The Federal Reserve’s Zugzwang Position

To listen to the audio version of this article click here.

It’s a funny bull market, this gold thing. Unloved by the mainstream commentariat, who desperately cry “barbarous relic”, and by the bitcoin bettors, who call it an “ugly yellow rock”, its price is now with a hair’s width of the all-time high. $1,905, as this Report is being written Tuesday morning Arizona time.

And this is on the eve of what may be war in Ukraine, with the Fed careening towards a fork in the road at full speed, if not on full tilt. On one side, they force rates higher. This will wipe out the marginal debtor. After rates have been falling so for so long, the margin may be a wide swathe of the economy. Each downtick is a greater incentive to borrow. And also a business case for borrowing to finance projects of ever-diminishing return on capital.

On the other side, those who understand credit—surely some are among the Fed elite—are eying the tightening conditions nervously. The Fed itself, via the excellent FRED site published by the St. Louis Fed, tracks the spread between junk bonds and Treasurys. Not only is the 10-year Treasury yield up to nearly 2%, but the spread is up from 3.0% to 3.74%.

By some estimates, the percentage of “zombie” debt out there is over 20%. Zombies are companies who make less in profit than their interest expense. They couldn’t afford to pay the interest (without borrowing more) even before this latest Fed wild hair. The higher the rate, the more previously-non-zombies become zombified.

In other words, zugzwang. In chess, this is when any move makes your position worse. This describes the Fed’s situation perfectly.

The Dollar Credit Loop

To hold a dollar is to be a creditor to the Fed, or its partner, the Treasury. If you have paper dollar bills, you are directly a creditor to the Fed. If you deposit them in a bank, then you are a creditor to the bank. The bank holds reserves at the Fed, which makes the bank a creditor of the Fed. And the bank owns Treasury bonds, so it is also a creditor to the Treasury. The Fed is a creditor to the Treasury, so the closed loop system is complete.

The dollars may be trapped in this loop—but you are not. You can buy gold, for example (though the seller takes over the dollars, and takes your place in the loop). One owns gold if one does not wish to invest or speculate in anything. This includes holding the Fed’s credit instrument and the Treasury’s credit instrument.

One would think that, as the Fed races towards the moment of either pulling the trigger or pulling back and putting its tail between its legs, that many people would prefer not to invest and not to speculate. And the price shows that some people are making this choice.

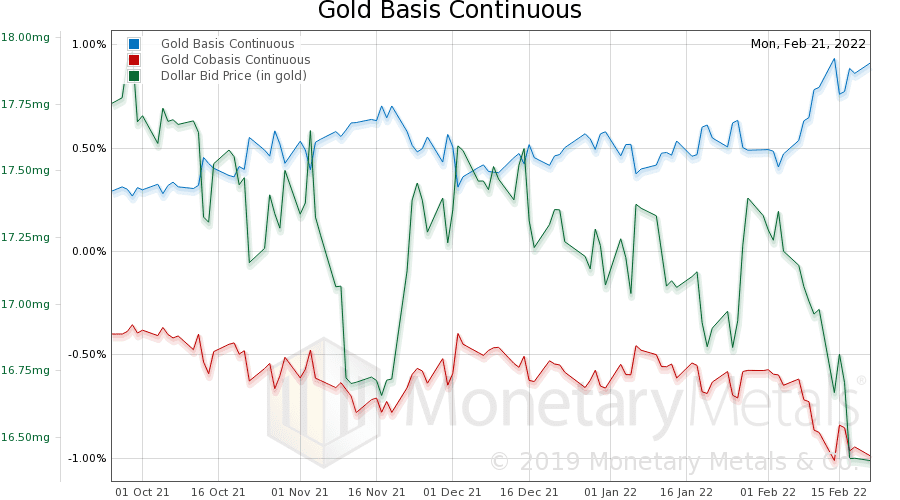

Let’s look at a chart of the supply and demand fundamentals.

This shows that, as the price goes up (shown as a falling price of the dollar, as measured in gold), the abundance of gold to the market rises and the scarcity of gold to the market falls. Since early this month, this trend has been pronounced. The basis has more than doubled from 0.4% to 0.9%.

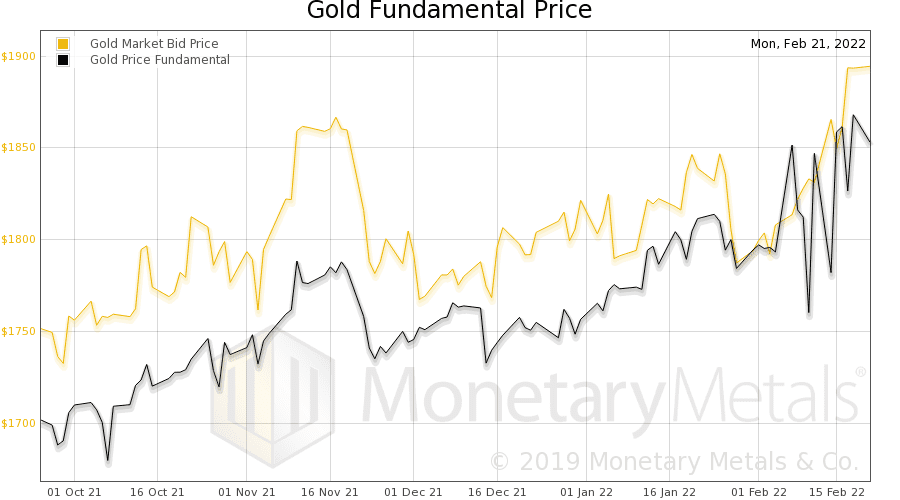

Here is the fundamental price.

The fundamental is very volatile since the start of February. It is a bit hard to read, but seems to be heading higher, though lagging the market price.

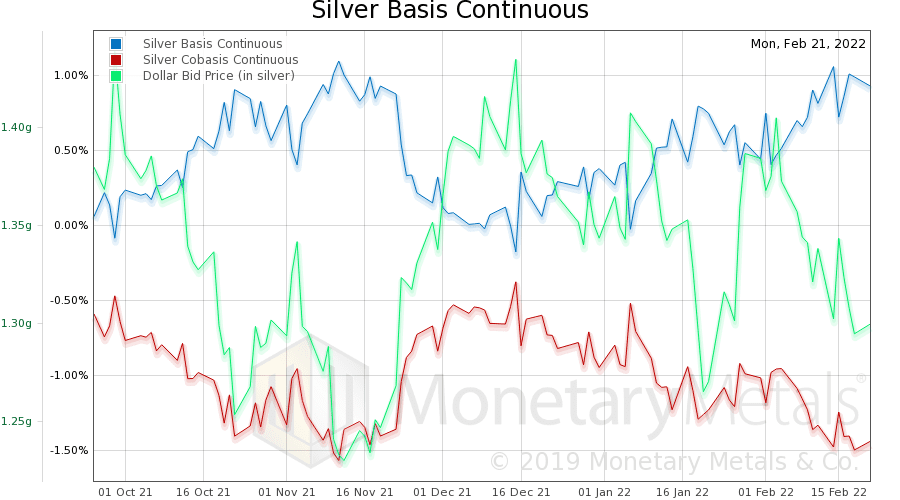

Here is silver.

Silver shows the same picture, with the rising basis visible even from mid-December.

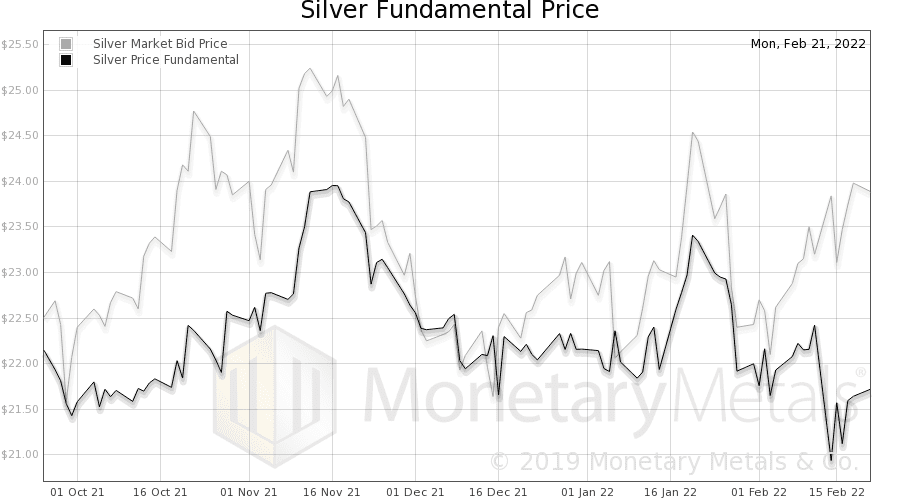

This is the silver fundamental price graph.

That’s a bit different than gold, huh?

Falling since mid-January, though perhaps perking up now. We discussed the reasons for silver divergence in our Gold Outlook 2022 Report.

Leave a Reply

Want to join the discussion?Feel free to contribute!