BitFlashCrash

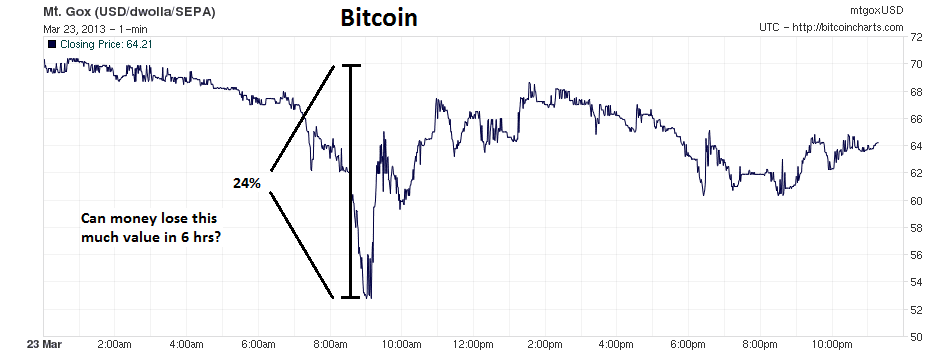

A flash crash occurs when the bid is either very thin or disappears altogether. Under any selling pressure, the cleared price can fall to any level at least temporarily.

By definition and by nature, money is not subject to flash crashes.

Of course, the bid for money approaches the infinite. The standard of value has constant marginal utility.

This might be worth keeping your backwardation eye on;

http://www.zerohedge.com/news/2013-03-24/another-gold-shortage-abn-halt-physical-gold-delivery?page=1

At face value, the new way to handle & administer your precious metals account is that you can’t have your precious metals. I don’t read Dutch, so face value could be worthless but this DOES strike me as backwardated.

JR: well said and we will definitely be watching to see what happens this week (and post next weekend)!

Zero Hedge has a picture of a flash smash of BTC priced in euro:

http://www.zerohedge.com/news/2013-03-25/bitcoin-mania-accelerates

Seems like ZeroHedge is suggesting that the Cyprus situation is somehow linked to the EUR bitcoin price. I’d be *very* surprised if anyone have bought bitcoins as a response to the depositor haircut in Cyprus. At tough times you rush to safety, not to an experimental 4-year-old first-of-a-kind distributed digital currency.

The most fundamental and possibly not well understood shortcoming is that the more miners there are, the more difficult mining is. It can’t really handle growing demand, from my mediocre understanding of economics. Should call it Irving Fisher’s Bitcoin. I could almost CPU mine profitably.

Somehow, it stayed steady and predictable for almost a year. Now the talk of the town is Pecunix.