“Indisputable Proof”

If there really was gold manipulation, articles like this one would do an injustice. The author uses the word “indisputable”. I do not think that word means what he thinks it means.

According to this article:

“Indian inflation eased to a 41-month low in April, giving the central bank room to extend monetary easing…”

I think that defining inflation as rising prices is one of the greatest cons ever. Ever see a magician perform live? With a loud noise and a big flourish, he misdirects attention to his right hand while his left reaches under the table to take a dove out of its cage. In this case, they misdirect attention to consumer prices (which may rise or fall for many reasons) as a distraction from the real nature of inflation. Counterfeit credit. This lede is more clear than most. Consumer prices aren’t rising too much so the central bank can dole out more counterfeit credit…

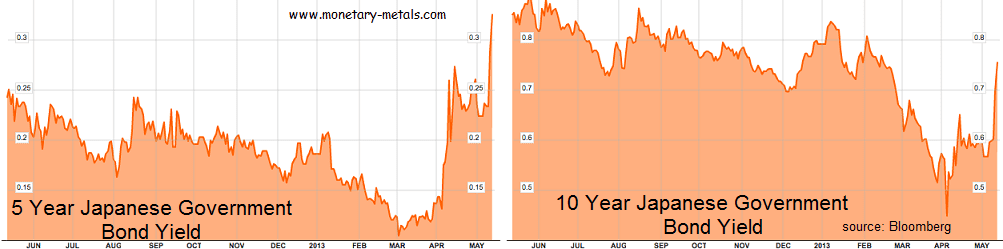

These are one-year charts, of the 5-year and the 10-year Japanese government bond yields. The 5-year looks very worrying. The 10-year is not good, by any means, but in perspective the rate is not (yet) above recent levels. This in itself is concerning, as the trend is clearly towards an inverted yield curve. One can think of an inverted bond yield curve-where the short-dated bond has a higher yield than the longer-as akin to backwardation. It is a sign of stress. What happens is that bond prices begin to fall. With little time remaining, the short-dated bond yield must rise dramatically (yield and price are a rigid mathematical relationship that depends on duration). Longer-dated bonds have a rising yield, but not as much. Japanese bond yields must be watched carefully now to see if this is the long-awaited collapse into the abyss or if the central bank can ferociously buy enough to stave of disaster for another while yet.

Government bond prices are falling but Japanese stocks are rising, which means money market spreads are narrowing, bid up by the Bank of Japan.

Government bonds are still ‘money good’ so it only means that more junk is approaching the status of ‘money good’ than yesterday. There’s your inflation.

It’s all priced in Yen anyhow, the credit of the Bank of Japan, the bidder on whatever garbage comprises the Japanese money market. Junk trading ‘money good’ with junk. There is no rationale here.

“How goes the stock becomes the gen’ral cry… Rather than fail we’ll at nine hundred buy… “

It’s money good at the moment…