Surest Way to Overthrow Capitalism, Report 6 Jan 2019

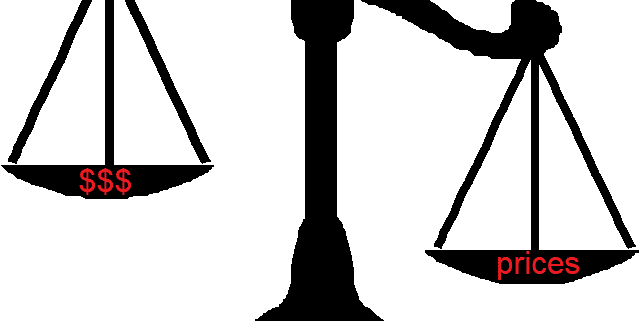

One of the most important problems in economics is: How do we know if an enterprise is creating or destroying wealth? The line between the two is objective, black and white. It should be clear that if business managers can’t tell the difference between a wealth-creating or wealth-destroying activity, then our whole society will be […]