Gold is a Giant Ouija Board, Report 25 Feb 2018

We have been promising to get back to the topic of capital destruction, which we put on hiatus for the last several weeks to make our case that the interest rate remains in a falling trend. Today, we have a different way of looking at capital destruction.

Socialism is the system of seeking out and destroying capital. Redistribution means taking someone’s capital and handing it over as income to someone else. The rightful owner would steward and compound it, not consume it. But the recipient of unearned free goodies happily and uncaringly eats it up. Socialism is not sustainable. It inherits seed corn from a prior, happier system, and it lasts only as long as the seed corn.

Totalitarian Socialism

There are different flavors of socialism. The 20th century witnessed an aggressive totalitarian form. Both communism and Naziism feature military occupation of domestic territory and conquest of foreign lands. Few people willingly feed whatever they have into the sausage grinder of State sacrificial collectivism. And so totalitarian socialism has armed thugs all over the streets, both open military and secret police. There are frequent killings, of those suspected of disloyalty or holding back small scraps. In their constant fear of uprising, they use disappearances, interrogations, and torture to root out the names of traitors to their bloody revolution.

Thankfully, the major totalitarian socialist regimes were defeated militarily like the Nazis, collapsed after they depleted all available capital like the Soviets, or reformed like China.

Soft Socialism

Another flavor of socialism is based on so-called soft power. It taxes and regulates every private productive activity, owns and monopolizes some sectors, and promises a minimum level of subsistence to all citizens including food, shelter, and medical care. Unlike the totalitarian forms, this kinder, gentler socialism allows vigorous debate whether the government should criminalize cigarettes, allow people to hail a taxi using an app on their phone, and whether the government should include gender reassignment surgery in the list of medical services to be provided for free. However, as the citizens have mostly gone through government schools, there is almost no debate about whether or not government should take over medical care in the first place.

This kind of socialism is not stable. It is either moving towards freer markets, as for example New Zealand famously did starting in the 1980’s. Or it is moving towards government control as the United States infamously did with Obamacare.

It’s not stable, because it is rife with contradictions. For example, if I cannot afford my healthcare, and you cannot afford your healthcare, and John and Susie cannot afford their healthcare, then of course we as a collective cannot afford our collective healthcare plus a bureaucracy to manage it (not even counting the waste and corruption). No one with basic economic literacy would believe that. An 8th grader wouldn’t believe it!

What makes it popular is the next contradiction. Most people expect to get free health care paid for by someone else. The thought of “free” is so enticing, that people overlook the obvious failings, such as the declining availability and spotty quality.

In this flavor of socialism, the destruction of capital is obvious. You can see it in the overworked staff of the National Health Service unable to care for every patient and forced to ration health care and cancel surgeries. You can observe the shabby government projects which house huge and permanent underclasses. You can witness the stagnant economies, which provide little opportunity for business owners to accumulate wealth, fewer good jobs for workers, or hope for the future.

Central Bank Socialism

There is a third flavor of socialism, which was unfortunately popularized by Milton Friedman. He did not see it as socialism, but as we shall show it certainly is.

This type of socialism lacks the totalitarian flavor’s military officers, strutting about and demanding to see your papers. It also lacks the boundless welfare programs and endless Ministries of Micromanagement of Human Life of the softer flavor.

I refer, of course, to central banking.

Friedman advocated a steady expansion of the quantity of dollars, what he called the K% Rule. Friedman’s followers today favor other rules, for example to expand the quantity in order to grow GDP by what they feel to be the “right” amount. The man most people think to be Friedman’s diametric opposite, John Maynard Keynes, advocated expansion in response to whatever economic problem may come along. Former Fed Chair Janet Yellen, a diehard New Keynesian, wrote a paper in which she argued for printing more dollars—to enable employers to hire more workers.

Whether the central bank is to expand the quantity of dollars at a steady rate, to achieve an economic goal, or purely at the discretion of philosopher-kings, the principle is the same. We consider them to be sub-flavors of the same flavor of socialism. The central bank can nudge us for our own good, if not the good of politically connected cronies.

What is this nudging? They have found a very clever way to induce people to do as the central planners wish, without the machine guns or bloated bureaucracies. Keynes, citing Lenin, referred to “engaging all of the hidden forces of economic law”. In the same breath, he admitted that it was “on the side of destruction,” but that does not seem to have deterred anyone.

What economic law induces people to act? It’s that people act according to incentives. The central bank can change certain incentives. We will leave off the falling interest rate for now, but let’s look at something else the central bank can do.

It can make it so that credit is available to companies who don’t even produce enough revenue to cover their interest expense. Normally, such zombies (as they are called) would not be able to obtain credit. Who lends money to a company that will have to borrow more money just to cover the interest? But we are not in a normal world. We are in the third flavor of socialism.

And the Fed has made it so that the zombies, who ought not to be able to get credit at all, have gotten mass quantities of it. And this brings us back to our theme of destruction of capital.

It should be obvious that it’s destructive to feed credit to a company which cannot pay its cost of credit (and this is in a world of suppressed cost of credit, at that). Zombies wear out machinery that they cannot replace, and pay workers’ wages with borrowed funds that they cannot afford. When the end inevitably arrives, those who lent to the zombie lose their principal.

It should also be obvious that zombies add to GDP, at least while they exist. So the GDP targeting crowd sees this as a good thing. And zombies produce goods, thus increasing supply and thus pushing down prices. So the inflation targeters justify even more of the policy that feeds credit to zombies. And zombies employ people, so the unemployment optimizers see the policy as good. Stock prices are also rising, so investors see it as good, not to mention Wall Street.

By every conventional macroeconomic aggregate measure, feeding credit to zombies is a Good Thing. This is not an argument in favor of lending to zombies. It is an argument against using conventional macroeconomic aggregate measures. They are misleading.

Nudging

However, they’re used for a reason. They provide cover to this third flavor of socialism, for the central planners who nudge us down the socialist road to the destruction of capital.

So how does this nudging work? What is the form of the incentive? They make it profitable to fork over your capital to zombies. People like to make a profit. Who would have known?

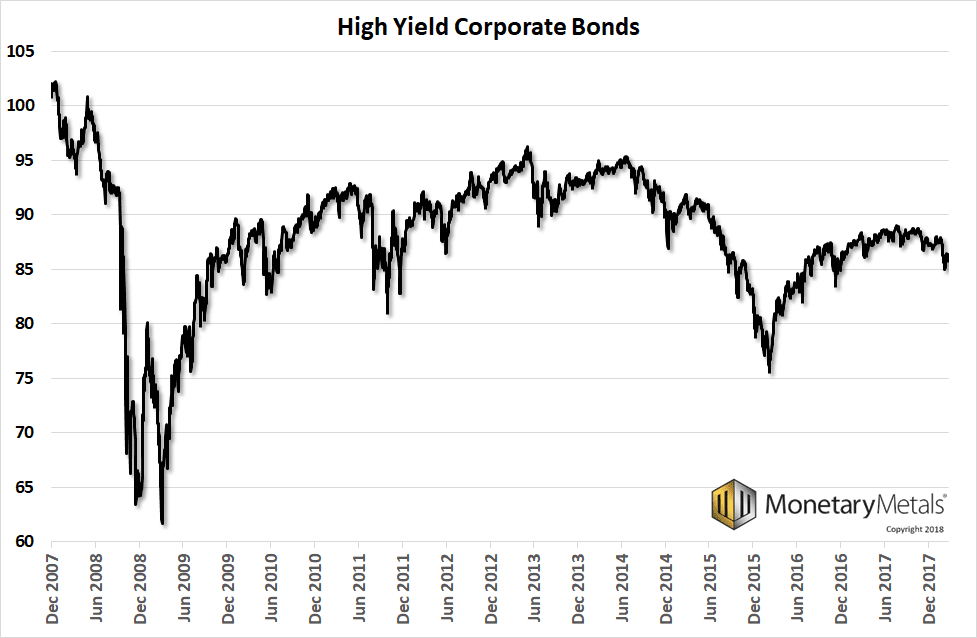

Here is a chart of an ETF which owns high yield corporate bonds, presumably zombies among them.

If you bought in the lows after the last crisis, you could have made capital gains of over 50% in four years (not counting the yield). After that, well it’s not looking so good. However, there is another trade that is still making money. At least for now. Here is a graph of the spread between junk and Treasury bonds (the BofAML US High Yield Master II Option-Adjusted Spread).

There is currently only a 3.5% difference in yield between junk bonds and Treasury bonds.

The way to have played this was to buy junk and short Treasurys. The more this spread narrowed, the more you won. It performed brilliantly until mid-2014. Then you wanted to be out of it until 2016. After that, you had another good run until a month ago.

We think this trade won’t be so good going forward. Not because it’s within a point of the all-time bottom. Though it is, and one would have to be worried about that. But because zombies are time bombs waiting to go off. With each passing day, they get closer to blowing up. Don’t forget that they are destroying investor capital, and piling up more debt every day. And also, they get closer to blowing up with each uptick in the interest rate. It looks to us like junk bond yields have been in a rising trend for about half a year. LIBOR has been in a rising trend for three years, steepening considerably since September.

Lured by profits, investors are feeding capital to zombies, who destroy it. They do it because the Federal Reserve has made it profitable to do so.

Keep in mind that employees of zombies buy houses, remodel kitchens, buy cars with 0% financing for 72 months, eat at restaurants, buy Swiss watches, etc. One could look at the major creditors of the zombies and their biggest vendors, and predict the impact to those entities. But beyond that, it is impossible to determine the full impact. The problem has grown very big.

Contrary to Milton Friedman, we argue that a central bank brings a flavor of socialism. The means may be different, but like the other flavors, the central banking flavor seeks out and destroys capital. The capital destruction is less obvious, especially if you look only at conventional macroeconomic measures such as GDP and unemployment. You must look at falling marginal productivity, or the rising number of people who are neither employed nor unemployed.

We need to evolve away from central banks, socialism, and a policy of capital destruction. We need to move forward towards the gold standard, the monetary system of a free market. The monetary system where capital is accumulated, not consumed.

Supply and Demand Fundamentals

The prices of the metals fell, $22 and $0.24 respectively. It’s an odd thing, isn’t it? Each group of traders knows how gold “should” react to a particular type of news. But they all want the same thing—they want gold to go up. And when it doesn’t, many hesitate to buy. Or even sell.

This is why speculation cannot set a stable price (I’m talking to you, bitcoiners).

So long as gold’s sole purpose is to bet on its price to make real money—we’re talking dollars here, baby!—then the trading action is like a giant Ouija Board, with each group having a thumb on it. You have the Indian jewelry buyers, the inscrutable central banks like China, the Wall Street firms, the gold bugs, the hedge funds, etc. When enough of those thumbs desire to push gold in the up direction, it goes up.

Of course this isn’t gold’s purpose, but that’s what is commonly believed.

It is endlessly fascinating as it is endlessly moving around, if not in the directions and for the reasons that gold analysts think. This is the dynamic we study, the interplay between buys and sellers of real metal, buyers and sellers of futures, and market makers. Many gold analysts see only the short futures position of the market makers, and conclude that they are pushing the price down. The long metal (or gold receivable, e.g. from a miner) is not reported in the Commitment of Traders report). So they misread the market. Plus, a quantity approach to position size (as with quantity of dollars or anything else) does not tell you much.

Let’s take a look at the only true picture of the supply and demand fundamentals for the metals. But first, here is the chart of the prices of gold and silver.

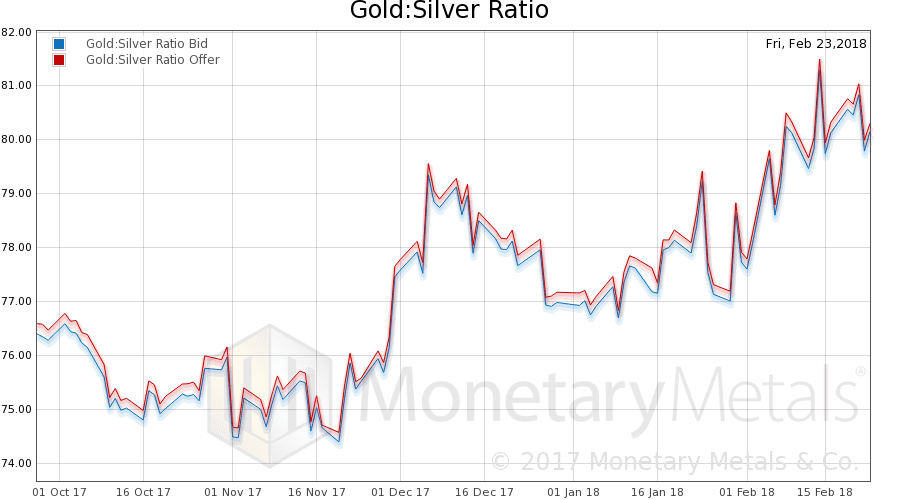

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). The ratio fell slightly.

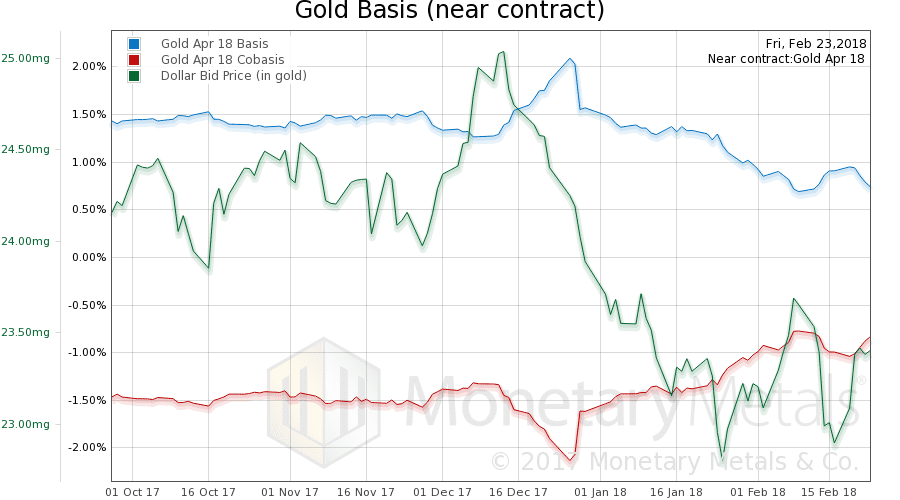

Here is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price.

Note that tiny rise in scarcity (i.e. cobasis, the red line) as the price of the dollar rose (inverse of the falling price of gold, in dollar terms). That is the typical pattern.

The Monetary Metals Gold Fundamental Price fell this week, to $1,387. Now let’s look at silver.

The same occurred in silver. The Monetary Metals Silver Fundamental Price fell 7 cents to $17.12.

Interestingly, the Monetary Metals Gold Silver Fundamental Ratio fell in a week when the fundamental prices of both metals fell. It is now 81.05.

© 2018 Monetary Metals

17 responses to “Gold is a Giant Ouija Board, Report 25 Feb 2018”

Leave a Reply

You must be logged in to post a comment.

Ive briefly scanned this weeks essay but feel that i must add this comment. National socialism in germany in the 1930s was not consuming capital prior to ww2 it was a society based labour prior to payment nearer to Adam Smith’s real bills doctrine.

Germany had no gold after the verseigh agreement. Germany was regenerated through popular uprising which stopped speculation (consumption) in favour of productive enterprise

china has joined in the with the west, in fact the west is consuming chinas capital and i would hardly call that a reformation, more a capitulation.

It’s one of the reasons they invaded neighboring countries. The quest for fresh loot.

Re China, I meant that it is no longer (for the most part) the murderous military officers strutting down the street, and secret police disappearing people totalitarian socialism. It has morphed to a large degree into the soft socialism flavor..

Keith take look at this im sure you’ll findit interesting https://youtu.be/P2TRFwCUthI

Thanks for replying to my comments

They did not invade neighboring countries “for fresh loot”

The lower interest rates go, the more capital can exist. Low interest rates mean that there is an excess of capital that has to be sustained by consumption. And only lower interest rates can make that happen. Crashing the system by raising interest rates, interest rates is not attractive so interest rates may go negative during the next recession. After that they may remain low and negative in countries that have stable currencies and low deficits. How that might work out you can read here:

http://www.naturalmoney.org/short.html

How can capital be sustained by consumption.? this is two sides of an equation the sum total of which is either positive or more likely negative.

Low interest rates under an irredeemable currency do not mean that capital is abundant. And I must emphatically state that there is no such thing as an “excess” of capital.

Keith please write a book.

Your understanding of economics is unique.

I have looked for it or them all over with no luck

Thanks

Fernando

Thanks for your kind words. I will write a book one day. But today is not that day! :)

PREMISE:

Medical service providers are just that, service providers. In that regard, doctors are no different in the market than automobile mechanics. Automobile mechanic income depends on the average income of car owners. Doctor income depends on the average income of patients. Every country, though, has figured out some way to pay medical service providers more than automobile mechanics so that the poor get some access to the care only the rich can afford and to minimize public health risks affecting all classes. Calls in the USA for market-based reforms to the health care affordability problem conveniently overlook this basic fact. This is not surprising considering the oligarchic trends within the US economy since health insurance became popular after WWII.

Instead of floundering in our traditional economic cynicism we could instead, like every other developed country in the world, undertake simple reforms to keep health care spending down to a reasonably low percentage of GDP . No constitutional roadblocks exist.

SUGGESTED REFORMS:

1. Lower the Medicare start age to 55. This would most efficiently remove the most difficult to insure group from the suggested reform process that will be undertaken by each individual state (as suggested at item #4 below).

2. Simplify the Medicare benefit structure so that there is one simple annual deductible for all parts of Medicare (A,B,and D) based upon a progressive income and asset test; and re-structure the Medicare Part B premium so that it is also based upon a progressive income and asset test.

2.1 Make Health Savings Accounts (HSA) available to anyone on Medicare who still has active employment income regardless of the size of their new Medicare annual deductible and also regardless of the structure of any employer benefits. People will be able to draw on tax-free HSA accounts to pay these deductible amounts.

2.2 A unified income and asset based Medicare deductible would eliminate the need for Medicare Advantage, Medicare Supplement, and Medicare Prescription Drug plans; saving the government and consumers hundreds of billions year in and year out. This would also stop the national torture due to complexity perpetrated upon our seniors.

2.3 Some percentage of current insurance workers could be leased by current insurance companies to the government during a transition phase, while those losing their jobs would get unemployment assistance.

3. Make Medicare the primary payor when coordinating with large employer group plans as it is for retiree plans and small groups today so that large employers would feel encouraged and justified to offer an option to employees to forgo actual coverage in exchange to a company contribution to a HSA.

4. For everyone through age 54 each state individually or in concert with other states could adopt some form of the proven models provided by other developed countries. Large states, who have larger populations and economies than many model countries, have the tax base and economies of scale to easily set up such model systems. If smaller states run into difficulty they can join together with other states, whether regionally proximate or not, to adopt models that work best for them as a group.

POLITICAL AND ECONOMIC FACTORS:

I believe these reforms could be politically viable because they feed into hot button issues of both the right and left. I know “Medicare at 55” is not as powerful a political phrase as “Medicare for all”, but the Medicare for All placards usually also have the catch phrases “Love it” and “Improve it”. But Medicare at 55 could be an attractive compromise since almost no right wingers would suggest doing away with Medicare so implicitly they approve of it and thus extending that approval down to age 55 to preserve the “free market” of healthcare ideas at the state level is a position right wingers could support. The left would be thrilled by the income and asset based unified Medicare deductible so they would feel like they got some extras in terms of love and improvement for Medicare. Right wingers in red states would like the individual state control aspect and enjoy pushing for a return to a cash-based system for the poor and concierge plans for the wealthy; while socialists in blue states will enjoy pushing for public options. Large employers will like having most of the claims of the over 55 group removed from their plans. They will like it even more when the wide establishment of public state plans makes it unnecessary for them to bother to provide health insurance at all. Leveraging the benefits that large business will enjoy into the reforms makes it easier to build political consensus since big businesses are large political donors. Ultimately the state plans that best satisfy consumers, medical service providers, and taxpayers will also best compete for doctors and businesses. Red, blue, or purple then; each state should be able to build an adequate plan.

Though insurance companies would be able to offer policies that would cover or lower the unified Medicare deductible, most people would find it simpler and more cost effective to just save most of the premium instead in an HSA . Most middle-income people would have relatively small deductibles and thus would be willing to devote some savings to such an emergency fund. I could imagine most banks/insurance/brokerage companies offering HSA accounts that pay higher than market returns simply as an inducement to use the other services of the company.

Even though big health insurance companies would probably have an advantage over smaller firms as they find a way to profitably downsize to basic employee leasing enterprises that provide administration services to Medicare and the state model plans; they, like all companies in the healthcare market, would be faced with the need to either adapt or die. I believe the big companies seeing the writing on the wall would actually support the reform process since they would be in the best position to morph into profitable survivors of the process.

Big Pharma…well big pharma would take a hit, but so be it…they will just have to deal with bulk discounted sales to Medicare and the state plans who in turn can just have the discounted drugs fulfilled through the existing pharmacy outlets.

Had to chime in here about healthcare. As a physical therapist assistant I have worked in acute and subacute settings. Eliminate the addictions of sugar, alcohol, fried foods and drug abuse from society and reduce the number of people in hospitals and on pharma drugs by AT LEAST half.

I apologize to Keith as well for sending this comment thread on a tangent into healthcare, but healthcare due to the reasons I mentioned in my premise is a bad topic to use to bash socialism. Almost no one when confronted with the realities of a pure cash-based medical system will choose that over some degree of socialized medicine.

As to your comment; I agree with it absolutely! Limiting my net carbs to 30 grams/day has been great for my health. I lost 60 lbs in 6 months (from 250 to 190). I didn’t miss beer, but one of these days when I have a full day of physical activity scheduled, I’m going to eat a whole watermelon in a day and nothing else…enjoy a sugar high, but burn it off while there is nothing else in my blood stream. Sure, I’ll drop out of ketosis for a few days after, but I’m willing to pay the price since I do miss watermelon!

Michael: when push comes to shove, almost everyone will promote socialism in every market. The stated reasons are different, but at the end of the day the essence is the same. It’s a magic pot that produces more food than you put into it. Or at least enables the average voter to get free goodies. Plus the other side is making those damned rich people pay according to their ability…

I just want to add something. I do not “bash” socialism. In the way that a doctor does not bash cancer. I see my role is to study the pathology and make a diagnosis.

1. Last week there was a feature interview with Jeffrey Snider on Macrovoices.com podcast. They discussed gold lending / leasing and its use as a collateral and the how that affected price during certain periods. Would be interesting to learn what is your take on that. As well would be great to hear you in their podcast. Your work deserves larger audience.

2. About socialism. It is not a bad idea per se -in a pure form. They were just early ~100-150 years. With the current level of automation there will be needed some form of socialism.

The examples you listed are distorted forms. They were mostly totalitarian, brutal and aggressive, because the world of capitalism (inside and outside) was fiercely fighting them. I am not defending their brutality, but we need to compare apples to apples.

I lived through last years of Soviets socialism. My parents recall 70s and early 80s as good times. They had free and pretty decent education and health care, worked reasonable hours, had enough of vacation time and were not stressed to pay bills. They had some savings and didn’t have any DEBT! (my grand grand parents were destined to be peasants forever with no choice of other life – that’s why i am partially biased here)

It took Soviets few decades to get there and they had devastating war on their territory, famine and so on. They lasted 70 years with no outside financing and outside trade limited to commodities only. Living by their means. They build infrastructure, roads, mines, plants… from scratch. In early years they paid for technology and machinery from the west with grain and gold. At the end they couldn’t keep up with the West in arms race and stupid (they say existential) external wars in Vietnam, Korea, Afghanistan and “promoting/supporting” other socialist countries around. They mostly got behind financially from Western rivals – you guessed it – after 1971, when gold standard was abolished and free fiat financing helped to borrow from the future and boost capitalist world in the following decades. Who is going to pay for that and how?

Name me any capitalist country that can survive with no financing and outside trade for 70 years. Not talking about defending themselves. I don’t know any. Smoot–Hawley just raised barriers to trade – didn’t eliminate it completely – and what followed – Great Depression with WW2 following.

“It is not a bad idea per se -in a pure form”.

Two quotes from the law “Each of us has a natural right — from God — to defend his person, his liberty, and his property. These are the three basic requirements of life, and the preservation of any one of them is completely dependent upon the preservation of the other two”

.”Slavery, restrictions, and monopoly find defenders not only among those who profit from them but also among those who suffer from them.”

You seem to be the latter.

Propaganda works most people are brainwashed.