Brexit Drives Gold Frenzy, Report 26 June, 2016

The big news this week was that the British voted to exit the European Union. This was not the outcome expected by pundits, or the polls.

“Risk on” assets were relentlessly bid up prior to the vote. For example, S&P 500 index futures had closed the previous Friday, June 17, at 2059. This Thursday, prior to the vote, they were up 60.5 or 2.9%, to 2119.50.

The British pound began its run up a day earlier than the S&P, closing at $1.42 on Thursday, June 16. This Thursday it was up to a high of $1.50. The same pattern occurred in crude oil (West Texas), up over $4 from the June 16 low to the June 23rd high, and in other assets.

After the vote, it was a giant blowout. By Thursday evening (Arizona time), the pound had hit a low of $1.32, a drop of about 18 cents or almost 12%. As of Friday’s close, the S&P was down 3.6% but continued to decline after hours with futures ending down -4.16%.

To hear mainstream gold commentators tell it, gold and silver went up whereas (nearly) everything else went down. That is not how we see it. At all.

The pound, euro, and other currencies are dollar derivatives. Therefore, we think it’s appropriate to price them in terms of the underlying thing from which they are derived. The dollar. The currencies went down in dollar terms, as did stocks.

However, for the same reason that the dollar cannot be properly priced in pounds or euros, gold cannot be priced in the dollar. For the same reason that if you fall off a cliff the height of the cliff top cannot be measured in terms of distance above your head, a meter stick cannot be measured in terms of a rubber band.

The dollar must be priced in gold. The dollar is not precisely a gold derivative. However, it is valuable only because, and only for so long as, gold makes a bid on it.

So we look at it like this. Other currencies and risk assets fell in dollar terms. And the dollar fell in gold terms. The dollar hit its high on that same date (June 16), of 24.36 milligrams of gold. It made a low on Thursday June 23, of 22.89mg, down -1.47mg.

The world’s reserve currency fell 6% in a week. Since everything else went down in terms of that currency, in reality they fell even more.

As always when the dollar falls, most people see only the rise in the price of gold. And gold commentators reiterate their call for gold to go up even more. They say that, now, people are starting to wake up (as if the low price of the metal was due to somnolence), and when they do gold will skyrocket.

We concede that, this time, there is more reason to think that the world of paper may have a big decline (and hence the mirror image, the price of gold, will rise). But as always, we want to see if this price move was real or if it was just leveraged speculators taking on even more leverage and going closer to all-in. So let’s look at the only true picture of the supply and demand fundamentals. But first, here’s the graph of the metals’ prices.

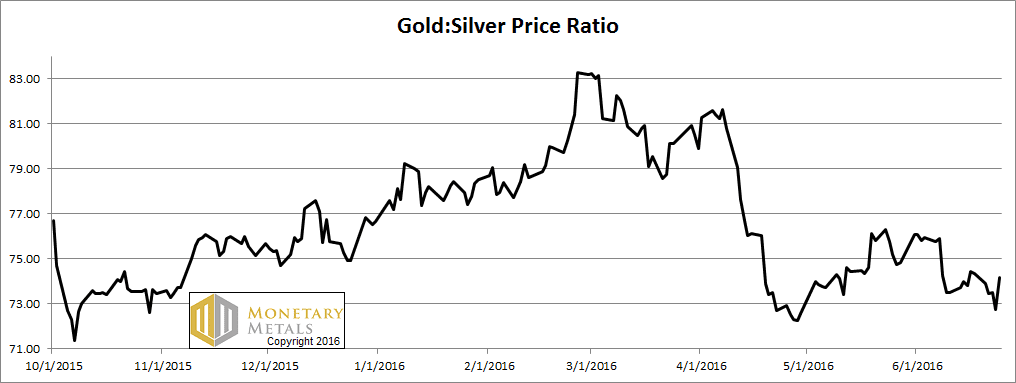

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio was down a hair this week.

The Ratio of the Gold Price to the Silver Price

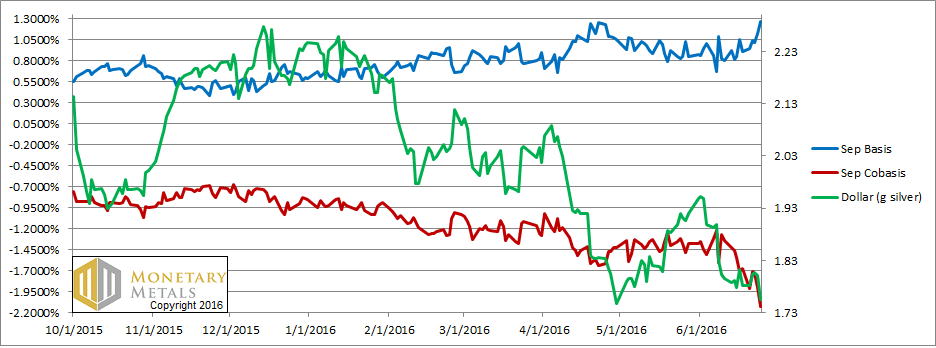

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

If you wanted to make a case that the price of gold was going to go higher, a picture of gold abundance (i.e. the basis, the blue line) spiking up would be discouraging. The scarcity (i.e. the cobasis, the red line), already deep into negative territory, fell further in a sharp drop from -1.2% to -1.6%.

One can now make an annualized carry of +1.5% to buy gold metal and sell an August future, which will deliver in two months. Where else can you make that kind of return? For comparison, the LIBOR rate for two-month maturity is 0.52%.

There can be no question that the marginal buyer of gold is the warehouseman. With such an outsized profit to carry it, surely these folks are keeping busy and off the streets.

Why is there such a profit to be made carrying gold? Because current speculators are leveraging up even further, and/or new speculators are entering the game, adding their fresh leveraged bets to the table. After all, gold should go up in an event like Britain leaving the Eurozone.

As we hinted above, there is a case to be made that gold is a better asset to hold than UK gilts, German bunds, or US Treasurys. It’s the same case that could have been made in 2001 when the price of gold was low, in 2011 when the price was high, last fall when the price was lower or Thursday when the price spiked to $1359. However, you can’t trade based on the background story.

Maybe some people will change their preferences. Meanwhile, the debtors are under a rising burden for each dollar of debt due to falling interest rates, not to mention a rising number of dollars of debt as well.

About 18 months ago, the Swiss National Bank had been struggling to maintain a peg to the euro, set at 1.2 francs. While the SNB had been blustering that it had unlimited resources to squander, it finally had to let go when it hit its stop-loss. When that happened, the interest rate in Switzerland plunged. Keith wrote a paper arguing that the Swiss franc will collapse.

Negative interest is not just a disincentive to hold paper currency (though it is, of course). It is not merely that gold becomes more attractive than negative-yielding paper (though it does, of course). More importantly, negative interest is a powerful incentive to destroy capital. If you could borrow at -1% per annum, then you have a license to lose capital at a rate of 0.5%. Would you want to extend credit like this?

We note that the Swiss yield curve has sunk further beneath the surface of zero, since that article in January 2015. The 20-year bond is now drowning, and the 30-year is practically zero. 18 months ago, the 10-year was about -0.25%. Now it is below -0.53%.

At some point, this will begin driving people to gold. Not to make a bet on its price, using leverage, and ultimately to make more dollars. But to own, as a way of avoiding falling rates and rising counterparty risk.

However, it doesn’t look like we’re at that point just yet.

Indeed, despite the rise in the market price, we see a drop in our calculated fundamental price. It’s now a bit under $1,100, or about $230 below the market. As we often say, we do NOT recommend naked shorting a monetary metal. It is always possible that some central bank will do something even more crazy and the price could go +$250 in an instant. Additionally, chartists may be drawn to bet on the gold price because they see momentum. We can tell you that the metal is overpriced, or conversely the dollar is underpriced. By a sizeable amount.

Now let’s turn to silver.

The Silver Basis and Cobasis and the Dollar Price

It’s a similar picture in silver.

The fundamental price didn’t move much, while the market price is up about 27 cents. The price of the metal is about $2.60 over what we calculate is its fundamental.

Interestingly, this puts the fundamental ratio below the market, under 72. We shall see if this state persists.

© 2016 Monetary Metals

29 responses to “Brexit Drives Gold Frenzy, Report 26 June, 2016”

Leave a Reply

You must be logged in to post a comment.

What about the impact that arbitrary spot trading will have? For instance, when those in short or long leveraged positions reach their individual buy/sell positions , won’t this perpetuate the sinusoidal trend on pricing?

The swiss franc will probably collapse at the same time than capitalism will, not before.

Fiat money is the ultimate form of money into the capitalism system, it is no accident, management mistake, policy error or because of nasty central bankers even if they are indeed.

ZIRP had been forecasted since the 19th century and succeeded in the 20th century in Japan so much that NIRP came into the 21th century everywhere where productivity is the most advanced.

Money illusion (gold included) might so finally disappear at last…

“ZIRP had been forecasted since the 19th century” – interesting, can you give a reference or link for that please?

The first occurence is in the 18th by Adam Smith himself (page 193 tome I, from a translation from french) :

that would have reached the last degree of wealth which the nature of its soil and its climate and its location to

respect other countries may allow him to achieve, which therefore could not reach beyond, and

that would not go by demoting, the wages of labour and capital profits would likely be very low both.

The idea of the fom of the capitalism when fully deployed and evolved is that competition between lenders will be so hard, that the fall of interest will fall near 0. It is written (I remember having read it) in the capital from Karl Marx but I do not find the exact sentence and where precisely easily.

However never NIRP has been mentioned from my readings and memory up to now for the 19th century and before.

Central banks currently just speed up the inevitable. The only possibility to postpone for a few decades would be third world war between USA and Germany (with Japan too would be the ice on the cake). Maybe a complete reset of the financial capital would be a new solution but it would be less “efficient” than destroying complete countries. This second solution is the one prefered by the BRICS while neocons and western banking oligarchy prefer the first one.

Keith,

While I understand the big increase in speculative gold purchases over the last week, what I’m struggling with is that your fundamental gold price is substantially lower this week vis a vis last week, yet we hear that physical ETF purchases are way up and refiners are working around the clock. How do you square this circle?

Maybe because ETF gold sourcing is not updated as quick as speculators come in and out…

Keith,

Separately, given the increased global political/economic risk associated with Brexit, doesn’t it seem counter-intuitive that the fundamental value of gold would drop in this context when clearly risk to the global economy has increased?

Hi Keith, your congratulations to Britain are highly appreciated

It is an exciting development that gives me some hope for the future.

shwepa: That is the dynamic. Gold bugs imagine the price can only go up because, quantity of money. But there’s this endless volatility as speculators are entering and exiting positions.

RD: I would encourage you to read my paper on the Swiss franc. For now, let me just say that we do not have capitalism. It is not capitalism which has socialized money in the control of a central bank. That is a key plank of Karl Marx. Capitalism has free markets, not central planning of credit.

I read everything you wrote but I do not believe in the hypothesis and assmuptions you (by you it is not directed to you it is most of economists and other trade apologists) made.

“For now, let me just say that we do not have capitalism. It is not capitalism which has socialized money in the control of a central bank” : your views unfortunately do not reflect reality and especially history. It is an etheric view which for example is often being rationalized by the reference of Nature.

“That is a key plank of Karl Marx. Capitalism has free markets, not central planning of credit.” : you just showed you had not read anything from him seriously as he wrote to Lafargue in 1870 : “All I know for sure is that I am not marxist” ! You probably do not know that Marx and Smith agreed on many and many issues (cf. 1844 writings) but they differ on some others and for example with consequences on humanity to simplify : negative for the former, positive for the latter.

What you refered is Proudhon’s philosophy which has been destroyed by Marx himself in Misère de la philosophie (Misery of philosophy). Indeed apart from the manifeste (a command form a party), it is absolutely clear that Marx has always wanted to destroy states (Ideologie allemande and le capital), yes ALL the states, all the lind of states and money but that’s another issue !

By the way, I think people should read more about this mythical and nearly biblical 19th century for “pure” capitalism lovers where they will discover that “current diseases” were already all known a couple of centuries ago and if 19th century was not enough pure, they should ask themselves why it NEVER happens this way (cf. Fekete and his gold standard cum real bills) such free markets myth. If you consider we never had real capitalism, you should maybe think that it will probably never happen this way on this planet and that there must be real reasons why it had not and won’t !

RD, I’m enjoying your insights here. I’ve read about the “mythical and nearly biblical 19th century for ‘pure’ capitalism lovers” and I agree that Utopias have always eluded us. Yet it is always important to study and develop those ideals. Only we must beware of wearing idealism as a blinder and of insisting that our ideals must be enforced onto all others to make the world perfect.

miamonaco: The volume of refining activity does not tell us anything about the gold price. It merely says either fresh gold is coming to market from the mines, or gold is merely changing forms as it changes hands. Neither tell us about the direction of the price.

ETFs are also a change of hands. Keep in mind that virtually all of the gold mined over thousands of years is still in human hands. This vast hoard of gold is never consumed. It mostly sits, but some of it is bought and sold. It is an axiom that every ounce has a seller and a buyer. This, also, does not tell us about the direction of the price.

Keith,

Would appreciate your thoughts on my second question, namely with significantly increased political and economic risk as the result of Brexit, why would the fundamental price of gold drop?

First the price of gold moved $200 under ‘fundamental’, now the price of gold is $200 over fundamental. I just have to say it folks — this simplistic method is useless to me.

That doesn’t mean our good Mr. Weiner is a bad guy. I just don’t see the value of monitoring the returns of warehousemen, the perceived marginal buyer. We are entering the latter stages of dollar hegemony. I believe different rules will apply.

While I disagree with the significance of the calculated fundamental price, for the most part Keith speaks the truth about the economic problems facing a country with an irredeemable fiat currency. And I appreciate that.

By the way, this “vast hoard of gold” might not be the best characterization of supply. After all, all the gold is the world fits in an Olympic sized swimming pool. Relative to a world full of phony fiat, I prefer a different characterization heard recently: “It’s a privilege to own even a single ounce.”

Does it not look like the momentum is starting to peter out?

I have one question on my mind – conspiracy one ;-) Don´t you think that present abundance of gold on the market is caused by central banks? Couldn’t they intervene and lend metal to BBs in advance for example? maybe silly question …

“Don´t you think that present abundance of gold on the market is caused by central banks?”

One of just many lies peddled by the fat-mouth conspiracy fringe, I’m afraid.

Much if not most of the world’s bullion flow passes through Switzerland, which recently made public its trade data (annual 1982-2013; monthly data from 2012):

http://www.ezv.admin.ch/themen/04096/04101/05233/05672/index.html?lang=en

Remember all those articles on all those gold websites highlighting West –> East gold flow? If you look at the Swiss database those flows have collapsed in 2016 and actually reversed slightly, about the time Keith’s cobasis started to dive in February. Of course there is no discussion about this new development as it is bearish and therefore ignored.

London is currently importing bullion at the fastest rate since data became available and it is doing so by diverting flow from the East by bidding up the price. E.g. gold flows from Dubai to Switzerland (then into UK) is the greatest on record (last 32 years). Hong Kong has flipped from being a net importer to net exporter. Flows into Thailand have reversed etc etc. I would urge you to extract and analyze the data yourself.

Strong sell, you have indeed found the right web site !

Not for me it’s a hold. The historic data informs that Eastern imports always decline after strong price rises and flows into London. But these declines are temporary and demand eventually returns.

Historically Switzerland’s two main suppliers of bullion are UK and USA. Late last year something remarkable happened. USA –> Swiss flow reversed as America started hoarding gold again. UK net exports of circa 500mt per year were unsustainable given how much we know was imported into UK during the bull market.

The flow dynamic has therefore changed with a rising price and we’ve seen the expected Eastern response. What’s next? Historically and seasonally Asian harvest buying from August are good months for gold.

From your own words :

“Of course there is no discussion about this new development as it is bearish and therefore ignored.”

What bearish excatly mean please ?

By the way nobody said asian physical purchases had not been reduced quite a lot in the first half of 2016.

Thanks for the comment rowingboat, it is funny how the West East flow meme has died.

Your gold flows data backs up the idea that with specs bidding up futures prices creating a profitable carry the bullion banks will meet that spec demand by shorting Comex and buying spot gold to carry/store in their vaults in London.

Who has said these west to east flows will last forever ?

It just confirms asians are mostly physical dip buyers while westeners are paper speculators.

May the gold face a 20% loss in their currencies (such in rupees), they may well com back with vengeance.

RD… The many articles/authors formerly quantifying flow from West to East (2013-15) have gone silent now that this overall net flow through Switzerland has reversed. The narrative being that Western supply would “run out”, that there would be “shortages” or a “price reset”. By ignoring the recent change in dynamic central banks must be surreptitiously supplying the market, right? (Hence the same old, same old question above). That Eastern buyers reduce purchases, take profits, in turn causing a reduction/reversal of imports is a bearish factor. But note the recent change/contrast with gold rising steeply through $1200 in February versus the correction from $1300 to $1200 in May:

http://www.platts.com/latest-news/metals/london/china-gold-imports-jump-68-in-may-to-115-mt-highest-26480084

The physical theory was not an absolute theory : it was a relative shortgage at these prices (confirmed in some bay back backwardation over the last couple of years).

If physical flows reverse with rising prices, that’s logic.

By the way as you noted it, it does not mean that now, the flows are not going to reverse one more time (from west to east) as asians would prefer physical over chasing paper like momentum western comex traders.

As of the close of business on Friday, the margin for new speculative positions in the main Comex 100-ounce gold contact will rise to $6,600 from $6,050. As of a week ago, before an increase that went into effect on Monday, this margin had stood at $4,950.

100 oz bars? to go with those 100 oz contracts? what’s a new spec position? ; )

Thank you for your responses. I understand what you are writing and I have nothing against. BUT. I have read some pieces from Mr. Suchecki on his blog about the gold market and he also wrote that BBs cooperate / could cooperate with Central Banks in times of stress. Mr. Weiner also wrote that we must look at the gold market from the whole perspective. IF so, CBs have approx. 34 % of all gold ever mined (if we take the estimation of Thomson Reuters).

So how we exactly (!) know that CBs do not intervene somehow in any times – stress or no stress? Do they provide gold only in times of stress – it is more logical of course; and if they provide gold only in times of stress how do we know this? I accept that my question has presupposition that they intervene….

My question is following my previous one I have raised maybe half a year ago or something. It was that If we have backwardation on some contracts so long (as we had from the beginning of the year) how is possible that the spot is not going higher faster or why is not going backwardation faster to other further contracts? I was meaning the question what was / is exactly behind this.

And today when we have carry activity on the market – why are we so confident that CBs doing nothing. If I understand correctly to arguments of Mr. Weiner – we need not care about flows. It is absolutely unimportant if gold flows from west to east or vice versa – they are just some corners of the market. I admit that I presuppose that it is more logical that CBs do not intervene in contango (one argument is that higher gold price is not good for them). But do we know this exactly?

But prof. Fisher wrote about that as well – and I also read Mr. Weiner´s response to his pieces … I mostly agree but my feeling was that his argument was more about prof. Fisher´s mistake about GOFO resp. GLR vs. LIBOR than about the Fisher´s argument that CB´s intervenes in times of contango.

Thank you for your opinion – if you have time to answer

Please recheck that 34% as gold miners produce approximately the total central bank holding every decade. And each year the potential CB influence reduces further as another 3000mt is added to the stock. The physical gold market is very fluid and I would suggest not stressed at all… the introduction and accommodation of China as a substantial/dominant importer since 2011 is testament to that. However, fluid flows are notoriously difficult to predict as anyone who has solved their N-S equations would attest… variables are highly nonlinear and coupled together in a complex way.

And so it is with gold. Who predicted that the 1300mt bullion flow through Switzerland to the East in 2015 would completely stop and reverse since February with a mere $250/oz price increase… that flows from Dubai to Switzerland then into UK would increase to the fastest rate in 32 years? Or how about the hundreds of tonnes that Japan exported to the West during the QE years, which was unprecedented? The hundreds of tonnes exported from Korea during the Asian Financial Crisis in the 1990s? Examine the USGS data for America where for a few years reported consumption was less than scrap supply with the result USA exported all of its mine production and production passing through it from South/Central America (USA is since hoarding again). But look at America’s surging scrap supply in 2011 when the gold price peaked, 400mt including net exports of scrap.

There is so much freely and publicly available information regarding the above-ground stock and its fluidity. However most gold commentators dare not report it because they want us to believe the market is rigid and in a stressed state… when ABC happens XYZ will happen (CB intervention/manipulation is usually the excuse given when what *should* happen does not).

Working from the latest GFMS stock figure and extrapolating forward based on their mine supply, current stock is 187,545t, which puts the central bank 32,515t at 17.34% and as rowingboat notes, this is continually declining.

IMO, central bank lending to bullion banks is at best tactical support for liquidity purposes, it cannot fill ongoing investor net demand for purposes of price suppression, which is what the mainstream goldbugs think and has led a number of high profile ones to calculate that central banks have/will imminently run out, yet the failure point never occurs. In addition, as rowingboats notes, there are “sinks” of metal that have in the past given up (and taken in) hoards of gold, which is another factor explaining why maybe the price doesn’t do what people think it should.