealer buys 50 gold Eagles first, bringing total inventory up to 1,050 oz. Then he can fill the customer order and sell the coins. The balance of gold in inventory never falls below 1,000 oz.