Putting the Latest Silver Crash Under a Lens

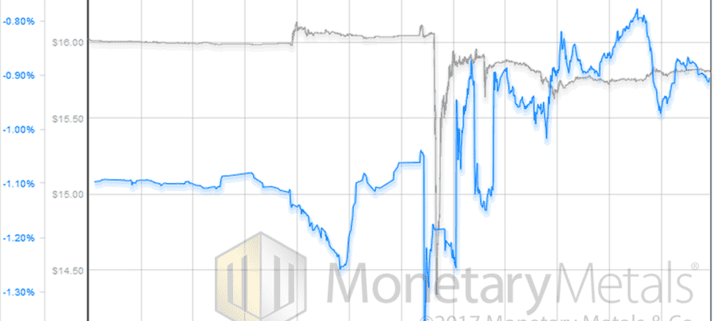

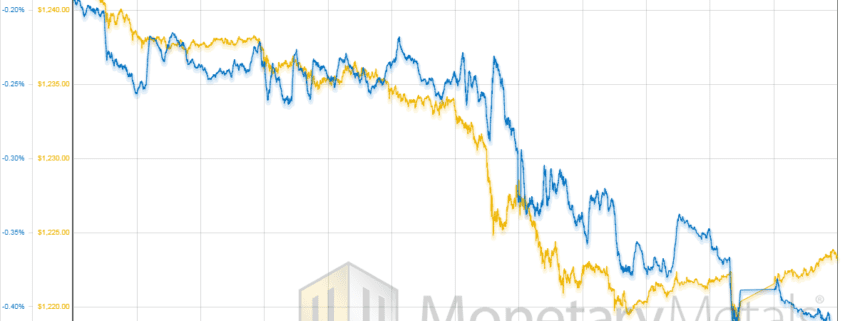

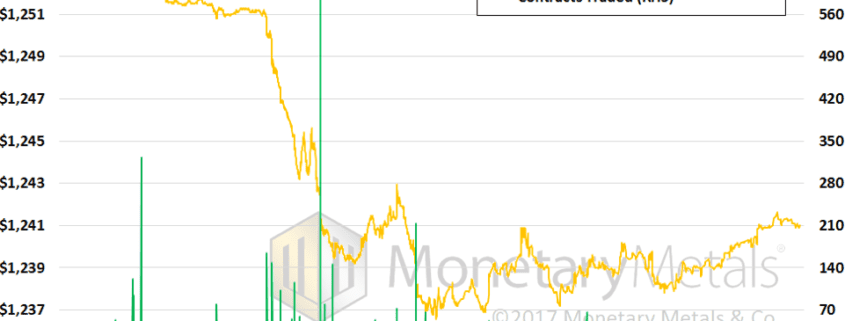

On Thursday, July 6, in the late afternoon (as reckoned in Arizona), the price of silver crashed. The move was very brief, but very intense. The price hit a low under $14.40 before recovering to around $15.80 which is about 20 cents lower than where it started. Buyers of silver are rejoicing. They can now […]