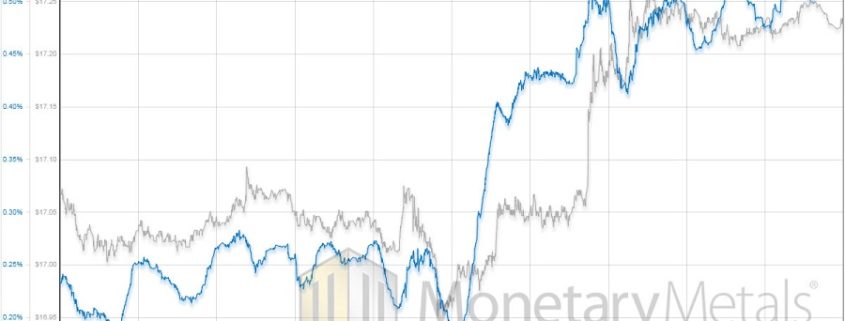

What Made Silver Go Up, Update 20 Oct 2017

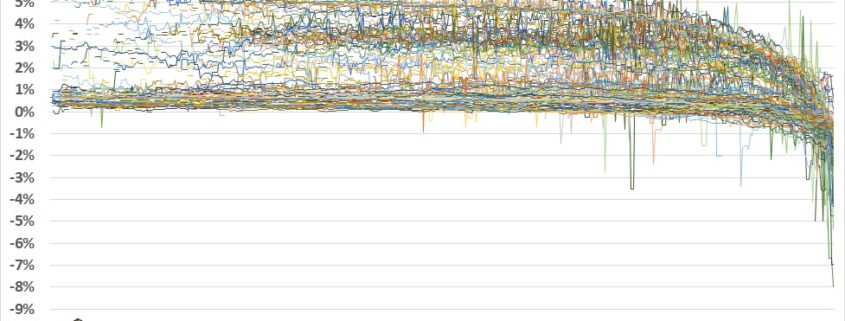

Silver’s move on October 19th was more extreme than gold’s (see here for an explanation of gold’s price action). The price move was four times as great. What of the basis move? The basis move was also correspondingly larger: 30bps vs. 7bps. Again, it uncannily tracks the price. Unlike gold—for whatever it’s worth—the silver basis […]