Gold Outlook 2023 Brief

This is a brief preview of our annual Gold Outlook Report. Every year we take an in-depth look at the market players, dynamics, fallacies, and drivers of markets, and finally, give our predictions for gold and silver prices over the coming year.

Click here to download a free copy of the full Gold Outlook Report 2023.

2023 begins with global markets on precarious footing. Last year the Federal Reserve raised interest rates faster, and higher, than at any point in recent history. And by all accounts, they aren’t done yet.

How much longer can they keep it up before markets start to buckle under the strain? What other major movements should investors be looking for in 2023? And where do we think gold and silver prices will go over the coming year? We tackle those questions and more, but first, a review of last year’s price calls.

A Review of our 2022 Price Calls

Last year, we said that the markets are at a crossroads, waiting for a political (hence unpredictable) decision: whether the Fed will hike rates as they had been promising, or not.

Well, they hiked.

We said that in the hike scenario:

“If asset prices go over the cliff as in 2008, then the price of gold will go down less. And stay down for a briefer moment.”

Well, asset prices dropped if not necessarily fell off a cliff yet. And they have yet more to drop, especially likely in residential real estate.

But what did gold do?

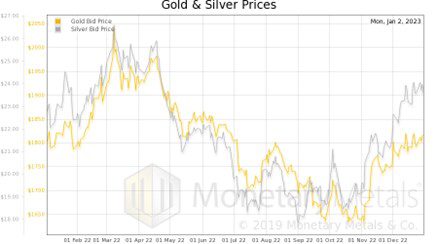

Its price went from $1,803 to $1,816. That is, it essentially did not change. At least by the end. It first rose to well over $2,000 before beginning a long drop to just over $1,600. And finally, a sharp rise back to even.

The price of gold, in dollars, is merely the mirror of the reality which is that the dollar has a value in gold (and when that value goes to zero, the dollar is done, like a steak kept under the broiler for three hours).

In other words, the dollar gyrated around wildly but held its value (because there are so many debtors, who owe so many dollars, desperately bidding on dollars to service their debts). The other currencies fared more poorly.

Anyways, back to our prediction a year ago. The price of gold held. Not only is gold unloved by the mainstream, or even much of the alternative assets community. But we had a year of desperate scrambling for dollar liquidity. Yet something extraordinary happened.

The selling of gold by people desperate for cash to avoid defaulting when liquidity is declining was matched by the buying of people seeking a refuge from declining credit quality.

We did not have the epic bull run that many in the gold community predicted. Nor a crash. We had some volatility, but the gold price held in the end.

Regarding silver, we said:

“If the crisis metastasizes, there could be a big drop in the silver price. And a big rise in the gold-silver ratio. 120 is not out of the question.”

Well, the crisis did not metastasize. So far, at least, the Fed has managed a so-called “soft landing”, causing bond prices to drop and hence prices of other assets without a 2008-style crisis.

And the price of silver not only held up, but rose about a dollar an ounce.

We also said two interesting and controversial things. First, many people view gold as a hedge for inflation—rising consumer prices.

“it is not necessarily true that the dollar price of gold keeps up with consumer prices.”

As we have written (here, here, and here) there are many nonmonetary forces that push prices up. To name a few: regulations, lockdown and whiplash, green energy restrictions, trade war and tariffs, and Ukraine war. These do not necessarily affect gold.

And there is an empirical demonstration of this. As of the time of this writing, the Consumer Price Index for December is not out, but as of November, prices are up over 7% (we assume December won’t change this much). If the gold price had moved up 7%, it would be about $1,930 at year’s end.

Our second comment was:

“There is not a direct correlation between the interest rate and the price of gold.”

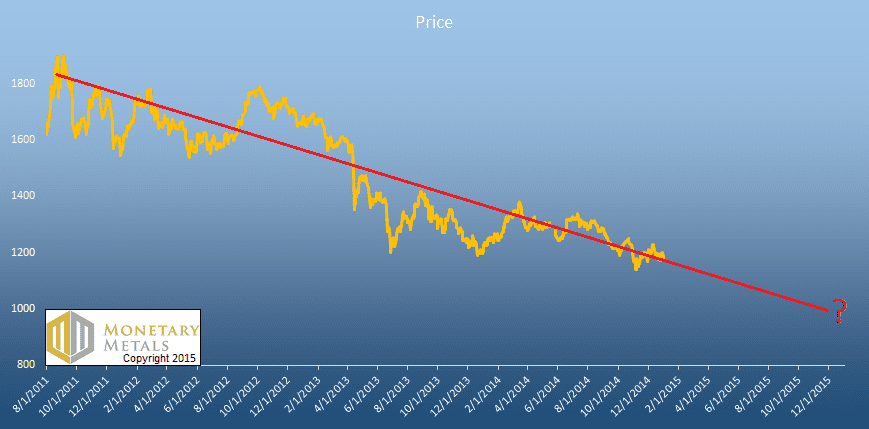

This is a link to a previous Outlook Report, showing the fact that the price of gold rose with the interest rate through 1980, then sagged during the falling rates of 1980’s and 1990’s, then skyrocketed during the falling interest rates of the 2000s, then fell with the falling rates of the 2010’s.

Some gold permabulls want to convince you that rising rates are good for gold, and of course permabears portray it as bad for gold. And they’re both wrong. There is little correlation over the long term.

And yes, we also looked at so-called real interest rates. Ironically, the actual rate at which actual lenders actually lend to actual borrowers is airily dismissed as the nominal rate. And a theoretical calculated rate—based on a consumer price index that even proponents dispute–is called the real rate. Economics is one helluva science! In what other field would such methodology be used? Anyways, so-called real rates don’t correlate with the gold price either.

Macroeconomic Conditions for 2023

Every year, we discuss macroeconomic conditions and how they’re likely to influence global markets, and what conditions, if any, will drive precious metals prices.

Last year, we started our economic assessment with this gem:

“One of the fundamental fallacies of socialism is that it does not admit production is conditional. In order for you to be able to buy goods, or get paid to do a job, many things have to occur first. An inventor needs to invent the product. An entrepreneur needs to organize a business. Then the business has to raise capital from investors, and later, lenders. It has to hire people (perhaps you). It has to produce the goods. Then distribute them. And finally, sell the goods to you.”

How is an entrepreneur supposed to organize and plan a business—much less raise capital—when the central planner of credit, AKA the central bank, is busily trying to distort the value of the monetary unit? Much less when it is busily jacking up the costs of doing business, by hiking the cost of capital?

Well, the answer is often that he can’t. Now we are seeing many startups laying off employees whom they had recently hired. Some are shutting their doors forever. Their cost of capital has skyrocketed—if they can raise any at all. Even large, established companies like Macy’s recently announced store closures. They may be able to raise capital, or they may have cash on the balance sheet (Macy’s had over $7B as of October). But why put it into a low-return business such as the marginal retail store when they could put it into T-Bills at nearly 5% with no risk and no headaches?

In 2022, it was not just central banks whose politicized decisions obliterated economic planning. For many years, Europe has been banning the use of energy sources that work, such as oil, coal, and nuclear. Instead, they have been pursuing energy sources that are unreliable such as wind and solar (solar is particularly questionable for extreme latitudes (Berlin is 52 degrees N Latitude).

Europe has fallen, by default, into dependency on natural gas. And due to geopolitics, that natural gas came from Russia. Which they now cannot buy. Thus, the price of energy skyrocketed. And the prices of all things made from energy (if energy is even rationed to those manufacturers at all—a whole ‘nother politicized decision-making process, by other central planners).

When you look at it this way, you can see why such price moves do not apply an upward force on the price of gold. The root is nonmonetary. It is a bunch of regulators spoking the wheels of those who would produce. Goods become scarcer, and society is generally impoverished.

The Fed is now ten months into a rate-hiking purge, which follows a zero-interest rate binge lasting well over a decade. It, along with its apologists and its critics alike, think that the result will be lower prices, because reduced quantity of money.

Does it work this way? Maybe, in the short term, there will be lower prices. But what about over the longer term? What are the economic consequences of the Fed’s rate-hiking purge?

For the rest of our Macroeconomic Analysis for 2023, Download the full Outlook Report

Bitcoin and Cryptocurrencies

What Gold Outlook Report would be complete without at least a word on the so-called “digital gold?”

We are not going to reiterate our previous discussions of the economic, social, and technical problems of bitcoin. Interested readers can click here to visit our repository of articles over the years.

We will mention just one new thing. Keith has been saying since 2012 that no one can borrow bitcoin. To do so is to have the value of one’s debt go up a thousand times (proponents certainly promote price targets higher than that, even). Imagine your monthly home mortgage payment going up from $1,500 to $1,500,000. You would be ruined.

Then so-called “yield farming” came to the market. Smug bitcoin advocates said “See! See!” What they missed, is now obvious. These schemes did not make their yields (or alleged yields) by financing any productive enterprise. They were self-fulfilling, self-referential schemes that basically amounted to borrowing to lever up to buy more crypto. When the price of crypto coins fell, these schemes blew up.

The crypto space is pervaded by a get-rich-quick mentality. But, while the retail speculators—and some prominent institutions—were betting they’d get rich, they ignored something. The firms formed to exploit the demand for all things crypto also held the same ethos.

When a financial institution is formed to get-rich-quick, too often it looks like FTX. This firm had no internal systems, much less controls. Who cares about such things when you’re becoming a billionaire overnight?

We certainly would not bet that there is not another (or several runs up in prices). But we can say with certainty, the sheen is off crypto as an asset class.

It’s all over but the crying.

Our Price Calls for 2023

Last year, we had the great uncertainty of whether the Fed would follow through on its mad promises to hike rates. We got clarity on this (they did). Now we face somewhat lesser uncertainty on when they will abandon hiking, and then return to zero interest rate policy and beyond.

Let’s first look at the current fundamentals, to see if we can glean a likely direction, before we look at the macro longer-term drivers.

Download the Full Outlook Report (free) for our complete analysis of gold and silver in 2023

How to get the Monetary Metals Gold Outlook 2023 Report

If you haven’t downloaded our Gold Outlook 2023 Report, click the image or this link to get your free copy.

” And due to geopolitics, that natural gas came from Russia.”

The gas came from Russia because it was cheapest.

Maybe you meant:”And due to geopolitics, that natural gas don’t come anymore from Russia.”

Economic science is the short name for political economy science. Wich make it rare to find analyses that are not

full of bias. So, thank you for all. Wish you good luck (with a L)