The Cycle of Falling Interest, Gold and Silver Report 12 Nov 2017

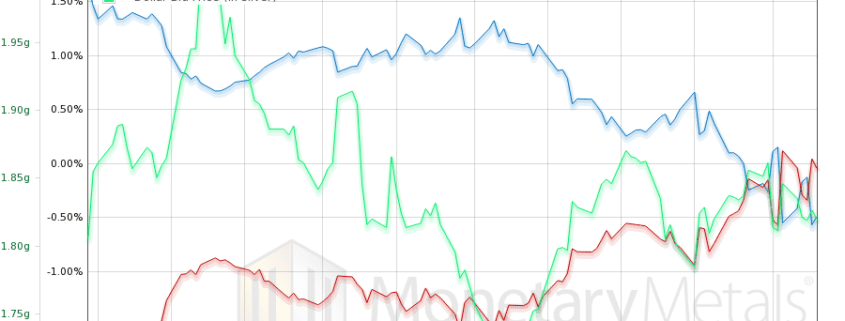

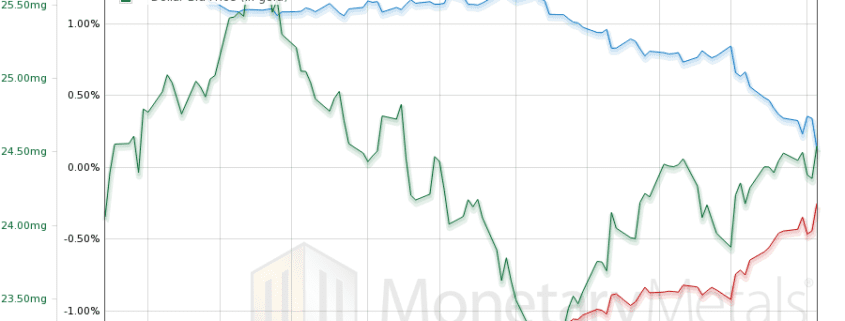

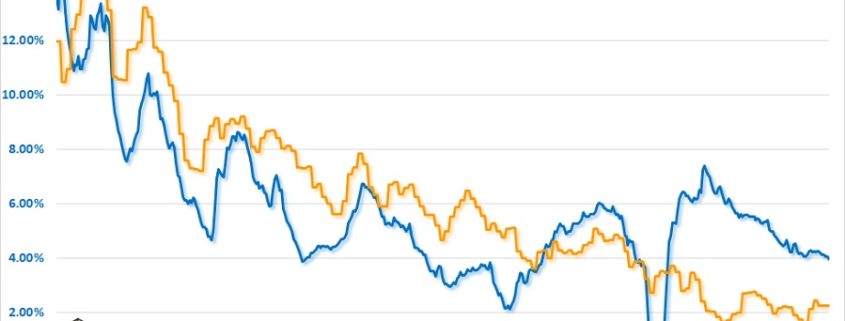

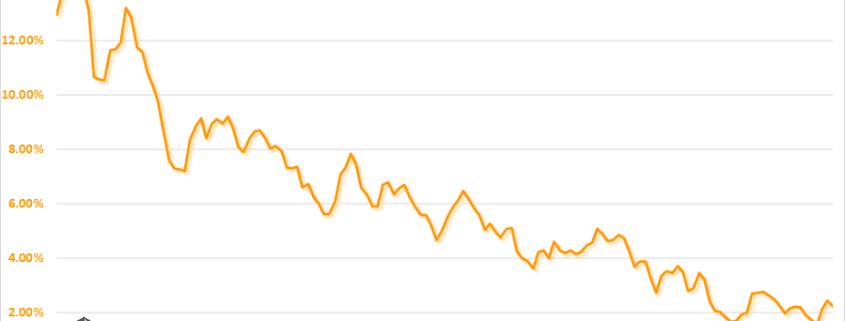

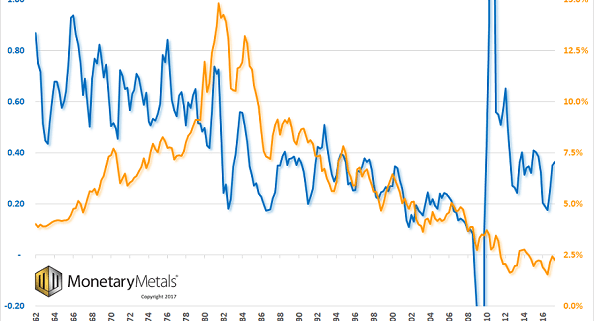

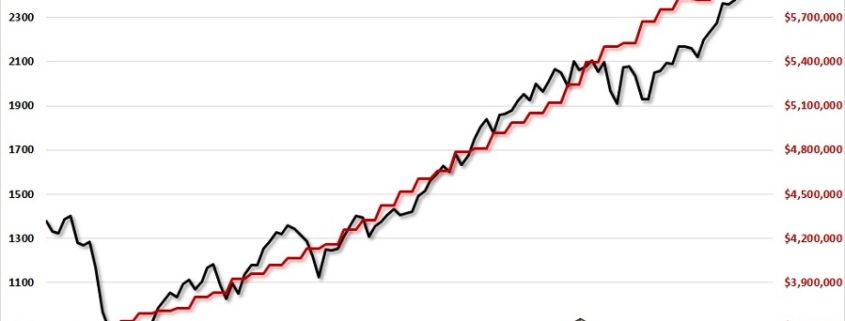

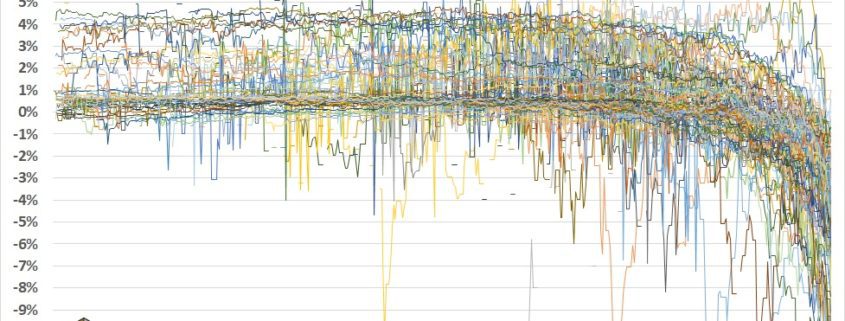

Over the past few weeks, we have looked at the effects of falling interest rates: falling discount applied to future cash flows (and hence rising stock and bond prices), and especially falling marginal productivity of debt (MPoD). Falling MPoD means that we get less and less GDP “juice” for each new dollar of borrowing “squeeze”. […]