Common Sense Monics, Report 10 Jun 2018

Suppose you’re driving a car, and you turn the steering wheel right. You will feel the door and pillar of the car push your left shoulder (in a left-drive car). This is an observed fact.

Common Sense Physics

One idea—let’s call it common sense physics—is that a force is pushing you outward into the door. If you picture the center of the circle that the car is making in its turn, there is an apparent radial force on you. The direction of this force is outward. It is called centrifugal force.

Or suppose you fill a jar with water and mixed soil sediments. You put it into a machine that spins it rapidly, with the lid facing inwards toward the center. After the machine spins for a while, you stop it and remove the jar. The heavier particles are at the bottom of the jar. Above them are the slightly less heavy, and so on, to the lightest. The water is at the top. This experiment confirms the idea. Something apparently pushes the heaviest particles farthest out from the center. Centrifugal force.

In any group of people who have not studied physics, this view is entirely uncontroversial. Indeed nearly everyone who hasn’t studied physics would agree with what we wrote above.

However, if you go to a group of people who have taken a college-level physics class, you would get the opposite reaction. The above view is wrong. And not a single one (who received a passing grade) would defend it.

Any first-year university student in physics would draw the circle and the radius. But he would add an additional concept—velocity. The velocity of the object is tangential to the circle. There is a force pulling the object. That is, there is a radial force, but its direction is inward—centripetal force. The object does not fall into the center, because its velocity is tangential. The net result is that the path is a circle.

One can devise experiments that illustrate problems in common sense physics. For example, tie a string with an embedded force gauge to a small weight. Spin it in a horizontal circle. The gauge shows tension on the string. The string being, well, a string, cannot push the weight outwards. Tension is a force pulling inward.

One can devise experiments to focus on a case where the common sense physics predicts one outcome and physics physics predicts the opposite outcome. Let’s go back to the weight spinning around the circle held by the string. What happens if you could cut the string at a precise moment? Using high speed photography, you could see what happens in the moment when the string separates.

Common sense physics predicts that the weight will fly out from the center of the circle, that is, radially. Physics physics predicts it will fly off on a tangent. We won’t make you wait until next week to resolve this cliff-hanger: the weight flies off tangentially. Here is a video showing this.

Physics is a science. Its observations are facts, and its theories about the world are black and white. They are not debatable (confining our discussion to Newtonian mechanics).

In physics, there is no room for opinion. Common sense physics is wrong. Physics physics is correct. It is not a matter of agreeing with physics, of course, but of understanding it. Thus the group of people who haven’t studied it, simply don’t understand it. They believe in a view which seems to make sense but which is just wrong. Those who have studied it know the truth.

You may be wondering where this is going. No, Monetary Metals is not angling for a job making videos to teach physics to students. We will stay in our money swim lane. There is an analogy between physics and money. Let’s look at common sense monics and physics monics (yes, we’re coining the term monics to refer to monetary science, just to make the next bit easier to read).

Common Sense Monics

Common sense physics begins with an observation. It does not look for other observations, but instead leaps to an apparent explanation. It never identifies the cause or even grasps the mechanism. So does common sense monics. Common sense physics says you feel a force on your left shoulder, something must be pushing you outward – out of the car. It does not ask if the car is pushing you inward.

Common sense monics begins with its own apparent observation. People are buying and selling everything in exchange for either printed pieces of paper, or electronic credits that are redeemable only for bits of paper. As the common sense physics concludes the driver’s body is pushing outward on the car door, the common sense monics concludes that these bits of paper are money. As physics physics calls centrifugal force an apparent force, so should physics monics call this paper apparent money.

Common sense physics does not look to experiments, does not ask what force could act at a distance (which Einstein, by the way, called “spooky”). The apparent force is enough. There’s nothing to see here, move along folks.

It is the same with common sense monics. People are trading paper dollars (or pounds, euros, yuan, etc.) for food, cars, houses, and iPhones. Apparently these pieces of paper are money. ‘Nuff said.

Physics physics says let’s put the weight on a string, spin it, and cut it. Let’s see what happens. The weight does indeed fly off—tangentially.

Physics monics should say let’s look at this apparent money, this paper, and ask what if the issuer is cut off. Will the paper continue to circulate indefinitely as money Will it retain its identity as money? Or will it fly off in a brief arc ending with impact into terra firma? If the latter, on what does its value depend? People do not value the apparent money for any attribute it possesses, but for something about the issuer…

That’s an interesting line of inquiry (and yes, we are aware of one instance where a fiat currency continued to circulate post the collapse of the central bank, at least for a while). Is money something owed by one party to another, or is money the thing paid to resolve that debt?

If money is the latter, if it is not something owed, then its value (and hence circulation) does not depend on the solvency of any party. Conversely, if the issuer’s collapse means the collapse of the apparent money, does that not make a case that apparent money is not actual money?

The apparent centrifugal force in physics is analogous to the apparent dollar money. There is no cause that acts on the driver of the car to create an outward force. This is a contradiction, because an action must have a cause. The apparent dollar money has its own contradiction. A debt is paid in money. If money itself is debt, then we pay debt with debt. This is a contradiction, because then the debt is not extinguished, merely shifted. So we have apparent money that cannot perform the function of money.

One area where our analogy breaks down is that most university-educated economics graduates would agree with the group of laymen who know nothing.

We don’t want to belabor the questions and observations of real physics monics, as we write about them frequently. Our point today is that science and its unique method of study must be brought to the realm of money and credit. The economic world is spinning on a string, and the string is certain to separate.

Mainstream Monetary Economics Is Lysenkoism

One important difference between physics and monics is that no one has a vested interest to indoctrinate the people in common sense physics (though regimes such as the USSR promoted Lysenkoism). Unfortunately, every government in the world today promotes common sense monics. The central bank seeks spooky something-for-nothing. They don’t want a consensus to form that central banking or central planning is harmful. They want to continue the apparent free lunch, where they can have free goodies without raising the taxes to pay for it.

Common sense monics believes that what the central banks do is: print money. Physics monics says the apparent printing is actually borrowing, and the apparent money is actually debt. Their solution of printing more is actually going deeper into debt. This is a vital distinction, because there’s no particular limit to the quantity of printed paper, however there is a very definite limit on how much debt a borrower can service.

So it’s much harder to teach physics monics than physics physics. We are not merely trying to teach something new. We need to teach that what people believe they know, just isn’t so.

Supply and Demand Fundamentals

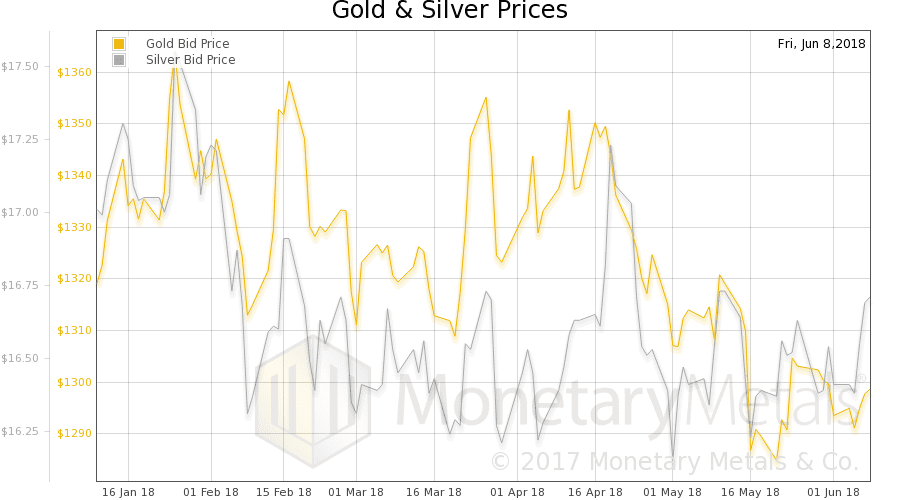

The prices of gold and silver rose five bucks and 37 cents respectively. Is this the blast off to da moon for the silver rocket of halcyon days, in other words 2010-2011?

We will look at the basis signals in a bit. But for now, we want to comment on the absolute moribund state of the retail market. Coin and bar premiums are near or at long-term lows. That means buyers are not necessarily buying new product from the mints, but rather there is plenty of “used” product floating around the market from other retail customers who are selling.

Every dealer we talk to acknowledges volume is down too. So not only is there less revenue, but the margin on that revenue is smaller. Keith is here in San Antonio for the International Precious Metals Institute conference, and though it’s his first time attendees keep saying it’s a smaller crowd.

This is not an environment for a Lift Off Event. It is not bullish, except in the way that before the bull market often must come capitulation. This smells like retail capitulation.

Below is the only true picture of the gold and silver fundamentals. But first, here is the chart of the prices of gold and silver.

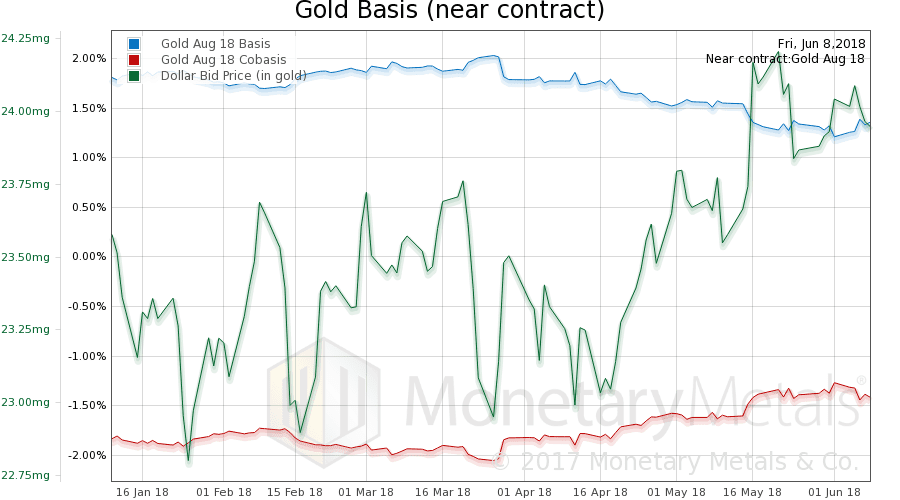

Here is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price.

The price of gold rose (which is really the falling price of the dollar, shown in green). As the price rose, the scarcity fell (i.e. cobasis, the red line). Nothing unusual about this.

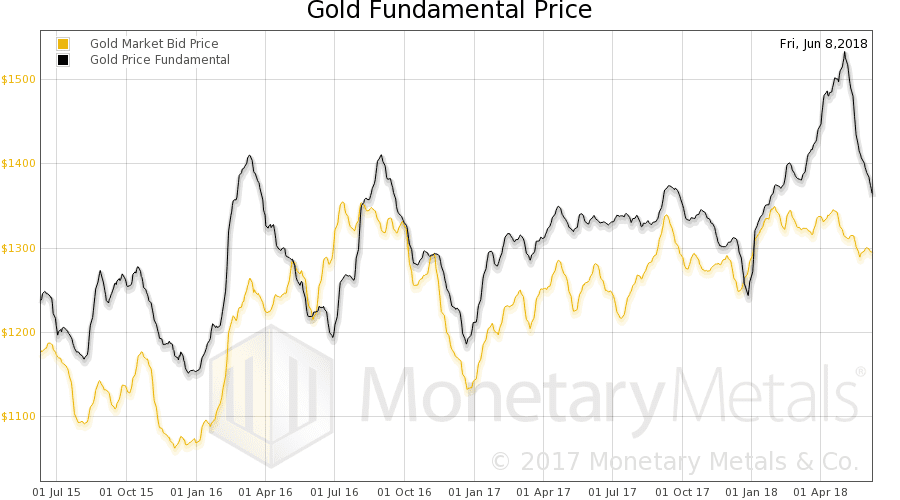

The Monetary Metals Gold Fundamental Price fell $35 this week to $1,351. The fundamental has almost completed its full round trip, as it went above (way above) its long-term range and now falling back into it. Here is a graph showing the fundamental for the last 3 years.

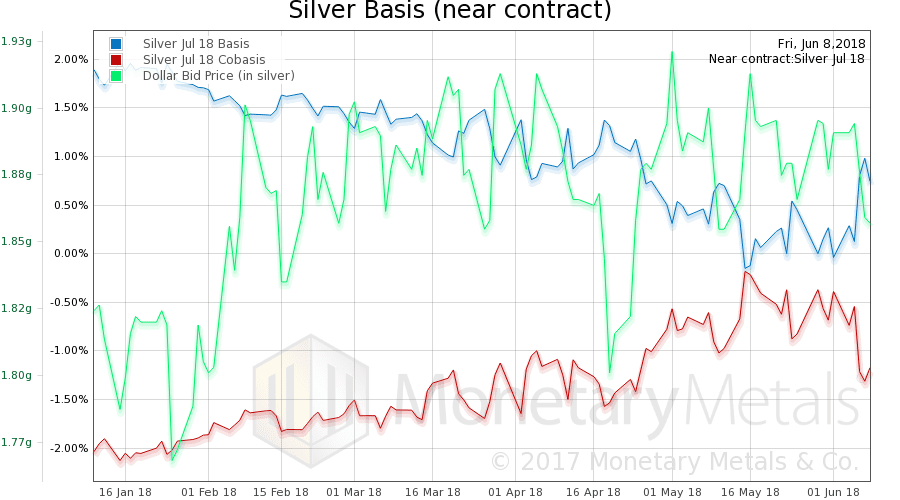

Now let’s look at silver.

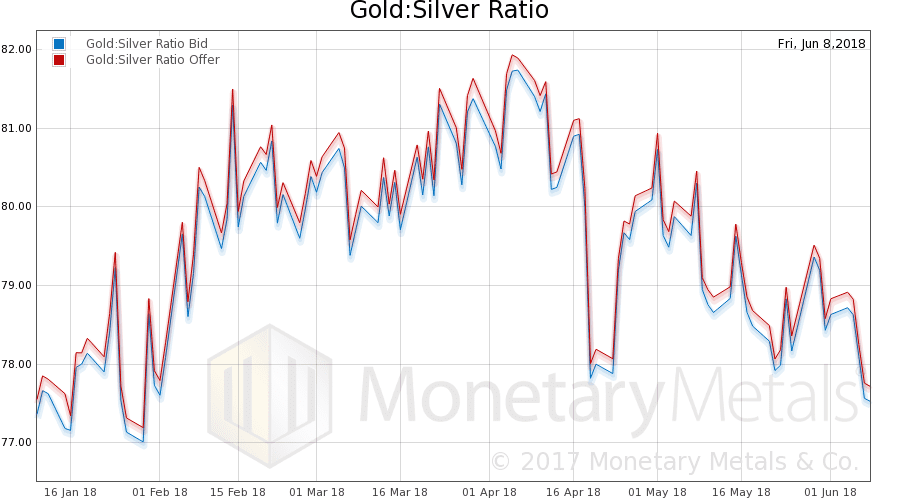

The July silver cobasis fell from -0.4% to -1.2%. The price of silver rose a lot more than did gold.

The silver basis continuous shows a much smaller move. It’s a little odd, as we are now well into the time when futures speculators are rolling their July contracts to September. This should be pushing down the contract price, which pushes up the cobasis. We normally see temporary backwardation as contract expiry approaches. This week, the move in the silver cobasis goes opposite to this. Obviously, much of the buying in silver was in futures, and most of that was in the July contract. Why would a speculator buy a July contract, that he would only have to roll in a few weeks? Perhaps he is not thinking of holding that long? We don’t know, we are guessing.

The Monetary Metals Silver Fundamental Price fell 38 cents to $17.13.

© 2018 Monetary Metals

“Physics physics”?

Suppose not support! If you are turning left your shoulder would not be pushed into the drivers side door but away from the door towards the passenger door.

Oops didn’t read far enough. Yes I took physics and velocity is the driving point that flips the teenagers car when he takes a corner too fast and ends up on its top. Never did that myself but knew some boys that did.

Wouldn’t the process (actively or passively) of shrinking its balance sheet by the central bank be the same thing as extinguishing debt?

It could easily be the case that I’m missing something here, but your example seems to have been reversed. Everything you’ve written makes perfect sense when you are turning the wheel *right* and not *left*.

The 3-year chart of fundamental provides great perspective.

Question: was early – mid 2016 a good time to buy gold? Hardly. The much better time to buy was late 2016.

Now take a look where fundamental was during those two periods… i.e., compare mid’16 with late ’16. Initially gold prices were high (i.e., bad time to buy) but once fundamental came back in line with gold, gold was priced at much better levels, at least in late 2016… (or now after it’s $70 drop) and therefore a better time to buy. In other words, a fundamental price considerably above bullion prices can be a warning to hold off purchases, not a signal to buy more because gold is “undervalued” relative to fundamental.

The lesson? A screaming higher fundamental appears to be a great signal to be selling gold, not buying it. The reverse is true as well.

I realize MM didn’t mean to incorporate sentiment indicators into the fundamental formula. And they didn’t, at least not intentionally. Yet every time fundamental is considerably above bullion the standard measures of sentiment (like the Daily Sentiment Index or DSI) are screaming “sell!”, because you just can’t have 80/90% of the trading public bullish at the beginning of a big move higher. “Plurality of opinion” is more often a turning point. (In both directions)

Which means the current drop in fundamental has been in the cards since April (see my previous comments during April/May) at the precise time when most investors were becoming exceedingly bullish.

So what comes next? My pure guess is another $40 – $60 drop in fundamental and a final washout in gold — but one that holds the critical $1,265 support on a closing basis, if it gets that low… which is questionable. Yet the bullion market is washed out and depressed quite enough already. It’s certainly possible we could start a rally now, before any final drop. The falling GSR certainly suggests as much. Overall, then, a continued weak market that strengthens as we move towards year end, with $1,265 a key price on many levels.

Can MM make the data available for a more detailed analysis of the predictive capability of the fundamental price, with an emphasis on causation? Someone’s got to settle this.

… *coining* the term …