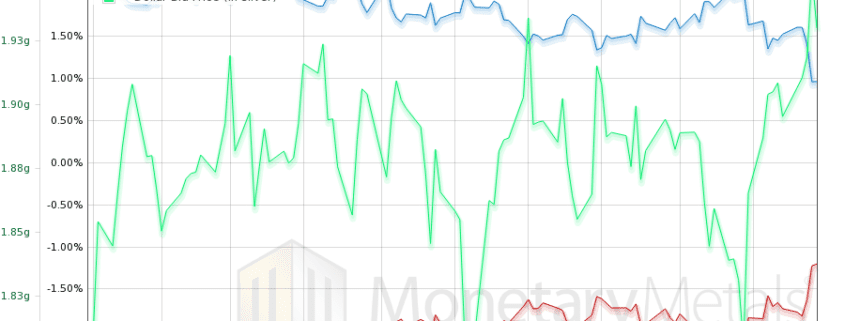

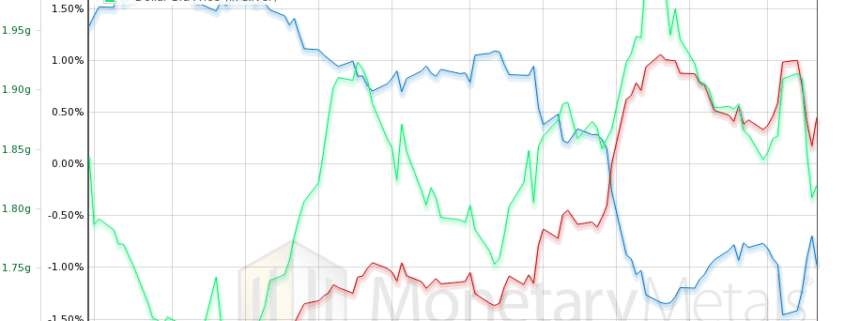

Lower Prices, Stronger Fundamentals

Since last week’s Report, the price action has been downwards. The price of gold dropped about $50, and that of silver $1.35. The gold-silver ratio rose to its highest level since the end of 2020. Technical chartists are either throwing in the towel, or tearing their hair out. We advise against tearing one’s hair […]