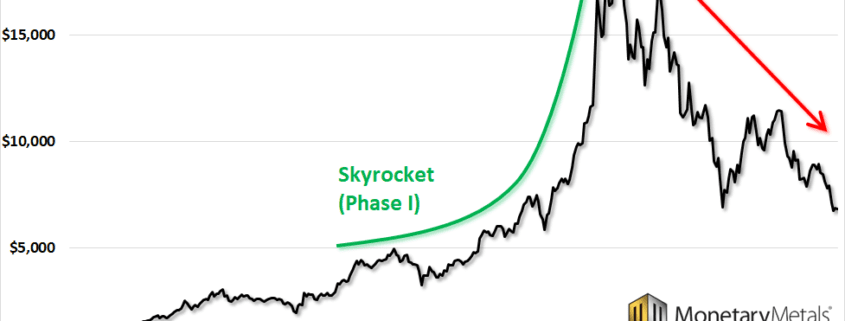

The Skyrocket Phase, Report 3 Apr 2018

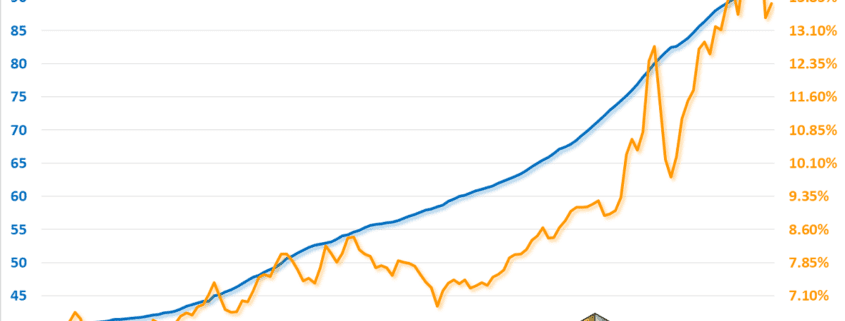

Let’s tie two topics we have treated, one in exhaustive depth and the other in an ongoing series. They are bitcoin and capital consumption. By now, everyone knows that the price of bitcoin crashed. Barrels of electrons are being spilled discussing and debating why, and if/when the price will go back to what it ought […]