Bitcoin Crashed. Again.

When writing about economics (as opposed to trading), one does not expect to be proven right within days of publishing something. Things can take years to play out. On Monday, February 25, we published What Drives the Price of Gold and Silver? In that article, I wrote:

If there is a credible rumor that the Fed is planning to further extend its “Quantitative Easing”, how would you expect the monetary metals to react? Typically, the gold price would rise and the silver price would rise even more. The question is why.

Traders read the headlines and they know how the price “should” react to such news, and they begin buying. For a while, the prophecy fulfills itself. But then what happens next? It may take an hour or a month, but sooner or later some of the new buyers begin to sell. What can be bought on speculation using leverage must eventually be sold.

On Tuesday, Fed Chairman Bernanke testified before the Senate. Sure enough, the prices of gold and silver rose sharply. The next day, the prices were back down. By Thursday the price of silver was lower than it had been prior to his announcement.

On March 3, we published a video asking Is Bitcoin Money? While I appreciate many aspects of the cool technology behind it (being a software developer in a previous career), and noting that it has several features that uniquely suit it for certain markets, I concluded that it is an irredeemable currency, but not money (i.e. the most marketable commodity). I received much feedback on the video, some of it negative, though mostly thoughtful and engaging.

At the time of the video, Bitcoin was trading around under $40. Since then, it rose to about $48.

I was surprised to read that yesterday it fell to a low of $37. It has mostly recovered though it is now a few dollars below its high of $49. What happened?

The technical term is that the “blockchain forked”. In the video, I was very careful not to criticize the digital currency on technical grounds such its cryptographic technology, peer-to-peer networking, its data formats, methods of validating transactions, or communications over Internet Protocol, etc. I wanted to keep the discussion about monetary science. There is a point that I could have made, and will now make here.

If a currency is subject to Internet availability or other technological considerations, it simply is not money. It may still be useful for enabling commerce that would otherwise not be feasible—this is not an attack on Bitcoin as such. But (at least) one key characteristic of money is missing. Money must be beyond question by everyone and at all times. By nature, gold never becomes “unavailable” (though one could entrust it to an institution that suffers from unavailability of course).

When its “blockchain forked”, Bitcoin’s essence was called into question. Suddenly there were possible competing claims to the same coin, possible loss of coins, and certain lack of availability of the currency at least until engineers fixed the problem.

It has crashed before, too. On August 17, it moved from about $15.50 to $10.50 in a few hours. There were previous crashes before that, and there will likely be more (no this is not a prediction for next week!)

Technology aside, there is another factor that contributes to so-called “flash crashes”. If there is a wide bid-ask spread and/or the stack of bids is sparse, then it does not take much selling pressure to cause the price to collapse. For purposes of this discussion, let’s focus on the. While it is possible for the price to rise explosively, there is an important asymmetry between bid and ask: in times of extreme stress, it is always the bid that is withdrawn, never the ask.

Imagine if the US Geological Survey said that there would be a massive earthquake in Los Angeles, estimated to be 15 in the Richter Scale and which would not leave anything taller than a fire hydrant standing. There would be no lack of offers to sell real estate. What would be gone would be the bids. Anyone who needed to sell would have to accept peanuts, if he could even get that.

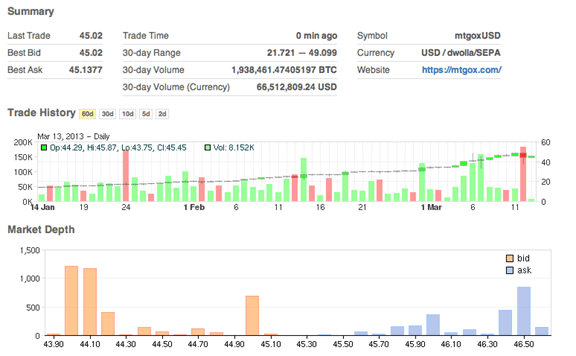

As I pen this, late Tuesday evening, I see a bid of $45.02 and an ask of $45.1377. This does not seem that bad, $0.1177 spread or about 26 basis points. But the bid looks thin to me! At $45.02, there is around 600 bid.

This is a screen capture I just took from Bitcoincharts.

$600 X $45 = $27,000

There is about twice the depth a whole DOLLAR lower. And then again there is another 1200 or so bid a bit lower than that. Even assuming that there is little liquidity at 1:30am EST, this is not a picture of a highly marketable good, much less the most marketable good. One lone trader who needs to sell $100,000 worth of Bitcoin could drive the price down about 2.5%.

To put this in perspective, a copper future is 25,000 pounds and copper is currently $3.55 per pound. One copper future is worth almost $90,000. I am reasonably certain that selling a copper future (or 10!) at this time of night would be but a small blip. In fact, in a few seconds, I watched the May copper future trade 25 contracts, or $2.2M. Copper is not money, of course.

So what’s the take-away?

Bitcoin is still apparently a great trade—a speculation—as it has risen more than 12% even from when I recorded that video. Bitcoin is still useful for certain transactions particularly across borders, and especially for those people unfortunate to live in countries with censorship, capital controls, or in which some kinds of goods are prohibited.

But it’s not money. It is not the good to hoard as the core of one’s savings, if one does not like the rate of interest or trust the banking system or feel comfortable about the future.

The good for this purpose remains gold.

Gold can never become unavailable in theory. In practice, it becomes unavailable to just about everyone. And it is within that flaw that bitcoin, if it survives, will discover itself and become money.

This little currency just keeps taking it the chin and just keeps getting back up.

I am not sure we’re on the same page with regard to the word “unavailable”.

I mean: if you have a gold coin in your pocket, it is always available. But if you have a Bitcoin it can’t be in your pocket, it must be in your computer. It will be unavailable if your hard drive crashes, if you get a bad virus, if the electricity shuts down, if you can’t connect to the Internet, etc.

Hi Keith.

By converting a passphrase into a private key, you can store your bitcoins in your head if you want. You don’t need your computer at all. You need the internet only to get transactions confirmed via the blockchain.

By unavaiIable I mean that because ownership of gold is relatively centralized, a condition of scarcity can be created by those with the gold. The money supply can be controlled. That may at times (like now) seem like the proper function of gold, but that’s not the point. The point is that it can be done by a cartel. When the bitcoin miners stop mining, supply of bitcoin will be created at the point of demand. By the market. Pure free market. This is a breakthrough in the history of money. Bitcoin price discovery would be to the RIGHT of the decimal. The supply cannot be controlled by a cartel. At least in theory. We’ll see.

The ultimate scenario would be to store your wealth in gold but spend it in as anonymously as you wished in bitcoin.

mossmoon: OK, one can memorize a passphrase. Can that be used to buy something from someone else? Or would it be correct to say that if the network is down then Bitcoin is unavailable–it cannot be used to transact without computers and the network?

You assert that gold is centralized, but the fact is that people have been accumulating it for thousands of years and hiding it from their governments. Gold has the highest stocks-to-flows ratio of any commodity by a large margin. There is no one entity, not even the most powerful government in the world, who can be said to “control” it, or its supply.

Bitcoin transactions can be transacted on any protocol. The internet could go down and bitcoin could still be transacted, on SMS for example.

I must respectfully disagree on whether the price of gold can be manipulated

Mossmoon:

As to manipulating the (measured-in-dollars) “price” of gold, please read through the material on this site! We make the case that one should not measure the price of gold in dollars the way one should not measure the length of a steel meter stick using rubber bands (or gummy bears). And second, we have documented in various ways the data to prove that there is not a scheme to naked-short futures.

As to the *supply* of gold, that is a whole ‘nother story. 5000 years worth of accumulated stocks, mostly hidden from governments and dispersed through the whole world.

I know this goes round and round, but: as I understand it, the basis analysis does not have anything to say about manipulation because it assumes the spot price is the physical price, which it is not. The exchanges are not a price discovery mechanism for physical metal.

The exchanges discover a price for a paper promise against a paper promise. The basis cannot be manipulated. But what is the basis actually measuring? A spread between paper promises.

If the spot price were just another paper price for a paper promise then it could be manipulated, and hence the basis could be manipulated.

I can assure you that one can buy gold and silver at spot (plus a small premium depending on what kind of product you are buying).

Yes, metal is bought and sold on the paper arbitrage. But that doesn’t show that price discovery isn’t in the wrong direction. I don’t see how you can get past the chicken-and-egg problem here.

But let me ask the question this way: Which has more influence on the spot price of a commodity: The actual physical commodity, or the futures price?

And how can we talk about price discovery of physical metal at all when the leverage is so high? When a billion ounces of silver trades in one day on an exchange that delivers 50 million ounces a year, does it really matter whether they are long or short or naked? Price discovery doesn’t mean anything anymore.

I think just focusing on the price mechanism itself is to put blinders on. To see silver manipulation for example, one needs to look elsewhere: the dumping of a huge number of contracts into a illiquid market on an almost daily basis; the massive concentrated short position; the leasing activity and the buying of forward mine production since the 1980s; the existence of a Silver Users Association and the depleted government stockpiles; the appearance of an ETF when those stockpiles plummeted under 200 million ounces; the fact that silver is the second most widely used commodity on earth but is mined as a by-product of the other base metals putting its industrial supply at risk and on and on and on.

And then there’s the motives of the actors. Why was silver demonetized? Why did Johnson take it out of the coinage? But those who ask these questions are tinfoil hatters of course.

All of these items can be explained away individually. It just takes a little heuristic common sense to put them all together.

Our entire system of money creation is a top down usurious pyramid scheme of debt money. With that kind of arrangement, the question isn’t Where is there manipulation? but Where ISN”T there manipulation?