Gold and silver prices

This chart shows the gold and silver bid prices around 3pm London time, a period of high liquidity as it corresponds with the setting of the afternoon LBMA benchmark gold price and the morning of Comex futures trading.

3 MONTH CHART OF GOLD & SILVER PRICES

3 YEAR CHART OF GOLD & SILVER PRICES

MAX CHART OF GOLD & SILVER PRICES

Dollar price

Monetary Metals® argues that gold is the objective measure of value, against which everything including dollars, must be measured—it is the dollar that is rising and falling in value against gold (and silver). This chart shows the price of a US dollar in milligrams of gold and grams of silver.

3 MONTH CHART OF DOLLAR PRICES

3 YEAR CHART OF DOLLAR PRICES

MAX CHART OF DOLLAR PRICES

Spot price bid-offer spread

This chart shows difference between the bid and offer price for gold and the bid and offer price for silver. This difference, or spread, can be an indicator of liquidity or stress in the market. When the market is highly liquid, bid-offer spreads may be tight (or low) but during periods of stress or uncertainty, the bid-offer spread may widen (or rise).

This chart is available in durations of three months, three years and from 1996 to today.

3 MONTH CHART OF SPOT PRICE BID-OFFER SPREAD

3 YEAR CHART OF SPOT PRICE BID-OFFER SPREAD

MAX CHART OF SPOT PRICE BID-OFFER SPREAD

^ Go to top

Gold to silver ratio

The gold:silver ratio is the price of gold in ounces of silver. For those focused on dollar profits, it can also be thought of as showing the relative performance of gold versus silver. A rising ratio indicates that gold is outperforming silver and a falling ratio indicates that silver is outperforming gold.

The offer ratio is the gold ask price divided by silver bid price price, representing the rate to buy (or go long) the ratio, that is, buying gold and selling silver. The bid ratio is the gold bid price divided by silver ask price price, representing the rate to sell (or go short) the ratio, that is, selling gold and buying silver.

3 MONTH CHART OF GOLD:SILVER RATIO

3 YEAR CHART OF GOLD:SILVER RATIO

MAX CHART OF GOLD:SILVER RATIO

Gold to silver ratio fundamental

This shows the ratio of Monetary Metals’ fundamental gold and silver prices. As with our fundamental prices, the degree of divergence between the market gold:silver ratio and our fundamental ratio is, in our opinion, an indication of market exuberance or pessimism.

Our fundamental prices are computed according to a model based on our economic theory. We believe that this model reflects the forces of supply and demand in the physical market however there is no guarantee that the market ratio will move to the fundamental ratio quickly or ever.

This chart is available in durations of three months, three years and from 1996 to today.

3 MONTH CHART OF GOLD:SILVER RATIO FUNDAMENTAL

3 YEAR CHART OF GOLD:SILVER RATIO FUNDAMENTAL

MAX CHART OF GOLD:SILVER RATIO FUNDAMENTAL

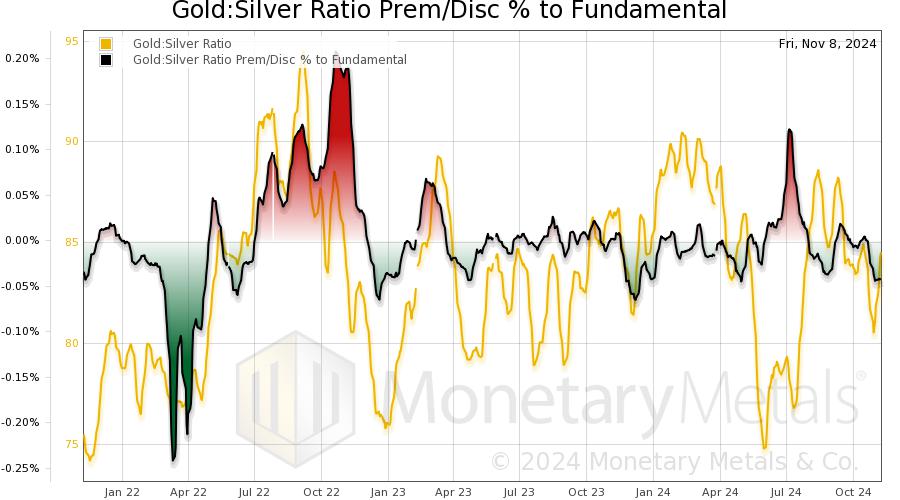

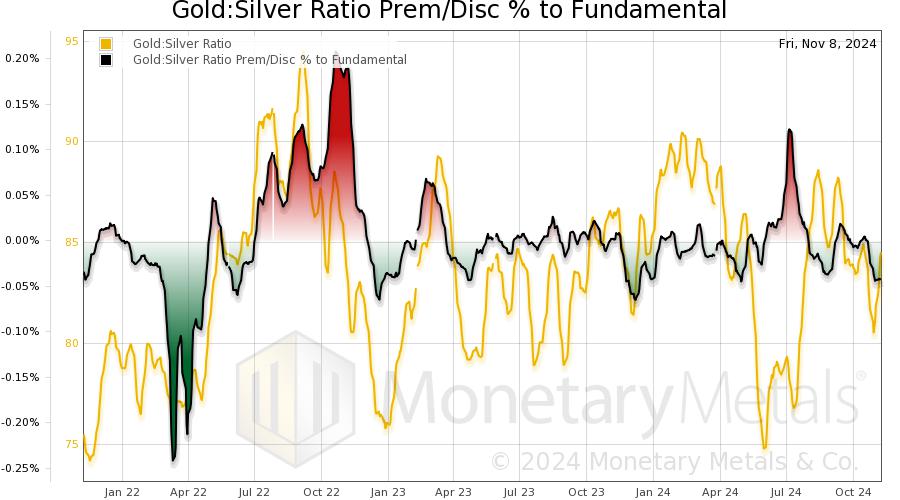

Gold to silver ratio prem/disc to fundamental

This chart shows the degree to which the market gold:silver ratio diverges from our fundamental ratio. Positive values indicate that the market ratio is above our fundamental ratio and this “premium” is shown in red as it reflects our opinion that the ratio may be overvalued (that is, the ratio will fall and silver will outperform gold in dollar terms). Negative values indicate that the market ratio is below our fundamental ratio and this “discount” is shown in green as it reflects our opinion that the ratio may be undervalued (that is, the ratio will rise and gold will outperform silver in dollar terms).

This chart is available in durations of three months, three years and from 1996 to today.

3 MONTH CHART OF GOLD:SILVER RATIO PREM/DISC TO FUNDAMENTAL

3 YEAR CHART OF GOLD:SILVER RATIO PREM/DISC TO FUNDAMENTAL

MAX CHART OF GOLD:SILVER RATIO PREM/DISC TO FUNDAMENTAL

Gold to silver basis ratios

This chart shows the difference between the basis for gold and silver and the cobasis for gold and silver. When the gold basis to silver basis ratio blue line is above 1, it indicates that the return from carrying gold is greater than the return that can be earned carrying silver, and below 1 silver offers the better carry return. When the gold cobasis to silver cobasis Ratio red line is above 1, it indicates that the return from decarrying gold is greater than the return that can be earned decarrying silver, and below 1 silver offers the better decarry return.

This chart is available in durations of three months, three years and from 1996 to today.

3 MONTH CHART OF GOLD:SILVER BASIS RATIOS

3 YEAR CHART OF GOLD:SILVER BASIS RATIOS

MAX CHART OF GOLD:SILVER BASIS RATIOS

^ Go to top

Gold fundamental price

Monetary Metals’ fundamental price seeks to back out speculative forces in the gold market to reveal the underlying physical supply and demand picture. The degree of divergence between the market price of gold and the fundamental price is, in our opinion, an indication of market exuberance or pessimism.

The fundamental price is computed according to a model based on our economic theory. We believe that this model reflects the forces of supply and demand in the physical market however there is no guarantee that the market price will move to the fundamental price quickly or ever.

3 MONTH CHART OF GOLD FUNDAMENTAL PRICE

3 YEAR CHART OF GOLD FUNDAMENTAL PRICE

MAX CHART OF GOLD FUNDAMENTAL PRICE

Gold premium/discount to fundamental

This chart shows the degree to which the market price diverges from the fundamental price. Positive values indicate that market prices are above our fundamental price and this “premium” is shown in red as it reflects our opinion that the gold price may be overvalued. Negative values indicate that market prices are below our fundamental price and this “discount” is shown in green as it reflects our opinion that the gold price may be undervalued.

This chart is available in durations of three months, three years and from 1996 to today.

3 MONTH CHART OF GOLD PREM/DISC TO FUNDAMENTA

3 YEAR CHART OF GOLD PREM/DISC TO FUNDAMENTAL

MAX CHART OF GOLD PREM/DISC TO FUNDAMENTAL

Dollar price in gold

Monetary Metals® argues that gold is the objective measure of value, against which everything including dollars, must be measured—it is the dollar that is rising and falling in value against gold (and silver). This chart shows the price of a US dollar in milligrams of gold.

3 MONTH CHART OF DOLLAR PRICE IN GOLD

3 YEAR CHART OF DOLLAR PRICE IN GOLD

MAX CHART OF DOLLAR PRICE IN GOLD

Gold spot price bid-offer spread

This chart shows difference between the bid and offer price for gold. This difference, or spread, can be an indicator of liquidity or stress in the market. When the market is highly liquid, bid-offer spreads may be tight (or low) but during periods of stress or uncertainty, the bid-offer spread may widen (or rise).

This chart is available in durations of three months, three years and from 1996 to today.

3 MONTH CHART OF GOLD SPOT PRICE BID-OFFER SPREAD

3 YEAR CHART OF GOLD SPOT PRICE BID-OFFER SPREAD

MAX CHART OF GOLD SPOT PRICE BID-OFFER SPREAD

^ Go to top

Gold basis

This chart shows the near gold futures contract basis and cobasis against the US dollar’s price in milligrams of gold.

The basis is a measure of the per annum return from carrying gold and is an indicator of abundance (the market would only offer a profit to arbitrageurs to stockpile gold if there was excess supply relative to demand). The cobasis is a measure of the per annum return from decarrying gold and is an indicator of scarity (the market would only offer a profit to arbitrageurs to sell gold from their stocks if there was a deficiency of supply relative to demand).

This chart should be read in conjunction with the gold carry/decarry (near contract) chart (that shows the actual dollar per ounce profit/loss) as small dollar values that may not be worth arbitraging can produce larger basis/cobasis percentage as the days to expiry of a contract falls.

Note: this chart switches to the next contract 14 days from the start of first notice day.

3 MONTH CHART OF GOLD BASIS (NEAR CONTRACT)

MAX CHART OF GOLD BASIS (NEAR CONTRACT)

Gold basis continuous

This chart shows a continuous (splicing together of individual) basis and cobasis against the US dollar’s price in milligrams of gold.

The basis is a measure of the per annum return from carrying gold and is an indicator of abundance (the market would only offer a profit to arbitrageurs to stockpile gold if there was excess supply relative to demand). The cobasis is a measure of the per annum return from decarrying gold and is an indicator of scarity (the market would only offer a profit to arbitrageurs to sell gold from their stocks if there was a deficiency of supply relative to demand).

This chart is available in durations of three months, three years and from 1996 to today.

3 MONTH CHART OF GOLD BASIS CONTINUOUS

3 YEAR CHART OF GOLD BASIS CONTINUOUS

MAX CHART OF GOLD BASIS CONTINUOUS

Gold carry/decarry (near contract)

This chart shows the dollar per ounce carry and decarry that could be earned on the near gold futures contract.

One carries gold by buying gold at spot and selling a future contract, that is, Future Bid Price less Spot Ask Price. One decarries gold by selling gold at spot and buying a future contract, that is, Spot Bid Price less Future Ask Price.

This chart should be read in conjunction with the gold basis (near contract) chart which shows the carry/decarry in percentage terms.

Note: this chart switches to the next contract 14 days from the start of first notice day.

This chart is also available for a duration of 18 months. Access to our charts is free to registered users of this website.

3 MONTH CHART OF GOLD BASIS IN DOLLARS (NEAR CONTRACT)

MAX CHART OF GOLD BASIS IN DOLLARS (NEAR CONTRACT)

Gold roll costs

This chart shows the cost of rolling gold from the near contract to the next contract if one has:

• A long position, that is, sell near, buy next (near contract bid price less next contract ask price)

• A short position, that is, buy near, sell next (near contract bid price less next contract ask price)

We define the next contract as the current contract as long as it is more than 14 days from the start of its first notice day, at which point we switch to the next closest contract. This chart is available in durations of three months, three years and from 1996 to today.

3 MONTH CHART OF GOLD ROLL COSTS

3 YEAR CHART OF GOLD ROLL COSTS

MAX CHART OF GOLD ROLL COSTS

^ Go to top

Gold forward rates

MM GOFO™ is the Monetary Metals® gold forward rate. This chart shows the bid and offer for MM GOFO™ of six-month duration.

These rates are indicative inter-bank wholesale rates only. Actual rates charged will depend on bank profit margins, client credit risk and other factors. For actual rates paid to investors on Monetary Metal’s leases, see our funded deals page. For a description of how we calculate MM GOFO™ from over-the-counter spot prices and Comex gold futures, see gold & silver forward offered rates.

3 MONTH CHART OF MM GOFO™ 6-MONTH

3 YEAR CHART OF MM GOFO™ 6-MONTH

MAX CHART OF MM GOFO™ 6-MONTH

MM GOFO™ 12-month gold forward rate

MM GOFO™ is the Monetary Metals® gold forward rate. This chart shows the bid and offer for MM GOFO™ of twelve-month duration.

These rates are indicative inter-bank wholesale rates only. Actual rates charged will depend on bank profit margins, client credit risk and other factors.

For actual rates paid to investors on Monetary Metal’s leases, see our funded deals page. For a description of how we calculate MM GOFO™ from over-the-counter spot prices and Comex gold futures, see gold & silver forward offered rates.

This chart is available in durations of three months, three years and from 1996 to today.

3 MONTH CHART OF MM GOFO™ 12-MONTH

3 YEAR CHART OF MM GOFO™ 12-MONTH

MAX CHART OF MM GOFO™ 12-MONTH

MM GOFO™ gold forward rates

MM GOFO™ is the Monetary Metals® gold forward rate. This chart shows all of the offered rates for MM GOFO™, to allow for easier comparison between gold forward rates across time and identification of periods of forward rate curve inversion.

These rates are indicative inter-bank wholesale rates only. Actual rates charged will depend on bank profit margins, client credit risk and other factors.

For actual rates paid to investors on Monetary Metal’s leases, see our funded deals page.

For a description of how we calculate MM GOFO™ from over-the-counter spot prices and Comex gold futures, see gold & silver forward offered rates.

This chart is available in durations of three months, three years and from 1996 to today.

3 MONTH CHART OF MM GOFO™ RATES

3 YEAR CHART OF MM GOFO™ RATES

MAX CHART OF MM GOFO™ RATES

MM GOFO™ gold forward rate bid-offer spreads

MM GOFO™ is the Monetary Metals® gold forward rate. This chart shows the spread between MM GOFO™ bid and offer rates for each duration. This difference, or spread, can be an indicator of liquidity or stress in the market. When the market is highly liquid, gold forward rate bid-offer spreads will be tight (or low) but during periods of stress or uncertainty, the bid-offer spread will widen (or rise).

These rates are indicative inter-bank wholesale rates only. Actual rates charged will depend on bank profit margins, client credit risk and other factors.

For actual rates paid to investors on Monetary Metal’s leases, see our funded deals page.

For a description of how we calculate MM GOFO™ from over-the-counter spot prices and Comex gold futures, see gold & silver forward offered rates.

This chart is available in durations of three months, three years and from 1996 to today.

3 MONTH CHART OF MM GOFO™ BID-OFFER SPREADS

3 YEAR CHART OF MM GOFO™ BID-OFFER SPREADS

MAX CHART OF MM GOFO™ BID-OFFER SPREADS

^ Go to top

Silver fundamental price

Monetary Metals’ fundamental price seeks to back out speculative forces in the silver market to reveal the underlying physical supply and demand picture. The degree of divergence between the market price of silver and the fundamental price is, in our opinion, an indication of market exuberance or pessimism.

The fundamental price is computed according to a model based on our economic theory. We believe that this model reflects the forces of supply and demand in the physical market however there is no guarantee that the market price will move to the fundamental price quickly or ever.

3 MONTH CHART OF SILVER FUNDAMENTAL PRICE

3 YEAR CHART OF SILVER FUNDAMENTAL PRICE

MAX CHART OF SILVER FUNDAMENTAL PRICE

Silver premium/discount to fundamental

This chart shows the degree to which the market price diverges from the fundamental price. Positive values indicate that market prices are above our fundamental price and this “premium” is shown in red as it reflects our opinion that the silver price may be overvalued. Negative values indicate that market prices are below our fundamental price and this “discount” is shown in green as it reflects our opinion that the silver price may be undervalued.

This chart is available in durations of three months, three years and from 1996 to today.

3 MONTH CHART OF SILVER PREM/DISC TO FUNDAMENTAL

3 YEAR CHART OF SILVER PREM/DISC TO FUNDAMENTAL

MAX CHART OF SILVER PREM/DISC TO FUNDAMENTAL

Dollar price in silver

Monetary Metals® argues that gold is the objective measure of value, against which everything, including dollars, must be measured—it is the dollar that is rising and falling in value against silver. This chart shows the price of a US dollar in grams of silver.

3 MONTH CHART OF DOLLAR PRICE IN SILVER

3 YEAR CHART OF DOLLAR PRICE IN SILVER

MAX CHART OF DOLLAR PRICE IN SILVER

Silver spot price bid-offer spread

This chart shows difference between the bid and offer price for silver. This difference, or spread, can be an indicator of liquidity or stress in the market. When the market is highly liquid, bid-offer spreads may be tight (or low) but during periods of stress or uncertainty, the bid-offer spread may widen (or rise).

This chart is available in durations of three months, three years and from 1996 to today.

3 MONTH CHART OF SILVER SPOT PRICE BID-OFFER SPREAD

3 YEAR CHART OF SILVER SPOT PRICE BID-OFFER SPREAD

MAX CHART OF SILVER SPOT PRICE BID-OFFER SPREAD

^ Go to top

Silver basis

This chart shows the near silver futures contact basis and cobasis against the US dollar’s price in grams of silver.

The basis is a measure of the per annum return from carrying silver and is an indicator of abundance (the market would only offer a profit to arbitrageurs to stockpile silver if there was excess supply relative to demand). The cobasis is a measure of the per annum return from decarrying silver and is an indicator of scarity (the market would only offer a profit to arbitrageurs to sell silver from their stocks if there was a deficiency of supply relative to demand).

Note: this chart switches to the next contract 14 days from the start of first notice day.

3 MONTH CHART OF SILVER BASIS (NEAR CONTRACT)

MAX CHART OF SILVER BASIS (NEAR CONTRACT)

Silver basis continuous

This chart shows a continuous splicing together of individual basis and cobasis against the US dollar’s price in grams of silver.

The basis is a measure of the per annum return from carrying silver and is an indicator of abundance (the market would only offer a profit to arbitrageurs to stockpile silver if there was excess supply relative to demand). The cobasis is a measure of the per annum return from decarrying silver and is an indicator of scarity (the market would only offer a profit to arbitrageurs to sell silver from their stocks if there was a deficiency of supply relative to demand).

This chart is available in durations of three months, three years and from 1996 to today.

3 MONTH CHART OF SILVER BASIS CONTINUOUS

3 YEAR CHART OF SILVER BASIS CONTINUOUS

MAX CHART OF SILVER BASIS CONTINUOUS

Silver carry/decarry (near contract)

This chart shows the dollar per ounce carry and decarry that could be earned on the near silver futures contact.

One carries silver by buying silver at spot and selling a future contract, that is, future bid price less spot ask price. One decarries silver by selling silver at spot and buying a future contract, that is, spot bid price less future ask price.

Note: this chart switches to the next contract 14 days from the start of first notice day.

This chart is available in durations of three months, three years and from 1996 to today.

3 MONTH CHART OF SILVER BASIS IN DOLLARS (NEAR CONTRACT)

MAX CHART OF SILVER BASIS IN DOLLARS (NEAR CONTRACT)

Silver roll costs

This chart shows the cost of rolling silver from the near contract to the next contract if one has:

• A long position, that is, sell near, buy next (near contract bid price less next contract ask price)

• A short position, that is, buy near, sell next (near contract bid price less next contract ask price)

We define the next contact as the current contract as long as it is more than 14 days from the start of its delivery month, at which point we switch to the next closest contract.

This chart is available in durations of three months, three years and from 1996 to today.

3 MONTH CHART OF SILVER ROLL COSTS

3 YEAR CHART OF SILVER ROLL COSTS

MAX CHART OF SILVER ROLL COSTS

Silver forward rates

MM GOFO™ is the Monetary Metals® silver forward rate. This chart shows the bid and offer for MM GOFO™ of six-month duration.

These rates are indicative inter-bank wholesale rates only. Actual rates charged will depend on bank profit margins, client credit risk and other factors. For actual rates paid to investors on Monetary Metal’s leases, see our funded deals page. For a description of how we calculate MM GOFO™ from over-the-counter spot prices and Comex silver futures, see silver & silver forward offered rates.

3 MONTH CHART OF MM GOFO™ 6-MONTH

3 YEAR CHART OF MM GOFO™ 6-MONTH

MAX CHART OF MM GOFO™ 6-MONTH

MM GOFO™ 12-month silver forward rate

MM GOFO™ is the Monetary Metals® silver forward rate. This chart shows the bid and offer for MM GOFO™ of twelve-month duration.

These rates are indicative inter-bank wholesale rates only. Actual rates charged will depend on bank profit margins, client credit risk and other factors. For actual rates paid to investors on Monetary Metal’s leases, see our funded deals page. For a description of how we calculate MM GOFO™ from over-the-counter spot prices and Comex silver futures, see silver & silver forward offered rates.

This chart is available in durations of three months, three years and from 1996 to today.

3 MONTH CHART OF MM GOFO™ 12-MONTH

3 YEAR CHART OF MM GOFO™ 12-MONTH

MAX CHART OF MM GOFO™ 12-MONTH

MM GOFO™ silver forward rates

MM GOFO™ is the Monetary Metals® silver forward rate. This chart shows all of the offered rates for MM GOFO™, to allow for easier comparison between silver forward rates across time and identification of periods of forward rate curve inversion.

These rates are indicative inter-bank wholesale rates only. Actual rates charged will depend on bank profit margins, client credit risk and other factors. For actual rates paid to investors on Monetary Metal’s leases, see our funded deals page. For a description of how we calculate MM GOFO™ from over-the-counter spot prices and Comex silver futures, see silver & silver forward offered rates.

This chart is available in durations of three months, three years and from 1996 to today.

3 MONTH CHART OF MM GOFO™ RATES

3 YEAR CHART OF MM GOFO™ RATES

MAX CHART OF MM GOFO™ RATES

MM GOFO™ silver forward rate bid-offer spreads

MM GOFO™ is the Monetary Metals® silver forward rate. This chart shows the spread between MM GOFO™ bid and offer rates for each duration. This difference, or spread, can be an indicator of liquidity or stress in the market. When the market is highly liquid, silver forward rate bid-offer spreads will be tight (or low) but during periods of stress or uncertainty, the bid-offer spread will widen (or rise).

These rates are indicative inter-bank wholesale rates only. Actual rates charged will depend on bank profit margins, client credit risk and other factors. For actual rates paid to investors on Monetary Metal’s leases, see our funded deals page. For a description of how we calculate MM GOFO™ from over-the-counter spot prices and Comex silver futures, see silver & silver forward offered rates.

This chart is available in durations of three months, three years and from 1996 to today.

3 MONTH CHART OF MM GOFO™ BID-OFFER SPREADS

3 YEAR CHART OF MM GOFO™ BID-OFFER SPREADS

MAX CHART OF MM GOFO™ BID-OFFER SPREADS