Gold and Silver Fundamentals Up, Report 28 August, 2016

The dollar exchange rates of the metals fell this week, with that of silver falling more.

Friday’s trading action was notable, because at first markets (including the US stock market) interpreted comments by Fed Chair Janet Yellen as “dovish”—i.e. low interest rates will continue. This means rising money supply, and everyone “knows” that that means rising prices. Especially of assets such as stocks and gold and silver.

But then Fed Vice Chair Stanley Fischer gave reiterated that the Fed may hike rates in September. This means a shrinking money supply, or at least a slow in the rate of growth. Therefore… sell. And the markets dutifully did.

When these gyrations are happening, it’s easy to get caught up in them. However, at the end of the day (literally, in the case of Friday) the falling silver price trend continued. These media appearances do not usually change the supply and demand fundamentals.

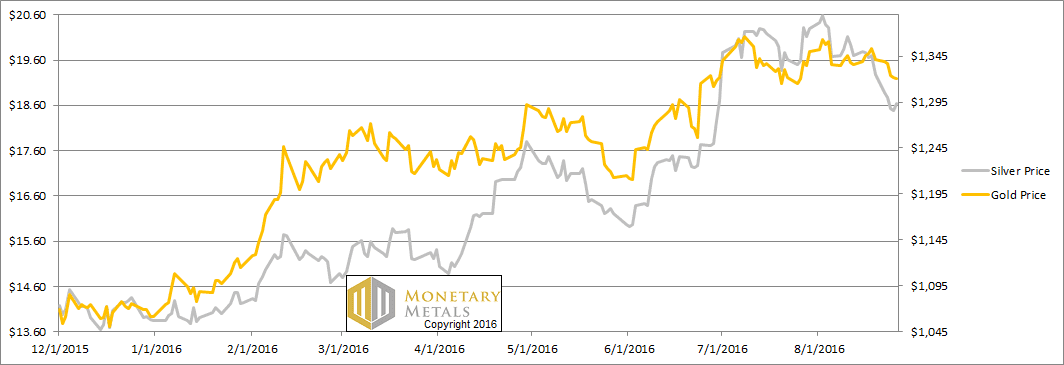

Speaking of supply and demand fundamentals, read on for the only the only true picture. But first, here’s the graph of the metals’ prices.

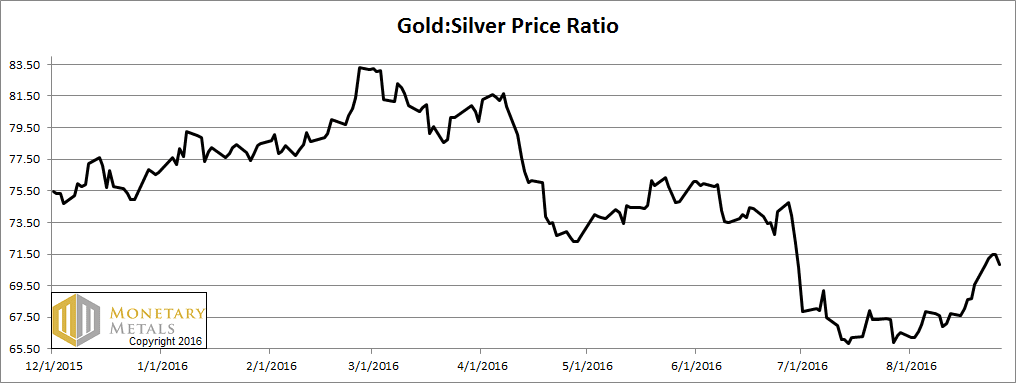

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It rose over a point this week.

The Ratio of the Gold Price to the Silver Price

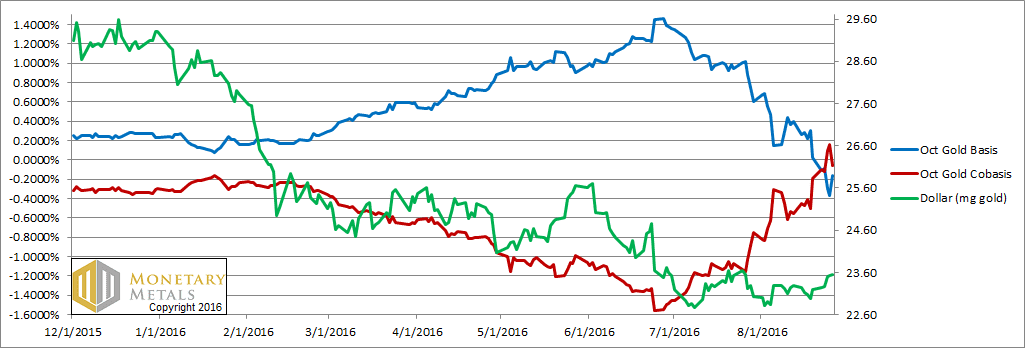

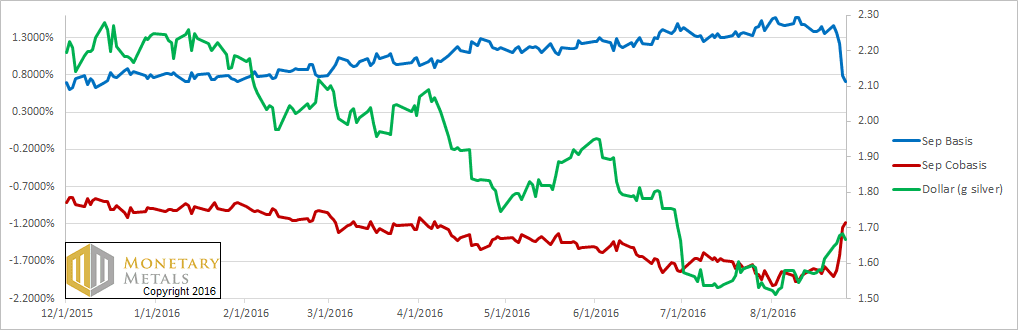

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

We haven’t seen this in a while. The gold basis crossed the cobasis. We actually had backwardation (temporary though it may be, as selling pressure on the October contact has already begun, due to the roll).

Unlike the market price, the calculated Monetary Metals fundamental price was up this week. It’s now 45 bucks above the market, the first time that fundamental > market since April.

The Silver Basis and Cobasis and the Dollar Price

In silver, we now see a big move in the bases, on Wednesday and especially Thursday.

Visually comparing the green line (i.e. price of the dollar, as measured in silver) to the red line (i.e. cobasis, silver’s scarcity measure) we see both rising. That is, the dollar is up (i.e. price of silver is down) and silver is more scarce to the market. This is generally the correlation we expect.

The fundamental price is up to around $17, which at least isn’t as far below the market price as last week.

© 2016 Monetary Metals

An interesting move in silver although, to me, quite an inexplicable move too. This 2 day move takes the fundamental GSR from near 90 to just above 80. What on earth happened? The price of silver didn’t even move very much on Thursday. It must surely take a very substantial amount of physical buying to change the bases like that.

I believe Keith is saying, in so many words, that speculators sold silver futures which is what pushed down the market price – while hoarders (of physical) bought, pushing up his calculated fundamental price.

When we see next weekend’s COT (reflecting data up to tomorrow, Tuesday), I expect to see somewhat of a drop in the Commercial Short positions and the Spec Long positions. It will be interesting.

Good point, TJ. So what did we see with COT?

Despite the dip and the normal long liquidation by specs, we saw a continuation of the recent trend — which is that managed money (hedge funds) continue to buy while smart money Commercials continue to sell. Nothing has changed!

For the record, the really small specs don’t generally have enough money to tip the scales one way or another, unless they act in mass towards the end of a huge run. But since hedge funds are just big boy speculators it’s all the same thing really. The trend following hedge funds serve the same function.

So speculation continues unabated. Traders are “buying the dip” since they are so confident prices will resume their uptrend any minute. What could possibly go wrong?!

Who in their right mind isn’t running for the exits here?

It’s NORMAL for people to sell when prices fall off. So why aren’t they selling this time? Simple: They are so dang sure we’re in a new bull market (I think Keith would say To the Moon!) that they’re actions have become largely Pavlovian.

It’s always hard to know when… but whether now or after another rally (unlikely, imo)

Watch Out Below.

To clarify the first paragraph — I should have added: what “should have been” the long liquidation by specs….(rather) we saw a continuation of the recent trend…

Asian gold demand is picking up, in particular price discounts in India are reducing:

http://in.reuters.com/article/asia-gold-demand-idINKCN1110Q3

Everything I’ve seen so far suggests the model’s work is like a moving average — delayed. It reflects the delayed effects of lingering bullish or bearish psychology well after the fact.

When the market was in free fall last year the Fundamental eventually caught up (or nearly so) but only near the end of the bear move. Now it appears investors/traders are influencing the basis, etc, in a bullish fashion towards the end of the bull move, i.e., in that we’ve seen the Fundamental make great strides UPwards… but only after the market has peaked and ready for a major fall. In other words, just because Fundamental has increased lately, (otherwise) I don’t see a reduction in the “danger” signs mentioned last week as declining.

Doesn’t mean we can’t use the model… just that the information offered by it might well be lagging rather than leading. Truth is, the model may still work wonderfully for the GSR for which at least part of it was intended. Will let Keith address that if he chooses. (Of course, we first have to see a major decline into year end to see that I was right about this. But in th end I refuse to see how the market can rally substantially when trend followers (again, hedge funds) have their largest position in history. Has no historical precedence)

But I’ve wrong before!

My .02

@rowingboat, thanks for the link.

Perhaps the Indian silver jewellers, who were already waiting in the wings ahead of the festive season, jumped in on Thursday after seeing the price dip on Wednesday.