Bernanke “No Tapering”: Silver Goes Up and Down Again

In February, I wrote What Drives the Price of Gold and Silver?

If there is a credible rumor that the Fed is planning to further extend its “Quantitative Easing”, how would you expect the monetary metals to react? Typically, the gold price would rise and the silver price would rise even more. The question is why.

Traders read the headlines and they know how the price “should” react to such news, and they begin buying. For a while, the prophecy fulfills itself. But then what happens next? It may take an hour or a month, but sooner or later some of the new buyers begin to sell.

Most people accept the Quantity Theory of Money. In brief, if the money supply rises then prices will rise (though often there is a caveat that not all prices will rise uniformly).

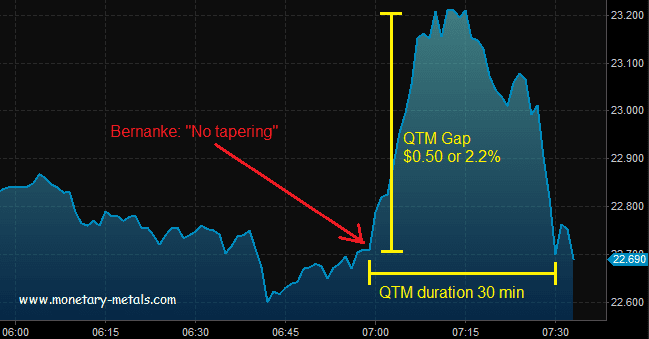

Today, Fed Chairman Bernanke said that the ongoing increases in the quantity of dollars will continue. The silver market reacted as it “should”: more money = higher silver prices. Look at this annotated chart.

In about 15 minutes, the silver price rose 2.2%. I call this the “Quantity Theory of Money Gap”. In about 15 minutes more, the price fell back to where it had been.

Within 30 minutes, all those who had bought based on this idea were, if not proven wrong, at least given losses by the market.

The price of the dollar as measured in gold or silver is collapsing and the rate of collapse will accelerate. This will be reflected in much higher prices of gold and silver when quoted in dollars. But it is not due to the quantity of money, and certainly not due to talk of the quantity of money.

I think people often buy gold and silver for the wrong reasons expecting inflation. Gold is a poor inflation hedge but an excellent crisis hedge. Almost all pundits – save for Prechter and a few others – expect inflation due to all the money printing. They forget the money printing is a drop in the ocean of debt. Gold and silver are crisis hedges if the banking system goes south. Few people expect this, so gold and silver are sold since there is no/low inflation.

I agree, and not only is the QE small relative to the debt, the drop in interest rate increases the burden of debt by a much much larger number.