I’m interested in learning more

Grow your gold like a billionaire

How does owning gold fit into a billionaire’s wealth strategy?

Monetary Metals offers A Yield on Gold, Paid in Gold®

With Monetary Metals’ Gold Fixed Income opportunities, your gold works for you, earning you income and compounding your ounces over time.

Complete the form and we will send you a free research report on The Case for Gold Yield in an Investment Portfolio, which shows the impact adding gold with yield can have on your investment portfolio.

The Oracle of Omaha

Gold…has two significant shortcomings, being neither of much use nor procreative…

…if you own one ounce of gold for an eternity, you will still have one ounce at its end.

The 170,000 tonnes of gold will be unchanged in size and still incapable of producing anything. You can fondle the cube, but it will not respond.

Clients of Monetary Metals get to prove legendary investor Warren Buffett wrong by earning A Yield on Gold, Paid in Gold®.

Leverage the power of monthly income, price appreciation, and compound interest in ounces to grow your wealth today.

Testimonials

See what our clients say

Real comments from real people who have started

earning interest with Monetary Metals.

How it works

Create your account

Complete your account set up in less than 15 minutes. We work with clients in the United States, and all over the world.

Fund your account

Purchase gold from us or send in metal you already own (bullion products only). Our purchase fees are below 1% for gold and silver. And we offer FREE shipping and insurance for any metal you send to fund your account.

Select your yield opportunities

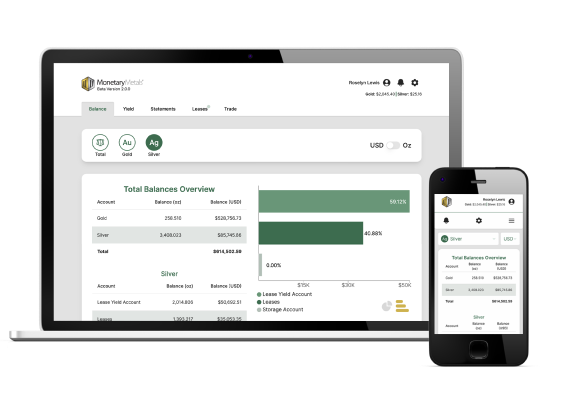

Choose which leases or bonds you want to participate in. You can opt-out of any opportunity, and you can withdraw your metal at any time. Actively manage your account, or set it and forget. It’s your metal. You’re in control.

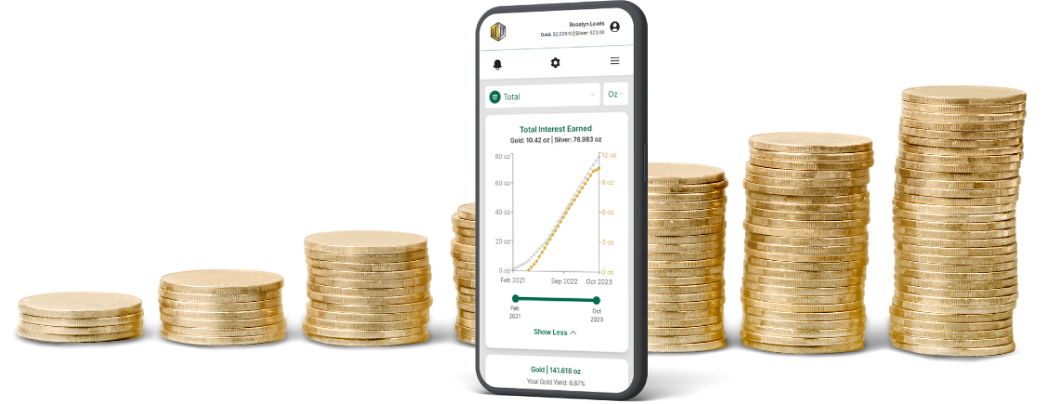

Watch your ounces grow!

You work hard for your metal, now it’s time your metal works hard for you. Day or night, 24/7, 365, your metal is earning you interest without you having to lift a finger. The only thing that’s better than compound interest, is compound interest in gold and silver!

Ready to get started? Open your account today!

How to open an account

Opening an account is a simple process and can be completed online in as little as 10 minutes.

Please bear in mind the following items:

Why earn interest on gold and silver?

How is Monetary Metals able to pay interest on gold and silver?

✓

We pay interest on gold and silver by connecting our clients with businesses that use gold productively – any company with physical gold or silver as inventory or work-in-progress. This includes jewelers, mints, precious metals dealers, refiners, recyclers, and mining companies.

We provide qualified businesses Gold Financing, Simplified™. They happily pay a fee to lease or borrow the gold & silver they require in their business. We take a small percentage of what they pay and the rest is distributed to our clients.

What interest rate can I expect to earn?

✓

Historically, Monetary Metals’ leases have paid between 2% – 5% net annual to investors. The weighted average rate of return in our lease program currently hovers between 3% and 4%. This rate of return is denominated in ounces and paid in ounces. For example, 100oz earning 3% every year, will generate 3oz in gold income, annually. Gold bonds, which are securities, offer higher yields, from 6% to 19%. on our recent offering). Gold bonds are available to accredited investors only.

Does Monetary Metals also pay interest on silver?

✓