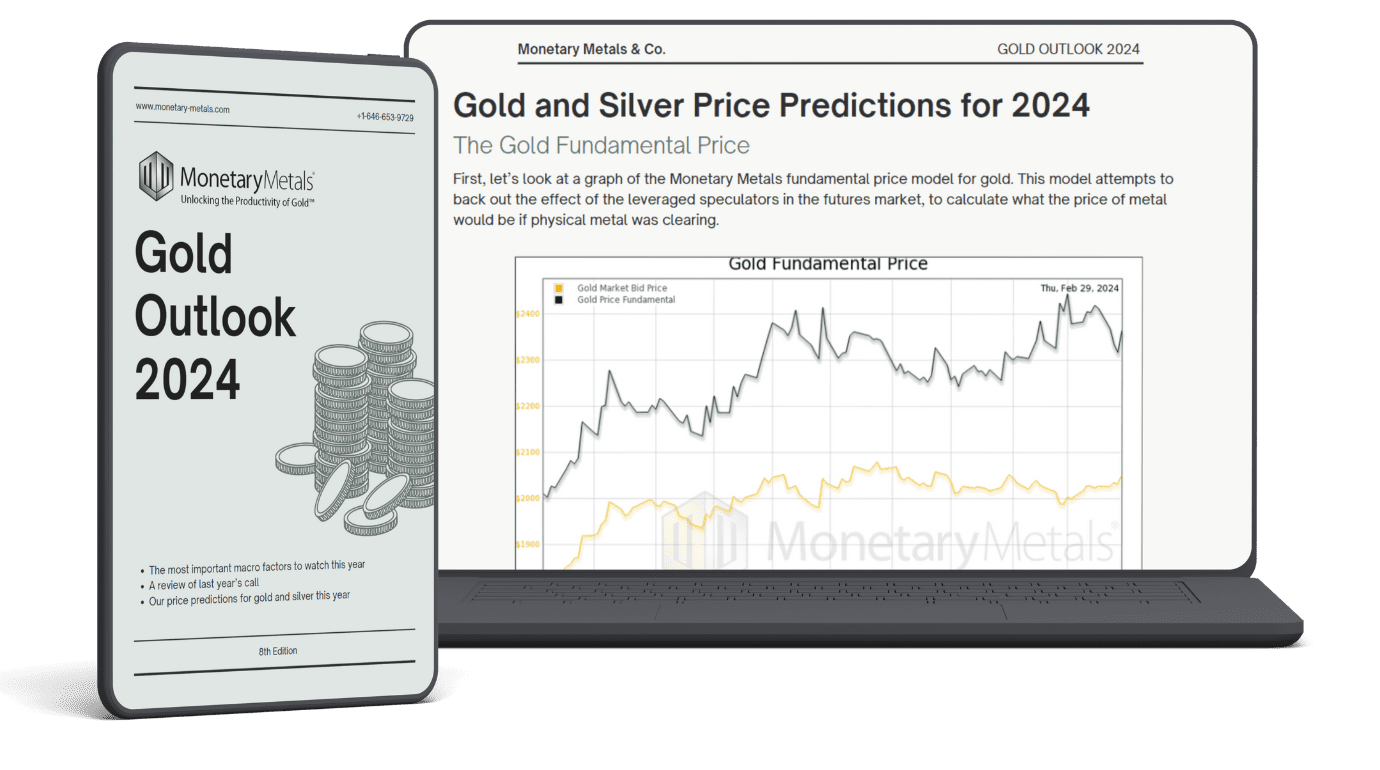

The Gold Outlook 2024 is here!

Read by hedge funds, bullion banks, industry CEO’s, and high-net-worth investors and traders round the world, Monetary Metals is pleased to present the Eighth Annual Monetary Metals Gold Outlook report.

What you always needed to know, but they were afraid to tell you…

The talking heads are talking again about recession, unemployment, and inflation. The same as they’ve always done, though now perhaps with a bit more urgency.

Most people have a sense that hiking the fed funds rate from 0 to 5% in 18 months has to have some consequences. But markets seem to be laughing in the face of the universal laws of economics. Will those economic laws reassert themselves in 2024? Or are we really in a new paradigm?

And what impact will either scenario have on gold and silver prices in 2024?

We discuss all this and much, much more in this year’s report. Discover why our research and analysis is among the best in the industry.

Get your free copy!