Gold and Silver Get Powelled, 27 Oct 2017

On Friday’s “Powell Spike”, somebody thought Powell would be good for gold. The price rallied four bucks in a minute, and then another three bucks within 8 minutes. But who? Was it stackers loading up on coins, prepping for inflatiocalypse? Or was it speculators loading up on leverage, betting on futures?

And how can we tell which is which? Think of the futures market tied to the spot market via a spring. As speculators push up futures, the spring pulls up the price of metal in the spot market. But the tension on the spring increases.

The basis is the measure of the spring tension.

Here is a chart showing Friday’s action (times are GMT).

That tight correlation shows that the action was driven in the futures market. The tension in that spring increased with each rise in price, and was relaxed with each dip. This is the fingerprints of unchanging fundamentals, in the face of hot action in the futures market.

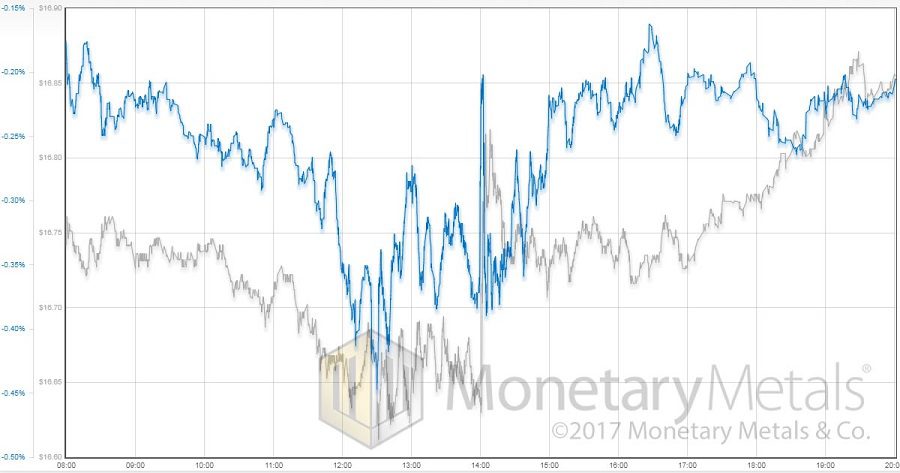

Here is the intraday action in silver.

There is less correlation than in gold. The major features are there, drop in basis with price decline in the London morning (that’s wee hours for those of you in the Western part of America). Then after a spike in volatility as the price shoots up for Powell (about 20 cents), the basis goes back to where it had been and keeps rising further. All that buying of futures was not enough at first to move the price of silver any further. But eventually it worked, and the price gets up to a high of about $16.87.

This is not the pattern you want to see, if you want significantly higher prices of the metals.

© 2017 Monetary Metals

Leave a Reply

Want to join the discussion?Feel free to contribute!