Why Monetary Metals?

We’ve earned the trust of our clients, and hope to earn yours.

We’re on a mission

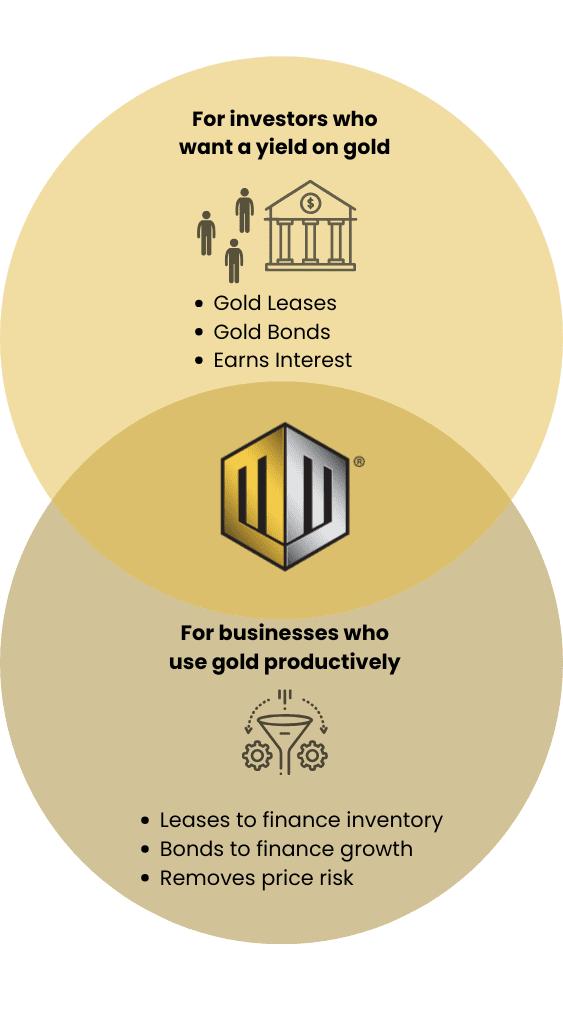

Our vision for the world is that everyone who wants to can save, earn and finance production in gold and silver.

Expert team

Decades of experience from the best and brightest in banking, software, and everything in between, all at your fingertips.

Proven track record

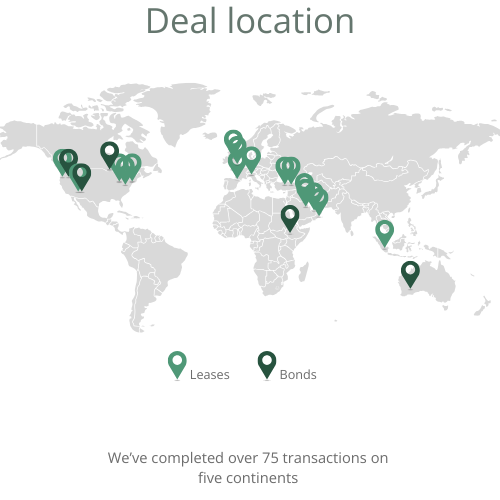

Actions speak louder than words. 74 funded opportunities, thousands of ounces distributed to our clients.

75

Funded transactions across five continents

3.32%

The weighted average return in gold of all active leases, annualized1

6.72%

The weighted average return in gold across all active leases and bonds, annualized2

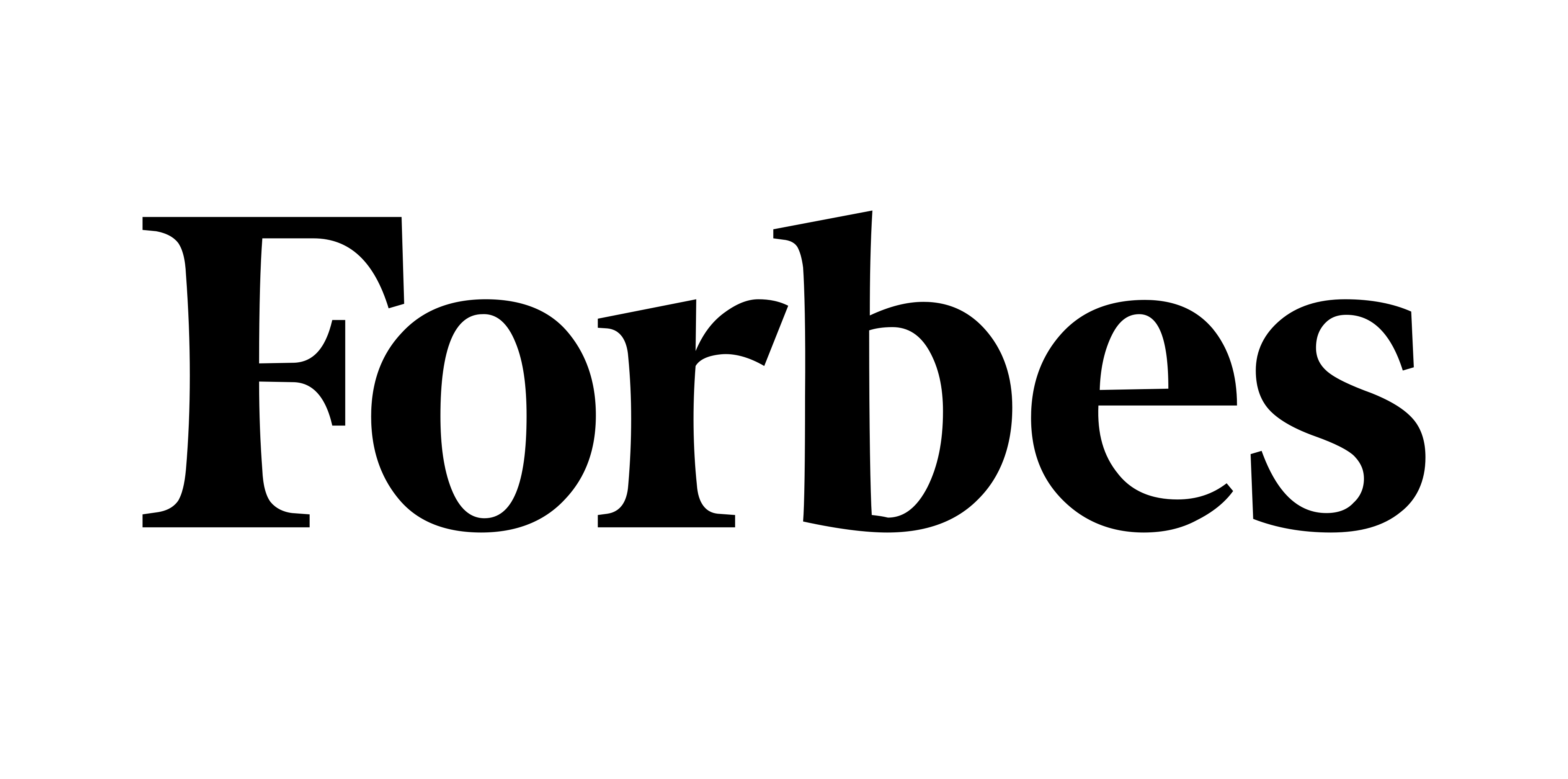

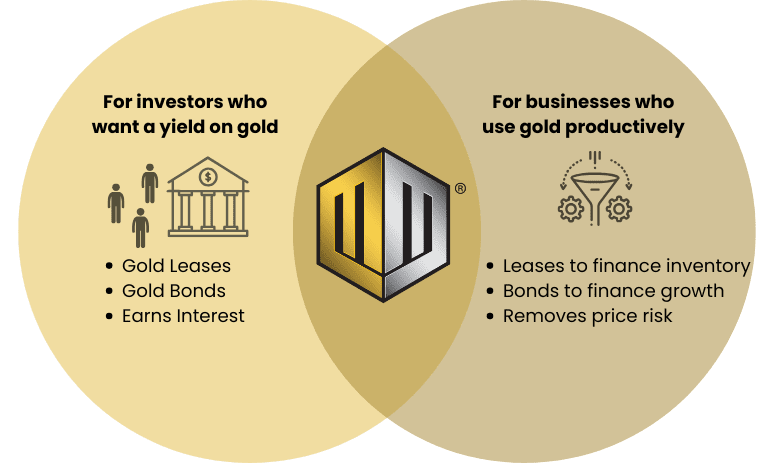

How does Monetary Metals generate a yield on gold?

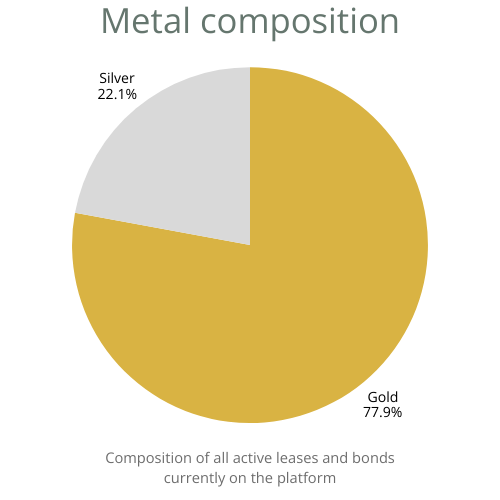

Monetary Metals operates the Gold Yield Marketplace®, a platform for individuals and institutions to earn a Yield on Gold, Paid in Gold® by financing qualified businesses in the precious metals industry. Monetary Metals expert team conducts due diligence on every company before approving them for our platform.

And you always remain in control of your metal. You can opt out of any opportunity you don’t want to participate in.

The Gold Yield Marketplace™

Lease program details

| Key terms | |

|---|---|

| Lease term: | One year (with annual renewal) |

| Metal: | Gold |

| Rate: | 2% to 4% |

| Payments: | Monthly |

| Minimum: | 10oz of gold |

| Lessee/borrower: | Download for more |

| Use of metal: | Download for more |

| Title and ownership: | Remains with investor |

| Storage and insurance: | Free |

| Other considerations: | Limited space available |

Learn more about our lease program

How it works

Monetary Metals by the numbers

It’s important for you to know the business you’re opening an account with. We are committed to honest and transparent communication with our clients. The data provided below is a high-level overview of our product offerings, so you can get to know us better.

Ready to grow your gold?

Start earning interest on gold and silver every month.

1Individual returns will vary, depending on opt-out selections. This number represents the annualized net return on gold to clients invested in all available leases. There are risks to leasing your precious metals, and all quoted rates are subject to lessee, and sublessee performance. Past performance is no guarantee of future results.

2Individual returns will vary, depending on opt-out selections. This number represents the annualized net return in gold to clients invested in all available leases and bonds on the platform. Due to the nature of bonds, part of this return calculation is unrealized. There are risks to leasing and loaning your precious metals, and all returns are subject to lessee, sublessee, and borrower performance. Past performance is no guarantee of future results.